Global and China Refractories Industry Report, 2016-2020

-

Feb.2016

- Hard Copy

- USD

$2,800

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

BXM088

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,000

-

- Hard Copy + Single User License

- USD

$3,000

-

Impacted by factors such as global economic downturn, China’s economic slowdown, weak growth in downstream sectors of refractories industry, as well as the rising prices of raw materials in recent years, the refractories industry of China has seen fiercer competition, which has resulted in a fall in companies’ orders and sales volume. Even worse, some have made losses.

In the first three quarters of 2015, the refractory output in China was 18.0825 million tons, down 7.63% from the same period of last year, with an estimated full-year output of roughly 26 million tons. Over the same period, China’s refractory exports totaled 1.2997 million tons, down 7.61% year-on-year, as opposed to some 1.75 million tons for the full year.

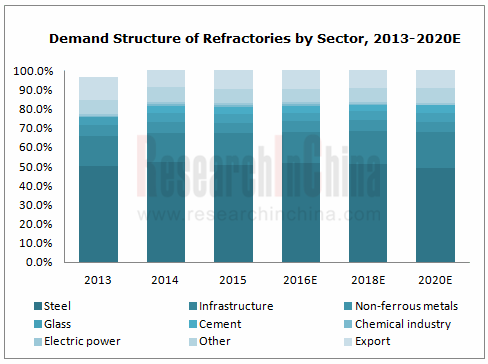

Among key downstream sectors of refractories industry including steel, cement, glass, and building materials, steel represented the largest portion, at around 65% of the global total. In 2015, the crude steel output worldwide amounted to 1.6228 billion tons, a year-on-year fall of 2.8%, of which 803.8 million tons came from China, down 2.3% from the previous year.

Affected by overcapacity in downstream sectors like steel, industrial restructuring and the decreased consumption of refractories for per ton of steel, the demand for refractories in China is anticipated to drop to 21.4 million tons (including export) by 2020, of which refractory for steel will hit about 10.5 million tons.

Source: the Association of China Refractories Industry; ResearchInChina

Presently, there have been several large corporate groups such as Vesuvius, RHI, Morgan Advanced Materials, Magnesita Refratários, and Shinagawa Refractories in the global refractories industry, and all of them have business layout in China.

So far in China, there have been over 2,000 manufacturers of refractory raw materials and products, with the market featuring fierce competition and low concentration, and the combined market share of the top 10 companies reaching about 15%. Through complementing each other and trans-regional allied reorganization of preponderant enterprises over recent years, a number of leading players consisting of Yingkou Qinghua Group, Beijing Lier High-temperature Materials, Luyang Energy-saving Materials, Puyang Refractories Group, and Zhejiang Zili Corporation Limited have sprung up.

Yingkou Qinghua Group:As the largest producer of refractories in China and the place where the Asia’s largest basic refractory production base is located, Yingkou Qinghua Group is primarily focused on basic refractories with annual capacity of 2 million tons. Its revenue reported RMB3 billion or so in 2015.

Beijing Lier High-temperature Materials:As a large general contractor of steel-used refractories in China, Beijing Lier High-temperature Materials have extended its industrial chain aggressively over the recent years. It acquired Liaoning Jinhong Mining Co., Ltd and Liaoning Haicheng Zhongxing Mining Group and organized them into a magnesite base in 2013, and carried internal integration of six companies in Liaoning-based Magnesite Material Base in 2014, and then planned an investment of RMB30 million to set up Beijing Lier E-commerce Co., Ltd in 2015 in a bid to erect an online transaction platform for refractory products.

Luyang Energy-saving Materials:As the largest producer of ceramic fiber in China, Luyang Energy-saving Materials completed the strategic cooperation agreement with Unifrax l LLC and transferred 29% equities to the latter, and obtained 100% equities of Unifrax (Suzhou) as well as the exclusive distributorship of Luyang Unifrax’s products in China in May 2015. Later in September 2015, LuYang Co., Ltd was renamed Luyang Energy-saving Materials Co., Ltd

Global and China Refractories Industry Report, 2016-2020 released by ResearchInChina mainly analyzes the following:

Supply and demand of refractory materials worldwide, status quo of development in major countries, etc.;

Supply and demand of refractory materials worldwide, status quo of development in major countries, etc.;

Policies, industrial environment, etc for refractory materials in China;

Policies, industrial environment, etc for refractory materials in China;

