China Silicon Carbide Industry Report, 2018-2023

-

Aug.2018

- Hard Copy

- USD

$3,000

-

- Pages:116

- Single User License

(PDF Unprintable)

- USD

$2,800

-

- Code:

BXM114

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,200

-

- Hard Copy + Single User License

- USD

$3,200

-

Silicon carbide (SiC) has a range of excellent properties such as high temperature stability, high thermal conductivity, acid and alkali corrosion resistance, low expansion coefficient and thermal shock resistance. It is widely applied in fields of metallurgy, refractories, grinding, ceramics, electronics, etc.

China is the largest producer and exporter of silicon carbide in the world. As the demand from downstream sectors like metallurgy and refractories picked up in 2017, China’s output of silicon carbide soared by 38.5% to more than 1 million tons on the previous year. But by product, black silicon carbide and green silicon carbide polarize: output of the former had a 53.9% jump while that of the latter slumped by 65.2%. Steep fall in output of green silicon carbide (often used for cutting solar wafers) is largely due to the fact that it is massively replaced by diamond wire saws over the past two years, and the environmental inspection becomes increasingly stringent, causing some companies to reduce production or even stop production. It is predicted that Chinese silicon carbide market will sustain growth in 2018 but likely at a lower rate due to stricter environment protection requirements.

Silicon carbide is made from quartz sand and petroleum coke. Black silicon carbide price has been on the rise since 2017, climbing to over RMB8,000 per ton in January 2018, because of stricter oversight on environment protection and robust upstream and downstream demand. Green silicon carbide price otherwise went down compared with previous years with the slump in demand.

As technological progress is made, silicon carbide, a kind of new-generation wide band gap semiconductor, has been commercialized and aroused a tide of research and development and production globally. Semiconductor vendors like Cree, Infineon and Rohm have launched more advanced SiC based semiconductor devices and modules since 2016, broadening application of SiC semiconductors.

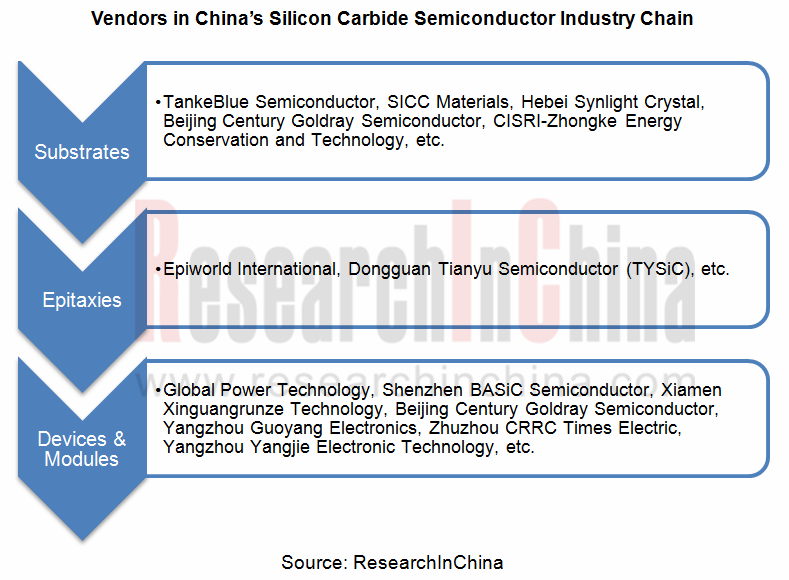

China follows behind closely and has been one of very few players engaged in both silicon carbide substrates and epitaxial materials. The country is marching towards a global leading role in semiconductor device design and manufacturing technologies. It as yet has built a relatively complete silicon carbide industry chain system.

In the future, silicon carbide semiconductor will find its way into power supply and photovoltaic industries, especially new energy vehicle field where it will be used more and promoted. The global silicon carbide power device market is estimated to be worth $1.4 billion in 2023, nearly four times larger than that in 2017.

