China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspension

Suspension is the generic term for all force-transmitting connection devices between the frame (or load-bearing body) and the axles (or wheels) of a vehicle. It transmits the force and torsion acting between the wheels and the frame, buffers the impact force on the frame or the body by uneven roads, and reduces the vibration caused thereby in a bid to ensure that the vehicle can run smoothly.

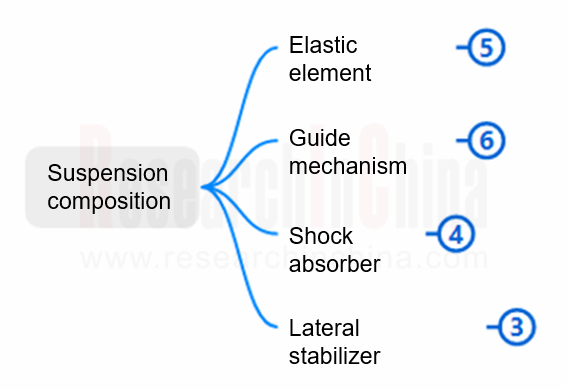

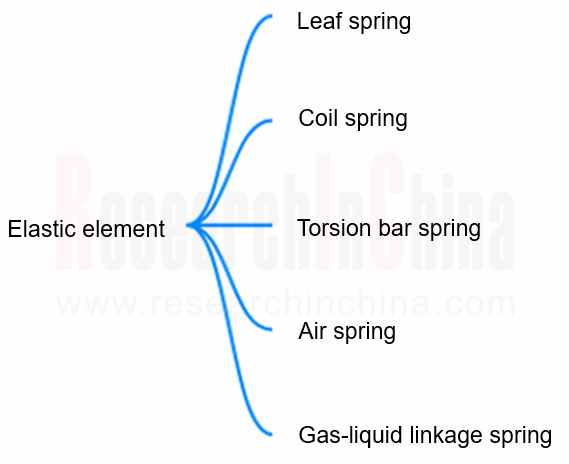

A typical suspension structure is composed of elastic elements, guide mechanisms and shock absorbers, and sometimes includes buffer modules and lateral stabilizer bars among others. Elastic elements are in the form of leaf springs, air springs, coil springs and torsion bar springs, of which coil springs and torsion bar springs are mostly used by modern cars and air springs are adopted by some high-end cars. Elastic elements are often used to withstand vertical force and convert it into elastic potential energy, thereby mitigating the impact caused by the vehicle running on the bumpy road.

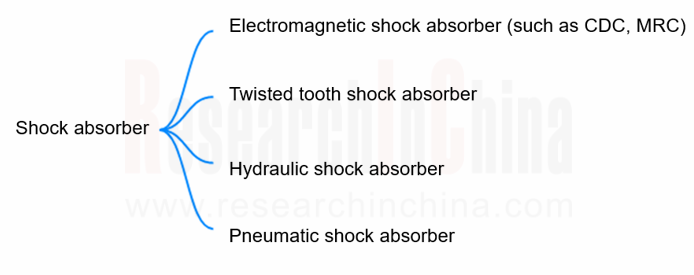

Shock absorbers absorb and release the elastic potential energy of elastic elements (usually discharged in the form of heat energy), and thus rapidly attenuate the vibration of the frame and the body, preventing the body from repeated bumps caused by the expansion and contraction of elastic elements. They change the cross section to alter the damping coefficient, and determine the softness and stiffness of the suspension according to the driving state. The Continuous Damping Control (CDC) offered by ZF is a mainstream electronically controlled shock absorber. It checks the road conditions 100 times per second, and changes the size of the internal valve according to the data sent by sensors, thereby adjusting the flow and then changing the damping that affects the softness and stiffness of the suspension, so as to achieve: 1) anti-roll when turning; 2) fewer nose dives when braking; 3) more ride comfort.

As the levels of electronic control get higher, electronically controlled suspension came into being. Electronically controlled suspension refers to a system that controls the suspension actuator through the electronic control system, adjusts damping, height and stiffness, and applies active force to improve vehicle comfort and stability.

