Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022", ResearchInChina released "Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022", which summarizes current ADAS and autonomous driving market status (installations, installation rate), functional applications, and market layout of China's top joint venture OEMs.

1. Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

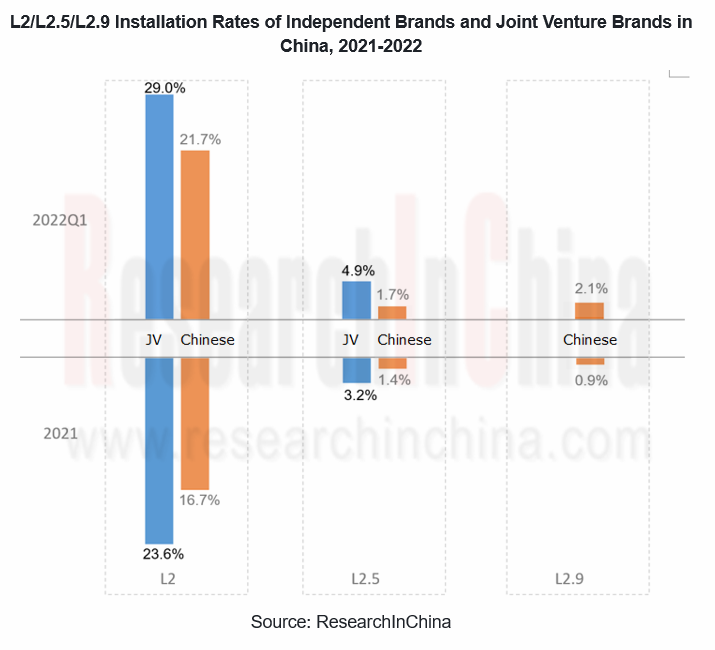

From the perspective of installation rate, the L2 and L2.5 functions of joint venture brands surpass those of independent brands by 7.3 percentage points and 3.2 percentage points respectively (data in 2022Q1). However, joint venture brands have not involved L2.9 for the time being, without similar functions offered by NIO NAD and Xpeng NGP.

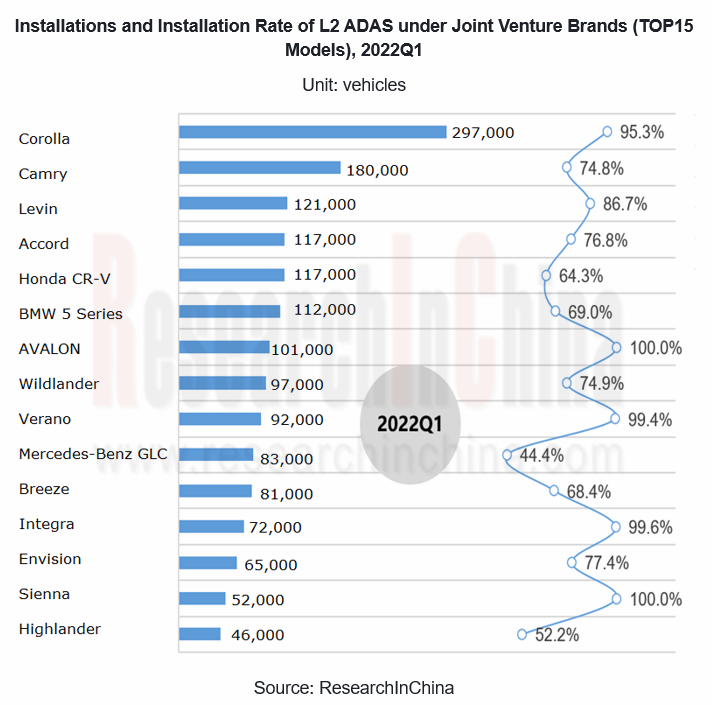

At present, joint venture brands mainly compete in L2 field. Toyota's Corolla, Camry and Levin, Honda's Accord and CR-V as well as BMW 5-Series dominate the L2 market.

In terms of mainstream functions, joint venture brands further upgraded full-speed ACC, AEB with pedestrian recognition and other functions in 2022, with TJA and ICA as the highlights.

As for sensor solutions, 1R1V is the mainstream solution of L2 ADAS under joint venture brands, and 3R1V is the advanced solution. Compared with 2021, OEMs achieved functional advancement by adding radar in 2022. For example, Volvo, Toyota, and Honda upgraded 1R1V to 3R1V, and Ford improved 3R1V to 5R1V.

