Global and China Agricultural Machinery Industry Report, 2017-2021

-

Jul.2017

- Hard Copy

- USD

$3,000

-

- Pages:160

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

BXM104

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,400

-

- Hard Copy + Single User License

- USD

$3,200

-

Since 2015, China's agricultural industry has transferred from the high-growth gold age (2004-2014) to the medium and low-speed growth stage with in-depth adjustment. China’s agricultural machinery industry only saw the sales growth rate of 5.8% in 2016, 1.6 percentage points lower than the growth rate of the entire machinery industry, which was mainly affected by lower agricultural machinery subsidies, falling crop prices, the adjustment of the agricultural planting structure, the transition from Chinese national emission standards II to III and other factors. In 2017, this slow growth trend is more obvious, and the annual sales growth rate is expected to be about 4.0%.

As the Chinese agricultural machinery market entered into the new normal state and the demand for traditional agricultural machinery (tractors, combine harvesters, planters, rotary tillers and others) was significantly saturated, the tractor output of Chinese backbone enterprises fell 9.0% year on year in 2016; meanwhile, their output of self-propelled wheeled grain harvesters and corn harvesters dropped 11.1% and 43.5% year on year respectively. In contrast, rice transplanters, crawler harvesters and grain dryers performed better.

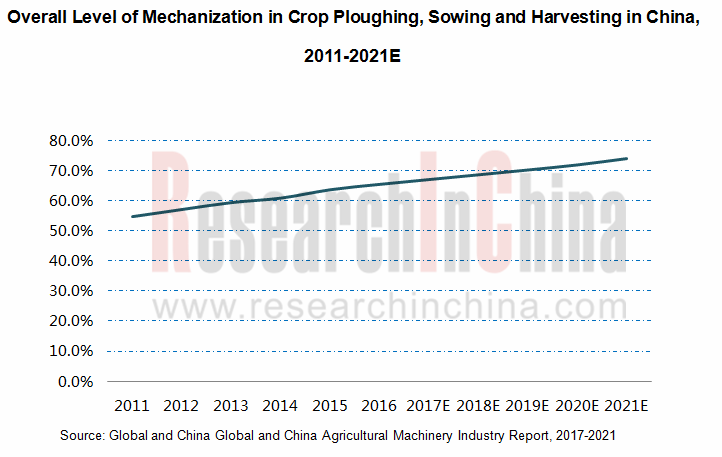

Although China's agricultural machinery industry is facing many challenges, the industry is still promising in the long run. The state has introduced Thirteenth Five-Year Plan for National Agricultural Mechanization Development, Action Program for Agricultural Machinery and Equipment Development (2016-2025) and other policies to promote the full agricultural mechanization. Data show that China's comprehensive agricultural mechanization level hit more than 65% in 2016, away from the goal of 70% in 2020.

On the other hand, the technologies of mechanized planting, corn mechanized harvesting and other weak links are promoted more radically while the traditional agricultural machinery market declines; the market share of power shift tractors, vertical axis harvesting machinery and supporting large complex agricultural machinery keeps rising. Therefore, high-end and intelligent products will become new growth engines in the market in the future with the further adjustment of the agricultural machinery demand structure.

In the face of the sluggish agricultural machinery market and the drop of the downstream demand, Chinese agricultural machinery enterprises compete with each other more intensely day by day. Some enterprises even witness the broken capital chain and cannot survive. However, some other enterprises have achieved steady growth by launching new products (such as Zoomlion, Sinoagri BOYO), opening up overseas markets (Foton Lovol, China YTO), expanding the industrial chain (Jiangsu World), mergers and acquisitions (LuoYang Zhongshou Machinery Equipment, Lion Agricultural Equipment) and other ways.