Supply and demand of refractory materials, competition pattern, etc in China;

Supply and demand of refractory materials, competition pattern, etc in China;

Development status and major companies of basic refractory material, unshaped refractory material, ceramic fiber, etc.;

Development status and major companies of basic refractory material, unshaped refractory material, ceramic fiber, etc.;

Upstream and downstream markets of refractory materials;

Upstream and downstream markets of refractory materials;

Operation, refractory material business analysis, etc of 13 global and 19 Chinese refractory material companies

Operation, refractory material business analysis, etc of 13 global and 19 Chinese refractory material companies

1. Overview of Refractories

1.1 Definition & Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

2. Development of Refractories Worldwide

2.1Market Supply and Demand

2.1.1 Production

2.1.2 Demand

2.2 Major Countries/Regions

2.2.1 Europe

2.2.2 United States

2.2.3 Japan

2.3.4 India

2.3.5 Australia

2.3.6 Brazil

2.3 Key Companies

3. Status Quo of China Refractories Industry

3.1 Major Policies

3.1.1 Domestic Policies

3.1.2 Export Environment

3.2 Status Quo of the Industry

3.2.1 Operation

3.2.2 Characteristics

3.3 Existing Problems

4. Status Quo of Chinese Refractories Market

4.1Market Supply and Demand

4.1.1 Production

4.1.2 Demand

4.2 Import & Export

4.2.1 Export

4.2.2 Import

4.3 Competition

4.3.1 Regional Pattern

4.3.2 Company Pattern

5. Refractory Product Segments

5.1 Basic Refractory

5.1.1 Development

5.1.2 Chrome-free Basic Refractory

5.1.3 Competitive Landscape

5.2 Unshaped Refractory

5.2.1 Development

5.2.2 Company Competition

5.3 Ceramic Fiber

5.3.1 Development

5.3.2 Key Companies

5.3.3 Development Prospects

6. Upstream/Downstream Refractories in China

6.1 Refractory Raw Material Market

6.1.1 Magnesite

6.1.2 Bauxite

6.1.3 Graphite

6.2 Downstream Refractory Market

6.2.1 Overview

6.2.2 Refractory for Steel Industry

6.2.3 Refractory for Glass Industry

6.2.4 Refractory for Cement Industry

7. Key Companies Worldwide

7.1 Vesuvius

7.1.1 Profile

7.1.2 Operation

7.1.3 Refractory Business

7.1.4 Development in China

7.2 RHI

7.2.1 Profile

7.2.2 Operation

7.2.3 Development Strategy

7.2.4 Development in China

7.3 Magnesita Refratários

7.3.1 Profile

7.3.2 Operation

7.3.3 Refractory Business

7.3.4 Development in China

7.4 Imerys

7.4.1 Profile

7.4.2 Operation

7.4.3 Refractory Business

7.5 Krosaki Harima

7.5.1 Profile

7.5.2 Operation

7.5.3 Development in China

7.6 Shinagawa Refractories

7.6.1 Profile

7.6.2 Operation

7.6.3 Development in China

7.7 Magnezit

7.7.1 Profile

7.7.2 Operation

7.7.3 Development in China

7.8 Harbison Walker International (former ANH Refractories)

7.8.1 Profile

7.8.2 Operation

7.8.3 Development in China

7.9 Morgan Advanced Materials (former Morgan Crucible)

7.9.1 Profile

7.9.2 Operation

7.9.3 Development in China

7.10 Refratechnik

7.10.1 Profile

7.10.2 Operation

7.10.3 Development in China

7.11 Chosun Refractories

7.11.1 Profile

7.11.2 Operation

7.11.3 Development in China

7.12 Minteq

7.12.1 Profile

7.12.2 Operation

7.12.3 Development in China

7.13 Saint-Gobain

7.13.1 Profile

7.13.2 Operation

7.13.3 Development in China

8. Key Enterprises in China

8.1 Puyang Refractories Group Co.,Ltd

8.1.1 Profile

8.1.2 Operation

8.1.3 Revenue Structure

8.1.4 Gross Margin

8.1.5 Development Strategy

8.2 Luyang Energy-saving Materials Co.,Ltd.

8.2.1 Profile

8.2.2 Operation

8.2.3 Revenue Structure

8.2.4 Gross Margin

8.2.5 Development Strategy

