Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavily on high-precision navigation, and the operating environment herein is relatively simple, not as complicated as autonomous vehicle technology. With a higher level of agricultural mechanization in China and the country's strong support for precision agriculture, autonomous agricultural machinery has gradually been applied to farmland. At present, most of autonomous agricultural machinery systems mainly focus on assisted driving and linear autonomous driving, which can not only reduce the operating difficulty and labor intensity of the driver in the operation of agricultural machinery, but also extend the operating time of the agricultural machinery.

In May 2020, the Ministry of Agriculture and Rural Affairs of the People's Republic of China (MARA), National Development and Reform Commission of China (NDRC), etc. issued the Notice on Printing and Distributing “Key Points of Digital Rural Development in 2020" , proposing research on key technologies and innovative applications around smart agriculture, smart agricultural machinery & equipment, etc. to promote the in-depth integration of artificial intelligence technology and agriculture.

China's autonomous agricultural machinery industry has entered a stage of rapid development

The development of autonomous agricultural machinery requires the coordination and cooperation between multiple parties. China's autonomous agricultural machinery industry has entered a stage of rapid development thanks to multiple factors such as the subsidy policy of the national autonomous agricultural machinery system, the success in the third phase of the BeiDou system (BDS-3), as well as "Unmanned Farm" promotion projects of agricultural machinery factories, science and technology enterprises and institutions.

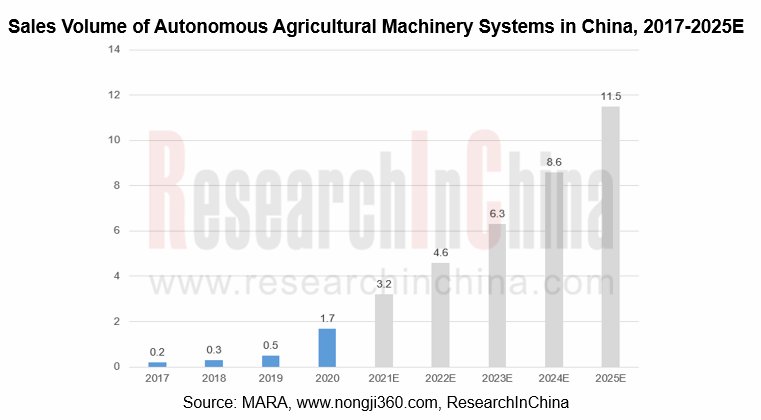

In 2020, China's agricultural automatic navigation system and equipment sales volume showed explosive growth. According to the data released by MARA, agricultural machinery supported the installation of more than 23,000 sets of Beidou terminals in 2020, nearly quadrupling that in the previous year; wherein, 17,000 sets of autonomous agricultural machinery systems were sold, a year-on-year spike of 188%. With the increase in the farmland circulation area, the preliminary construction of high-standard farmland and the loss of rural population exacerbated by further urbanization, we predict that China's autonomous agricultural machinery systems will continue to maintain rapid growth for a while. By 2025, China will sell 115,000 sets of autonomous agricultural machinery systems.

At present, the ownership of large and medium-sized agricultural machinery used in agricultural operations in China exceeds 5 million units. Such agricultural machinery uses autonomous agricultural machinery systems relatively easier, and can operate more accurately and efficiently when combined with automatic driving systems and intelligent control systems. For the agricultural machinery, tractors feature the highest installation rate in autonomous driving systems.

According to data from the National Bureau of Statistics of China, China produced 617,700 tractors in 2019, reflecting a slight rebound. Large and medium-sized tractors gradually replaced small tractors. As of the end of 2019, China had boasted 22.24 million agricultural tractors, including 4.44 million large and medium-sized tractors. ResearchInChina believes that the penetration rate of China's autonomous agricultural machinery systems is still less than 1% as per the ownership of large and medium-sized agricultural machinery.

In 2020, Ministry of Finance of China issued more than RMB20 billion as the central government’s subsidies for the purchase of agricultural machinery. China plans to make the comprehensive mechanization rate of crop plowing, planting and harvesting reach 75% by 2025. In the context of the continuous improvement of the agricultural mechanization level, China's agricultural autonomous driving industry is still in the early stage of development, with enormous potentials.

However, we should also be aware that the long-term penetration rate of China’s autonomous agricultural machinery will be much lower than that in Europe and America, mainly because it is difficult to apply large-scale agricultural machinery in Chinese cultivated land which is mostly located in mountains and hills and it is still necessary to ensure the livelihood of Chinese farmers in vast rural areas for a long time.

