Global and China IC Substrate Industry Report, 2014-2015

-

July 2014

- Hard Copy

- USD

$2,400

-

- Pages:97

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

ZYW177

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,500

-

- Hard Copy + Single User License

- USD

$2,600

-

Global and China IC Substrate Industry Report, 2014-2015 contains the followings

1. Status quo of global semiconductor industry

2. Introduction of IC substrate

3. Analysis on IC substrate market

4. Analysis on IC substrate industry

5. Research on 11 IC substrate vendors

6. Research on the world’s top 4 IC substrate packaging companies.

PCB (printed circuit board) industry can be divided into three broad categories i.e. rigid PCB, flexible PCB (FPCB) and substrate. IC substrate industry suffered a continuous decline in 2012 and 2013, rooted in two aspects: first, the PC shipment declined, and CPU substrate as the main type of IC substrate enjoyed the highest average selling price (ASP); second, to suppress the development of Japanese and Taiwanese IC substrate vendors, Korean companies slashed price, Samsung Electro-Mechanics (SEMCO), in particular, implemented a nearly 30% price cut. This led to the global IC substrate industry market scale down 10.3% to USD7.568 billion in 2013. But after suffering comes happiness, IC substrate industry is expected to bloom in 2014 and 2015.

There are several factors for the growth in 2014.

First, MediaTek’s 8-core MT6592 adopts FC-CSP packaging. Released in October 2013, the chip will see shipment boost-up in 2014. Entering the age of 28nm, MediaTek will ensure uniform adoption of FC-CSP packaging; Spreadtrum from Mainland China will follow in its footsteps.

First, MediaTek’s 8-core MT6592 adopts FC-CSP packaging. Released in October 2013, the chip will see shipment boost-up in 2014. Entering the age of 28nm, MediaTek will ensure uniform adoption of FC-CSP packaging; Spreadtrum from Mainland China will follow in its footsteps.

Second, LTE 4G networks are under construction, thereof IC substrate is needed by BASESTATION chip.

Second, LTE 4G networks are under construction, thereof IC substrate is needed by BASESTATION chip.

Third, wearable devices are invading the market, which will stimulate SiP module packaging, also needs IC substrate.

Third, wearable devices are invading the market, which will stimulate SiP module packaging, also needs IC substrate.

Fourth, the pursuit of ultra-thin mobile phone requires chip with good heat dissipation, FC-CSP packaging boasts obvious advantages in terms of heat dissipation and thickness. Main chip for mobile phone of the future will be the FC-CSP packaging or SiP module packaging, involving power management and memory.

Fourth, the pursuit of ultra-thin mobile phone requires chip with good heat dissipation, FC-CSP packaging boasts obvious advantages in terms of heat dissipation and thickness. Main chip for mobile phone of the future will be the FC-CSP packaging or SiP module packaging, involving power management and memory.

Fifth, PC industry will revive in 2014. Tablet PC will not see high growth, even fall in 2014, since consumers have been aware of its function only as a toy but completely unable to compare with PC in performance, PC industry will usher in recovery. At last, SEMCO will not fall back on price-cutting competition, because it is Taiwan’s TSMC not Samsung Electronics that on track to produce Apple’s next-generation processor A8. Even slashing price, it is impossible for TSMC to turn over the order.

Fifth, PC industry will revive in 2014. Tablet PC will not see high growth, even fall in 2014, since consumers have been aware of its function only as a toy but completely unable to compare with PC in performance, PC industry will usher in recovery. At last, SEMCO will not fall back on price-cutting competition, because it is Taiwan’s TSMC not Samsung Electronics that on track to produce Apple’s next-generation processor A8. Even slashing price, it is impossible for TSMC to turn over the order.

The global IC substrate industry market scale is expected to grow at a rate of 9.8% in 2014, and then speed up to 11.6% in 2015.

