Global and China Bi-Metal Band Saw Blade Industry Report, 2014-2017

-

Sep.2014

- Hard Copy

- USD

$2,400

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,200

-

- Code:

LMX056

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

The sales volume of bi-metal band saw blade continued to slide in China, totaling 49.45 million meters throughout the year 2013, down 2.5% year on year, largely due to international financial crisis, a drop in domestic Manufacturing Sentiment Index and a decline in the output of supporting sawing machine. Despite falling sales volume, the scope of decline narrowed, compared with year-on-year contraction of 5.2% in 2012.

As far as competitive landscape of the market is concerned, local Chinese bi-metal band saw blade companies have been expanding their capacities and making more investments in the R&D of new materials, new technologies and new products, thus continuously improving market shares of local brands, from around 20% in 1999 to 60% or so in 2013. The specific measures are as follows:

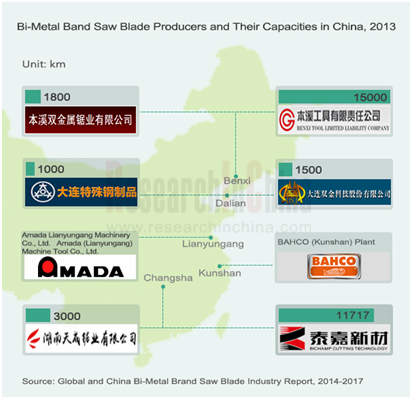

Capacity expansion: Bichamp Cutting Technology, a key manufacturer in China, raised its bi-metal band saw blade capacity from 5 million meters in 2009 to 11.72 million meters in 2013; Benxi Tool Limited Liability Corporation boosted its bi-metal band saw blade capacity from 6.30 million meters in 2010 to 15 million meters in 2013;

R&D Expenses: Bichamp Cutting Technology lavished ever more capital on R&D during 2009-2013, from RMB3.38 million to RMB 11.54 million, or from 1.97% to 4.21% of the company’s total revenue. In the first half of 2014, the company introduced the brand LEAPCUT, which is targeted at middle and low-end market.

While local brands are grabbing more market share, foreign players that focus on high-end products are also endeavoring to expand their presence in China. Take Japanese Amada for example. The company opened its Shanghai facility in Qingpu District of the city in May 2013; Amada Technical Center (China) opened in Shanghai in July 2013. The revenue of the company in China topped JPY 20 billion in 2012, and is expected to hit JPY 50 billion in 2014.

The Japanese Amada can provide all-round saw cutting services. In the first quarter of FY2014, the company earned revenue of JPY 51.4 billion, a jump of 13.8% from a year earlier, JPY 6.9 billion of which came from band saw business, up 14% from the year before and accounting for 13.4% of the company’s total revenue.

It can be seen from development trend of the industry that the Chinese bi-metal band saw blade market is expected to recover during 2014-2015, for: 1) The demand for high speed steel, a main raw material for bi-metal band saw blade, started to pick up in the first half of 2014. Tiangong International, one of industry leaders, posted revenue of RMB 608 million from domestic high speed steel business, soaring by 231% year on year, which means that some downstream cutting tool manufacturers have resumed purchasing; 2) With gradual recovery of export markets and rapid development of emerging industries like automobile, aerospace, aviation, military industry and IT, sawing machine output in China is expected to emerge from negative growth and realize stable expansion in 2015.

Global and China Bi-metal Band Saw Blade Industry Report, 2014-2017 by ResearchInChina focuses on the following:

High-speed steel, an upstream raw material of bi-metal band saw blade, and top 3 companies;

High-speed steel, an upstream raw material of bi-metal band saw blade, and top 3 companies;

Operation, output, import and export volume, development trend of sawing machine industry, a supporting sector of bi-metal band saw blade, and 7 key companies;

Operation, output, import and export volume, development trend of sawing machine industry, a supporting sector of bi-metal band saw blade, and 7 key companies;

Development and competitive landscape of global bi-metal band saw blade market;

Development and competitive landscape of global bi-metal band saw blade market;

Policy climate, sales volume and competitive landscape of China bi-metal band saw blade industry;

Policy climate, sales volume and competitive landscape of China bi-metal band saw blade industry;

8 global and 6 Chinese bi-metal band saw blade companies;

8 global and 6 Chinese bi-metal band saw blade companies;

Market summary and industry forecast for the period 2014-2017.

Market summary and industry forecast for the period 2014-2017.

