Global and China Isostatic Graphite Industry Report, 2018-2022

-

Sep.2018

- Hard Copy

- USD

$3,200

-

- Pages:135

- Single User License

(PDF Unprintable)

- USD

$3,000

-

- Code:

ZLC067

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,500

-

- Hard Copy + Single User License

- USD

$3,400

-

Isostatic graphite, a kind of high-end specialty graphite with multiple excellent properties, is widely used in semiconductor, electric discharge & mold machining, nuclear power, metallurgy and aviation, particularly in PV field, the largest applied market.

Global photovoltaic (PV) industry has been developing apace over recent years, with new installed capacity hitting 98GW in 2017, a year-on-year increase of 40%, bringing total global installations to 402.5GW. China added 53GW in the year, an upsurge of 53.4% from a year earlier, with cumulative installed capacity reporting 130GW.

Spurred by the booming PV sector, global output of isostatic graphite reached 142kt in 2016, about 71.5% of which was consumed in PV field. China demanded 74kt of isostatic graphite, 73.7% of which came from the PV industry. However, as China-made products are still inferior to foreign high-end ones, the isostatic graphite for high-end applications like nuclear power is largely imported, with a self-sufficiency rate of about 70.8%.

Japan, the United States and Europe are home to major isostatic graphite producers in the world. Enterprises with capacity of over 10kt include TOYO TANSO, IBIDEN and Tokai (Japan), SGL (Germany), and Mersen (France). Among them, SGL, Mersen and TOYO TANSO have production bases in China.

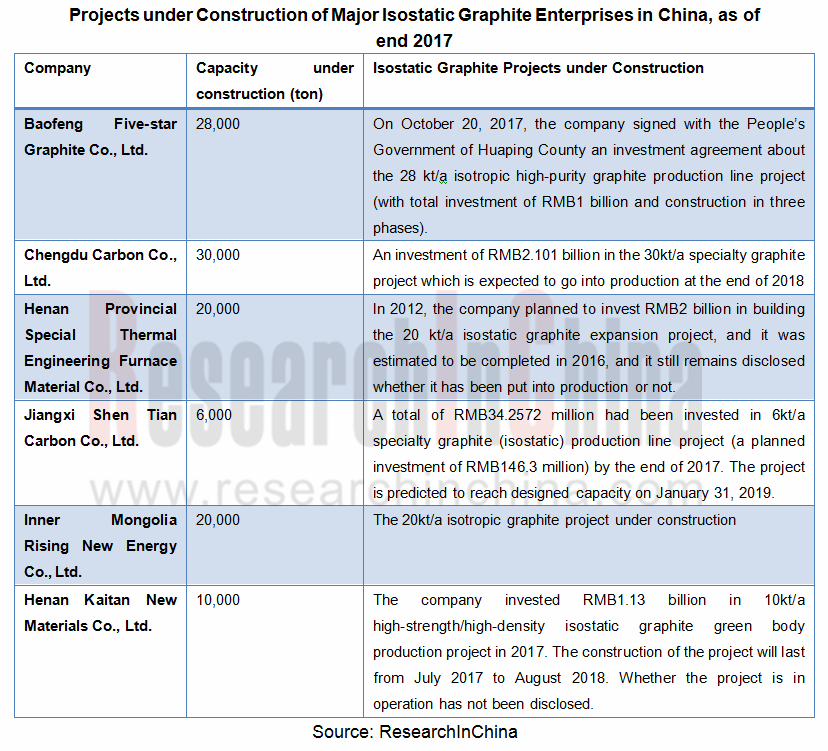

Famous Chinese isostatic graphite producers include Baofeng Five-star Graphite, Chengdu Carbon (Fangda Carbon New Material), Datong Xincheng New Material, Jilin Carbon and Sinosteel Advanced Material (Zhejiang). Among them, Baofeng Five-star Graphite boasts larger capacity (10kt/a), and Chengdu Carbon has the most product specifications and varieties. Several firms including Chengdu Carbon are still ramping up production with a combined capacity of about 114kt/a under construction.