IC substrate industry falls into three camps i.e. Japan, Korea and Taiwan. Japanese companies as the IC substrate pioneer have the strongest technical strength, mastering the most profitable CPU substrate. Korean and Taiwanese companies rely on the industrial chain cooperation, the former hold about 70% of the world's memory capacity, the Apple’s processor foundry provider Samsung also can produce part of mobile phone chips.

Taiwanese companies are more powerful in the industrial chain by possessing 65% of global foundry production capacity and 80% of senior mobile phone chip foundry (by TSMC or UMC), whose margin is much higher than that of traditional electronic products, (gross margin) exceeding 50%. MediaTek’s MT6592, for instance, the foundry is charged by TSMC or UMC, the packaging is completed by ASE and SPIL, the substrate is offered by Kinsus and testing by KYEC; sharing the same factory, these vendors are pretty high-efficient.

The utterly disadvantaged Mainland Chinese companies in the industrial chain lack support from foundries and packaging companies, lagging behind Taiwanese counterparts several even a dozen years. Even Hisilicon and Spreadtrum have impressive shipments, Taiwanese companies still hold the discourse right of the supply chain.

1. Global Semiconductor Industry

1.1 Overview

1.2 IC Packaging

1.3 IC Packaging and Testing

2. IC Substrate

2.1 Introduction

2.2 Flip Chip IC Substrate

2.3 Trends

3. IC Substrate Market and Industry

3.1 IC Substrate Market

3.2 Mobile Phone Market

3.3 WLCSP Market

3.4 PC Market

3.5 Tablet PC Market

3.6 FPGA and CPLD Market

3.7 IC Substrate Industry

3.8 Wafer Foundry Market Size

3.9 Wafer Foundry Industry Competition

4. IC Substrate Vendors

4.1 Unimicron

4.2 IBIDEN

4.3 Daeduck Electronics

4.4 SIMMTECH

4.5 LG INNOTEK

4.6 SEMCO

4.7 Nan Ya PCB

4.8 Kinsus

4.9 Shinko

4.10 Kyocera SLC

4.11 AT&S

5. IC Substrate Packaging Companies

5.1 ASE

5.2 Amkor

5.3 Siliconware Precision

5.4 STATS ChipPAC

5.5 MITSUBISHI GAS CHEMICAL COMPANY

Quarterly Revenue of Global Semiconductor Industry, 2009-2014

Revenue of Global Semiconductor Industry, 2008-2017E

Revenue of Global Semiconductor Industry by Product, 2012-2017E

Market Size Growth of Global Semiconductor Industry by Product, 2012-2017E

Annual Capital Expenditure of Semiconductor Industry, 2008-2017E

Capital Expenditure of Global Semiconductor Industry by Downstream Application, 2008-2017E

IC Packaging Types Used by Major Electronic Products

Global IC Packaging and Testing Market Size, 2012-2017E

Global IC Substrate Market Size by Technology, 2012-2015E

Global Outsourcing IC Packaging and Testing Market Size, 2012-2017E

Global IC Packaging Market Size, 2012-2017E

Global IC Testing Market Size, 2012-2017E

Revenue of Taiwan Semiconductor Packaging & Testing Service Revenue, 2009-2013

Revenue of Global Top Ten Packaging Vendors, 2013

Global IC Substrate Market Size, 2009-2016E

Application Products of IC Substrate

IC Substrate by Node, 2011-2016E

Global Mobile Phone Shipment, 2007-2015E

Global 3G/4G Mobile Phone Shipment by Region, 2011-2014

Worldwide Smartphone Sales to End Users by Vendor, 2013 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System, 2013 (Thousands of Units)

Worldwide Mobile Phone Sales to End Users by Vendor, 2013 (Thousands of Units)

WLCSP Packaging Market Size, 2010-2016E

WLCSP’s Shipment by Application, 2010-2016E

Global PC-use CPU and Discrete GPU Shipment, 2008-2015

Global Tablet PC Shipment, 20011-2016E

Market Share of Major Tablet PC Brands,2013

Shipment of Major Global Tablet PC Vendors, 2012-2013

Application Distribution and Geographical Distribution of FPGA and CPLD Market, 2011