Global and China Silicon Carbide Industry Report, 2018-2023 highlights the following:

Global silicon carbide industry (smelting and processing, power semiconductors) (market size, key companies, etc.);

Global silicon carbide industry (smelting and processing, power semiconductors) (market size, key companies, etc.);

China silicon carbide industry (policy environment, industry status and development trend);

China silicon carbide industry (policy environment, industry status and development trend);

China silicon carbide smelting and processing market (supply and demand, import and export, key companies and price trend);

China silicon carbide smelting and processing market (supply and demand, import and export, key companies and price trend);

China silicon carbide semiconductor industry (market size, industry chain (substrates, epitaxies, devices, etc.), key companies, etc.);

China silicon carbide semiconductor industry (market size, industry chain (substrates, epitaxies, devices, etc.), key companies, etc.);

15 Chinese silicon carbide smelting and processing companies and 10 silicon carbide semiconductor vendors (operation, revenue structure, silicon carbide business, etc.).

15 Chinese silicon carbide smelting and processing companies and 10 silicon carbide semiconductor vendors (operation, revenue structure, silicon carbide business, etc.).

1 Overview

1.1 Definition and Classification

1.2 Properties and Applications

1.3 Industry Chain

2 Global Silicon Carbide Industry

2.1 Silicon Carbide Smelting and Processing

2.1.1 Market Situation

2.1.2 Key Companies

2.2 Silicon Carbide Power Semiconductor

2.2.1 Overview

2.2.2 Market Situation

2.2.3 Silicon Carbide Substrate

2.2.4 Silicon Carbide Epitaxial Wafer

2.2.5 Silicon Carbide Device

2.2.6 Key Companies

3 China Silicon Carbide Industry

3.1 Policies

3.2 Status Quo

3.3 Development Trend

4 China Silicon Carbide Smelting and Processing Market

4.1 Supply and Demand

4.1.1 Supply

4.1.2 Demand

4.1.3 Blade Grade Silicon Carbide

4.2 Import and Export

4.2.1 Export

4.2.2 Import

4.3 Price Trend

4.4 Corporate Competition

5 China Silicon Carbide Semiconductor Market

5.1 Market Situation

5.2 Silicon Carbide Substrate

5.2.1 Status Quo

5.2.2 Key Companies

5.3 Silicon Carbide Epitaxial Wafer

5.4 Silicon Carbide Device

5.5 Application

6 Upstream and Downstream of Silicon Carbide in China

6.1 Upstream

6.1.1 Quartz Sand

6.1.2 Anthracite

6.1.3 Petroleum Coke

6.2 Downstream

6.2.1 Abrasives

6.2.2 Refractories

6.2.3 Steel

6.2.4 Special Ceramics

6.2.5 LED

6.2.6 PV

6.2.7 New Energy Vehicle

6.2.8 Microwave Device

7 Key Chinese Silicon Carbide Smelting and Processing Companies

7.1 Henan Yicheng New Energy Co., Ltd.

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 R&D and Investment

7.1.6 Clients and Suppliers

