Global and China High Barrier Material (PVDC, EVOH, PEN) Industry Report, 2014-2017

-

Aug.2014

- Hard Copy

- USD

$2,700

-

- Pages:140

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

WLQ020

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

High barrier materials can block the penetration of small molecular gas (such as O2, CO2, N2, water vapor), aroma and other organic solvent vapor prominently. By virtue of better barrier performance, polyvinylidene chloride (PVDC), ethylene / vinyl alcohol copolymer (EVOH) and polyethylene naphthalate (PEN) are mainly used to produce thin films and containers, and utilized in such fields with higher requirements on barrier properties as food, medicine, military products, cosmetics, pesticides, precision instruments and high-grade fine chemicals; additionally, they are also suitable for the production of vacuum insulation panel materials.

In the world, only a small number of companies are capable of producing PVDC, EVOH and PEN which require high-quality raw materials and strict process control, so that the current PVDC, EVOH and PEN markets are dominated by a few oligopolists.

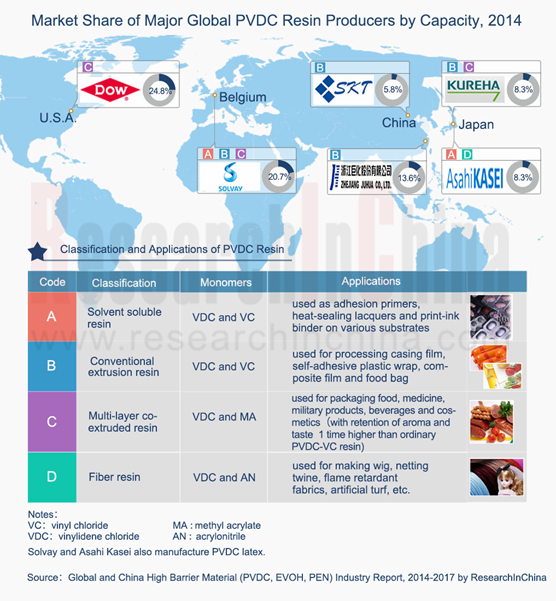

PVDC raw materials exist in the forms of PVDC resins and latexes. Global PVDC resin producers embrace Dow Chemical (USA.), Solvay (Belgium), Kureha (Japan) and Asahi Kasei (Japan). The global PVDC resin capacity reached 228Kt/a in 2013, and will hit 242Kt/a in 2014. New capacity is mainly contributed by Chinese PVDC manufacturers (but the capacity is not fully released).

?

As of 2014, there has been only two PVDC resin production enterprises in China, namely Zhejiang Juhua and Nantong SKT. Both companies produce PVDC resins used in casing films. In recent years, Juhua has increased investment in PVDC, so that the capacity jumped from 3Kt/a in 2009 to 28Kt/a in 2013 and will further rise to 33Kt/a in 2014. Nantong SKT primarily supplies PVDC resins to Henan Shuanghui(i.e., Shineway Group) for the purpose of casing film production. By the end of 2014, Nantong SKT will add the capacity of 3.6Kt/a PVDC resins, so the total capacity will reach 13.6Kt/a.

Chinese PVDC resin market presents two characteristics.

(1) Limited varieties of PVDC resin products with insufficient output and high import dependence (the import dependence ratio of PVDC resin processing equipment is also high). In 2013, China's apparent consumption of PVDC resin amounted to 53.6Kt/a, and the ratio of import dependence was 48.5%, compared with the over 50% before 2013.

(2) PVDC resin application will continue to extend, and the consumption will maintain rapid growth. In 2014, China’s PVDC resin consumption fields are mainly reflected in casing films. As China releases the capacity of plastic wrap PVDC resins and multilayer extrusion PVDC resins as well as enhances the localization rate of PVDC film processing equipment, the future PVDC consumption fields will be enlarged, and the consumption will climb rapidly.