Market Share of Major FPGA Vendors, 1999-2013

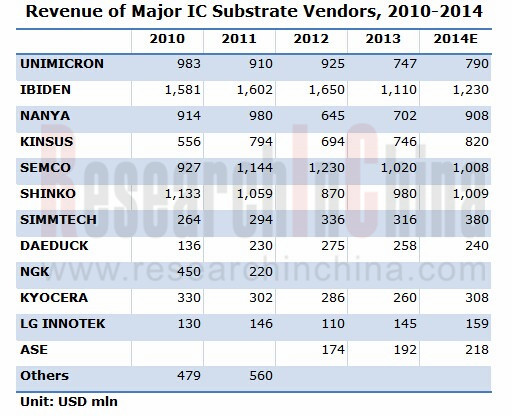

Revenue of Major IC Substrate Vendors, 2010-2014

Global Foundry Market Size, 2008-2017E

Foundry Revenue of Advanced Nodes, 2012-2017E

Global Foundry Capacity by Node, 2012-2018E

Global Foundry Revenue by Node, 2012-2018E

Global Ranking by Foundry, 2013

Unimicron’s Organizational Structure

Unimicron’s Revenue and Gross Margin, 2003-2014

Unimicron’s Revenue and Operating Margin, 2009-2014

Unimicron’s Quarterly Revenue and Gross Margin, Q1 2012-Q1 2014

Unimicron’s Sales Breakdown by Technology, 2010-2014

Unimicron’s Sales Breakdown by Application, 2010-2014

Unimicron’s Capacity by Product, 2010-2014

Unimicron’s CAPEX, 2004-2013

Unimicron's M & A

IBIDEN Revenue and Operating Margin, FY2006-FY2015

Revenue of IBIDEN by Business, FY2006-FY2015

Revenue of IBIDEN by Business, Q2 FY2012-Q1 FY2014

Operating Income of IBIDEN by Business,Q2 FY2012-Q1 FY2014

Revenue of IBIDEN ‘s Electronics Business by Product, FY2010-FY2015

IBIDEN’s CAPEX and Depreciation, FY2010-FY2015

Major Projects of IBIDEN in 2014

Revenue and Operating Margin of Daeduck Electronics, 2005-2014

Revenue of Daeduck Electronics by Business, 2009-2014

SIMMTECH’s Organizational Structure

SIMMTECH’s Revenue and Operating Margin, 2004-2014

Revenue, Gross Margin and Net Margin of SIMMTECH, 2009-2014

SIMMTECH’s Balance Sheet, 2009-2013

Quarterly Revenue of SIMMTECH by Product, Q3 2013-Q4 2014

Revenue of SIMMTECH by Product, 2012- 2015

Quarterly Gross Margin and Operating Margin of SIMMTECH, Q1 2013-Q4 2014

Quarterly Shipment of SIMMTECH, Q1 2013-Q4 2014

SIMMTECH’s Shipment, 2012-2015

Quarterly Capacity Utilization of SIMMTECH, Q1 2013-Q4 2014

Capacity Utilization of SIMMTECH, 2012- 2015

SIMMTECH’s Revenue by Application, 2008-2014

Substrate Revenue of SIMMTECH by Application, 2012-2014

SIMMTECH’s Plants

Revenue and Operating Margin of LG INNOTEK, 2006-2014

Quarterly Revenue and Operating Margin of LG INNOTEK, Q1 2011-Q1 2014

Revenue of LG INNOTEK by Business, 2011-2014

Operating Income of LG INNOTEK by Business, 2011-2013

Revenue and Operating Margin of SEMCO, 2009-2014

Revenue of SEMCO by Segment, 2010-2014

Operating Income of SEMCO by Segment, 2012-2014

Quarterly Revenue and Operating Margin of SEMCO’s ACI Segment, Q1 2013- Q4 2014

SEMCO’s IC Substrate Sales by Technology, 2013-2015

Operating Income of SEMCO’s IC Substrate by Technology, 2013-2015

Organizational Structure of Nan Ya PCB

Revenue and Gross Margin of Nan Ya PCB, 2006-2014

Revenue and Operating Margin of Nan Ya PCB, 2009-2014

Monthly Revenue and Growth Rate of Nan Ya PCB, May 2012-May 2014

Production Allocation and Monthly Capacity of Nan Ya PCB

Revenue and Gross Margin of Kinsus, 2004-2014