7.1.7 Silicon Carbide Business

7.1.8 Forecast and Outlook

7.2 Ningxia Orient Tantalum Industry Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 Silicon Carbide Business

7.2.6 Development Strategy

7.3 Jiangsu Haobo New Materials Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 Silicon Carbide Business

7.4 Pingluo Binhe Silicon Carbide Products Co., Ltd.

7.4.1 Profile

7.4.2 Silicon Carbide Business

7.5 Lanzhou Heqiao Resource Co., Ltd.

7.5.1 Profile

7.5.2 Silicon Carbide Business

7.6 Ningxia Tianjing Longding Silicon Carbide Co., Ltd.

7.6.1 Profile

7.6.2 Silicon Carbide Business

7.7 Tianzhu Zhengyu Silicon Carbide Co., Ltd.

7.7.1 Profile

7.7.2 Silicon Carbide Business

7.8 Ningxia Jinjing New Materials Co., Ltd.

7.8.1 Profile

7.8.2 Silicon Carbide Business

7.9 Tonghua Hongxin Abrasive Co., Ltd.

7.9.1 Profile

7.9.2 Silicon Carbide Business

7.10 Linshu Zhengyu Silicon Carbide Factory

7.10.1 Profile

7.10.2 Silicon Carbide Business

7.11 Jiangsu Leyuan New Materials Group Co., Ltd.

7.11.1 Profile

7.11.2 Silicon Carbide Business

7.12 Hanjiang Hongyuan Xiangyang Silicon Carbide Special Ceramics Co., Ltd.

7.12.1 Profile

7.12.2 Silicon Carbide Business

7.12.3 Development Advantages

7.13 Yili Master Carborundum Products Co., Ltd.

7.13.1 Profile

7.13.2 Silicon Carbide Business

7.14 Xinjiang Longhai Silicon Industry Development Co., Ltd.

7.14.1 Profile

7.14.2 Silicon Carbide Business

7.15 Shandong Jinmeng New Materials Co., Ltd.

7.15.1 Profile

7.15.2 Silicon Carbide Business

8 Key Chinese Silicon Carbide Semiconductor Vendors

8.1 TanKeBlue Semiconductor Co., Ltd.

8.1.1 Profile

8.1.2 Operation

8.1.3 Revenue Structure

8.1.4 Gross Margin

8.1.5 Clients and Suppliers

8.1.6 R&D and Investment

8.1.7 Silicon Carbide Business

8.1.8 Development Strategy

8.2 SICC Materials Co., Ltd.

8.2.1 Profile

8.2.2 Silicon Carbide Business

8.3 Hebei Synlight Crystal Co., Ltd.

8.3.1 Profile

8.3.2 Silicon Carbide Business

8.4 Beijing Century Goldray Semiconductor Co., Ltd.

8.4.1 Profile

8.4.2 Silicon Carbide Business

8.5 Yangzhou Yangjie Electronic Technology Co., Ltd.

8.5.1 Profile

8.5.2 Operation

8.5.3 Silicon Carbide Business

8.6 Global Power Technology (Beijing) Co., Ltd.

8.6.1 Profile

8.6.2 Silicon Carbide Business

8.7 EpiWorld International Co., Ltd.

8.7.1 Profile

8.7.2 Silicon Carbide Business

8.8 Semiconductor Business Unit of Zhuzhou CRRC Times Electric Co., Ltd.

8.8.1 Profile

8.8.2 Silicon Carbide Business

8.9 Dongguan Tianyu Semiconductor Co., Ltd. (TYSiC)

8.9.1 Profile

8.9.2 Silicon Carbide Business

8.10 Xiamen Xinguangrunze Technology Co., Ltd.

8.10.1 Profile

8.10.2 Silicon Carbide Business

SiC Industry Chain

Global SiC Capacity, 2012-2018

Structure of Downstream Demand for SiC Worldwide, 2009-2018

Major SiC Smelting and Processing Enterprises Worldwide

