ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function application, market layout, development trends, etc. of leading conventional OEMs in China in the current ADAS and autonomous driving market.

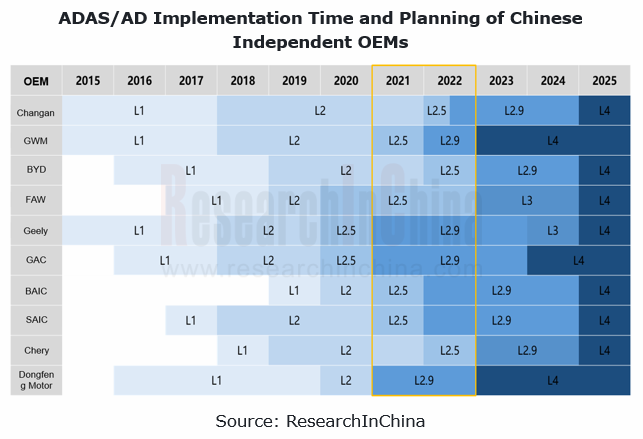

Chinese independent brands plan implementation of L4 autonomous driving in 2024/2025

This report sorts out the autonomous driving development plans and product implementation of each company. In terms of L4 autonomous driving, they set almost the same goal: implementation in 2024/2025.

In its strategy "Smart Geely 2025", Geely proposes commercialization of L4 autonomous driving, complete mastery of L5 autonomous driving, and realization of full-stack self-development in 2025.

In its strategy "Smart Geely 2025", Geely proposes commercialization of L4 autonomous driving, complete mastery of L5 autonomous driving, and realization of full-stack self-development in 2025.

GAC will release a strategic model (AH8) in 2024, which will be based on Huawei's MDC810 platform and support L4 autonomous driving.

GAC will release a strategic model (AH8) in 2024, which will be based on Huawei's MDC810 platform and support L4 autonomous driving.

In April 2022, HAOMO.AI, an autonomous driving subsidiary of Great Wall Motor, announced its roadmap for HPilot, an intelligent driving product for passenger cars, and the plan of launching HPilot 4.0 in 2023, a product that supports L4 autonomous driving.

In April 2022, HAOMO.AI, an autonomous driving subsidiary of Great Wall Motor, announced its roadmap for HPilot, an intelligent driving product for passenger cars, and the plan of launching HPilot 4.0 in 2023, a product that supports L4 autonomous driving.

Following their progressive development strategy, Chinese independent brands have kept rolling out vehicle models with L0-L2.9 functions. In sales’ term, their performance also shines.

Chinese independent brands have been in the battle position of L2 ADAS and launch an offensive in L2.5/2.9.

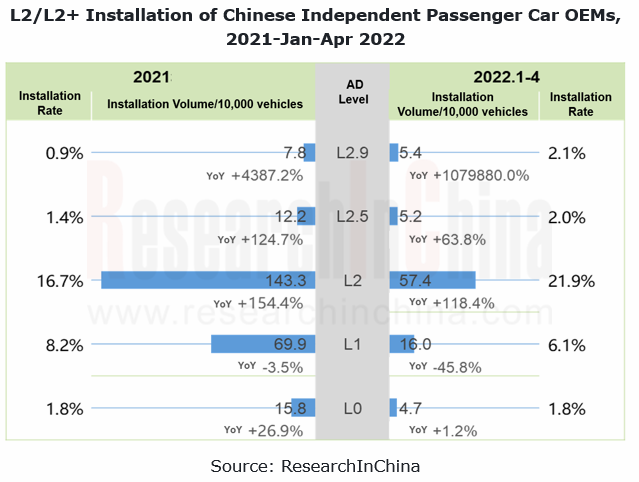

ResearchInChina’s data show that Chinese independent brands had 2.489 million vehicles equipped with ADAS functions in 2021 (installation rate: 29.1%), an upsurge of 69.6% year on year; from January to April 2022, the ADAS installations sustained growth, up from 636,000 vehicles in the same period of the previous year to 887,000 units (installation rate: 33.9%). It is clear that the ADAS installation has not been hampered by negative factors such as the epidemic or chip shortage, but instead taken a big step forward.

From sub-functions, it can be seen that with the battle position in L2 ADAS, Chinese independent brands go on the offensive in L2.5/L2.9. In 2021, Chinese auto brands gradually doubled down on L2, and thus enjoyed growth in both installations and installation rate. Between January and April 2022, L2 installations soared by 118.4% on the previous year to 574,000 units, and the installation rate also reached 21.9%; the installations of L2.5 and L2.9 surged to 106,000 units, and the combined installation rate rose to 4.1%.

Around 2021, quite a few OEMs such as Changan, GWM and BYD added the lane change turn signal capability, plus TJA+ICA+LKA, enabling highway assist (HWA), which meant they stepped into L2.5 autonomous driving. Furthermore, the upgrade of HD maps and sensors empowers vehicles with the function of navigation guided pilot (NGP) or navigate on pilot (NOP), realizing the L2.9 autonomous driving function. Examples include WEY Mocha, Lynk & Co 01EM-F and new ARCFOXαS HI version.

BYD is way ahead in L2 ADAS market, and local suppliers follow local OEMs to rise.

