Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According to ResearchInChina’s data, from January to May 2022, 3.12 million passenger cars in China were equipped with OTA; the installation rate hit 44.6%, a year-on-year increase of 16.2 percentage points. By 2026, the OTA installation rate of Chinese passenger cars is expected to reach 88%, that is, 21.937 million passenger cars will boast OTA.

OTA updates are mainly reflected in infotainment, and will gradually spread to ADAS, body & control, and power.

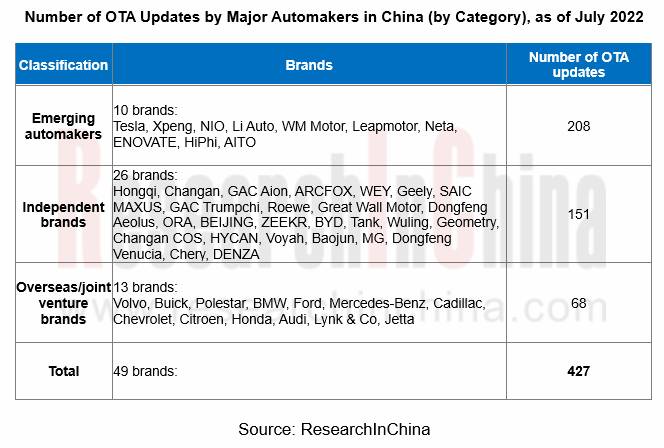

As of July 15, 2022, 49 auto brands (including brands of emerging automakers, independent companies, and joint ventures) had accomplished about 427 OTA updates. Among them, 10 emerging brands had implemented a total of 208 OTA updates, 26 independent brands had completed 151 OTA updates, and 12 joint venture brands had fulfilled 68 OTA updates.

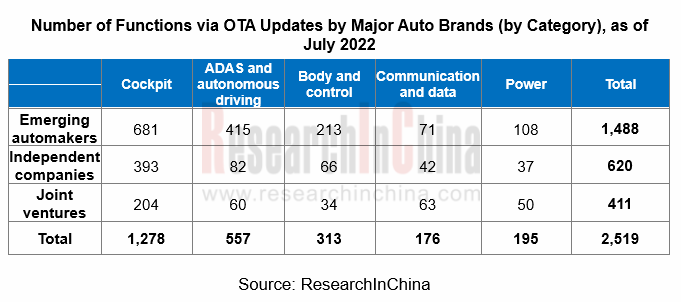

Regardless of emerging automakers, independent companies, or joint ventures, their OTA updates concentrate on cockpits (covering application entertainment, information display, etc.), reaching 1,278 updates; another 557 updates are about ADAS and autonomous driving.

In the era of OTA 3.0, OEMs explore SAAS (Software as a Service)

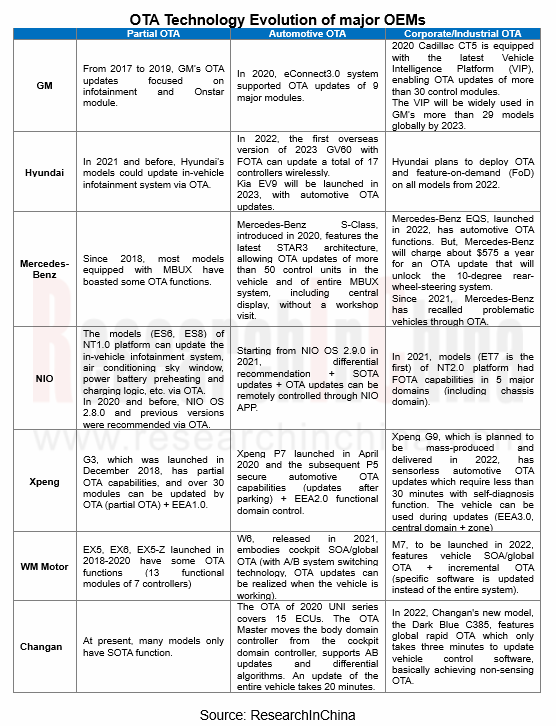

ABUP believes that automotive OTA industry should go through four development stages: component-level OTA, vehicle-level OTA, enterprise-level OTA, and industrial-level OTA. OTA has evolved from the 1.0 era (non-critical safety function updates) and the 2.0 era (automotive OTA) to the current 3.0 era (SAAS).