Advantages of Third-generation SiC Semiconductor

Application of SiC Power Devices

Policies for SiC in Some Countries and Regions

Global SiC Power Semiconductor Market Size, 2015-2023E

Application Structure of Global SiC Semiconductor, 2016-2022E

Global SiC n-type Substrate Shipment and Output Value, 2016

Global SiC Epi-house & Epi-Service Suppliers

Classification of SiC Power Devices

Global Power Device Manufacturers

Major Companies in Global SiC Semiconductor Industry Chain

Policies on SiC in China, 2011-2018

China’s SiC Capacity (by Product), 2015-2018

China’s SiC Semiconductor Industry Chain

China’s SiC Output (by Product), 2011-2018

China’s SiC Output (by Region), 2017

China’s SiC Apparent Consumption, 2013-2018

China’s SiC Demand Structure (by Product), 2017

Comparison between Mortar Line Cutting and Diamond Wire Cutting

Penetration Rate of Diamond Wire Cutting in Photovoltaic Industry

Market Share of Major Electroplated Diamond Wire Manufacturers in China, 2016

China’s SiC Export, 2013-2018

China’s SiC Export Value (by Destination), 2017

China’s SiC Import, 2013-2018

China’s SiC Import Value (by Country of Origin), 2017

China’s SiC Ex-factory Price (tax included), 2016-2017

Black SiC Price Trend in Ningxia, 2017-2018

Capacity of Major SiC Smelting and Processing Companies in China, 2017

Major Companies in Chinese SiC Industry Chain

China’s SiC Semiconductor Output Value (by Industrial Chain Link), 2017

International SiC Monocrystal Substrate Size and Share in Power Electronics, 2005-2020E

Competitive Landscape of Global SiC Wafer Market (including R&D Institutions), 2018

Development History of SiC Epitaxy

China’s Import Value and Export Value of Silica Sand and Quartz Sand, 2014-2018

Anthracite Price Trend in North China, 2016-2018

China’s Output of Petroleum Coke, 2010-2018

Operating Rate of Petroleum Coke in China, 2017-2018

Price Trend of Petroleum Coke in China, 2016-2018

China’s Petroleum Coke Import Structure (by Country), 2017

Diagram of Silicon Wafer Cutting

China’s Output of Refractories and YoY Growth, 2010-2023E

China’s Output of Refractories (by Product), 2010-2017

Application of SiC in Steel Industry

China’s Output of Crude Steel and YoY Growth, 2010-2023

China’s Output of Electric Furnace Steel and Proportion, 2013-2023

Top 10 Enterprises by Crude Steel Output in China, 2017

Ceramic Matrix Composite Industry Chain

Comparison between Three LED Chip Substrate Materials

SiC Substrate LED Chip

China’s LED Output Value (by Production Process), 2011-2023E

Market Share of LED Chip Vendors in Mainland China, 2016-2018

Cost Structure of LED Chip

China’s Cumulative PV Installed Capacity, 2009-2023E

China’s Output and Sales of New Energy Vehicle (by type), 2013-2018

Electric Vehicle Charging Pile Ownership and Pile-to-vehicle Ratio in China, 2015-2023E