8.3 Ruitai Materials Technology Co., Ltd.

8.3.1 Profile

8.3.2 Operation

8.3.3 Revenue Structure

8.3.4 Gross Margin

8.3.5 Operation of Subsidiaries

8.3.6 Development Strategy

8.4 Beijing Lier High-temperature Materials Co., Ltd

8.4.1 Profile

8.4.2 Operation

8.4.3 Revenue Structure

8.4.4 Gross Margin

8.4.5 Development Strategy

8.5 Henan Rongjin High Temperature Materials Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Revenue Structure

8.5.4 Major Customers

8.6 Zhejiang Zili Corporation Limited

8.6.1 Profile

8.6.2 Operation

8.6.3 Revenue Structure

8.6.4 Major Customers

8.6.5 Development Strategy

8.7 Yingkou Qinghua Group Co., Ltd.

8.7.1 Profile

8.7.2 Operation

8.7.3 Key Projects

8.8 Wugang Refractory Co., Ltd

8.8.1 Profile

8.8.2 Operation

8.8.3 Development Strategy

8.9 Yingkou Jinlong Refractories Group Co., Ltd

8.9.1 Profile

8.9.2 Operation

8.10 Shandong Refractories Group Co.,Ltd

8.10.1 Profile

8.10.2 Operation

8.10.3 Main Subsidiaries

8.11 Tongda Refractory Technologies Co., Ltd

8.11.1 Profile

8.11.2 Operation

8.11.3 Key Projects

8.12 Sinosteel Refractory Co., Ltd

8.12.1 Profile

8.12.2 Operation

8.13 Jiangsu Sujia Group Co., Ltd.

8.13.1 Profile

8.13.2 Operation

8.14 Haicheng Houying Trade Group Co., Ltd.

8.14.1 Profile

8.14.2 Operation

8.14.3 Key Projects

8.15 Shanxi Xixiaoping Refractories Co., Ltd.

8.15.1 Profile

8.15.2 Operation

8.16 Others

8.16.1 Zhengzhou Zhengdong Technology Co., Ltd.

8.16.2 Shandong Luqiao New Materials Co., Ltd.

8.16.3 Sinosteel Luoyang Institute of Refractories Research Co., Ltd.

8.16.4 Haicheng Magnesite Refractory General Factory

9. Conclusion & Prediction

9.1 Market

9.2 Enterprises

Classification of Refractories

Refractory Industry Chain

Refractory Consumption Structure (by Sector)

Global Output of Refractories, 2011-2020

Output Structure of Refractories Worldwide by Country/Region, 2014

Driving Forces for the Development of Global Refractories Industry, 2014-2016

Global Demand for Refractories, 2009-2020

Production Structure of Refractories in Europe by Product, 2014

Refractory Output and Sales Value of PRE’s Member Units, 2009-2013

Output of Refractories in Japan, FY2010-FY2014

Consumption of Refractories for Iron & Steel in Japan, FY2011-FY2014

Output and Sales Value of Refractories in India, FY2012-FY2014

Application Fields and % of Refractories in Brazil

Leading Refractory Companies in the World, 2014

Policies on Refractories in China, 2009-2015

Total Export Quotas of Main Refractory Raw Materials in China, 2012-2016

Main Economic Indicators of Chinese Refractories Industry, 2011-2015

Main Economic Indicators of Key Chinese Refractory Companies, 2014-2015

Output and Growth Rate of Refractory Raw Materials in China, 2001-2020E

Export Volume and Value of Main Refractory Raw Materials and Products in China, 2014-2015

Import Volume and Value of Main Refractory Raw Materials and Products in China, 2014-2015

Top 15 Refractory Enterprises in China (by Revenue), 2013

Output and YoY Growth of Refractories in China, 2005-2020

Output of Refractories (by Product) in China, 2010-2020E

Output of Refractories in Key Provinces and Municipalities of China, 2012-2015

Demand for Refractories in China, 2013-2020E

Demand for Refractories (by Sector) in China, 2013-2020E

Export Volume and Value of Refractories in China, 2011-2015

Export Volume of Refractories (by Product) in China, 2009-2015

Volume Structure of Exported Basic Refractories (by Country) from China, 2014

Volume Structure of Exported Alumina-Silica Refractories (by Country) from China, 2014

