China Motion Controller Industry Report, 2015-2017

-

Nov.2015

- Hard Copy

- USD

$1,800

-

- Pages:69

- Single User License

(PDF Unprintable)

- USD

$1,700

-

- Code:

BXM085

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,700

-

- Hard Copy + Single User License

- USD

$2,000

-

Motion controllers are the devices that control all kinds of motor-driven actuators to follow the predetermined trajectory, and they find key application in machine tool, textile machinery, plastic machinery, printing machinery, packaging machinery, medical equipment and other industries.

Affected by factors such as industry upgrading and product structure adjustment of equipment manufacturing, Chinese motion controller market hovered at a low level since 2012, and then basically stabilized in 2014 with the market size of RMB7.13 billion which went up 8.5% year on year.

With the promulgation of "Made in China 2025" and other policies, industrial robots and CNC machine tools have become the focus, which means motion controllers will see rapid development as the core components of intelligent equipment. It is expected that Chinese motion control market size will approximate RMB10 billion in 2017.

Motion controllers are divided into general motion controllers and special motion controllers, of which the former can fall into three categories: PC-based controllers, PLC-based controllers, and embedded controllers. Currently, PLC-based controllers prevail as traditional mainstream controllers, and will integrate with the emerging open-style PC-based controller amid competition.

Source: China Motion Controller Industry Report, 2015-2017 by ResearchInChina

Chinese motion controller market is mainly dominated by world-renowned giants, while local Chinese players are mostly small and medium-sized firms which target at medium and low-end markets. Among China's domestic enterprises, Leetro, Googol Technology, Leadshine Technology, Weihong Electronic Technology and Adtech give priority to motion controllers and provide customers with system solutions.

Googol Technology: As China's largest maker of motion controllers, Googol Technology holds nearly half of the market share in the field of PC-based motion controllers. In 2014, the company established Chongqing Googol Automation Applied Technology Development Co., Ltd. and Googol Yangtze River Intelligent Manufacturing Technology Research Institute in Yongchuan, Chongqing. In 2015, it is building Googol Park at Songshan Lake, which is expected to be completed by the end of this year. By then, Googol Park will become one of the first batch of industry 4.0 unmanned intelligent plants in China.

Leetro: The company has embarked on independent R & D of general motion controllers earlier than most of its rivals in China. Its products are mainly used in optical engraving machines, dispensers and other industries. In the first half of 2015, the company’s two new products - AC servo drivers and network controllers were launched for a trial; in the second half year, the small-lot production may be accomplished.

Adtech: This leading provider of motion control solutions in China serves Foxconn, GoerTek and the like. In 2014, the company was acquired by Shanghai STEP Electric Corporation; meanwhile, its annual motion controller/card revenue amounted to RMB80.328 million, accounting for 52% of company’s total revenue.

China Motion Controller Industry Report, 2015-2017 released by ResearchInChina highlights the following:

Development environments of motion controllers in China, including industrial environment and policy climate, etc.;

Development environments of motion controllers in China, including industrial environment and policy climate, etc.;

Competition pattern, supply and demand of Chinese motion controller market;

Competition pattern, supply and demand of Chinese motion controller market;

Market situation of general motion controllers and special motion controllers in China;

Market situation of general motion controllers and special motion controllers in China;

Development of motion controller downstream industries in China;

Development of motion controller downstream industries in China;

Operation, revenue structure and development strategies of 16 key motion controller companies in China.

Operation, revenue structure and development strategies of 16 key motion controller companies in China.