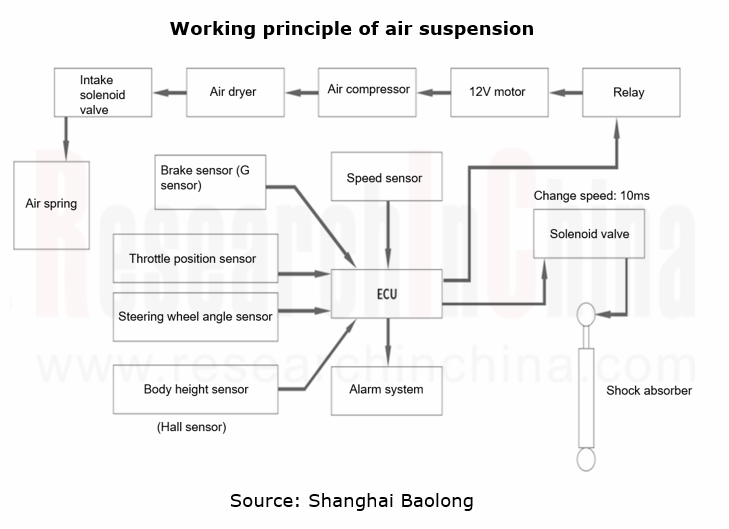

A suspension electronic control unit (ECU) collects height, speed, steering wheel angle, brake wheel cylinder pressure, driving mode, etc. as input signals through sensors and CAN bus. Algorithms are then used to process these signals and make out the control signal that enables the optimal system control performance. The drive circuit controls the time when the solenoid valve is energized or de-energized, or its current, adjusts the inflation and deflation of air springs, or regulates the damping force of shock absorbers, thus realizing adjustment of the stiffness and damping of the suspension.

At present, the suspension industry focuses on promoting air suspension systems. In general, vehicle models equipped with air springs also come complete with MRC or CDC; however, those with MRC or CDC are not necessarily fitted with air springs.

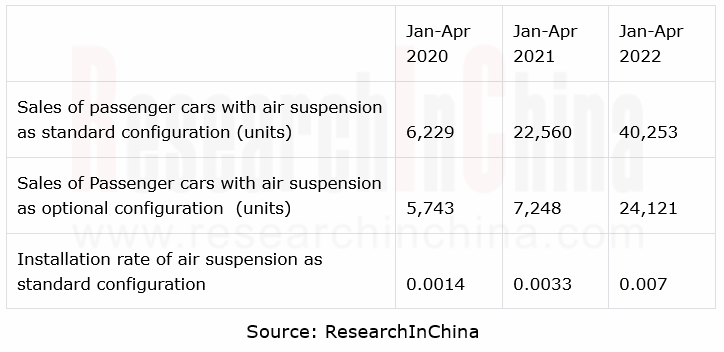

Development trend 1: the penetration rate of air suspension is as low as 0.7% in Chinese passenger car market.

In terms of commercial vehicles, air suspension finds wider application in commercial vehicles as regulations require mandatory installation. According to the Technical Specifications for Safety of Power-Driven Vehicles Operating on Roads (2017), the rear axles of trucks (cross weight: ≥12,000kg) transporting hazardous articles, all semi-trailers transporting hazardous articles, and three-axle balustrade and silo-type semi-trailers should be equipped with air suspension since January 1, 2020. The penetration rate of air suspension in Chinese commercial vehicles remains very low, compared with about 85% in rich world, leaving plenty of space to grow.

According to the statistics of ResearchInChina, the air suspension penetration in the imported passenger car market was about 25% from January to April 2022, compared with about 0.7% in the China-made passenger car market.

Development trend 2: Chinese OEMs and Tier 1 suppliers are rapidly lowering the application threshold of air suspension.

Air suspension makes cars much easier to maneuver and far more comfortable. It is mostly used in imported luxury cars priced at more than RMB600,000, such as Mercedes-Benz, BMW, Audi, Volvo, Land Rover and Porsche. Emerging carmakers like NIO, Xpeng and Li Auto, and conventional automakers including Geely, FAW-Hongqi and Great Wall Motor install air suspension on their high-end smart cars for branding. They either work on independent full-stack development, or cooperate with air suspension suppliers, realizing downward penetration of air suspension.

Chinese automakers may tend to develop their own air suspension control units and algorithms (which are eventually integrated into chassis domain controllers). They split hardware assembly into air supply units, air springs, sensors and other components, and purchase them separately. Then OEMs take on the ultimate integration. This mode brings opportunities to domestic component suppliers to make breakthroughs at a single point, for example, Shanghai Baolong, Zhongding Sealing Parts, Tuopu Group, and KH Automotive Technologies among others have gradually achieved mass production and supply of air suspension components.

At present, the air suspension of a single vehicle is worth about RMB11,000-16,000. With the localization of the supply chain and the increase in production, the average price of passenger car air suspension made in China is expected to drop to less than RMB8,000.

Driven by consumption upgrade and localization, air suspension is sinking to RMB600,000 to RMB300,000 models of emerging automakers as an optional or even a standard configuration from luxury cars priced at RMB600,000. Since 2018, the launch of NIO ES8 and ES6 has downgraded air suspension to vehicles with prices lower than RMB400,000. In 2021, ZEEKR 001 and Dongfeng Voyah FREE further pushed air suspension down to models within RMB300,000.

In the clear trend of automobile consumption upgrade in China, models valued above RMB200,000 has made up much more of the total sales, with the proportion up from 17.3% in 2016 to 30% in 2021. The upgrade of automobile consumption has also accelerated the penetration of air suspension.