As the demand from downstream sectors like PV is growing steadily, China’s output of isostatic graphite and self-sufficiency rate will rise along with operation of isostatic graphite projects under construction and improvement in performance of the products, to an estimated 103.7kt and 87.9% in 2022, respectively.

Global and China Isostatic Graphite Industry Report, 2018-2022 highlights the followings:

Global isostatic graphite industry (status quo, market size, competitive landscape, development in major countries, etc.);

Global isostatic graphite industry (status quo, market size, competitive landscape, development in major countries, etc.);

The isostatic graphite industry in China (development environment, supply & demand, competitive landscape, import & export, price comparison, development trends, etc.);

The isostatic graphite industry in China (development environment, supply & demand, competitive landscape, import & export, price comparison, development trends, etc.);

Downstream sectors (PV, electrical discharge machining (EDM), nuclear power, etc.);

Downstream sectors (PV, electrical discharge machining (EDM), nuclear power, etc.);

Eight foreign and twenty Chinese enterprises (profile, operation, R&D investment, isostatic graphite business, etc.)

Eight foreign and twenty Chinese enterprises (profile, operation, R&D investment, isostatic graphite business, etc.)

1 Overview of Isostatic Graphite

1.1 Introduction

1.2 Application

1.3 Industry Chain

2 Development of Global Isostatic Graphite Industry

2.1 Status Quo

2.2 Market Size

2.3 Competitive Landscape

2.4 Development in Major Countries

2.4.1 USA

2.4.2 Japan

2.4.3 Germany

3. Development of China Isostatic Graphite Industry

3.1 Development Environment

3.1.1 Upstream

3.1.2 Development Environment

3.1.3 Production Technology

3.2 Demand

3.2.1 Demand

3.2.2 Demand Structure

3.3 Supply

3.4 Competitive Landscape

3.5 Import and Export

3.6 Price Comparison

3.7 The Gap with Foreign Countries

3.8 Development Trend

3.8.1 Isostatic Graphite Is Gearing towards Large Specifications

3.8.2 The Release of Capacity Conduces to a Rise in Self-Sufficiency

3.8.3 Robust Demand from Downstream Sectors Facilitates the Development of Isostatic Graphite Industry

4. Development of Downstream Sectors

4.1 Photovoltaic Industry

4.1.1 Status Quo

4.1.2 Market Size

4.1.3 Demand for Isostatic Graphite

4.2 Electrical Discharge Machining (EDM) Industry

4.2.1 Overview

4.2.2 Demand for Isostatic Graphite

4.3 Nuclear Power Industry

4.3.1 Overview

4.3.2 Demand for Isostatic Graphite

5. Major Overseas Companies

5.1 Mersen

5.1.1 Profile

5.1.2 Operation

5.1.3 Isostatic Graphite Business

5.1.4 Development in China

5.2 TOYO TANSO

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Isostatic Graphite Business

5.2.5 Development in China

5.3 Tokai Carbon

5.3.1 Profile

5.3.2 Operation

5.3.3 Isostatic Graphite Business

5.3.4 Development in China

5.4 SGL Group

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Isostatic Graphite Business

5.4.5 Development in China

5.5 IBIDEN

5.5.1 Profile

5.5.2 Operation

5.5.3 Isostatic Graphite Business

5.5.4 Development in China

5.6 Poco Graphite

5.6.1 Profile

5.6.2 Isostatic Graphite Business

5.6.3 Development in China

5.7 GrafTech

5.7.1 Profile

5.7.2 Operation

5.7.3 Isostatic Graphite Business

5.8 NTC

5.8.1 Profile

5.8.2 Isostatic Graphite Business

6. Key Chinese Companies

6.1 Fangda Carbon New Material Co., Ltd