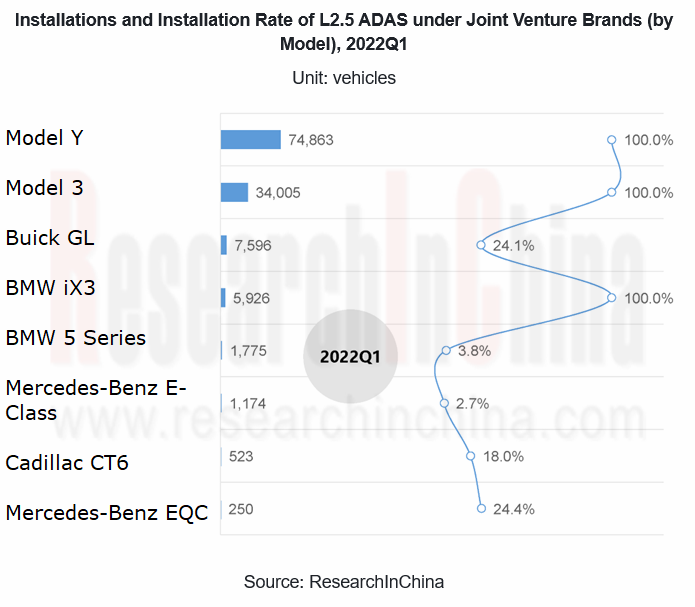

L2.5 is a new arena for joint venture brands. Tesla Model Y/Model X, Buick GL8, BMW iX3/5 Series, Mercedes-Benz E-Class/EQC, Cadillac CT6, etc. have landed in China at first to compete with traditional independent brands and emerging brands.

From the function point of view, L2.5 features automatic lane change (ALC) which is performed by driver by pressing turn signal switch before the vehicle makes its own judgment to change the lane. Different brands set different trigger speeds for ALC. For example, the BMW ALC can only be turned on when the speed is above 70km/h.

Regarding sensor solutions, 5R1V is the current mainstream solution, mainly available in Buick and Cadillac. In addition, Mercedes-Benz uses 5R2V (front-view binocular camera), while BMW and Tesla adopt 5R3V (three front-view cameras).

2. Honda and Mercedes-Benz took the lead in dabbling in L3 thanks to Japanese and German regulations

Japan:

At the legal level, the amendment to Japan's "Road Vehicle Law" in April 2020 allowed L3 autonomous vehicles to go on roads. In November 2020, Japanese Ministry of Land, Infrastructure, Transport and Tourism issued a L3 autonomous vehicle sales license to Honda.

At the legal level, the amendment to Japan's "Road Vehicle Law" in April 2020 allowed L3 autonomous vehicles to go on roads. In November 2020, Japanese Ministry of Land, Infrastructure, Transport and Tourism issued a L3 autonomous vehicle sales license to Honda.

In March 2021, Honda announced to begin limited sales of Honda Legend EX equipped with Honda SENSING? Elite which can be used in designated areas within Japan.

In March 2021, Honda announced to begin limited sales of Honda Legend EX equipped with Honda SENSING? Elite which can be used in designated areas within Japan.

Germany:

In 2017, Germany amended its Road Traffic Act to allow L3 autonomous vehicles on roads. In December 2021, German KBA (Kraftfahrt-Bundesamt) granted system approval for Drive Pilot, a L3 autonomous driving system offered by Mercedes-Benz.

In May 2022, Mercedes-Benz offered both EQS and S-Class with optional L3 Drive Pilot support, so that such models can enjoy L3 autonomous driving on German expressways. BMW’s L3-certified system won’t be available until the end of 2023. It’s apparently going to be called “Personal Pilot” and will be initially rolled out on 7 Series / i7 G70 in Europe and China. Beginning July 2024, the technology will be implemented in G6x models: G60 5 Series Sedan, G61 5 Series Touring, G68 5 Series Sedan Long Wheelbase, G65 X5 / iX5, G66 X6 / iX6, and the G67 X7 / iX7.

In addition to Japan and Germany, European Union, South Korea, and the United Kingdom have successively issued relevant standards or regulations for L3 autonomous driving:

In April 2019, European Union issued "Guidelines on the Exemption Procedure for EU Approval of Automated Vehicles", focusing on autonomous vehicles that can drive themselves in a limited number of driving situations. This encompasses vehicles on L3 and L4 of SAE International. These are already being tested and are expected to be commercially available.