KH Automotive Technologies has its own air spring assembly line, with the planned annual capacity of the Phase I up to 150,000 sets. Tuopu Group's first air suspension system factory is located in Ningbo Binhai New Area, with the total investment of about RMB600 million. The facility is scheduled to come into operation in June 2022, producing 2 million sets of air suspension annually for 500,000 vehicles.

Shanghai Baolong has invested RMB1 billion in building an air spring production line in Hefei, with the annual capacity supporting 100,000 vehicles. The second and third lines will start production in 2023. Another six production lines are planned to be built in the future. In 2025, the company will boast air spring capacity that supports more than 500,000 vehicles.

The operation of a large number of air spring production lines in China will surely facilitate the mass adoption of air springs in vehicles, laying a hardware foundation for the introduction of higher-level suspension functions such as Magic Carpet Suspension.

Development trend 3: Magic Carpet suspension springs up.

Common air suspension systems often allow manual selection of driving modes which differ in suspension settings. Magic Carpet suspension goes a step further, scanning the pavement in front of the car through cameras and radars to adjust the damping, height and stiffness of the air suspension so as to smoothly pass through bumpy roads. Magic Carpet suspension generally has one more environmental perception system (vision and radar, etc.) and controllers with higher computing power (the computing power of domain controllers may be used) than air suspension.

The environmental perception system most widely used in Magic Carpet suspension is the stereo vision system. Mercedes-Benz's Magic Carpet suspension system is called the MAGIC BODY CONTROL which uses a stereo vision system. BMW also uses stereo cameras as a perception system.

The BMW Magic Carpet Suspension is composed of the following systems: dynamic damping control system, integral active steering system, intelligent all-wheel drive system, 4 wheel speed sensors, electric active stabilizer bars on the front and rear axles, 12V battery and inverter, and front windshield stereo camera.

Among Chinese stereo vision suppliers, Smarter Eye and Shanghai Baolong have both secured designated projects for Magic Carpet suspension.

Voyah first introduced the "Magic Carpet" function to its MPV Dreamer. The solution is comprised of the following units: four CDC shock absorbers, five acceleration sensors, cameras & control units, and front double wishbone + rear five-link + air suspension. The front camera scans the pavement 5 to 15 meters in front of the vehicle in real time to detect special road conditions such as speed bumps and road bulges. Meanwhile, sensors monitor the movement of the vehicle and transmit the movement signal to the control unit which then calculates the sensor signal and output the control current to the solenoid valves on four CDC shock absorbers according to the internal control algorithms, thus controlling the damping force to offer more driving comfort.

Development trend 4: suspension control needs to combine with steering, braking control, and ADAS functions

In the chassis control of luxury brands, electronically controlled suspension never exists independently, and instead often combines with steering and brake control systems, such as Mercedes-Benz's E-Active Body Control System.

Mercedes-Benz's E-Active Body Control uses five multi-core processors, more than 20 sensors, and stereo cameras to predict different driving situations. The specific functions are described as follows:

* Based on 48V fully active suspension, handling characteristics vary more than ever in driving modes;

* E-ACTIVE BODY CONTROL controls the damping and springs force of each shock absorber separately, which can suppress the body rolling, pitching and lifting movements;v

* In the COMFORT driving mode, ROAD SURFACE SCAN uses the SMPC stereo multi-function camera to monitor the pavement ahead of the vehicle. The spring struts are then activated to reduce much of body shake and vibration when going through bumps;

* In the CURVE driving mode, the vehicle will actively tilt according to the condition. The tilt function and comfortable suspension settings deliver far more ride comfort, especially for passengers with more sensitive stomachs (when they are stuffed);

* E-ACTIVE BODY CONTROL in concert with PRE-SAFE is able to reduce the damage from a side impact.

* Thanks to rear-axle steering (optional), the S-Class feels as manoeuvrable as a compact car in the city. The steering angle at the rear axle is up to ten degrees. The turning circle is reduced by up to two meters. This enables the turning diameter of the long-wheelbase S-Class to be less than 11 meters;

* The combination of rear-wheel steering with more direct front-wheel steering enables high levels of agility and high-speed stability;

* The integration of steering and braking systems offers more precise and stable operation in dynamic situations.

Like ADAS, Magic Carpet suspension also requires an environmental perception system, so the two can share some sensors. Among Chinese enterprises, Smarter Eye and Shanghai Baolong have launched “Magic Carpet suspension + ADAS” fusion perception solutions together with their partners.

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...

Automotive Electronics OEM/ODM/EMS Industry Report, 2023

Automotive electronics OEM/ODM/EMS research: amid the disruption in the division of labor mode in the supply chain, which auto parts will be covered by OEM/ODM/EMS mode? Consumer electronic manu...

China Automotive Smart Glass Research Report, 2023

Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.Smart dimming glass is a new type of special optoelectronic glass formed by com...

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...

Intelligent Steering Key Components Report, 2023

Research on intelligent steering key components: four development trends of intelligent steering

The automotive chassis consists of four major systems: transmission system, steering system, driving ...