The report focuses on the followings:

Status quo of global agricultural machinery market, agricultural machinery development and key enterprises in major countries;

Status quo of global agricultural machinery market, agricultural machinery development and key enterprises in major countries;

China’s agricultural machinery market environment and policies (including subsidies, planning, emission standards, etc.);

China’s agricultural machinery market environment and policies (including subsidies, planning, emission standards, etc.);

Overview, main products, major enterprises, agricultural mechanization and future trends of China's agricultural machinery industry;

Overview, main products, major enterprises, agricultural mechanization and future trends of China's agricultural machinery industry;

Status quo of major agricultural machinery segments including tractors, harvesters, rice transplanters, cotton pickers and grain dryers;

Status quo of major agricultural machinery segments including tractors, harvesters, rice transplanters, cotton pickers and grain dryers;

Development of agricultural machinery industry in 17 major provinces including Shandong, Henan and Heilongjiang;

Development of agricultural machinery industry in 17 major provinces including Shandong, Henan and Heilongjiang;

Operation, R & D and development strategy of 8 global and 18 key Chinese agricultural machinery enterprises.

Operation, R & D and development strategy of 8 global and 18 key Chinese agricultural machinery enterprises.

1 Status Quo of Global Agricultural Machinery Industry

1.1 Market Overview

1.1.1 Production

1.1.2 Major Agricultural Machinery

1.2 Major Countries

1.2.1 USA

1.2.2 Canada

1.2.3 Germany

1.2.4 Italy

1.2.5 Japan

1.3 Major Companies

2 Development Environment for Agricultural Machinery Industry in China

2.1 Market Environment

2.2 Policy Environment

2.2.1 Major Policies

2.2.2 Agricultural Machinery Purchase Subsidies

2.2.3 Agricultural Machinery Emission Standards

3 Development of Agricultural Machinery Industry in China

3.1 Status Quo

3.1.1 Overview

3.1.2 Major Product Markets

3.1.3 Import & Export

3.1.4 Market Pattern

3.2 Agricultural Mechanization

3.2.1 Total Power and Structure of Agricultural Machinery

3.2.2 Ownership and Structure of Agricultural Machinery

3.2.3 Level of Agricultural Mechanization

3.2.4 Agricultural Mechanization Services

3.3 Development Trend

4 Main Agricultural Machinery Products in China

4.1 Tractor

4.1.1 Status Quo

4.1.2 Product Structure

4.1.3 Enterprise Pattern

4.2 Harvester

4.2.1 Supply and Demand

4.2.2 Mechanized Harvesting of Main Crops

4.3 Transplanter

4.3.1 Status Quo

4.3.2 Major Products

4.3.3 Major Regions

4.3.4 Export

4.3.5 Key Players

4.4 Cotton Picker

4.5 Grain Dryer

5 Key Provinces of Agricultural Machinery in China

5.1 Shandong

5.1.1 Total Amount of Agricultural Equipment

5.1.2 Level of Agricultural Mechanization

5.1.3 Agricultural Mechanization Services

5.1.4 Major Agricultural Machinery Enterprises

5.1.5 Development Planning

5.2 Heilongjiang

5.2.1 Total Amount of Agricultural Equipment

5.2.2 Level of Agricultural Mechanization

5.2.3 Agricultural Mechanization Services

5.2.4 Agricultural Machinery Enterprises

5.2.5 Development Planning

5.3 Henan

5.3.1 Total Amount of Agricultural Equipment

5.3.2 Level of Agricultural Mechanization

5.3.3 Agricultural Mechanization Services

5.3.4 Development Planning

5.4 Hebei

5.4.1 Total Amount of Agricultural Equipment

5.4.2 Level of Agricultural Mechanization

5.4.3 Development Planning

5.5 Anhui

5.5.1 Total Amount of Agricultural Equipment

5.5.2 Level of Agricultural Mechanization

5.5.3 Agricultural Machinery Operation

5.5.4 Development Planning

5.6 Hunan

5.6.1 Total Amount of Agricultural Equipment

5.6.2 Level of Agricultural Mechanization

5.6.3 Development Planning

5.7 Jiangsu

5.7.1 Total Amount of Agricultural Equipment

5.7.2 Level of Agricultural Mechanization

5.7.3 Agricultural Machinery Enterprises

5.7.4 Development Planning

5.8 Others

5.8.1 Jiangxi

5.8.2 Hubei

5.8.3 Jilin

5.8.4 Yunnan

5.8.5 Shanxi

5.8.6 Sichuan

5.8.7 Inner Mongolia

5.8.8 Liaoning

5.8.9 Shaanxi

5.8.10 Zhejiang

6 Global Major Agricultural Machinery Companies

6.1 John Deere

6.1.1 Profile

6.1.2 Operation

6.1.3 Development in China

6.2 CNH Industrial

6.2.1 Profile

6.2.2 Operation

6.2.3 Development in China

6.3 AGCO

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 CLAAS

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 SDF

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 Kubota

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 Mahindra

6.7.1 Profile

6.7.2 Operation

6.7.3 Agricultural Machinery Business

6.7.4 Development in China

6.8 ISEKI

6.8.1 Profile

6.8.2 Operation

6.8.3 Development in China

7. Key Agricultural Machinery Companies in China

7.1 YTO Group Corporation

7.1.1 Profile

7.1.2 Operation

7.1.3 First Tractor Company Limited

7.1.4 Luoyang Zhongshou Machinery Equipment Co., Ltd.

7.1.5 Development Strategy

7.2 Foton Lovol International Heavy Industry Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 R&D Capability

7.2.4 Development Strategy

7.3 Changzhou Dongfeng Agricultural Machinery Group Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Development Strategy

