| |

|

|

The global mobile phone shipment in 2005 was 795 million units, 57% of which (about 455 million units) had the photographing function. It is predicted that 85% of the mobile phones will be camera phones by 2008 with a shipment of 800 million units; and the market scale of camera phone module will accordingly rise from $2 billion in 2005 to $4.8 billion by 2008, showing very promising prospects.

The camera phone module industry chain mainly includes three parts: image sensor, lens and assembly.

As for image sensors, most of the manufacturers (except Japanese ones) adopt CMOS image sensors. The market share of CCD image sensor will remain stable in the future, due to Japanese manufacturers’ high requirement for quality, and currently only CCD sensor can satisfy the demand of Japanese market.

There are about 20 CMOS sensor manufacturers worldwide, which can be classified into three categories.

One is memory manufacturers, including Micron, Magnachip, ST, and Cypress. Micron was the earliest one to enter CMOS sensor field, it acquired Photobits as early as 2000, and realized large amounts shipments in 2005. These memory manufacturers are capable of manufacturing large amount of wafers. There are few types of memory products. These manufacturers are thus known with low costs; they manufacture a large quantity of products, but only few different kinds. They mainly target the mobile phone market. Before taking its independence, Magnachip was the logic IC division of Hynix. And Cypress is a large SRAM manufacturer.

Another category is specialized CMOS image sensor manufacturers, including Omnivision, Pixelplus, Transchip, Pixart, ElecVision, Taiwan Advanced Sensors Corporation (TASC). The first three manufacturers are specialized in mobile phone market with a big advantage for design; while the other three ones are Taiwan-based manufacturers which are not so interested in mobile phone market, but more engaged in optical mouse field.

The third group is CCD/CMOS image sensor manufacturers with high fundamental technologies, Sony and Kodak for example.

Characteristics of CMOS sensor manufacturers:

1. Most of them have wafer plants, or have a close relationship with wafer plants, which is a necessary condition for low costs.

2. Most of them have been through M&As. For instance, Omnivision acquired CDM Optics in Apr 2005; Magnachip acquired IC Media in Apr 2005; Micron acquired Photobit at the end of 2001; and Kodak acquired Imaging Department of the National Semiconductor of the US.

3. Proficient in CMOS technique, but lacking of optical and image color processing technologies.

4. The assembly processes of most manufacturers are centralized in Taiwan. For instance, Omnivision entrusts VisEra to assemble, Micron entrusts Kingpak, Samsung entrusts ASE, Pixart entrusts Sigurd, and IC Media entrusts King Yuan Electronics.

Relationship between CMOS sensor IC and wafer plants

|

Manufacturer |

Maximum pixel (megapixel) |

Manufacturing plant |

|

OmniVision |

5.17 |

TSMC |

|

Micron |

5.04 |

Has its own wafer plant |

|

Magnachip |

3.2 |

Has its own wafer plant |

|

ST |

2 |

Has its own wafer plant |

|

ESST |

1.3 |

Has its own wafer plant |

|

Transchip |

2 |

TSMC |

|

Agilent |

5 |

TSMC |

|

pixelplus |

3.2 |

Dongbu Anam |

|

Kodak |

30 |

IBM |

|

Toshiba |

3.2 |

Has its own wafer plant |

|

Crypress |

3 |

Has its own wafer plant |

|

Samsung |

7 |

Has its own wafer plant |

|

Pixart |

1.3 |

Subsidiary of UMC |

|

TASC |

2.1 |

TSMC |

|

ElecVision |

0.3 |

TSMC |

|

Galaxycore |

3 |

SMIC |

Lens manufacturers are concentrated in Taiwan, Japan and South Korea. Due to its high technology content, Lens industry has a high entry threshold. And Taiwan-based enterprises are obviously advantageous in costs with a market share of 57% in 2005, which is expected to reach 65% by 2006.

There are 4 major camera phone lens manufacturers in Taiwan are Genius, Largan, Asia Optical, and Premier. The global market shares for those four are 23%, 25%, 5% and 4% respectively

With the pixel upgrade of camera phones, more and more lens manufacturers are engaged in glass lens manufacturing, but the manufacturers who only have plastic lens technologies are declining. Enplas, for instance, whose sales revenue reduced 6 billion yen with a profit decline from 8.45 billion yen to 3.7 billion yen. Especially in 2-megapixel camera phone lens market, glass lens manufacturers are taking obvious advantages; the optical giants like Fujinon, Konica Minolta, and Largan almost monopolize the market.

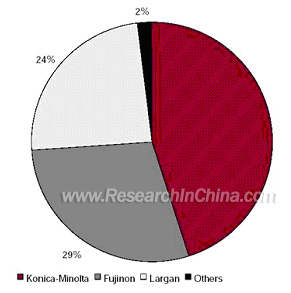

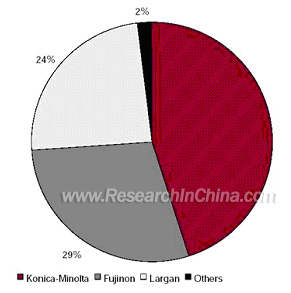

Market shares of major 1.3-megapixel lens manufacturers, 2005Q2

As for assembly industry, Flextronics has become the largest camera phone module manufacturer in the world after it acquired the CMOS image sensor department of Agilent, and the image sensor testing plant of ASE; however, it does not have very efficient R&D. Altus, affiliated to Foxconn Group, developed fast, and its market share has risen from 4% in 2004 to 9% in the second half of 2005 with a shipment of 41 million sets. Meanwhile, domestic manufacturers are declining sharply. During the first half of 2005, the operation revenue of Macat’s major businesses was 157 million Yuan, a 40% decrease year-on-year; the profit of its major businesses was 3.55 million Yuan, a 82% decrease year-on-year; and its net losses were 14 million Yuan, a 286% increase year-on-year. This is mainly caused by the loss of its major client Agilent, which turned to Fextronics.