In April 2019, European Union issued "Guidelines on the Exemption Procedure for EU Approval of Automated Vehicles", focusing on autonomous vehicles that can drive themselves in a limited number of driving situations. This encompasses vehicles on L3 and L4 of SAE International. These are already being tested and are expected to be commercially available.

In January 2020, South Korea released safety standards to operate L3 autonomous vehicles which are allowed to drive up to 100 km/h, the general highway speed limit in the country.

In January 2020, South Korea released safety standards to operate L3 autonomous vehicles which are allowed to drive up to 100 km/h, the general highway speed limit in the country.

In April 2022, the UK Department for Transport proposal to amend “Highway Code". As part of that, it will allow drivers in autonomous vehicles to watch TV from an infotainment screen in self-driving mode, as long as they keep driving in a single lane at below 60 km/h and they're ready to take back control when it is necessary. This can be deemed as L3 autonomous driving specification. Meanwhile, UK government expects to have a full regulatory framework in place to support the widespread deployment of autonomous driving technology by 2025.

In April 2022, the UK Department for Transport proposal to amend “Highway Code". As part of that, it will allow drivers in autonomous vehicles to watch TV from an infotainment screen in self-driving mode, as long as they keep driving in a single lane at below 60 km/h and they're ready to take back control when it is necessary. This can be deemed as L3 autonomous driving specification. Meanwhile, UK government expects to have a full regulatory framework in place to support the widespread deployment of autonomous driving technology by 2025.

3. Can foreign capital promote the landing of L3 in China?

For automakers, "local pilot and overseas expansion" is a convention. Thanks to its broad market and open-mindedness, China has become the first target market for major foreign automakers to promote L3 autonomous driving. After obtaining a sales license and road certification in Germany, Mercedes-Benz has made its foray into the United States and China. “Mercedes-Benz hopes to acquire certification for L3 autonomous driving in the United States in 2022, and discussions with authorities in China on the topic are ongoing”, Chief Executive Ola Kaellenius said in a press call in February 2022. BMW plans to launch vehicles equipped with L3 autonomous driving systems to Chinese market in 2023-2024.

With implementation of "Regulations on Administration of Intelligent Connected Vehicles in Shenzhen Special Economic Zone" on August 1, 2022, China will take Shenzhen as a pilot to gradually explore the implementation and promotion of L3 autonomous driving.

Can the L3 system, which was first implemented abroad, be successfully localized in China?

From the perspective of technical verification and data accumulation, the answer is yes. The upgrade and iteration of the autonomous driving system requires massive training data, especially the test data of real road environments. After taking the lead in road operation, Honda, Mercedes-Benz, etc. will inevitably accumulate valuable data, which will improve sensors, algorithms, actuators, HMI and other aspects of autonomous driving system, and strengthen the functionality, stability, robustness, security, etc. of the system.

However, issues such as data security and responsibility determination will undoubtedly become a "stumbling block" for the localization of foreign brands in China.