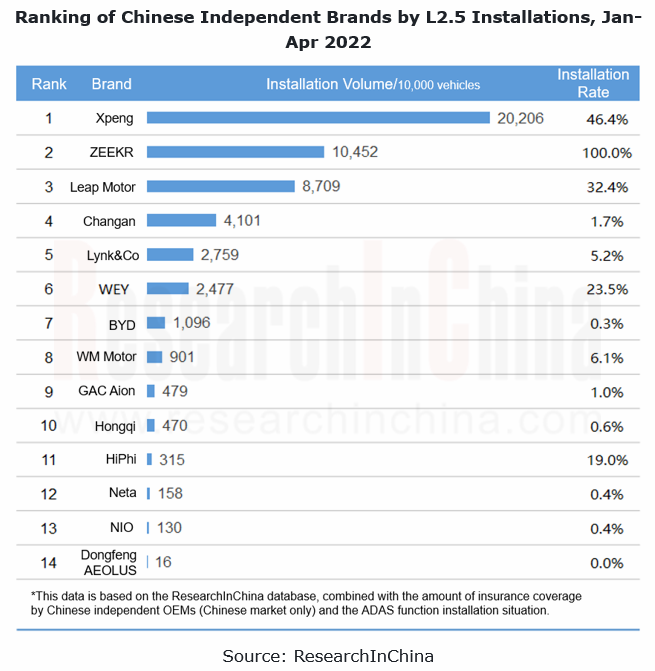

As of April 2022, among all the Chinese independent competitors (including emerging carmakers), 47 and 14 brands have delivered L2 and L2.5 models to users, respectively, of which BYD, Haval and Geely were at the forefront.

Entering 2022, BYD still gains popularity in market, becoming a sought-after brand among multiple consumers. The average monthly installations of L2 in Song PLUS and Han models outnumber 10,000, helping BYD to claim the top spot on the OEMs’ ranking list by L2 installations.

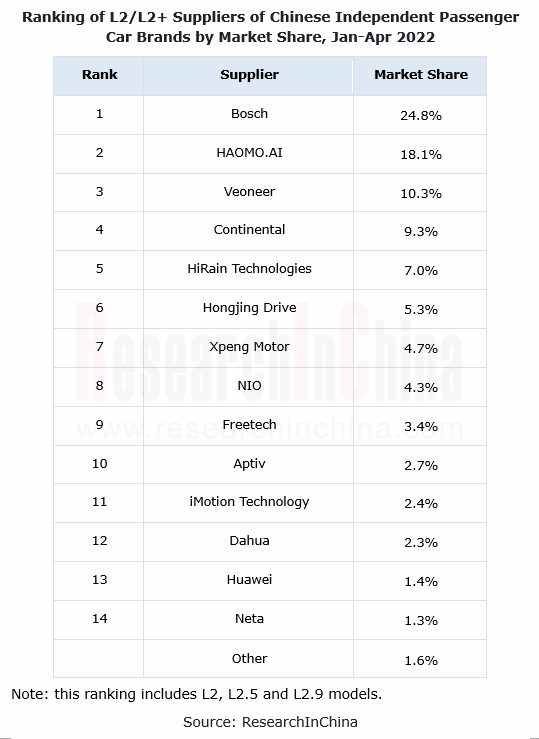

The boom of Chinese independent OEMs in the L2 passenger car market has also boosted local L2 suppliers, among which HAOMO.AI, Jingwei HiRain Technologies, Hongjing Drive and Freetech among others lead the way.

In the L2.5 camp, there are few companies, 14 in total, having actually delivered cars to users, of which 5 are conventional brands. From both installations and installation rate, it can be said that GWM WEY is an outstanding typical conventional automaker in L2.5.

Thanks to the full-stack self-development of autonomous driving algorithms of Great Wall Motor's autonomous driving subsidiary HAOMO.AI, the full range of WEY Mocha models rolled out in May 2021 carry standard L2.5 functions, gaining the lead in the industry. In addition, in April 2022 BYD introduced 2022 Han, a model equipped with highway assist (HWA) and interactive lane change assist (ILCA) systems. This model is expected to be a trump card for BYD to forge into the L2.5 market.

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...

Automotive Sensor Chip Industry Report, 2023

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on percepti...

Automotive Electronics OEM/ODM/EMS Industry Report, 2023

Automotive electronics OEM/ODM/EMS research: amid the disruption in the division of labor mode in the supply chain, which auto parts will be covered by OEM/ODM/EMS mode? Consumer electronic manu...

China Automotive Smart Glass Research Report, 2023

Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.Smart dimming glass is a new type of special optoelectronic glass formed by com...

Automotive Ultrasonic Radar and OEM Parking Roadmap Development Research Report, 2023

Automotive Ultrasonic Radar Research: as a single vehicle is expected to carry 7 units in 2025, ultrasonic radars will evolve to the second generation.

As a single vehicle is expec...

Autonomous Driving SoC Research Report, 2023

Research on autonomous driving SoC: driving-parking integration boosts the industry, and computing in memory (CIM) and chiplet bring technological disruption.

“Autonomous Driving SoC Research ...

China ADAS Redundant System Strategy Research Report, 2023

Redundant System Research: The Last Line of Safety for Intelligent VehiclesRedundant design refers to a technology adding more than one set of functional channels, components or parts that enable the ...