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 R&D Investment

6.1.6 Chengdu Carbon Co., Ltd.

6.1.7 Chengdu Rongguang Carbon Co., Ltd.

6.1.8 Forecast and Outlook

6.2 Datong Xincheng New Material Co., Ltd.

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Major Customers

6.2.6 R&D Investment

6.2.7 Isostatic Graphite Business

6.2.8 Forecast and Outlook

6.3 Jilin Gaoke Special Carbon Materials Co., Ltd.

6.3.1 Profile

6.3.2 Isostatic Graphite Business

6.4 North Industries Group Red Arrow Co., Ltd.

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Isostatic Graphite Business

6.5 Pingdingshan Oriental Carbon Co., Ltd.

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Gross Margin

6.5.5 Isostatic Graphite Business

6.6 Sinosteel Advanced Material (Zhejiang) Co., Ltd.

6.6.1 Profile

6.6.2 Isostatic Graphite Business

6.7 Mersen (Chongqing) Co., Ltd.

6.7.1 Profile

6.7.2 Isostatic Graphite Business

6.8 Pingdingshan City Kaiyuan Specialty Graphite Ltd.

6.8.1 Profile

6.8.2 Isostatic Graphite Business

6.8.3 Developments

6.9 Liaoning Dahua Glory Special Graphite Co., Ltd.

6.9.1 Profile

6.9.2 Isostatic Graphite Business

6.10 Sichuan Guanghan Shida Carbon Inc.

6.10.1 Profile

6.10.2 Isostatic Graphite Business

6.10.3 Developments

6.11 Jiangsu Hoken Carbon Technology Co., Ltd.

6.11.1 Profile

6.11.2 Isostatic Graphite Business

6.11.3 Developments

6.12 Hemsun High Purity Graphite Technology Co., Ltd

6.12.1 Profile

6.12.2 Isostatic Graphite Business

6.13 Baofeng Five-star Graphite Co., Ltd.

6.13.1 Profile

6.13.2 Isostatic Graphite Business

6.13.3 Developments

6.14 Sichuan Qingyang New Material Technology Co., Ltd.

6.14.1 Profile

6.14.2 Isostatic Graphite Business

6.15 Hebei Haili Special Graphite Manufacturing Co., Ltd.

6.15.1 Profile

6.15.2 Isostatic Graphite Business

6.16 Shanghai Sinmo Industries Co., Ltd.

6.16.1 Profile

6.16.2 Isostatic Graphite Business

6.17 Henan Kaitan New Materials Co., Ltd.

6.17.1 Profile

6.17.2 Isostatic Graphite Business

6.18 Guizhou Geruite New Materials Co., Ltd.

6.18.1 Profile

6.18.2 Business Performance

6.18.3 Developments

6.19 Inner Mongolia Ruisheng New Energy Co., Ltd.

6.19.1 Profile

6.19.2 Isostatic Graphite Business

6.20 Pingdingshan Boxiang Carbon Co., Ltd.

6.20.1 Profile

6.20.2 Isostatic Graphite Business

Isostatic Graphite Process Flow Diagram

Application of Isostatic Graphite

Isostatic Graphite Industry Chain

New PV Installed Capacity of Major Countries Worldwide, 2010-2018

Global Output of Isostatic Graphite, 2009-2018

Global Output of Isostatic Graphite, 2017-2022E

Global Isostatic Graphite Application Structure, 2018

Comparison between Global and Chinese Major Isostatic Graphite Manufacturers

China’s Natural Graphite Output, 2011-2018

China’s Artificial Graphite Output, 2013-2018

China’s Natural Graphite Imports, 2011-2017

China’s Artificial Graphite Imports, 2011-2017

China’s Natural Graphite Exports, 2011-2017

China’s Artificial Graphite Exports, 2011-2017

Policies on Isostatic Graphite Industry in China, 2006-2018

Demand for Isostatic Graphite in China, 2009-2018

Demand for Isostatic Graphite in China, 2017-2022E

Isostatic Graphite Application Structure in China, 2017

Isostatic Graphite Application Structure in China, 2018

China’s Output of Isostatic Graphite, 2009-2018

China’s Output of Isostatic Graphite, 2017-2022E

Capacity and Projects under Construction of Major Isostatic Graphite Enterprises in China