Volume Structure of Exported Other Refractories (by Country) from China, 2014

Import Volume and Value of Refractories in China, 2011-2015

Import Volume of Refractories (by Product) in China, 2011-2015

Output Structure of Refractories (by Province/Municipality) in China, 2014-2015

Major Refractory Companies in Henan Province

Major Refractory Companies in Liaoning Province

Revenue of Major Refractory Companies in China, 2013-2015

Layout of World’s Major Refractory Companies in China as of end-2015

Main Basic Refractory Raw Materials and Refractory Products

Typical Applications of Basic Refractories

Application of Chromium-free Basic Firebrick in Developed Countries

Technology Roadmaps and Key Manufacturers of Chromium-free Basic Firebrick Substitutes

Key Chromium-free Basic Refractory Projects of Leading Company in China over Recent Years

Comparison between Shaped Refractory and Unshaped Refractory

Proportion of Unshaped Refractory in Major Countries/Regions, 2014

Output and % of Unshaped Refractory in China, 2010-2020

Key Manufacturers of Unshaped Refractory and Capacities in China, 2015

Applications and % of Ceramic Fiber in China

Output of Ceramic Fiber in China, 2007-2020E

Subsidiaries of World’s Leading Ceramic Fiber Manufacturers in China

Leading Ceramic Fiber Enterprises and Their Capacity in China, 2015

Substitution Advantages of Ceramic Fiber

Distribution of Magnesite Reserves Worldwide, 2014

Distribution of Magnesite Resources in China

Output of Magnesite in Major Countries, 2013-2014

Price Trend of Magnesite in the World, 2002-2014

Output of Magnesia (by Product) in China, 2007-2015E

Export Volume of Magnesia (by Product) in China, 2007-2015

Distribution of Bauxite Reserves Worldwide, 2014

Output of Bauxite in Major Countries, 2013-2014

Distribution of Bauxite Resources in China

Export Volume of Refractory Aluminum Clay in China, 2009-2015

Consumption of Bauxite Chamotte and Bauxite in China, 2008-2015

Distribution of Natural Graphite Reserves Worldwide, 2014

Distribution of Graphite (Crystalloid) in China, 2014

Export Volume of Natural Flake Graphite in China, 2009-2015

Main Consumption Fields and Unit Consumption of Refractories

Output of Main Downstream Refractory Industries, 2014-2015

Refractories for Iron and Steel Industry

Output of Crude Steel Worldwide, 2008-2015

Top 10 Producers (Countries) of Crude Steel in the World, 2015

Consumption of Crude Steel in Major Countries

Output and YoY Growth of Crude Steel in China, 2006-2020E

Consumption of Refractories for Per Ton of Steel in China, 2013-2020E

Top 10 Companies by Iron & Steel Output in China, 2014

Key Enterprises of Refractories for Iron & Steel and Major Customers in China

Output of Sheet Glass in China, 2012-2020E

Distribution Chart of Refractories for Glass Melting Furnace

Use (%) of Various Refractories in Glass Furnace

Consumption of Fused Cast Aluminum Oxide for Various Glass Furnaces

Key Companies of Fused Cast Refractory in China and Their Leading Products

Application of Refractories in Cement Kiln

Cement Output in China, 2008-2020E

Revenue and Profits of Vesuvius, 2010-2015

Revenue and Profits of Vesuvius (by Business), 2010-2015

Global Operations of Vesuvius at the end of 2014

Revenue of Vesuvius (by Region), 2013-2014

Refractory Products of Vesuvius

Vesuvius’ Revenue from Refractories, 2011-2015

Vesuvius’ Revenue from Refractories and YoY Growth (by Region), 2013-2015

Refractory Companies of Vesuvius in China

Major Bases and Clients Worldwide of RHI, 2015

Sales Volume of RHI, 2013-2015

Revenue and Profits of RHI, 2009-2015

Revenue of RHI (by Business), 2011-2015

Operating Revenue of RHI (by Region), 2013-2014

RHI’s Strategy for 2020

Refractory Companies of RHI at the end of 2015

RHI’s Sales in China, 2010-2015

Global Layout of Magnesita Refratários

Competitive Edges and Market Share of Magnesita Refratários

Revenue and Net Income of Magnesita Refratários, 2010-2015

Revenue Structure (by Business) of Magnesita Refratários, 2013-2015

Refractory Sales Volume and Revenue of Magnesita Refratários, 2013-2015

Revenue from Refractories (by Application) of Magnesita Refratários, 2013-2015

Revenue from Refractories (by Region) of Magnesita Refratários, 2013-2015