EVOH is suitable for the production of packaging films, gasoline tank, composite bottles and co-extruded plastic sheets. In 2014, the global EVOH resin capacity is recorded at 142Kt, and the market is monopolized by Kuraray (Japan), Nippon Gohsei (Japan) and ChangChun PetroChemical (Taiwan). Due to robust market demand, the former two giants keep expanding capacity. In January 2014, Kuraray’s subsidiary in the United States (Kuraray America, Inc.) raised the EVOH resin capacity by 12Kt/a, so that Kuraray’s global capacity ascended to 81Kt/a. In early 2015, the subsidiary of Nippon Gohsei in the United States (NOLTEX L.L.C.) will obtain the new EVOH resin capacity of 15Kt/a, then the global capacity of Nippon Gohsei is to hit 66Kt/a.

On a global basis, the overwhelming majority of PEN resins gets used to produce PEN films and injection molding products; besides, about 10% of PEN resins are adopted for the production of PEN fibers. Currently, the PEN market is occupied by the joint ventures set up by Teijin (Japan) and DuPont (USA), and SKC (South Korea).

The report highlights the following:

Overview of high barrier materials (including definition, classification, industry chain, related policies, prospects, etc.);

Overview of high barrier materials (including definition, classification, industry chain, related policies, prospects, etc.);

Global and Chinese PVDC, EVOH, PEN market (embracing definition, classification, production technology, processing technology, capacity, output, sales volume, import, export, applications and development prospects, etc.);

Global and Chinese PVDC, EVOH, PEN market (embracing definition, classification, production technology, processing technology, capacity, output, sales volume, import, export, applications and development prospects, etc.);

Profile, revenue, revenue structure, R & D investment, PVDC, EVOH and PEN business, and business in China of global and Chinese PVDC, EVOH and PEN producers (comprising PVDC companies such as USA Dow and Belgium Solvay, EVOH enterprises such as Japan Kuraray and Nippon Gohsei, as well as PEN manufacturers such as Japan Teijin and USA DuPont).

Profile, revenue, revenue structure, R & D investment, PVDC, EVOH and PEN business, and business in China of global and Chinese PVDC, EVOH and PEN producers (comprising PVDC companies such as USA Dow and Belgium Solvay, EVOH enterprises such as Japan Kuraray and Nippon Gohsei, as well as PEN manufacturers such as Japan Teijin and USA DuPont).