Comparison of Maximum Product Specifications between Major Isostatic Graphite Companies in China

Net Import Volume of Isostatic Graphite in China, 2009-2018

Isostatic Graphite Price Comparison between China and Foreign Countries, 2015-2016

Comparison of Isostatic Graphite Prices at Home and Abroad, Sept 2018

Isostatic Graphite Projects under Construction in China, as of 2017

China’s Self-sufficiency Rate of Isostatic Graphite, 2017-2022E

New Installed PV Power Capacity in China, 2015-2022E

China’s Demand for Isostatic Graphite, 2017-2022E

China’s PV Installed Capacity and YoY Growth, 2012-2018

China’s PV Installed Capacity (by Region), 2018H1

China’s PV Installed Capacity and YoY Growth, 2017-2022E

China’s Output of PV Components, 2009-2017

China’s Output of PV Components, 2017-2022E

China’s Crystalline Silicon Cell Output and Its Demand for Isostatic Graphite, 2011-2018

Output Value of China Mold Industry, 2009-2018

Demand of China’s Nuclear Power Industry for Isostatic Graphite, 2018-2020E

Presence of Mersen’s R&D Centers, as of 2018H1

Revenue and Net Income of Mersen, 2014-2018

Isostatic Graphite Capacity and Usage Rate of Mersen, 2016-2019

Parameters of Mersen’s EDM-use Isostatic Graphite

Business Scope of TOYO TANSO

Product Applications of TOYO TANSO

Revenue and Net Income of TOYO TANSO, 2014-2018

Revenue of TOYO TANSO (by Product), 2015-2018

Revenue of TOYO TANSO (by Region), 2015-2018

Isostatic Graphite Production and Processing Subsidiaries of TOYO TANSO

Isostatic Graphite Business Development History of TOYO TANSO

Isostatic Graphite Capacity of TOYO TANSO, 2006-2017

Parameters of TOYO TANSO’s Main Isostatic Graphite Products

TOYO TANSO’s Revenue from Special Graphite by Product, 2018H1

Revenue and Net Income of Tokai Carbon, 2014-2018

Fine Carbon Revenue of Tokai Carbon, 2012-2018

Isostatic Graphite Capacity of Tokai Carbon, 2006-2018

Isostatic Graphite Product Series and Performance Index of Tokai Carbon

Performance Index of Tokai Carbon’s Isostatic Graphite for Electrical Discharge Machining

Subsidiaries of Tokai Carbon in China

Revenue and Net Income of SGL, 2014-2018

Revenue of SGL (by Division), 2015-2018

Revenue Structure of SGL (by Division), 2015-2018

SGL’s Revenue from GMS Division and % of Total Revenue, 2015-2018

Product Applications of GSL’s GMS Division, 2016

Product Applications of GSL’s GMS Division, 2017

Isostatic Graphite Capacity of SGL, 2006-2018

Parameters of SGL Group’s SIGRAFINE Isostatic Graphite for PV and Semiconductors

Standard Size of SGL Group’s SIGRAFINE Isostatic Graphite for EDM

Parameters of SGL Group’s SIGRAFINE Isostatic Graphite for EDM

Parameters of SGL Group’s SIGRAFINE Molded Carbon and Isostatic Graphite for Glass and Refractories

Revenue and Net Income of IBIDEN, FY2014-FY2018

IBIDEN’s Revenue by Product, FY2017-FY2022E

Applications of IBIDEN’s Isostatic Graphite

Isostatic Graphite Capacity of IBIDEN, 2008-2018

Parameters of IBIDEN’s EDM-use Isostatic Graphite

Subsidiaries of IBIDEN in China

Performance Index of POCO’s EDM-use Isostatic Graphite

Revenue and Net Income of GrafTech, 2012-2018

Applications and Features of GrafTech’s Isostatic Graphite in Continuous Casting Field