7.3.4 Key Projects

7.4 Shandong Changlin Machinery Group Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Development Strategy

7.5 Jiangsu Changfa Group

7.5.1 Profile

7.5.2 Operation

7.5.3 Agricultural Machinery Subsidiary -- Jiangsu Changfa Agricultural Equipment Co., Ltd.

7.6 Shandong Shifeng (Group) Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Development Strategy

7.7 Shandong Wuzheng (Group) Co. Ltd.

7.7.1 Profile

7.7.2 Operation

7.7.3 Development Strategy

7.8 Zoomlion Heavy Machinery Co., Ltd.

7.8.1 Profile

7.8.2 Operation

7.8.3 R&D Capability

7.9 Shandong Juming Group

7.9.1 Profile

7.9.2 Operation

7.9.3 Development Strategy

7.10 Jiangsu World Agricultural Machinery Co., Ltd.

7.10.1 Profile

7.10.2 Operation

7.11 Shandong CLAAS Jinyee Agricultural Machinery Co., Ltd.

7.11.1 Profile

7.11.2 Operation

7.12 Modern Agricultural Equipment Co., Ltd.

7.12.1 Profile

7.12.2 Operation

7.12.3 Agricultural Machinery Subsidiary -- Luoyang Zhongshou Machinery Equipment Co., Ltd.

7.13 Xinjiang Machinery Research Institute Co., Ltd.

7.13.1 Profile

7.13.2 Operation

7.13.3 Major Subsidiaries

7.14 Xingguang Agricultural Machinery Co., Ltd.

7.14.1 Profile

7.14.2 Operation

7.14.3 Competitive Edge

7.14.4 Development Strategy

7.15 Hebei Sino-Agri BOYO Agricultural Machinery Co., Ltd.

7.15.1 Profile

7.15.2 Operation

7.15.3 R&D Capability

7.16 Tianjin Yongmeng Machinery Manufacturing Co., Ltd.

7.16.1 Profile

7.16.2 Operation

7.16.3 R&D

7.17 LION Agricultural Equipment Co., Ltd.

7.17.1 Profile

7.17.2 Operation

7.17.3 Development Strategy

7.18 Hebei Nonghaha Agricultural Machinery Group Co., Ltd.

7.18.1 Profile

7.18.2 Operation

8. Summary and Forecast

8.1 Market

8.2 Enterprise

Gross Output Value of Agricultural Machinery Worldwide, 2010-2021E

Global Agricultural Machinery Market Structure by Region, 2016

Tractor Sales in Major Countries/Regions Worldwide, 2010-2016

Harvester Sales in Major Countries/Regions Worldwide, 2010-2016

Major Agricultural Machinery Sales in the United States, 2006-2016

Major Agricultural Machinery Sales in Canada, 2006-2016

Major Indicators of Agricultural Machinery Industry in Germany, 2010-2016

Major Indicators of Agricultural Machinery Industry in Italy, 2010-2016

Output Value and Sales of Agricultural Machinery in Japan, 2011-2017

Output Value and Sales of Agricultural Machinery Industry in Japan by Product, 2015-2016

Sales and Growth of Major Agricultural Machinery Players in the World, 2016

China’s GDP Growth, 2013-2017

Purchase Prices of Main Crops in China, 2017

Plans for Planting Restructuring in China, 2016-2020E

Prosperity of Agricultural Machinery in China, 2015-2017