Revenue and Operating Margin of Kinsus, 2009-2014

Monthly Revenue and Growth Rate of Kinsus, May 2012-May 2014

Revenue of Kinsus by Product, 2011-2014

Revenue of Kinsus by Downstream Application, 2011

Revenue of Kinsus by Applications, Q1 2014

Client Structure of KINSUS, 2013-2014

Shinko’s Revenue and Net Income, FY2007-FY2015

Shinko’s Revenue by Business, FY2011-FY2014

Revenue and EBITDA Margin of AT&S, FY2005-FY2014

Global Presence of AT&S

Substrate Plant Ramp of AT&S in Chongqing

Revenue of AT&S by Region, FY2014

Balance Sheet of AT&S, FY2014

ASE Group Organization Chart

ASE’s Revenue and Gross Margin, 2001-2014

ASE’s Revenue and Operating Margin, 2009-2014

Monthly Revenue of ASE, May 2012-May 2014

ASE’s Revenue by Business, 2010-2013

Revenue and Gross Margin of ASE’s Packaging Division, Q1 2013-Q1 2014

Revenue of ASE’s Packaging Division by Type, Q1 2013-Q1 2014

Revenue and Gross Margin of ASE’s Materials Division, Q1 2013-Q1 2014

Revenue and Gross Margin of ASE’s EMS, Q1 2013-Q1 2014

Revenue of ASE’s EMS by Application, Q1 2013-Q1 2014

ASE’s Revenue by Application, Q1 2014

Revenue, Gross Margin and Operating Margin ofAmkor, 2005-2014

Amkor’s Revenue by Packaging Type, 2007-2012

Amkor’s Revenue by Product, 2012-2014Q1

Organizational Structure of Siliconware Precision

Revenue, Gross Margin, Operating Margin of Siliconware Precision, 2003-2014

Monthly Revenue of SPIL, May 2012-May 2014

Quarterly Revenue, Gross Margin and Operating Margin of SPIL, Q1 2012-Q1 2014

Revenue of SPIL by Region, 2005-2014

Revenue of SPIL by Downstream Application, 2005-2014

Revenue of SPIL by Business, 2005-2014

Capacity of SPIL, 2006-2014

Revenue and Gross Margin of STATS ChipPAC, 2004-2014

Revenue of STATS ChipPAC by Packaging Type, 2006-2013

Revenue of STATS ChipPAC by Application, 2006-2013

Revenue of STATS ChipPAC by Region, 2006-2013

Organization Chart of Mitsubishi Gas Chemical

Revenue and Operating Income of Mitsubishi Gas Chemical, FY2009-FY2015

Revenue of Mitsubishi Gas Chemical by Segment, FY2009-FY2015

Operating Income of Mitsubishi Gas Chemical by Segment, FY2013-FY2015

CAPEX and Depreciation of Information and Advanced materials Segment of Mitsubishi Gas Chemical, FY2009-FY2014

Global and China CMOS Camera Module (CCM) Industry Report, 2020-2026

The global CCM market has been ballooning thanks to expeditious penetration of multi-camera phones and advances in automotive ADAS, being worth $22.723 billion with a year-on-year spike of 16.6% in 20...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2020-2025

Electronic components like MLCC enjoy a rosy prospect alongside the burgeoning electronic manufacturing, the thriving internet and the prevalence of smart hardware.

MLCC was much sought after and it...