Parameters of GrafTech’s Major Isostatic Graphite Products

Isostatic Graphite Capacity of NTC, 2010-2018

Parameters of NTC’s Isostatic Graphite

Revenue and Net Income of Fangda Carbon, 2013-2018

Operating Revenue of Fangda Carbon (by Product), 2014-2017

Operating Revenue Structure of Fangda Carbon (by Product), 2014-2017

Operating Revenue of Fangda Carbon (by Region), 2014-2018

Operating Revenue Structure of Fangda Carbon (by Region), 2014-2018

Gross Margin of Fangda Carbon (by Product), 2014-2017

R&D Costs and % of Total Revenue of Fangda Carbon, 2014-2018

Revenue and Net Income of Chengdu Carbon, 2013-2018

Product Solutions and Specifications in Chengdu Carbon’s 30kt/a Special Graphite Project

Performance and Purposes of Chengdu Rongguang Carbon’s Isostatic Graphite Technology

Specifications of Chengdu Rongguang Carbon’s Isostatic Graphite Products

Revenue and Net Income of Chengdu Rongguang Carbon, 2014-2018

Revenue and Net Income of Fangda Carbon New Material, 2017-2022E

Revenue and Net Income of Datong Xincheng New Material, 2014-2018

Revenue of Datong Xincheng New Material (by Product), 2014-2017

Revenue Structure of Datong Xincheng New Material (by Product), 2014-2017

Gross Margin of Datong Xincheng New Material, 2014-2018

Datong Xincheng New Material’s Revenue from Top 5 Customers and % of Total Revenue, 2015-2017

R&D Costs and % of Total Revenue of Datong Xincheng New Material, 2014-2018

Main R&D Projects of Datong Xincheng New Material and Its Investment in These Projects, 2018H1

Revenue and Net Income of Datong Xincheng New Material, 2017-2022E

Specification, Performance and Application of Isotropic Graphite of Jilin Gaoke Special Carbon Materials

Revenue and Net Income of North Industries Group Red Arrow, 2015-2018

Revenue of North Industries Group Red Arrow (by Product), 2015-2018

Revenue Structure of North Industries Group Red Arrow (by Product), 2015-2018

Revenue and Net Income of Jiangxi Shentian, 2014-2017

Revenue and Net Income of Pingdingshan Oriental Carbon, 2014-2018

Revenue of Pingdingshan Oriental Carbon (by Business), 2015-2018

Revenue Structure of Pingdingshan Oriental Carbon (by Business), 2015-2018

Gross Margin of Pingdingshan Oriental Carbon, 2014-2018

Equity Structure of Sinosteel Advanced Material (Zhejiang)

Financing of Sinosteel Advanced Material (Zhejiang)

Isostatic Graphite Project of Sinosteel Advanced Material (Zhejiang)

Isostatic Graphite Project of Mersen (Chongqing)

Isostatic Graphite Capacity of Mersen (Chongqing), 2008-2018

Isostatic Graphite Projects of Hemsun High Purity Graphite Technology

Performance Index of Isostatic Graphite Products of Hemsun High Purity Graphite Technology

Main Financial Indices of Guizhou Geruite New Materials, 2016-2017

Net Income of Guizhou Geruite New Materials, 2018-2019E

Global and China Optical Fiber Preform Industry Report, 2021-2026

Optical fiber preforms play a key role in the optical fiber communication industry chain. The global construction of 4G and FTTH requires less optical fiber and cable, which has dragged down the deman...

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China Optical Fiber Preform Industry Report, 2020-2026

Optical fiber preform as a hi-tech product and a crucial link in the optical fiber industry chain contributes to 70% or so of profit margin. Global 4G and FTTH construction at dusk leads to the shrink...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...