Refractory Companies of Magnesita Refratários in China

Global Operations of Imerys

Revenue and Net Income of Imerys, 2011-2015

Revenue of Imerys (by Region), 2012-2015

Revenue of Imerys (by Business), 2012-2015

Imerys’ Revenue from Four Major Businesses (by Product), 2014

Imerys’ Monolithic Refractories (Calderys) Products and Application

Imerys’ Refractory Mineral Products and Application

Distribution of Imerys’ Refractory Minerals Production Bases

Distribution of Calderys Company’s Production Bases

Milestones in the Development of Calderys, 2005-2015

Development Course of Krosaki

Revenue and Net Income of Krosaki, FY2009-FY2015

Revenue (by Business) of Krosaki, FY2012-FY2015

Applications and Percentage of Krosaki’s Refractories, FY2014

Revenue (by Region) of Krosaki, FY2012-FY2014

Development Course of Shinagawa

Main Products of Shinagawa

Selected Economic Indicators of Shinagawa, FY2012-FY2015

Revenue (by Business) of Shinagawa, FY2012-FY2015

Global Operations of Shinagawa

Overseas Sales of Shinagawa, FY2009-FY2014

Distribution of Shinagawa’s Companies in China

Main Products and Services of Magnezit

Global Operations of Magnezit

Key Clients of Magnezit

Main Products of HWI

Main Plants and Products of HWI

Hit Products of Morgan Advanced Materials

Revenue and Profits of Morgan Advanced Materials, 2009-2015

Revenue of Morgan Advanced Materials (by Country/Region), 2012-2015

Revenue and Profit Margin of Morgan Advanced Materials (by Business), FY2013-FY2015

Revenue of Morgan Advanced Materials (by Applied Sector), FY2014

Key Companies of Morgan Advanced Materials in China

Distribution of Refratechnik’s Plants Worldwide

Refratechnik’s Plants in China

Main Products of Chosun

Distribution of Chosun’s Key Bases Worldwide

Selected Economic Indicators of Chosun, 2010-2013

Production Bases of Chosun in China

Main Refractory Products of Minteq

Revenue (by Business) of Minerals Technologies Inc., 2014

Main Subsidiaries of Minteq

Minteq’s Revenue from Refractory Business, 2012-2015

Revenue and Operating Income of Saint-Gobain, 2013-2015

Key Operations of Saint-Gobain

Application of Saint-Gobain’s Refractories and Competitors

Revenue of Saint-Gobain (by Business), 2013-2015

Revenue of Saint-Gobain (by Region), 2013-2015

Business Turnover of Saint-Gobain in China, 2008-2015

Refractory Companies of Saint-Gobain in China

Revenue and Net Income of Puyang Refractories Group, 2009-2015

Output and Sales Volume of Puyang Refractories Group, 2011-2015

Operating Revenue and YoY Growth (by Product) of Puyang Refractories Group, 2012-2015

Operating Revenue (by Region) of Puyang Refractories Group, 2009-2015

Operating Revenue and Percentage (by Target Customer) of Puyang Refractories Group, 2011-2014

Operating Revenue and Percentage (by Sales Model) of Puyang Refractories Group, 2012-2014

Gross Margin of Refractories of Puyang Refractories Group, 2009-2015

Gross Margin of Main Products of Puyang Refractories Group, 2012-2015

M&A Events of Puyang Refractories Group, 2009-2015

Revenue and Net Income of Luyang Energy-saving Materials, 2009-2015

Operating Revenue (by Product) of Luyang Energy-saving Materials, 2010-2015

Operating Revenue (by Region) of Luyang Energy-saving Materials, 2010-2015

Consolidated Gross Margin of Luyang Energy-saving Materials, 2009-2015

Gross Margin (by Product) of Luyang Energy-saving Materials, 2009-2015

Equity Structure of Luyang Energy-saving Materials, end-2015

Business Development of Ruitai Materials Technology, 2008-2015

Revenue and Net Income of Ruitai Materials Technology, 2009-2015

Output and Sales Volume of Ruitai Materials Technology, 2011-2015

Operating Revenue (by Product) of Ruitai Materials Technology, 2011-2015

Operating Revenue (by Region) of Ruitai Materials Technology, 2009-2015

Gross Margin of Refractory Materials of Ruitai Materials Technology, 2008-2015

Gross Margin (by Product) of Ruitai Materials Technology, 2011-2015

Revenue and Net Income of Ruitai Materials Technology’s Key Subsidiaries, 2014

Business Development of Beijing Lier High-temperature Materials, 2011-2015

Revenue and Net Income of Beijing Lier High-temperature Materials, 2009-2015

Main Production Lines and Capacities of Beijing Lier High-temperature Materials, 2015