Global and China Voice Coil Motor (VCM) Industry Report, 2019-2025

VCM (voice circle motor or voice coil actuator), a part for smartphone camera, shares around 6% of smartphone camera industry chain value.

Globally, popularity of smartphones such as those with mult...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2019-2025

Chinese aluminum electrolytic capacitor market has been expanding amid a transfer of its downstream industries to China like home appliance illumination, cellphones and computers as well as automatic ...

Global and China Flexible Printed Circuit (FPC) Industry Report, 2019-2025

Flexible printed circuit (FPC) products make their way into consumer electronics like smartphone and tablet PC, in the form of modules for display, touch control, fingerprint recognition, etc. The vol...

Global and China GaAs Industry Report, 2019-2025

Gallium arsenide (GaAs), one of the most mature compound semiconductors, is an integral part of smartphone power amplifier (PA). In 2018, GaAs-based radio frequency (RF) seized over half of the GaAs w...

Global and China Advanced Packaging Industry Report, 2019-2025

The global semiconductor packaging and testing market is enlarging with the prevalence of consumer electronics, automotive semiconductors and the Internet of Things (IoT), with its size edging up 2.5%...

Global and China MLCC Electronic Ceramics Industry Report, 2019-2025

MLCC is mainly used in audio and video equipment, mobile phones, computers and automobiles. The prospective boom of MLCC formula powder hinges on demand: 1) The accelerated renewal of consumer electro...

Global and China OLED Industry Report, 2019-2025

OLED, a new-generation display technology, features simple display structure, green consumables and flexibility and can be rolled up, which makes it easier to transport and install without considering...

Global and China Camera Module Industry Report, 2019-2025

Affected by factors like the maturity of mobile phone markets worldwide and the prolonged replacement of mobile phone by users, the mobile phone market has undergone a slowdown in growth rate. From Q4...

Global and China Multi-Layer Ceramic Capacitor (MLCC) Industry Report, 2018-2023

MLCC finds most application in consumer electronics, automobile and industrial fields and gets beefed up remarkably with the approaching 5G era of cellphones and tablet PCs, the advances in automotive...

Global and China Aluminum Electrolytic Capacitor Industry Report, 2018-2023

Aluminum electrolytic capacitor, a core electronic component, is widely used in consumer electronics, computers and peripherals, industry, electric power, lighting and automobiles.

Global aluminum e...

Global and China CMOS Camera System Industry Report, 2017-2021

Global CCM (CMOS Camera Module) market was worth USD16.611 billion in 2015, a year-on-year rise of 3.8% from 2014, the slowest rate since 2010. Global market fell modestly in 2016 due to a drop in shi...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2017-2021

Global OLED market size approximated USD15.7 billion in 2016, a 20.8% rise from a year earlier. Stimulated by reports that Apple will adopt OLED screen for multiple iPhone models in 2017-2018, OLED sc...

Global and China CMOS Camera System Industry Report, 2016-2020

Global and China CMOS Camera System Industry Report, 2016-2020 covers the following:1. Analysis of CMOS Image Sensor (CIS) Industry and Market, with 7 vendors involved.2. Analysis of CMOS Camera Lens ...

Global and China Multi-layer Ceramic Capacitor (MLCC) Industry Report, 2017-2020

The rapid development of consumer electronics and industrial intelligentization has greatly promoted the booming of passive components including multi-layer ceramic capacitor (MLCC). In 2015, China’s ...

Global PCB Industry Report, 2015-2020

Global PCB Industry Report, 2015-2020 highlights the followings:1. Global PCB Market and Status Quo of the Industry2. Global Downstream Markets of PCB3. Mobile Phone PCB Trends4. Tablet PC/Laptop Comp...

Global and China Organic Light-Emitting Diode (OLED) Industry Report, 2016-2020

The OLED market has been developing rapidly worldwide over the recent years, and its market size reached USD13 billion in 2015. With technology and capacity construction, OLED (from small-sized panels...