In the era of OTA 3.0, OTA functional services of OEMs are propelled by demand instead of R&D. OEMs guide users to purchase software OTA services. In the future, SAAS will become an important income source for major OEMs.

With deep involvement of automotive OTA, the business models of automakers are changing. The model of hardware "costization" + software "profit" continues to penetrate in the smart car market. Many automakers have pre-embed hardware in new models, and subsequently open functions through OTA software updates, so as to obtain commercial profits.

In the past two years, both emerging automakers and conventional car companies have been stepping up their exploration of SAAS model. In addition to offering paid OTA for new functions and services, many automakers have announced plans to launch "subscription on demand" services.

In addition to selling cars, Tesla makes money by selling software and services. Its software revenue comes from FSD (Full Self-Driving), OTA updates, and advanced Internet of Vehicles. The price of Tesla's FSD has been rising, hitting as high as $12,000. In addition, Tesla has introduced the Acceleration Boost upgrade for $2,000 that improved the 0-60 mph acceleration of Model 3 Dual Motor (Long Range) from 4.4 seconds to 3.9 seconds.

Hyundai announced to offer OTA and feature-on-demand (FoD) on all models from 2021. Users can not only update software and systems remotely, but also selectively purchase software systems.

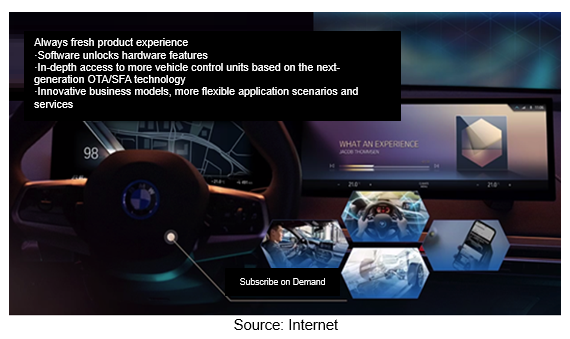

In July 2021, BMW announced about its Functions on Demand system, in which customers can choose to pay monthly subscriptions for certain options. It unlocks the hardware modules pre-installed on the vehicle through software, remotely provides customers with new products and services, and helps customers enjoy the latest products in an innovative way.

In July 2022, BMW launched a number of subscription-based services for drivers in South Korea, including heated seats, a heated steering wheel, high-beam-assist headlights, simulated sound waves, wireless Apple CarPlay and other functions. Heated seats, for example, run for about RMB120 per month. per month or RMB1,180 per year.

At the same time, there have been some changes in the profit models of assisted driving systems of some OEMs. In the past, users had to pay for optional advance assisted driving systems which now tend to be included in the standard configuration, whereas the software cost is included in the car price for the purpose of suppressing the continuous price spike of battery-electric vehicles since 2022 and raising the activation rate of advanced assisted driving systems to collect real road data; in addition, the standard configuration of assisted driving systems improves the cost performance and value preservation rate of vehicles.

On May 6, 2022, Xpeng suddenly made major changes to users' rights and interests. It installed the intelligent assisted driving system software as standard, and canceled the lifetime free charging and free home charging piles. According to the data released by Xpeng in October 2021, the activation rate of XPILOT 3.0 with high-speed NPG is 59.29%, and it will continue to rise thanks to the standard configuration of assisted driving software;

In 2022, Tesla offers free Enhanced Autopilot as standard in China for a limited time, while it still charges FSD as an option;

Li Auto has always adhered to the standard autonomous driving system. The newly launched Li L9 is equipped with the Li AD Max full-stack intelligent driving system and hardware solution as standard;

NIO has altered its business strategy for ET7. It comes standard with LCC and ALC which are ready to use, so that users need not pay additional fees or buy the NIO Pilot Selected Package.

SAAS is paid separately or charged include the car price, and it has become a business strategy that major OEMs should consider and explore.