1. Profile of Motion Controller

1.1 Definition and Classification

1.2 Industry Chain

2 Development Environment of Motion Controller Industry in China

2.1 Industry Environment

2.2 Policy Environment

3 Motion Controller Market in China

3.1 Development

3.2 Supply & Demand

3.2.1 Supply

3.2.2 Demand

3.3 Competition Pattern

4 Chinese Motion Controller Market Segments

4.1 Overview

4.2 General Motion Controllers

4.3 Special Motion Controllers

5 Motion Controller Application Industry in China

5.1 Overview

5.2 CNC Machine Tools

5.2.1 Market Situation

5.2.2 Application of Motion Controllers in CNC Machine Tool

5.3 Textile Machinery

5.3.1 Market Situation

5.3.2 Application of Motion Controllers in Textile Machinery

5.4 Medical Equipment

5.5 Electronic Devices

5.6 Plastic Machinery

5.7 Printing Machinery

5.8 Robotics

6 Major Motion Controller Manufacturers in China

6.1 Leadshine Technology

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Clients and Suppliers

6.2 ADTECH

6.2.1 Profile

6.2.2 Operation

6.2.3 Motion Controller Business

6.3 Leetro Automation Co., Ltd.

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Key Clients

6.3.5 Technical Superiority

6.4 Googol Technology (HK) Limited

6.4.1 Profile

6.4.2 Operation

6.4.3 R & D Capability

6.4.4 Development Strategy

6.5 ADLINK

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Motion Controller Business

6.6 Advantech

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Motion Controller Business

6.6.5 Development Strategy

6.7 Sciyon

6.7.1 Profile

6.7.2 Operation

6.7.3 Revenue Structure

6.7.4 Gross Margin

6.7.5 R&D

6.7.6 Motion Controller Business

6.8 Shanghai Weihong Electronic Technology Co., Ltd.

6.8.1 Profile

6.8.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.8.5 Major Clients

6.8.6 Key Projects

6.9 TOPCNC Automation Technology Co., Ltd.

6.9.1 Profile

6.9.2 Motion Controller Business

6.10 Tankon

6.10.1 Profile

6.10.2 Motion Controller Business

6.11 Haichuan Numerical Control Technology Co., Ltd.

6.11.1 Profile

6.11.2 Motion Controller Business

6.12 HollySys

6.12.1 Profile

6.12.2 Operation

6.13 RichAuto S&T

6.13.1 Profile

6.13.2 Motion Controller Business

6.14 Overseas Companies in China

6.14.1 Delta Tau

6.14.2 Trio

6.14.3 Galil

7 Summary and Forecast

7.1 Summary

7.1.1 Market

7.1.2 Enterprises

7.2 Trend

Structure of Motion Controller System

Classification of Motion Controllers

Motion Controller Industry Chain

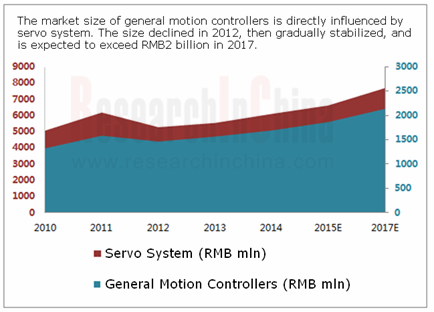

Market Size of Servo System in China, 2010-2017E

Market Size of AC Servo System in China, 2010-2017E

Market Share of AC Servo System in China by Brand, 2014

Market Share of Servo System in China by Sector, 2014

Policies on Motion Controllers in China, 2006-2015

Market Size of Motion Controllers in China, 2008-2015

Output of Motion Controllers in China, 2006-2015

Demand for Motion Controllers in China, 2006-2015

Market Share of Major Motion Controller Companies in China, 2014

Market Share of Major PC-based Motion Controller Companies in China, 2014

Market Size of General Motion Controllers in China, 2006-2015

Market Share of General Motion Controllers in China by Type, 2013-2015

Market Size of Motion Controllers in CNC Field in China, 2010-2015

Market Share of Motion Controllers in China by Sector, 2014

Market Size of Machine Tools in China, 2006-2015

Output of CNC Machine Tools and CNC Rate in China, 2006-2015

Market Size of CNC Machine Tool-use Motion Controllers in China, 2008-2017E

Market Size of Motion Controllers in Engraving and Milling Industry in China, 2008-2017E

Market Size of Textile Machinery Industry in China, 2008-2017E

Application of Motion Controllers in Textile Machinery Industry in China, 2015

Market Size of Medical Device Industry in China, 2008-2017E

Market Size of Electronic Equipment Manufacturing Industry in China, 2006-2017E

Market Size of Plastic Processing Machinery Industry in China, 2006-2017E

Market Size of Printing Machinery Industry in China, 2006-2017E

Sales Volume of Industrial Robots in China, 2006-2017E

Major Domestic and Foreign Robot Controller Enterprises and Their Products

Main Products of Leadshine Technology

Revenue and Net Income of Leadshine Technology, 2011-2015

Capacity, Output and Sales Volume of Leadshine Technology by Product, 2011-2014

Operating Revenue of Leadshine Technology by Product, 2011-2014

Operating Revenue of Leadshine Technology by Region, 2011-2014

Gross Margin of Leadshine Technology by Product, 2011-2014

Revenue and Net Income of ADTECH, 2011-2015

Main Motion Controllers of ADTECH

Revenue and Net Income of Leetro, 2011-2015

Motion Controller Series of Leetro

Operating Revenue Structure of Leetro by Business, 2011-2015

Leetro’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2015

Main Motion Controllers of Googol Technology

Applications of Motion Controllers of Googol Technology

Revenue and Net Income of ADLINK, 2009-2015

Revenue Structure of ADLINK by Business, 2010-2015

Motion Control Card Products of ADLINK

Revenue and Net Income of Advantech, 2009-2015

Gross Margin of Advantech, 2009-2015

Operating Revenue of Advantech by Business, 2013-2015

Operating Revenue of Advantech by Region, 2013-2014

Motion Controllers of Advantech

Revenue and Net Income of Sciyone, 2009-2015

Operating Revenue of Sciyone by Business, 2012-2015

Operating Revenue of Sciyone by Region, 2012-2015

Gross Margin of Sciyone by Business, 2009-2015

R&D Costs of Sciyon and % of Revenue, 2009-2015

Motion Controllers of Sciyon

Revenue and Net Income of Motion Controller Subsidiaries of Sciyone, 2014-2015

Revenue and Net Income of Weihong Electronic, 2011-2015

Operating Revenue and Breakdown of Weihong Electronic by Product, 2012-2014

Sales Volume and Sales-output Ratio of Weihong Electronic by Product, 2012-2014

Operating Revenue and Breakdown of Weihong Electronic by Region, 2012-2014

Gross Margin of Weihong Electronic by Product, 2011-2014

Weihong Electronic’s Revenue from Top 5 Clients and % of Total Revenue, 2014

Raised Fund Investment Projects of Weihong Electronic and Progress, 2015

Main Motion Controllers of TOPCNC

Main Motion Controllers of Tankon

Main Motion Controllers of Haichuan Numerical Control

Revenue and Net Income of HollySys, FY2013-FY2015

Main Business of HollySys

Revenue and Operating Income of HollySys by Business, FY2013-FY2015

Main Motion Controllers of RichAuto S&T

Main Motion Controllers of Delta Tau

Global Network of Trio

Main Motion Controllers of Trioand Characteristics

Main Motion Controllers of Galil

Market Size of CNC and GMC Motion Controllers in China, 2013-2017E

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...