1 Overview of High Barrier Materials

1.1 Definition

1.2 Classification

1.3 Industry Chain

1.4 Policy

1.5 Prospect

2 Polyvinylidene Chloride (PVDC)

2.1 Definition and Classification

2.1.1 Definition

2.1.2 Classification

2.2 Production Process

2.3 Global Supply & Demand Analysis and Forecast

2.3.1 Global Capacity

2.3.2 Global Supply & Demand Analysis

2.4 China’s Supply & Demand Analysis and Forecast

2.4.1 China’s Capacity

2.4.2 China’s Supply and Demand Analysis

2.5 Import & Export Analysis

2.5.1 Export Analysis

2.5.2 Import Analysis

2.6 Application and Prospect

2.6.1 PVDC Casing Film

2.6.2 PVDC Coating Film

2.6.3 PVDC Plastic Wrap

2.6.4 PVDC Shrink Film

2.6.5 PVDC Coextruded Stretch Film

3 Major Global and Chinese PVDC Manufacturers

3.1 Dow Chemical

3.1.1 Profile

3.1.2 Operation

3.1.3 Revenue Structure

3.1.4 The Performance Plastics Segment

3.1.5 R&D Costs

3.1.6 Production Bases and Capacity of PVDC

3.1.7 PVDC Resins (SARAN)

3.1.8 PVDC Films (SARANEX)

3.2 Solvay

3.2.1 Profile

3.2.2 Operation

3.2.3 Revenue Structure

3.2.4 Gross Margin

3.2.5 R&D Costs

3.2.6 Specialty Polymers

3.2.7 Production Bases and Capacity of PVDC

3.2.8 PVDC Products

3.3 Kureha

3.3.1 Profile

3.3.2 Operation

3.3.3 Revenue Structure

3.3.4 R & D Costs

3.3.5 Production Bases and Capacity of PVDC

3.3.6 PVDC Products

3.3.7 Business in China

3.4 Asahi Kasei

3.4.1 Profile

3.4.2 Operation

3.4.3 Revenue Structure

3.4.4 R & D Costs

3.4.5 Production Bases and Capacity of PVDC

3.4.6 PVDC Products

3.5 Zhejiang Juhua

3.5.1 Profile

3.5.2 Operation

3.5.3 Revenue Structure

3.5.4 Gross Margin

3.5.5 R&D Costs

3.5.6 Operating Costs

3.5.7 PVDC Business

3.5.8 Development Strategy

3.6 Henan Shuanghui Investment & Development Co., Ltd.

3.6.1 Profile

3.6.2 Operation

3.6.3 PVDC Business

4 Ethylene Vinyl Alcohol Copolymer (EVOH)

4.1 Definition and Properties

4.2 Production Process

4.3 Global Supply and Demand Analysis

4.3.1 Global Capacity

4.3.2 Global Supply and Demand

4.4 China's Supply and Demand Analysis

4.4.1 Status Quo

4.4.2 EVOH Supply and Demand in China

4.5 Application and Prospect

4.5.1 EVOH Barrier Packaging Films and Co-extruded Plastic Sheets

4.5.2 EVOH Multilayer Fuel Tanks

4.5.3 EVOH Multilayer Composite Bottles

4.5.4 Textile Materials

4.5.5 Medical Materials

4.5.6 Vacuum Insulation Panels

5 Major Global and Chinese EVOH Producers

5.1 Kuraray

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 R & D Costs

5.1.5 Major Overseas Subsidiaries of Kuraray

5.1.6 Production Bases and Capacity of EVOH

5.1.7 EVOH Products

5.1.8 Business in China

5.2 Nippon Gohsei

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Production Bases and Capacity of EVOH

5.2.5 EVOH Products

5.2.6 Business in China

5.3 Taiwan ChangChun PetroChemical

6 Polyethylene Naphthalate (PEN)

6.1 Definition and Properties

6.2 Production Process

6.2.1 PEN Resin

6.2.2 PEN Film

6.3 Status Quo of Global and Chinese PEN Resin Production

6.3.1 Global Market

6.3.2 China Market

6.4 Application and Prospect

6.4.1 PEN Film

6.4.2 Packaging Containers

6.4.3 PEN Fiber

6.4.4 PEN/PET Blends and Copolymers

7 Major Global and Chinese PEN Producers

7.1 Teijin

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 R & D Costs

7.1.5 Production Bases and Capacity of PEN

7.1.6 PEN Products

7.1.7 Business in China

7.2 DuPont

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 R & D Costs

7.2.5 PEN Business

7.3 SKC

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 PEN Business

Permeability Comparison between Medium and High Barrier Materials

Oxygen Transmission Rate (OTR) of Medium and High Barrier Materials Versus Relative Humidity

High Barrier Material Industry Chain

Molecular Structure and Related Features of PVDC

Global Consumption of PVDC Resin, 2010-2017E

Global Consumption of PVDC Resin by Region, 2013

Capacity of PVDC Resin in China, 2009-2017E

Output of PVDC Resin in China, 2009-2017E

Apparent Consumption of PVDC Resin in China, 2009-2017E

Import Dependence Ratio of PVDC Resin in China, 2009-2017E

Export Volume and Value of PVDC in China, 2010-2014

Import Volume and Value of PVDC in China, 2009-2014

Revenue and YoY Growth of Dow, 2009-2014

Net Income and YoY Growth of Dow, 2009-2014

Net Profit Margin of Dow, 2009-2014

Revenue Structure of Dow by Segment , 2011-2014

Revenue Structure of Dow by Region, 2009-2014

Revenue Structure of Dow’s Performance Plastics Segment by Business, 2011-2013

Revenue Structure of Dow’s Performance Plastics Segment by Region, 2013

Dow’s R&D Costs, YoY Growth and % of Revenue,2009-2013

Production Process of Dow's PVDC Resin (SARAN)

Number of Employees in Solvay by Region, 2009-2013

Main Business of Solvay by Operating Segments,2013

Profile of Solvay by Region,2013

Revenue and YoY Growth of Solvay, 2009-2014

Net Income and YoY Growth of Solvay, 2009-2014

Net Profit Margin of Solvay, 2009-2014

Net Sales Structure of Solvay's Advanced Materials Segment by Business and Region,2013