Major Policies on Agricultural Machinery Industry in China, 2015-2017

Subsidies for Agricultural Machinery in China, 2004-2017

Central Subsidies for Purchase of Agricultural Machinery (by Province), 2017

Major Indicators of Agricultural Machinery Industry in China, 2011-2017

Output of Major Agricultural Machinery in China, 2011-2016

Tractor Output of Backbone Enterprises in China, 2012-2016

China’s Agricultural Machinery Imports, 2010-2017

China’s Agricultural Machinery Exports, 2010-2017

Export Value of Major Agricultural Machinery Products in China, 2016

Export Surplus of Agricultural Machinery in China, 2011-2017

Overseas Agricultural Machinery Players' Layout in China

Total Power of Agricultural Machinery in China, 2011-2021E

Power of Agricultural Machinery Per Hectare of Farmland in China, 2011-2021E

Total Power of Main Agricultural Equipment in China, 2011-2017

Total Power of Agricultural Machinery in Major Provinces, 2016

Major Agricultural Machinery Ownership in China, 2011-2021E

Ownership Ratio of Small Tractors and Large-and Medium-sized Tractors in China, 2004-2021E

Acreage of Farmland Covered by Mechanized Operation, 2011-2017

Overall Level of Mechanization in Crop Ploughing, Sowing and Harvesting in China, 2011-2021E

Mechanized Farming, Sowing, and Harvesting of Crops in China, 2011-2021E

Overall Level of Mechanization in Crop Plowing, Sowing, and Harvesting in Major Provinces in China, 2016

Regional Layout of Whole-course Mechanization of Main Crops Production in China

First Demonstration Counties Basically Realizing Whole-course Mechanization of Main Crops Production in China, 2016

Number of Agricultural Mechanization Service Organizations and Agricultural Machinery Cooperatives in China, 2011-2021E

Total Revenue of Agricultural Mechanization Services, 2011-2021E

Major Indices of Agricultural Machinery in 13th Five-year Period in China

Tractor Output and YoY Growth Rate in China, 2010-2017

Output Breakdown of Tractors in China by Type, 2010-2017

Top5 Enterprises in Chinese Large and Medium-sized Tractor Market, 2016

Top5 Enterprises in Chinese Small-wheel Tractor Market, 2016

Ownership and Structure of Harvesters in China, 2010-2017

Combine-harvester Output and Sales Volume in China, 2010-2017

China’s Combine-harvester Imports and Exports, 2014-2016

China’s Combine-harvester Exports and Proportion (by Country/Region), 2016

Level of Mechanized Harvesting of Three Main Crops in China, 2010-2021E

Wheat Harvester Ownership in China, 2010-2021E

Corn Harvester Ownership in China, 2010-2017

Sales Volume Structure of Corn Harvesters in China by Type, 2016

Three Corn Harvester Clusters in China

Market Share of Major Corn Harvester Enterprises in China by Sales Volume in China, 2015