OTA supervision is becoming strict and standardized

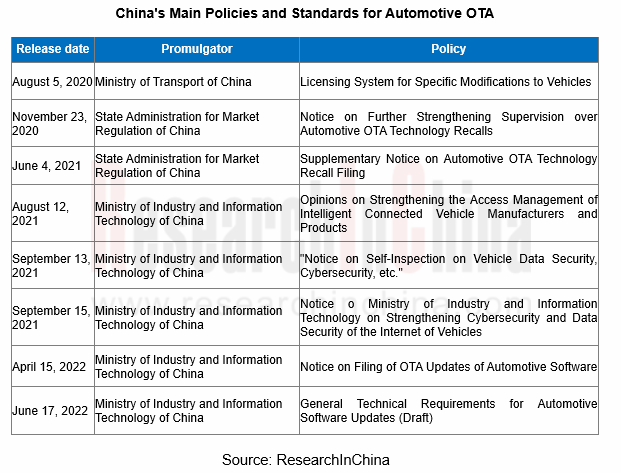

With the rapid growth of automotive OTA technology, China has issued a number of policies and standards about OTA updates in the past two years, clarifying requirements for ICV software updates.

On April 15, 2022, the Ministry of Industry and Information Technology Equipment Industry Development Center issued "Notice on Filing of OTA Updates of Automotive Software", which stipulates that automakers licensed to produce road motor vehicles should file for their vehicles equipped with OTA updates and every OTA update implemented. Authorities have attached great importance to OTA recalls, and have improved relevant procedures and specifications. A strict and effective regulatory mechanism will regulate the software updates of automakers. It will have a positive impact on the development of the entire industry while protecting the rights and interests of consumers.

NXP’s Intelligence Business Analysis Report, 2022-2023

In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replace...

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR5...

Analysis on Baidu’s Intelligent Driving Business, 2022-2023

Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions. &n...

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

Ambarella was founded in 2004 and is headquartered in California, the US. Before 2014, Ambarella was the exclusive chip supplier of GoPro. Ambarella was listed on NASDAQ in 2012. When the sports camer...

Global and China Electronic Rearview Mirror Industry Report, 2023

Electronic rearview mirror research: 2023 will be the first year of mass production as the policy takes effect

Global and China Electronic Rearview Mirror Industry Report, 2023 released by ResearchIn...

China Autonomous Driving Domain Controller Research Report, 2023

Autonomous driving domain controller research: explore computing power distribution and evolution strategies for driving-parking integrated domain controllers.

In China, at this stage the industry i...

China In-Vehicle Payment Market Research Report, 2023

China In-Vehicle Payment Market Research Report, 2023 released by ResearchInChina analyzes and researches the status quo of China's in-vehicle payment market, components of the industry chain, layout ...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes. 01 Build up their own software and hardware capabilities...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2023 (Foreign Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report,2023 (Chinese Players)

Research on tier 1 suppliers’ cockpit business: new innovative intelligent cockpit products highlight multi-domain integration, multimodal interaction, and ever higher functional integration.

Follow...

Company Analysis: Jingwei Hirain’s Automotive and Intelligent Driving Business, 2022-2023

Founded in 2003, Jingwei Hirain Technologies is headquartered in Beijing, with modern production facilities in Tianjin and Nantong. In 2022, Jingwei Hirain Technologies recorded revenue of RMB4,021 mi...

China Passenger Car HUD Industry Chain Development Research Report, 2023

Research on HUD industry chain: new technologies such as LBS and optical waveguide help AR-HUD become a “standard configuration”.

As HUD technology advances, AR-HUD, which can combine virtual informa...

Body (Zone) Domain Controller and Driver IC Industry Research Report,2023

Body (zone) domain controller research: evolution of body electronic and electrical architecture driven by MOSFET and HSD.

The mode of control over body electronic functions is changing with the evol...

China Automotive Fragrance and Air Purification Systems Research Report, 2023

Automotive fragrance and air purification systems: together to create a comfortable and healthy cockpitTechnology trend: intelligence of fragrance system and integration of air purification system

In...

Global and China Solid State Battery Industry Report, 2023

Solid state battery research: semi-solid state battery has come out, is all-solid state battery still far away?In recent years, the new energy vehicle market has been booming, and the penetration of n...

Global and China Passenger Car T-Box Market Report, 2023

T-Box industry research: the market will be worth RMB10 billion and the integration trend is increasingly clear.

ResearchInChina released "Global and China Passenger Car T-Box Market Report, 2023", w...

Analysis Report on Auto Shanghai 2023

Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 20...

Chinese Emerging Carmakers’ Telematics System and Entertainment Ecosystem Research Report, 2022-2023

Telematics service research (III): emerging carmakers work on UI design, interaction, and entertainment ecosystem to improve user cockpit experience.

ResearchInChina released Chinese Emerging Carmake...