| |

Research on Shandong Denghai Seeds Co., Ltd.

Shangdong Denghai Seeds Co., Ltd. is a listed high-tech agriculatural company, founded by and named after Denghai Li, a well-known Chinese corn breeding and cultivation expert. The company that specializes in maize breeding ranked the third place among China’s top 50 seed companies in 2006. Shandong Denghai with very strong strength in R&D is the only domestic company so far that does not need pay for seed use right. Its main products include Denghai No.9 and Denghai No.11. The company has also set up the Shandong Denghai-Pioneer Seeds Co., Ltd. together with the Pioneer Hi-Bred International, Inc. in the U.S. and holds 51% stake in the joint venture. The Denghai series of maize seeds developed by Denghai Li, the founder of Shandong Denghai, were once on the top of China’s seed industy before 2005.

Main Business Revenue and Operating Profit, H1 2007

Source: ResearchInChina

The summer maize seed of Xianyu No.335 is marketed by its unit of Shandong Denghai-Pioneer Seeds Co., Ltd., whose marketing strategy totally differs from other domestic companies. Shandong Denghai-Pioneer Seeds Co. promotes the monoseeding concept and sells the bagged seed based on the amount of seed needed per mu, equal to 1/15 hectare. The selling price of the bagged seed is three times homegrown seeds and its gross profit margin has risen to 68% compared with 30% of homegrown seeds. Before that, domestic farmers used to plant seeds by 3-4 times the amount actually needed. The market share of the summer maize seed of Xianyu No.335 was less than 7% in 2007, so there still is big space for the growth of its market share.

From the above chart, we can see that Xianyu No.335 has already become the key profit source of the company. However, as the ownership of Xianyu No.335 is in the hands of the joint venture company, so Shandong Denghai has to pay huge for the seed use right. Therefore, though the profit of the joint venture totaled CNY38 million in 2007, Shandong Denghai only got net profit of CNY7.24 million from it, still resulting in a rise of its profit in 2007 by 26.85% year on year. But the sales of its former flagship product, Denghai No. 11 in 2007 were not satisfactory.

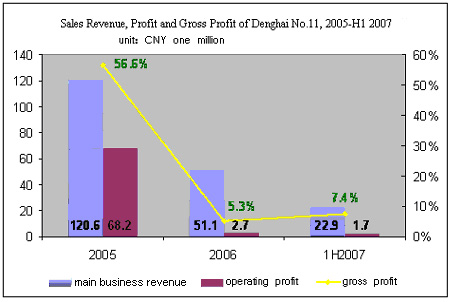

Sales Revenue, Profit and Gross Profit of Denghai No.11, 2005-H1 2007

Source: ResearchInChina

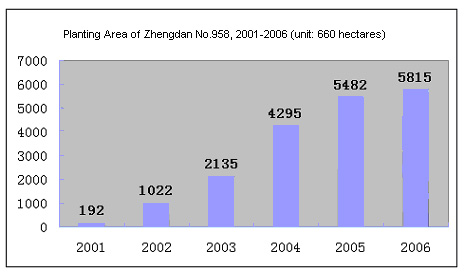

The reason behind the sharp decline in sales volume and profit of Denghai No.11 is the rising popularity of Zhengdan No.958, which is a new species of crossbreeding maize with excellent quality and high yield, which was bred successfully by Henan Academy of Agricultural Science in 2000.

Henan Academy of Agricultural Science authorized four companies to market Zhengdan No.958 across the country through publicly bidding. Zhengdan No.958 became very popular, soon after it was put on the market and replaced Denghai No. 11 only in a few years. Zhangdan No. 958 has become the biggest maize species in China, taking up 25% market share across the country.

Planting Areas of Zhengdan No.958, 2001-2006 (unit: 660 hectare)

Source: ResearchInChina

Among the four authorized companies, each of them has made great attempts to maximize its own benefit, but ignored the overall interest. In 2006, the planting areas of the four companies totaled 29,700 hectares and the unauthorized planting areas also reached 16,500 to 19,800 hectares, while the total yield was 300,000-400,000 tons, excluding a large amount of seeds in stock in 2006. Substantial amount of Zhengdan No.958 has penetrated the market and this has forced dealers to dump their maize at low prices, thus leading to a drastic decline in profitability of Denghai No.11.