Sales Volume of Rice Transplanters in China, 2014-2021E

Mechanical Transplanting Rate of Rice Transplanters in China, 2011-2021E

Subsidy of Transplanter in China, 2017

Market Share of Rice Transplanters by Type in China, 2016

Demand Structure of Rice Transplanters in China, 2016

Transplanting Rate of Rice in Major Provinces of China, 2016

China’s Rice Transplanter Imports and Exports, 2014-2016

Import Value of Rice Transplanter in China by Country, 2016

Export Value of Rice Transplanter in China by Country, 2016

Cotton Acreage in China by Region, 2014-2016

Domestic Cotton Picker Enterprises and R&D Progress, 2017

China’s Grain Output, 2011-2021E

Ownership of Grain Dryer in China, 2015-2021E

Major Grain Dryers Enterprises in China

Total Power and Output Value of Agricultural Machinery in Shandong, 2011-2021E

Ownership of Major Agricultural Machinery in Shandong, 2010-2017

Overall Level of Agricultural Mechanization in Shandong, 2011-2021E

Major Agricultural Machinery Enterprises in Shandong, 2016

Total Power and Agricultural Machinery in Heilongjiang, 2011-2021E

Ownership of Major Agricultural Machinery in Heilongjiang, 2011-2017

Overall Level of Agricultural Mechanization in Heilongjiang, 2011-2021E

Major Agricultural Machinery Enterprises in Heilongjiang

Total Power of Agricultural Machinery in Henan, 2011-2021E

Ownership of Major Agricultural Machinery in Henan, 2011-2017

Overall Level of Agricultural Mechanization in Henan, 2011-2021E

Total Power of Agricultural Machinery in Hebei, 2011-2021E

Ownership of Major Agricultural Machinery in Hebei, 2011-2017

Overall Level of Agricultural Mechanization in Hebei, 2011-2021E

Total Power of Agricultural Machinery in Anhui, 2011-2021E

Ownership of Major Agricultural Machinery in Anhui, 2012-2016

Overall Level of Agricultural Mechanization in Anhui, 2011-2021E

Total Revenue from Agricultural Machinery Operation in Anhui, 2010-2017

Total Power of Agricultural Machinery in Hunan, 2011-2021E

Ownership of Major Agricultural Machinery in Hunan, 2012-2016

Overall Level of Mechanization in Rice Plowing, Sowing, and Harvesting in Hunan, 2011-2021E

Total Power of Agricultural Machinery in Jiangsu, 2011-2021E

Ownership of Major Agricultural Machinery in Jiangsu, 2012-2016

Overall Level of Mechanization in Crop Production in Jiangsu, 2011-2021E

Major Agricultural Machinery Enterprises in Jiangsu, 2017

Total Power of Agricultural Machinery in Jiangxi, 2013-2021E

Ownership of Major Agricultural Machinery in Jiangxi, 2012-2016

Major Indicators of Agricultural Machinery Industry in Jiangxi, 2020E

Hubei’s Goals for Regional Development of Agricultural Machinery Industry, 2020E

Total Power of Agricultural Machinery in Jilin, 2011-2021E

Ownership of Major Agricultural Machinery in Jilin, 2012-2016

Total Power of Agricultural Machinery in Yunnan, 2011-2021E

Ownership of Major Agricultural Machinery in Yunnan, 2012-2016

Total Power of Agricultural Machinery in Shanxi, 2011-2021E

Total Power of Agricultural Machinery in Sichuan, 2011-2021E

Total Power of Agricultural Machinery in Inner Mongolia, 2011-2021E

Total Power of Agricultural Machinery in Liaoning, 2011-2021E

Total Power of Agricultural Machinery in Shaanxi, 2011-2021E

Total Power of Agricultural Machinery in Zhejiang, 2011-2021E

Net Sales and Net Income of John Deere, FY2011-FY2017

Net Sales and Operating Income of John Deere by Business, FY2011-FY2017

Net Sales of John Deere by Region, FY2013-FY2016

Production Bases of John Deere in China, 2017

Revenue and Profit of CNH Industrial, 2012-2017

Revenue of CNH Industrial by Business, 2015-2016

Revenue of CNH Industrial by Region, 2015-2016

Agricultural Machinery Production Bases of CNH Industrial in China, by the end of 2016