The national agricultural machinery subsidy policy has greatly promoted the sales growth of autonomous agricultural machinery systems

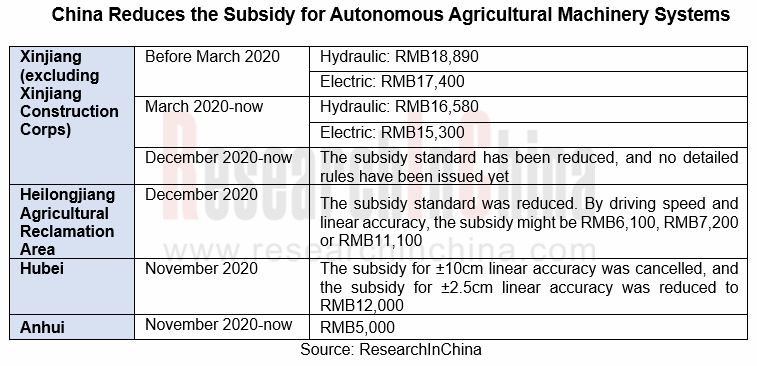

Now, a set of domestic autonomous agricultural machinery system is priced at RMB50,000-60,000, dropping significantly from RMB100,000-140,000 in the previous years. At present, a set of system can obtain about subsidy of RMB15,000-25,000 which reduces the economic burden of farmers and promoted the sales growth of autonomous agricultural machinery systems.

As agricultural geographical conditions and machinery development vary with regions, each province or city in China sets its own subsidy amount for autonomous agricultural machinery systems, and adjusts the subsidy policy according to its own development. The subsidy mainly hinges on braking methods (hydraulic/electric), driving speed (≥12km/h, 9-12km/h) and linear accuracy (±10cm/±2.5cm). With the continuous reduction in the price of autonomous agricultural machinery systems, many provinces have cut down the amount of subsidy for agricultural machinery automatic navigation systems and equipment.

There are three main reasons for the decline in the subsidy for autonomous agricultural machinery systems:

1. In areas where autonomous agricultural machinery is well promoted, such as Xinjiang and Heilongjiang, autonomous agricultural machinery has undergone the initial promotion stage and has actually entered the marketization stage;

2. The subsidy for autonomous agricultural machinery is lowered in accordance with the driving speed and linear accuracy requirements, mainly for the purpose of guiding autonomous driving systems to develop toward efficient production and high-precision operations of agricultural machinery;

3. The price of autonomous agricultural machinery systems continues to decline year-on-year, and the scale effect is gradually emerging.

Autonomous agricultural machinery covers the whole process of agricultural production

At present, autonomous agricultural machinery has been applied in major agricultural planting areas in China, covering the entire agricultural production process: "cultivation- planting – management - harvesting".

In terms of autonomous agricultural machinery, enterprises such as Dongfeng Iseki and Jiufu Agricultural Machinery have conducted experiments and demonstrations of unmanned rice transplanting in Jiansanjiang Farm and other places, and have made good progress. In 2020, a rice transplanter operator earned RMB700 per day in Northeast China, reflecting labor costs rose significantly. Unmanned rice transplanting requires fewer operators or even does not need operators anymore, so that social and economic benefits hereby are very significant. Heilongjiang, Inner Mongolia, Jiangsu and other regions are also actively conducting experiments on unmanned farms and unmanned operation of agricultural machinery. At present, many unmanned farm projects have been built in China, such as Great Northern Wilderness Unmanned Jiansanjiang Farm, the unmanned farm of South China Agricultural University in Zengcheng District, Guangzhou, the unmanned farm in Jiading District, Shanghai, and the “5G+ unmanned farm” in Haimen, Nantong, Jiangsu. These projects will prompt China's autonomous agricultural machinery into the autonomous driving stage.

Chinese autonomous agricultural machinery will still focus on the aftermarket in the short term

Automatic navigation systems are already necessary for the intelligentization of agricultural machinery, especially large tractors, in developed countries. In the United States, high-horsepower tractors with more than 100 horsepower produced by companies such as Case and John Deere are equipped with agricultural machinery automatic navigation systems before marketing.

From the perspective of the global market, large agricultural machinery manufacturers offer a series of models pre-installed with automatic driving (GPS Ready), such as John Deere’s 8R series AutoTrac technology, Case New Holland’s Magnum series AFS AccuGuide technology, and AGCO’s AutoGuide3000 coming with Danfoss hydraulic valves, Agrirobo automation technology of Kubota’s X tractor, and Smartpilot system of Yanmar’s YR8D-A automatic rice transplanters.