Solvay's R&D Costs, YoY Growth and % of Revenue, 2009-2013

Revenue and YoY Growth of Solvay's Specialty Polymers Business, 2009-2013

Main Products of Solvay Specialty Polymers

Combination of Barrier Properties (Diofan? Aqueous High Barrier Polymer Dispersions)

Major Products and Services of Kureha by Segment

Revenue and YoY Growth of Kureha, FY2009-FY2013

Net Income and YoY Growth of Kureha, FY2009-FY2013

Net Profit Margin of Kureha, FY2009-FY2013

Revenue Structure of Kureha by Segment, FY2010-FY2013

Net Sales and Operating Income of Kureha's Specialty Plastics, FY2009-FY2013

Revenue Structure of Kureha by Region, FY2009-FY2013

Kureha's R&D Costs, YoY Growth and % of Revenue, FY2009-FY2013

Kureha's R&D Costs by Segment, FY2009-FY2013

Revenue and YoY Growth of Asahi Kasei, FY2009-FY2013

Net Income and YoY Growth of Asahi Kasei, FY2009-FY2013

Net Profit Margin of Asahi Kasei, FY2009-FY2013

Revenue Structure of Asahi Kasei by Segment, FY2009-FY2013

Revenue Structure of Asahi Kasei by Region, FY2010-FY2013

Asahi Kasei's R&D Costs, YoY Growth and % of Revenue, FY2009-FY2013

R&D Costs of Asahi Kasei by Segment, FY2012-FY2013

Revenue and YoY Growth of Juhua, 2009-2014

Net Income and YoY Growth of Juhua, 2009-2014

Net Profit Margin of Juhua, 2009-2014

Revenue Structure of Juhua by Product, 2009-2014

Revenue Structure of Juhua by Region, 2009-2014

Juhua's R&D Costs, YoY Growth and % of Total Revenue, 2009-2014

Juhua's Operating Costs of Food Packaging Materials, 2012-2013

Revenue and YoY Growth of Shuanghui, 2009-2014

Net Income and YoY Growth of Shuanghui, 2009-2014

Net profit margin of Shuanghui, 2009-2014

Global Capacity of EVOH Resin and YoY Growth, 2009-2017E

Global Capacity of EVOH Resin by Country, as of 2014

Global Output of EVOH Resin and YoY Growth, 2009-2017E

Global Consumption of EVOH Resin and YoY Growth, 2009-2017E

Consumption of EVOH Resin and YoY Growth in China, 2009-2017E

Structure of Typical EVOH Co-extrusion Multilayer

Structure of Typical EVOH Multilayer Fuel Tank

Revenue and YoY Growth of Kuraray, FY2009-FY2013

Net Income and YoY Growth of Kuraray, FY2009-FY2013

Net Profit Margin of Kuraray, FY2009-FY2013

Revenue Structure of Kuraray by Segment, FY2012-FY2013

Revenue Structure of Kuraray by Region, FY2009-FY2013

Kuraray’s R & D Costs, YoY Growth and % of Revenue, FY2009-FY2013

Major Overseas Subsidiaries of Kuraray

Kuraray's EVOH Capacity by Product and Production Base, as of 2014

Kuraray’s Production Process of EVOH Resin

Range of Kuraray's EVOH Resin Grades

Kuraray’s Processing of EVOH Film

Products List and Segments of NIPPON GOHSEI

Revenue and YoY Growth of Nippon Gohsei, FY2009-FY2013

Net Income and YoY Growth of Nippon Gohsei, FY2009-FY2013

Net Profit Margin of Nippon Gohsei, FY2009-FY2013

Nippon Gohsei's Standard Grades of EVOH Resin

Nippon Gohsei's Special Grade of EVOH Resin

Applications for EVOH Resin (SoarnoL) of Nippon Gohsei

Overseas Subidiaries of Nippon Gohsei

Production Process of PEN Resin

Production Process of PEN Film

Business Domains and Growth Drivers of Teijin

Revenue and YoY Growth of Teijin, FY2009-FY2013

Net Income and YoY Growth of Teijin, FY2009-FY2013

Net Profit Margin of Teijin, FY2009-FY2013

Revenue Structure of Teijin by Region, FY2009-FY2013

Teijin's R & D Costs, YoY Growth and % of Revenue, FY2009-FY2013

Gobal Network of DuPont Teijin Films