Domestic Maize Seed Market

At present, China’s seed market is in chaos with the feature of oversupply. Seed production and sales follow seasons closely. As the production and sales are done in different period of time, so it often results in great blindness in seed production, which is the major reason behind it that China has a serious oversupply of seed. Meanwhile, as government policy to offer subsidies for quality seeds is of poor operability, this makes some local governments oftern take the side of local seed companies and real seed companies supplanted.

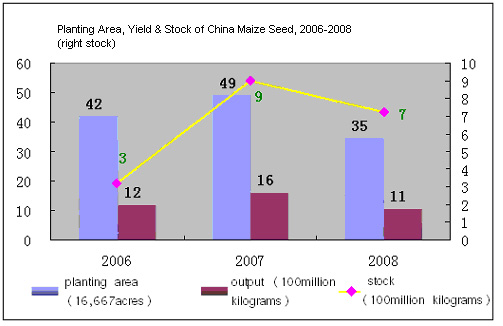

The maize seed market in 2007 is a typical example. China’s planting area of crossbreeding maize reached 323,400 hectares in 2006, representing a rise of 46,200 hectares against 2005 and the yield amounted to 1.6 million tons, an increase of 400,000 tons against 2005. Given 300,000 tons of seed in stock in 2005, the total supply of crossbreeding maize seed in 2007 should reach 1.9 million tons. China’s annual demand for crossbreeding maize seed is around one million tons based on the total planting areas of 26.4 million hectares in China, so the total suuply of 1.9 million tons in 2007 should be almost enough for two years of usage.

The supply and demand for maize seed will be improved in 2008, when the toal supply will be reduced to 1.8 million tons from 1.9 million tons posted in 2007 and especially the total supply of the new seed will be reduced to 1.1 million tons from 1.62 million tons. The pressure of seed industry will be eased off greatly, due to poor competitve edge of seed in stock.

In fact, China’s annual demand for maize seed remains basically around one million tons. From the perspective of the quantity, the yield of new seed each year is well able to meet the market demand. The oversupply of maize seed is a surplus in total amount and structure.

The disparity in variety is very big. For example, as for good quality seeds like Zhengdan No.958, Jundan No.20 and Xianyu No.335, their sales volume keep steady, while the sales of inferior species, like Denghai series of Shandong Denghai, are not satisfactory.

Planting Area, Yield and Stock of China Maize Seed, 2006-2008

(right: stock)

Source: ResearchInChina

Generally speaking, the life cycle of a seed is around five years. But Zhengdan No.958 can still enjoy at least 2-3 years period of great prosperity in the maize seed market by virtue of its good performance. The promising Jundan No.20 is on an upward trend and may become a star seed in two or three years to replace Zhengdan No.958.

Company Prospect

Good quality seed and marketing ability are the core competitiveness for a seed company. Shandong Denghai has a history of developing new products independently for its own production. Though its R&D ability is quite strong, the company, so far, still hasn’t developed its new flagship products, which can compete with Zhengdan No.958.

In addition, the marketing ability of Shandong Denghai is not very good, which can be proved by its defeat since the launch of Zhengdan No.958. It has failed to perceive timely the market changes and make adjustments to its marketing strategy accordingly. But, it just accepted the reality passively, leading to a continuous decline in sales of its flagship product and a heavy buildup in stock in the past two years. In the years, when Denghai series products were populous in the market, the selling prices were 10%-15% higher than its peers.

Before Shandong Denghai launches its new flagship products to compete with Zhengdan No.958, its profit source mainly comes from its subsidiary Shandong Denghai-Pioneer Seeds Co., Ltd. As we mentioned earlier, large part of profit of Denghai-Pioneer is seized by American Pioneer Hi-Bred International, Inc. and Shandong Denghai can only gain a small part of “commission”. We would like to make a proposal that when Shandong Denghai has its new flagship product, the company should learn from the advanced marketing mode of Denghai-Pioneer for gaining good economic returns, but not adopt the vicious competitive mode like what Zhengdan No. 958 is doing.

In the long term, there must be a big restructuring in the industry to integrate the various sized maize seed companies in China. The companies, which have the advantages in brands and marketing channels, will expand their market share gradually. We cannot neglect foreign companies like American Pioneer Hi-Bred International, Inc., which created Dunhuang-Pioneer Seed Co., Ltd. in 2005 with the Gansu Dunhuang Seed Co., Ltd. The Dunhuang-Pioneer, which is producing the crossbreeding maize seed of Xianyu No. 335, is expected to gain profit staring from 2008.

|