Revenue and Net Income of Yicheng New Energy, 2011-2018

Revenue Breakdown of Yicheng New Energy by Business, 2016-2017

Revenue Breakdown of Yicheng New Energy by Region, 2011-2017

Consolidated Gross Margin of Yicheng New Energy, 2011-2018

R&D Costs of Yicheng New Energy and % of Total Revenue, 2012-2017

Yicheng New Energy’s Procurement from Top 5 Suppliers, 2015-2018

Yicheng New Energy’s Revenue from Top 5 Customers, 2015-2018

SiC Output and Sales of Yicheng New Energy, 2013-2017

SiC Revenue and Gross Margin of Yicheng New Energy, 2013-2017

Revenue and Net Income of Yicheng New Energy’s SiC-related Subsidiaries, 2017

Revenue and Net Income of Yicheng New Energy, 2017-2023E

Revenue and Net Income of Ningxia Orient Tantalum Industry, 2011-2018

Revenue Breakdown of Ningxia Orient Tantalum Industry (by Business), 2012-2017

Revenue Breakdown of Ningxia Orient Tantalum Industry (by Region), 2012-2017

Consolidated Gross Margin of Ningxia Orient Tantalum Industry, 2012-2018

SiC Revenue and Gross Margin of Ningxia Orient Tantalum Industry, 2012-2017

Specifications of Ningxia Orient Tantalum Industry’s SiC Products

Development History of Jiangsu Haobo New Materials

Revenue and Net Income of Jiangsu Haobo New Materials, 2013-2017

Operating Revenue of Jiangsu Haobo New Materials (by Business), 2013-2017

Gross Margin of Jiangsu Haobo New Materials, 2013-2017

Development History of Lanzhou Heqiao Resource

Equity Structure of Lanzhou Heqiao Resource

Specifications of Lanzhou Heqiao Resource’s Black SiC Grit

Specifications of Lanzhou Heqiao Resource’s Black SiC Powder

Specifications of Lanzhou Heqiao Resource’s High-density Large-crystal Black Silicon Carbide

Lanzhou Heqiao Resource’s High-density Large-crystal Black Silicon Carbide

Specifications of Lanzhou Heqiao Resource’s Black SiC Sand

Main Economic Indicators of Ningxia Tianjing Longding Silicon Carbide, 2017-2018

Specifications of Ningxia Jinjing New Materials’s Black SiC

Equity Structure of Tonghua Hongxin Abrasive

Main Products of Jiangsu Leyuan New Materials Group

Key Performance Indicators of Large-crystal Black SiC of Hangjiang Hongyuan Xiangyang Silicon Carbide Special Ceramics

Specifications and Models of SiC Industrial Pumps of Hangjiang Hongyuan Xiangyang Silicon Carbide Special Ceramics

Revenue and Net Income of TankeBlue Semiconductor, 2014-2017

Operating Revenue of TankeBlue Semiconductor (by Product), 2014-2017

Operating Revenue of TankeBlue Semiconductor (by Region), 2014-2017

Gross Margin of TankeBlue Semiconductor, 2014-2017

TankeBlue Semiconductor’s Revenue from Top 5 Customers, 2014-2017

TankeBlue Semiconductor’s Procurement from Top 5 Suppliers, 2014-2017

R&D Expenditure of TankeBlue Semiconductor, 2014-2016

6-inch Conductive SiC Crystal of TankeBlue Semiconductor

2 to 4-inch Conductive SiC Wafers of TankeBlue Semiconductor

X-inch Semi-insulating SiC Crystal of TankeBlue Semiconductor

2 to 4-inch Semi-insulating SiC Wafers of TankeBlue Semiconductor

2-inch SiC Wafer Standards of TankeBlue Semiconductor

3-inch SiC Wafer Standards of TankeBlue Semiconductor

4-inch SiC Wafer Standards of TankeBlue Semiconductor

6-inch SiC Wafer Standards of TankeBlue Semiconductor

Test- level SiC Wafer Standards of TankeBlue Semiconductor

Equity Structure of SICC Materials

Foreign Sales Network of SICC Materials

Domestic Sales Network of SICC Materials

Specifications of SICC Materials’ N-type 2-inch Substrate

Specifications of SICC Materials’ N-type 3-inch Substrate

Specifications of SICC Materials’ N-type 4-inch Substrate

4-inch SiC Products and Performance of Hebei Synlight Crystal

6-inch SiC Products and Performance of Hebei Synlight Crystal

Development History of Beijing Century Goldray Semiconductor

SiC-related Products and Applications of Beijing Century Goldray Semiconductor

Development History of Yangzhou Yangjie Electronic Technology

Revenue of Yangzhou Yangjie Electronic Technology (by Product), 2013-2017

Development History of Xiamen XinGuangRunZe Technology

Products of Xiamen XinGuangRunZe Technology

Global and China Optical Fiber Preform Industry Report, 2021-2026

Optical fiber preforms play a key role in the optical fiber communication industry chain. The global construction of 4G and FTTH requires less optical fiber and cable, which has dragged down the deman...

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China Optical Fiber Preform Industry Report, 2020-2026

Optical fiber preform as a hi-tech product and a crucial link in the optical fiber industry chain contributes to 70% or so of profit margin. Global 4G and FTTH construction at dusk leads to the shrink...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...