Asia Pacific Network of Teijin DuPont Films

Comparison between Teonex and PET Film

Revenue and YoY Growth of DuPont, 2009-2014

Net Income and YoY Growth of DuPont, 2009-2014

Net Profit Margin of DuPont, 2009-2014

Revenue Structure of DuPont by Segment, 2009-2014

Revenue Structure of DuPont Performance Materials by Product Group/Industry/ Region,2013

DuPont's R & D Costs, YoY Growth and % of Revenue of DuPont, 2009-2014

Equity Structure of SKC, as of 2013

Revenue and YoY Growth of SKC, 2010-2013

Net Income and YoY Growth of SKC, 2010-2013

Net Profit Margin of SKC, 2010-2013

Revenue and Operating Income of SKC by Business, 2003-2013

Key Performance Indicators of PVDC

Classification and Applications of PVDC

Major Global PVDC Resin Producers and Their Capacity, 2012-2014

Major PVDC Resin and Latex Producers and Their Capacity in China, 2013-2014

Export Volume and Value of PVDC in China by Source Province and Municipality, 2013-2014

Export Volume and Value of PVDC in China by Destination Country, 2013-2014

Import Volume and Value of PVDC in China by Source Country, 2013-2014

Import Volume and Value of PVDC in China by Destination Province/Municipality, 2013-2014

Chinese Casing Film Production Enterprises and Their Capacity, 2014

Major Chinese PVDC Coating Film Production Enterprises and Their Capacity, 2014

Major Products and Applications/Market of Dow's Performance Plastics Segment

Dow's Range of SARANEX Coextruded Barrier Films Products

Net Sales Structure of Solvay by Segment, 2012-2014

Revenue Structure of Solvay by Region and Country,2009-2013

Gross Margin of Solvay by Segment, 2009-2013

Solvay's Range of DIOFAN High Barrier Polymer Products

Solvay's Range of Ixan Barrier Polymer Resin Products

Application of Ixan? Soluble Barrier Polymer Powders

Subsidiaries of Kureha in China

Gross Margin of Juhua by Product, 2009-2014

Gross Margin of Juhua by Region, 2009-2014

PVDC Capacity, Output, Sales Volume and Average Price of Juhua, 2009-2014

Revenue and Net Income of Shuanghui’s Subsidiaries Engaged in PVDC casing film, 2012-2013

Properties of EVOH Resin

Global EVOH Resin Producers and Their Capacity, as of 2014

Global Consumption of EVOH Resin by Region and Application Area, 2013 Vs. 2011

Consumption of EVOH Resin by Application Area in China, 2013 Vs. 2011

Advantages and Disadvantages of Several Types of Fuel Tanks

Kuraray’s Types and Applications of EVOH Films

Branches of Kuraray in China

Sales Revenue and Operating Income of Nippon Gohsei by Segment, FY2009-FY2013

Nippon Gohsei's Production Bases and Capacity of EVOH Resin, as of 2014

Properties of PEN

Revenue Structure of Teijin by Segment, FY2009-FY2013

Revenue Structure of DuPont by Region, 2010-2013

SKC Business Division and Capacity of Main Products by Region, as of 2013

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...

Global and China MO Source Industry Report, 2019-2025

MO source is a key raw material for metal-organic chemical vapor deposition (MOCVD) process. Global MO source output ranged at 102.6 tons in 2018, a rise of roughly 4.6% from a year earlier, a figure ...

Global and China Bi-Metal Band Saw Blade Industry Report, 2018-2023

Chinese manufacturing rebounded in the wake of a pick-up in infrastructure construction between 2016 and 2018, so did the bi-metal band saw blade as a key integral of metal processing industry. In 201...