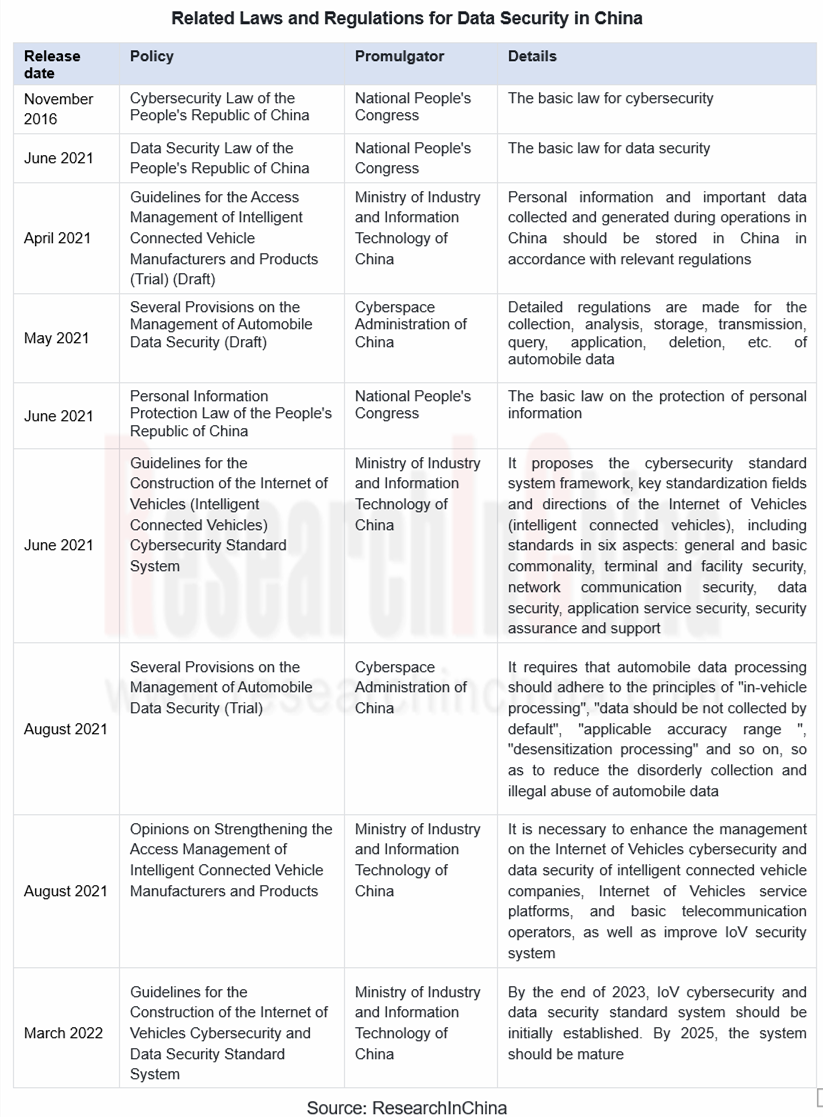

China has successively promulgated a number of laws and regulations for data security, and has continuously strengthened and refined security supervision. The "Several Provisions on Management of Automobile Data Security (Trial)" requires that automobile data processing should adhere to the principles of "in-vehicle processing", "data should be not collected by default", "applicable accuracy range ", "desensitization processing" and so on, so as to reduce the disorderly collection and illegal abuse of automobile data. This will lead to strict supervision over map surveying and cross-border data transmission in the process of foreign-funded enterprises developing autonomous driving business in China, so the localization of data will be the primary issue.

In terms of liability determination, there is no uniform international standard:

German automakers (Mercedes-Benz, BMW) and Japanese car companies (Honda) assume responsibilities;

German automakers (Mercedes-Benz, BMW) and Japanese car companies (Honda) assume responsibilities;

A new update to Highway Code in UK in January 2022 suggests that insurance companies rather than individuals should be liable for claims in the case of an accident occurring in the autonomous mode;

A new update to Highway Code in UK in January 2022 suggests that insurance companies rather than individuals should be liable for claims in the case of an accident occurring in the autonomous mode;

South Korea and Shenzhen, China stipulate that the driver of an L3 autonomous vehicle should bear the primary responsibility for any accident, but if the vehicle is defective, the automaker should be jointly and severally liable.

South Korea and Shenzhen, China stipulate that the driver of an L3 autonomous vehicle should bear the primary responsibility for any accident, but if the vehicle is defective, the automaker should be jointly and severally liable.

The non-uniformity of the accident liability determination standards will bring certain difficulties to the operation strategy of the autonomous driving system, and will also become a bottleneck for OEMs to expand abroad. This requires the joint efforts of the whole industry in the world.

In addition, Chinese independent brands should not be underestimated, especially the brands that have achieved L2.9, such as NIO, Li Auto, Xpeng, WM Motor, IM Motors, Neta, Avatr and other emerging brands or new brands of traditional automakers. In fact, they have been able to achieve L3 autonomous driving, both in terms of hardware configuration and functionality. However, due to laws and regulations, they only offer L2.9 functions at present, still focusing on the role of drivers during the driving process and emphasizing the assisted driving function of the system. Once the policy is relaxed, a fierce battle will happen between Chinese independent brands and foreign brands.

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...

China Passenger Car Cockpit-Parking Industry Report, 2023

Cockpit-parking integration research: cockpit-parking vs. driving-parking, which one is the optimal solution for cockpit-driving integration?Cockpit-parking vs. driving-parking, which one is the optim...