Preface

1. Overview of Bi-Metal Band Saw Blade

1.1 Definition

1.2 Upstream and Downstream

1.3 Industry Features

1.4 Entry Barriers

2 Chinese High Speed Steel Industry Development

2.1 Overview of High Speed Steel

2.2 Market Analysis

2.3 Major Producers

2.3.1 Tiangong International Co., Ltd.

2.3.2 Heye Special Steel Co., Ltd.

2.3.3 Jiangsu Feida Group

3 Chinese Saw Machine Industry

3.1 Definition and Classification

3.2 Operation

3.3 Output

3.4 Import and Export

3.5 Development Trend

4 Global Bi-Metal Band Saw Blade Industry

4.1 Development History

4.2 Market Size

4.3 Competition Pattern

5 Chinese Bi-Metal Band Saw Blade Industry

5.1 Policy

5.2 Development History

5.3 Sales Volume

5.4 Competition Pattern

5.4.1 Regional Competition

5.4.2 Competition between Local Brands and Foreign Brands

5.4.3 Product Competition

5.4.4 Competition among Chinese Local Brands

5.5 Problems

6 Key Bi-Metal Band Saw Blade Companies Worldwide

6.1 DoALL Company

6.1.1 Profile

6.1.2 Development Course

6.1.3 Products

6.1.4 Dynamics

6.2 Lenox Tools

6.2.1 Profile

6.2.2 Products

6.2.3 Dynamics

6.3 Starrett

6.3.1 Profile

6.3.2 Products

6.3.3 Operation

6.3.4 Development in China

6.4 Amada

6.4.1 Profile

6.4.2 Development Course

6.4.3 Products

6.4.4 Operation

6.4.5 Development in China

6.4.6 Amada Opens Shanghai Facility as It Speeds up Investment in Growing Chinese Market

6.4.7 Performance Forecast

6.5 BAHCO

6.5.1 Profile

6.5.2 Development Course

6.5.3 Products

6.6 WIKUS

6.6.1 Profile

6.6.2 Development Course

6.6.3 Products

6.6.4 Dynamics

6.7 EBERLE

6.7.1 Profile

6.7.2 Development Course

6.7.3 Products

6.7.4 Operation

6.8 RONTGEN

6.8.1 Profile

6.8.2 Products

7 Key Companies of Bi-Metal Band Saw Blades in China

7.1 Bichamp Cutting Technology (Hunan) Co., Ltd.

7.1.1 Profile

7.1.2 Products

7.1.3 Operation

7.1.4 Revenue Structure

7.1.5 R&D and Investment

7.1.6 Clients and Suppliers

7.1.7 Gross Margin

7.1.8 Competitive Advantages

7.1.9 IPO Process

7.2 Benxi Tool (Group) Limited Liability Company

7.2.1 Profile

7.2.2 Products

7.2.3 Capacity

7.3 Hunan Techamp Saw & Manufacture Co., Ltd.

7.4 Benxi Bi-Metal Saw Co.,Ltd.

7.5 Dalian Bi-Metal S&T Co.,Ltd.

7.6 Dalian Special Steel Product Co., Ltd.

7.6.1 Profile

7.6.2 Products

8 Key Companies of Saw Machine in China

8.1 Zhejiang Julihuang Sawing Machine Group Co., Ltd.

8.1.1 Profile

8.1.2 Launch Listing Application for NEEQ

8.2 WinFox Machinery Inc.

8.3 Zhejiang Weiye Sawing Machine Co., Ltd.

8.4 Zhejiang Chendiao Machinery Co., Ltd.

8.5 Zhejiang Aolinfa Machine Co., Ltd.

8.6 Zhejiang Hujin Sawing Machine Co., Ltd.

8.7 Zhejiang Hengyu Sawing Machine Co., Ltd.

9 Market Overview and Development Forecast

9.1 Market Overview

9.2 Development Forecast

9.2.1 Trends

9.2.2 Output Forecast of Saw Machine

9.2.3 Sales Volume Forecast of Bi-Metal Band Saw Blades

Comparison of Three Major Metal Cutting Ways

Upstream and Downstream of Bi-Metal Band Saw Blade Industry

GDP Growth in China, 2000-2014

Classification of HSS

HSS Market Share in China, 2013

Major Chinese HSS Producers and Operation, 2013

Development Course of Tiangong International

Financial Indicators of Tiangong International, 2009-2014

Reveneu Breakdown of Tiangong International, 2012-H1 2014

Gross Margin of Tiangong International by Products, 2012-2013

HSS Products of Tiangong International

HSS Products Developed by Tiangong International, 1H2014

HSS Revenue of Tiangong International, 2012-2014

Sales Volume, ASP, and Gross Margin of Tiangong International by Products, H1 2014

Future Capacity Growth Target of Tiangong International

HSS Products of Heye Special Steel Co., Ltd.