Output and Sales Volume of Refractories (by Product) of Beijing Lier High-temperature Materials, 2012-2014

Operating Revenue (by Product) of Beijing Lier High-temperature Materials, 2012-2015

Operating Revenue (by Region) of Beijing Lier High-temperature Materials, 2010-2015

Gross Margin of Refractories of Beijing Lier High-temperature Materials, 2009-2015

Gross Margin (by Product) of Beijing Lier High-temperature Materials, 2012-2015

Integration Map of Liaoning-based Magnesite Material Bases of Beijing Lier High-temperature Materials

Main Products of Henan Rongjin High Temperature Materials

Revenue, Net Income and Gross Margin of Henan Rongjin High Temperature Materials, 2012-2015

Operating Revenue (by Product) of Henan Rongjin High Temperature Materials, 2013-2015

Top 5 Clients of Henan Rongjin High Temperature Materials, 2013-2015

Selected Economic Indicators of Zhejiang Zili Corporation Limited, 2011-2015

Output and Sales Volume of Main Products of Zhejiang Zili Corporation Limited, 2011-2015

Operating Revenue (by Product) of Zhejiang Zili Corporation Limited, 2011-2015

Operating Revenue Structure (by Sales Mode) of Zhejiang Zili Corporation Limited, 2011-2015

Zhejiang Zili Corporation Limited’s Revenue from Top 5 Clients and % of Total Revenue, 2011-2013

Construction Scheme for Equity Investment Projects of Zhejiang Zili Corporation Limited, 2015

Main Products and Application of Yingkou Qinghua Group

Refractory Material Output of Yingkou Qinghua Group, 2012-2015

Refractory Material Output of Wugang Refractory Co., Ltd, 2012-2015

Production Capacity (by Product) of Yingkou Jinlong Refractories Group, 2015

Refractory Subsidiaries and Capacities of Main Products of Yingkou Jinlong Refractories Group, 2015

Refractory Output of Yingkou Jinlong Refractories Group, 2013-2015

Development History of Shandong Refractories Group

Refractory Output of Shandong Refractories Group, 2012-2015

Production Capacity of Key Subsidiaries and Branches under Shandong Refractories Group

Refractory Output of Tongda Refractory Technologies, 2012-2015

Revenue and Net Income of Tongda Refractory Technologies, 2011-2015

Refractory Output of Sinosteel Refractory, 2012-2015

Refractory Output of Jiangsu Sujia Group, 2012-2015

Main Refractory Products of Haicheng Houying Trade Group

Revenue and Taxes of Haicheng Houying Trade Group, 2009-2015

Refractory Output of Haicheng Houying Trade Group, 2012-2015

Selected Economic Indicators of Shanxi Xixiaoping Refractories, 2012-2015

Refractory Output of Zhengzhou Zhengdong Technology, 2012-2015

Refractory Output of Shandong Luqiao New Materials, 2012-2015

Refractory Output of Sinosteel Luoyang Institute of Refractories Research, 2012-2015

Production Capacity (by Product) of Haicheng Magnesite Refractory General Factory

Revenue and YoY Growth of Haicheng Magnesite Refractory General Factory, 2007-2015

Demand and Output of Refractories in China, 2014-2020

Sales Value of World’s Influential Refractory Companies, 2014-2015

Refractory Output of Leading Chinese Enterprises, 2014-2015

Big M&A Events in Chinese Refractories Industry, 2013-2015

Global and China Optical Fiber Preform Industry Report, 2021-2026

Optical fiber preforms play a key role in the optical fiber communication industry chain. The global construction of 4G and FTTH requires less optical fiber and cable, which has dragged down the deman...

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China Optical Fiber Preform Industry Report, 2020-2026

Optical fiber preform as a hi-tech product and a crucial link in the optical fiber industry chain contributes to 70% or so of profit margin. Global 4G and FTTH construction at dusk leads to the shrink...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...