Net Sales and Net Income of AGCO, 2011-2016

Net Sales Structure of AGCO by Product, 2016

Net Sales Structure of AGCO by Region, 2016

AGCO’s Factories in China, by the end of 2016

Net Sales and Net Income of CLAAS, FY2011-FY2016

Net Sales Structure of CLAAS by Region, FY2016

4S Stores of CLAAS in China, by the end of Jun 2016

Net Sales and Net Income of SDF, 2011-2016

Net Sales Structure of SDF, 2015-2016

Global Production Base of SDF

Revenue and Net Income of Kubota, 2011-2016

Revenue of Kubota by Region, 2011-2016

Revenue of Kubota by Business, 2011-2016

Major Subsidiaries of Kubota in China, 2017

Business Structure of Mahindra

Sales Structure of Mahindra by Business, FY2016-FY2017

Global Agricultural Equipment Business Operation of Mahindra, 2017

Global Tractor Sales Volume of Mahindra, FY2008-FY2017

Mahindra’s Agricultural Machinery Factories in China, 2016

Revenue of ISEKI, 2012-2016

Revenue of ISEKI by Region, 2015-2016

Revenue of ISEKI by Business, 2015-2016

Revenue from Overseas Markets of ISEKI, 2015-2016

Revenue of YTO Group, 2010-2017

Revenue and Net Income of First Tractor, 2011-2017

Operating Revenue and Gross Margin of First Tractor by Business, 2013-2016

Agricultural Machinery Sales Volume and Revenue of First Tractor by Product, 2014-2016

Capacity and Output of First Tractor’s Main Products, 2015-2016

Operating Revenue of First Tractor by Region, 2011-216

Main Agricultural Machinery of FotonLovol

Revenue of FotonLovol, 2010-2017

Agricultural Equipment Revenue of Sector of FotonLovol, 2010-2016

Revenue of Changzhou Dongfeng Agricultural Machinery Group, 2011-2017

Revenue of Shandong Changlin Machinery Group, 2009-2017

Agricultural Machinery Subsidiaries of Shandong Changlin Machinery Group

Revenue of Jiangsu Changfa Group, 2011-2017

Major Subsidiaries of Jiangsu Changfa Group

Revenue and Profit & Tax of Shandong Shifeng, 2011-2017

Revenue of Shandong Wuzheng, 2010-2016

Production Bases of Zoomlion Heavy Machinery

Main Economic Indices of Zoomlion Heavy Machinery, 2015-2016

Revenue of Shandong Juming, 2011-2017

Development History of World Agricultural Machinery

Revenue of World Agricultural Machinery, 2011-2017

Subsidiaries and Main Products of Modern Agricultural Equipment, 2017

Revenue of Modern Agricultural Equipment, 2011-2017

Operating Revenue of Modern Agricultural Equipment by Business, 2013-2016

Major Agricultural Machinery Products of Xinjiang Machinery Research Institute

Revenue and Net Income of Xinjiang Machinery Research Institute, 2011-2017

Operating Revenue of Xinjiang Machinery Research Institute by Region, 2012-2016

Major Subsidiaries and Their Revenue of Xinjiang Machinery Research Institute, at the end of 2016

Revenue and Net Income of Xingguang Agricultural Machinery, 2012-2017

Revenue of Xingguang Agricultural Machinery by Product, 2012-2016

Revenue of Xingguang Agricultural Machinery by Region, 2012-2016

Number of Dealers of Xingguang Agricultural Machinery, 2012-2017

Corn Combine-harvester Sales Volume of Tianjin Yongmeng Machinery Manufacturing, 2013-2017

Major Economic Indicators of Agricultural Machinery Industry in China, 2016-2020E

Revenue of Major Agricultural Machinery Enterprises in China, 2016

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...