Operating Indicators of Heye Special Steel Co., Ltd., 2009-2013

Business Distribution of Erasteel

Marketing Network of Jiangsu Feida Group

Business Units of Jiangsu Feida Group

Development Course of Jiangsu Feida Group

HSS Products of Jiangsu Feida Group

Classification of Saw Machine

Output of Metal Saw Machine in China, 2009-2013

Export Volume of Saw Machine in China, 2001-2012

Import Volume of Saw Machine in China, 2001-2012

Import and Export Value of Saw Machine in China, 2005-2012

Development History of Global Bi-Metal Band Saw Blade Industry

Global Market Size of Bi-Metal Band Saw Blade, 2006-2013E

Global Bi-Metal Band Saw Blade Manufacturers

Chinese Policies on Bi-Metal Band Saw Blade Industry, 2005-2014

Development History of Chinese Bi-Metal Band Saw Blade Industry

Sales Volume of Bi-Metal Band Saw Blades in China, 2006-2013

Sales Volume of Bi-Metal Band Saw Blades for Metal Cutting in China, 2006-2013

Market Share of Local Brands of Bi-Metal Band Saw Blade in China, 1985-2015

Capacity of Chinese Bi-Metal Band Saw Blade Manufacturers

Marketing Network of DoALL Company in USA

Development Course of DoALL Company

Bi-Metal Band Saw Blades of Lenox Tools

Major Production Bases of Starrett Worldwide

Operating Performance of Starrett, FY2007-FY2013

Operating Performance of Starrett, FY2012-FY2013

Revenue Breakdown of Starrett by Regions, FY2011-FY2013

Regulation of Primalloy Band Saw Blade of Starrett

Business Distribution of Amada

Development Course of Amada

Bi-Metal Band Saw Blades of Amada

Operating Performance of AMADA, FY 2010- FY 2014

Operating Performance of AMADA, Q1 FY 2014

Revenue Breakdown of Amada, Q1 FY2014

Net Sales and Operating Margin of Amada by Regions, FY2012-FY2014

Business Distribution of AMADA in China

Development Course of Amada in China

Revenue of Amada in China, 2009-2014

Shanghai Facility of Amada

Operating Performance of AMADA, FY 2014E

Revenue Breakdown of AMADA, FY 2014E

Development Course of BAHCO

Bi-Metal Band Saw Blade of BAHCO

Business Distribution of WIKUS Worldwide

Development Course of WIKUS

Bi-Metal Band Saw Blade Products of WIKUS

Business Distribution of EBERLE Worldwide

Development Course of EBERLE

Bi-Metal Band Saw Blades of EBERLE

Operating Performance of Greiffenberger Group, 2007-2013

Operating Performance of Greiffenberger Group, 2013-2014

Bi-Metal Band Saw Blades of RONTGEN

Bi-Metal Band Saw Blades of Bichamp Cutting Technology (Hunan) Co., Ltd.

Brand Target and Application of Bichamp Cutting Technology (Hunan) Co., Ltd.

Capacity, Output and Sales Volume of Bi-Metal Band Saw Blade of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2013

Revenue and Net Income of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2013

Major Operating Indicators of Bichamp Cutting Technology (Hunan) Co., Ltd., H1 2014

Revenue Breakdown of Bichamp Cutting Technology (Hunan) Co., Ltd. by Product, 2010-2013

Revenue Structure of Bichamp Cutting Technology (Hunan) Co., Ltd. by Brands, 2011-2013

Revenue Structure of Bichamp Cutting Technology (Hunan) Co., Ltd. by Region, 2009-2011

Domestic Revenue Structure of Bichamp Cutting Technology (Hunan) Co., Ltd. by Regions, 2011-2013

R&D Costs and % of Total Revenue of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2013

Tire Mold Projects Invested with Raised Funds of Bichamp Cutting Technology (Hunan) Co., Ltd.

Economic Benefit of Bimetal Band Saw Blade Projects of Bichamp Cutting Technology (Hunan) Co., Ltd.

Bichamp Cutting Technology (Hunan) Co., Ltd.’s Revenue from Top 5 Clients and % of Total Revenue, 2013

Bichamp Cutting Technology (Hunan) Co., Ltd. ’s Procurement from Top 5 Suppliers and % of Total Procurement,2013

Consolidated Gross Margin and Gross Margin of Bi-Metal Band Saw Blade of Bichamp Cutting Technology (Hunan) Co., Ltd., 2009-2013

Bi-Metal Band Saw Blades of Benxi Tool (Group) Limited Liability Company

Bi-Metal Band Saw Blade Capacity of Benxi Tool (Group) Limited Liability Company, 2010-2013

Bi-Metal Band Saw Blades of Dalian Bi-Metal S&T Co., Ltd.

Operation of Dalian Special Steel Product Co., Ltd.

Specifications of Bi-Metal Band Saw Blades of Dalian Special Steel Product Co., Ltd.

Marketing Network of Zhejiang Julihuang Sawing Machine Group Co., Ltd.

Band Saw Machine Products of Zhejiang Julihuang Sawing Machine Group Co., Ltd.