In the domestic OEM market, China YTO’s Dongfanghong tractors, Lovol’s Arbos series and Ceres series, Zoomlion’s PL2304 tractors and 3WP-600HA unmanned plant protection machines, etc. feature OEM autonomous solutions.

In the domestic aftermarket, autonomous systems of foreign brands played the main role before 2017. Since 2017, domestic brands have gradually taken the lead in the market thanks to the national subsidy for autonomous agricultural machinery made in China. Supported by policies, China has initially formed a relatively complete industrial chain system of autonomous agricultural machinery. Upstream companies engaged in Beidou navigation equipment, lidar and computing platforms work closely with midstream autonomous system vendors to provide autonomous driving systems for downstream agricultural machinery enterprises and enable mass application in some areas.

Chinese autonomous agricultural machinery still focuses on the aftermarket, mainly because:

1. Large-scale farms with a high degree of mechanization are the first to promote autonomous agricultural machinery systems. The post-installed system can be modified on the basis of the original agricultural machinery, which is easier to be accepted by customers;

2. An agricultural machine installed with an OEM system costs hundreds of thousands of yuan, which is not appealing to customers. However, the average price of a post-installed system for autonomous agricultural machinery is only RMB50,000-60,000 and can be subsidized RMB15,000-25,000 by the government additionally, posing obvious cost advantages;

3. The domestic autonomous agricultural machinery systems are still in the early stage of development, thus with weak technical reliability and stability. Therefore, post-installed autonomous driving systems are relatively easy to accept.

At the same time, post-installed Beidou navigation autonomous driving systems face many problems in the promotion. E.g:

(1) Agricultural operations are sensitive to timing, so customers have higher requirements for positioning stability and after-sales services; moreover, prices are a crucial factor;

(2) The failure rate of autonomous driving systems is relatively high, so the reliability and functions need be further improved;

(3) Users are still unfamiliar with autonomous driving systems, so they may operate improperly or wrongly. Therefore, new users should be trained before operations, and old users should be trained constantly also.

In the future, autonomous agricultural machinery will have promising application prospects in China through cutting-edge technologies such as the Internet of Things, big data, cloud computing and AI, in the wake of the continuously improved domestic agricultural production management, the transformation of agriculture from traditional operations to precise operations, and the upgrading of agricultural enterprises from extensive management to refined management.

Next-Generation Embodied AI Robot Communication Network Topology and Chip Industry Report, 2026

AI Robot Communication Network and Chip Research: Six Evolution Trends and Chip Transformation

Embodied AI robots, namely the new generation of AI robots integrating large AI models and physical enti...

Swarm Intelligence and Robotic Collaboration Application Report, 2025

Research on swarm intelligence and robotic collaboration: Swarm intelligence and robotic collaboration will break through the boundaries of individual intelligence and will be widely adopted across va...

Robot Controllers (Brain & Cerebellum) Research Report, 2025

Robot Controller Research: Brain-Cerebellum Integration Becomes a Trend, and Automotive-Grade Chips Migrate to Robots

ResearchInChina has released the Robot Controllers (Brain & Cerebellum) Resea...

Tactile Sensor Research Report, 2025

ResearchInChina has released the "Tactile Sensor Research Report, 2025", which conducts research, analysis and summary on the basic concepts, technical principles, advantages and disadvantages o...

Embodied AI and Humanoid Robot Market Research 2024-2025: Product Technology Outlook and Supply Chain Analysis

Six Trends in the Development of Embodied AI and Humanoid Robots

In 2025, the global humanoid robot industry is at a critical turning point from technology verification to scenario penetration, and t...

Global and China Smart Meters Industry Report, 2022-2027

Meters are widely used in the national economy and are an important part of metering to promote the development of metering. As a legal measuring tool, meters are mainly used in the supply process of ...

China Smart Agriculture and Autonomous Agricultural Machinery Market Report, 2022

Research on smart agriculture and autonomous agricultural machinery: top-level design, agricultural digitization and automation present a potential marketAmid the pandemic, the conflict between Russia...

Global and China Heat Meters Industry Report, 2022-2027

A heat meter is an instrument used to measure, calculate and display the value of heat released or absorbed by water flowing through a heat exchange system, and is mainly used for measuring the heatin...

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...