Band Saw Machine Products of WinFox Machinery Inc.

Marketing Network of Zhejiang Weiye Sawing Machine Co., Ltd.

Band Saw Machine Products of Zhejiang Weiye Sawing Machine Co., Ltd.

Band Saw Machine Products of Zhejiang Chendiao Machinery Co., Ltd.

Marketing Network of Zhejiang Chendiao Machinery Co., Ltd.

Band Saw Machine Products of Zhejiang Aolinfa Machine Co., Ltd.

Marketing Network of Zhejiang Hengyu Sawing Machine Co., Ltd.

Output of Saw Machines in China, 2014-2017E

Sales Volume of Bi-Metal Band Saw Blades in China, 2014-2017E

Sales Volume of Bi-Metal Band Saw Blades for Metal Cutting in China, 2014-2017E

Global and China Rare Earth Permanent Magnet Industry Report, 2018-2023

Rare earth permanent magnets consist of SmCo permanent magnet and NdFeB permanent magnet among which NdFeB as a kind of 3rd-Gen rare earth permanent magnetic material takes a lion’s share of the marke...

Global and China NdFeB Industry Report, 2018-2023

Featured with strong magnetic energy product and high compacted density, NdFeB is widely used in various fields. The NdFeB industry over the recent years has characterized the following:

First, the N...

Global and China Vanadium Industry Report, 2018-2023

Vanadium, deemed as the “vitamin” of metals, finds wide application in steel, chemicals, new materials and new energy. There is now global research and development of vanadium for applying it to more ...

Global and China Cobalt Industry Report, 2018-2023

Cobalt, an essential raw material for lithium battery, is widely used in electric vehicles as well as computer, communication and consumer electronics. 59% of cobalt was used in lithium battery global...

Global and China Nickel Industry Report, 2017-2020

Global primary nickel output in 2016 fell 1.5% to 1.934 million tons. In 2017, as China’s nickel pig iron project in Indonesia reaches design capacity gradually, nickel metal supply is expected to hit...

Global and China Cobalt Industry Report, 2017-2021

In recent years, the global refined cobalt market has been in a state of oversupply, but the inventory has been decreasing year by year. In 2016, the global refined cobalt output and consumption were ...

China Silicon Carbide Industry Report, 2016-2020

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, sweeping more than 80% of the global total. However, excessive capacity expansi...

China Antimony Industry Report, 2016-2020

According to USGS, global antimony reserves totaled 2 million tons and antimony ore production 150,000 tons in 2015. In China, the reserves of antimony stood at 950,000 tons and antimony ore productio...

Global and China Cobalt Industry Report, 2016-2020

Cobalt is an important strategic metal used in lithium battery manufacturing, hard alloy smelting and superalloy production, mainly available in Congo, Australia, Cuba and other countries.

In 2015, t...

China Silicon Carbide Industry Report, 2015-2019

China is the largest producer and exporter of silicon carbide in the world, with the capacity reaching 2.2 million tons, accounting for more than 80% of the global total. In 2014, the total silicon ca...

Global and China Antimony Industry Report, 2015

Since 2015, China’s antimony industry has been characterized by the followings:

China sees a continued decline in the output of antimony concentrates and antimony products. Owing to weak demand from ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2015-2018

Since the year 2012, due to the aftermath of the global financial crisis and the sub-prime crisis, the prosperity index of manufacturing in China has continued to decline, and the machine tool industr...

Global and China Aluminum Alloy Automotive Sheet Industry Report, 2014-2017

In recent years, driven by energy conservation and emissions reduction and improvement of fuel efficiency, auto industry has been required to develop towards an increasingly lightweight trend. A great...

China Rare Earth Industry Report, 2014-2018

Rare earth, also known as rare earth metal or rare earth element, collectively refers to lanthanides (including fifteen elements) and closely-related scandium and yttrium. As a crucial strategic resou...

China Silicon Carbide Industry Report, 2014-2017

As a major producer and exporter of silicon carbide, China contributes about 80% to the global silicon carbide capacity. In 2013, China exported 286,800 tons of silicon carbide after the abolition of ...

China Antimony Industry Report, 2014-2017

Since 2014, China’s antimony industry has been characterized by the following:

First, China holds a stable position as a major antimony producer. According to the statistics by USGS, in 2013, up...

Global and China Vanadium Industry Report, 2014-2017

The world’s recoverable vanadium reserves so far has been recorded at 14 million tons, mainly found in China, Russia, South Africa and other countries. In 2013, roughly 151,000 tons of vanadium (V2O5 ...

Global and China Silica(White Carbon Black) Industry Report, 2014-2017

China, the world’s largest silica producer, had silica capacity of 2.20 million tons in 2013, slowing to a year-on-year increase of 8.1% and accounting for 60% of global capacity, of which 2.079 milli...