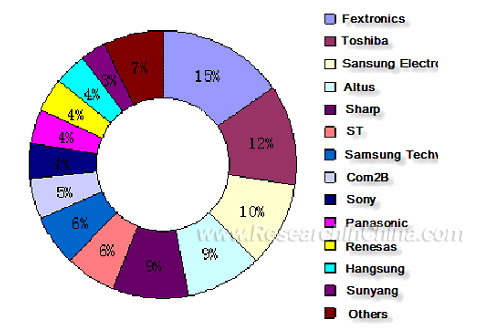

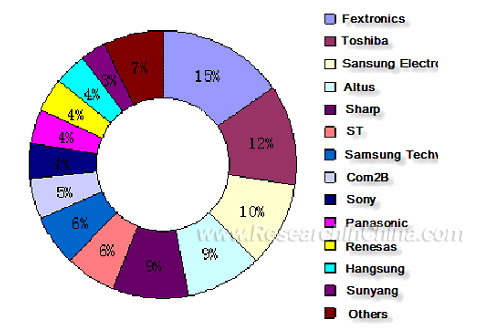

Market shares of major camera module assembly manufacturers, second half of 2005

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

The global mobile phone shipment in 2005 was 795 million units, 57% of which (about 455 million units) had the photographing function. It is predicted that 85% of the mobile phones will be camera phones by 2008 with a shipment of 800 million units; and the market scale of camera phone module will accordingly rise from $2 billion in 2005 to $4.8 billion by 2008, showing very promising prospects.

The camera phone module industry chain mainly includes three parts: image sensor, lens and assembly.

As for image sensors, most of the manufacturers (except Japanese ones) adopt CMOS image sensors. The market share of CCD image sensor will remain stable in the future, due to Japanese manufacturers’ high requirement for quality, and currently only CCD sensor can satisfy the demand of Japanese market.

There are about 20 CMOS sensor manufacturers worldwide, which can be classified into three categories.

One is memory manufacturers, including Micron, Magnachip, ST, and Cypress. Micron was the earliest one to enter CMOS sensor field, it acquired Photobits as early as 2000, and realized large amounts shipments in 2005. These memory manufacturers are capable of manufacturing large amount of wafers. There are few types of memory products. These manufacturers are thus known with low costs; they manufacture a large quantity of products, but only few different kinds. They mainly target the mobile phone market. Before taking its independence, Magnachip was the logic IC division of Hynix. And Cypress is a large SRAM manufacturer.

Another category is specialized CMOS image sensor manufacturers, including Omnivision, Pixelplus, Transchip, Pixart, ElecVision, Taiwan Advanced Sensors Corporation (TASC). The first three manufacturers are specialized in mobile phone market with a big advantage for design; while the other three ones are Taiwan-based manufacturers which are not so interested in mobile phone market, but more engaged in optical mouse field.

The third group is CCD/CMOS image sensor manufacturers with high fundamental technologies, Sony and Kodak for example.

Characteristics of CMOS sensor manufacturers:

1. Most of them have wafer plants, or have a close relationship with wafer plants, which is a necessary condition for low costs.

2. Most of them have been through M&As. For instance, Omnivision acquired CDM Optics in Apr 2005; Magnachip acquired IC Media in Apr 2005; Micron acquired Photobit at the end of 2001; and Kodak acquired Imaging Department of the National Semiconductor of the US.

3. Proficient in CMOS technique, but lacking of optical and image color processing technologies.

4. The assembly processes of most manufacturers are centralized in Taiwan. For instance, Omnivision entrusts VisEra to assemble, Micron entrusts Kingpak, Samsung entrusts ASE, Pixart entrusts Sigurd, and IC Media entrusts King Yuan Electronics.

Relationship between CMOS sensor IC and wafer plants

|

Manufacturer |

Maximum pixel (megapixel) |

Manufacturing plant |

|

OmniVision |

5.17 |

TSMC |

|

Micron |

5.04 |

Has its own wafer plant |

|

Magnachip |

3.2 |

Has its own wafer plant |

|

ST |

2 |

Has its own wafer plant |

|

ESST |

1.3 |

Has its own wafer plant |

|

Transchip |

2 |

TSMC |

|

Agilent |

5 |

TSMC |

|

pixelplus |

3.2 |

Dongbu Anam |

|

Kodak |

30 |

IBM |

|

Toshiba |

3.2 |

Has its own wafer plant |

|

Crypress |

3 |

Has its own wafer plant |

|

Samsung |

7 |

Has its own wafer plant |

|

Pixart |

1.3 |

Subsidiary of UMC |

|

TASC |

2.1 |

TSMC |

|

ElecVision |

0.3 |

TSMC |

|

Galaxycore |

3 |

SMIC |

Lens manufacturers are concentrated in Taiwan, Japan and South Korea. Due to its high technology content, Lens industry has a high entry threshold. And Taiwan-based enterprises are obviously advantageous in costs with a market share of 57% in 2005, which is expected to reach 65% by 2006.

There are 4 major camera phone lens manufacturers in Taiwan are Genius, Largan, Asia Optical, and Premier. The global market shares for those four are 23%, 25%, 5% and 4% respectively

With the pixel upgrade of camera phones, more and more lens manufacturers are engaged in glass lens manufacturing, but the manufacturers who only have plastic lens technologies are declining. Enplas, for instance, whose sales revenue reduced 6 billion yen with a profit decline from 8.45 billion yen to 3.7 billion yen. Especially in 2-megapixel camera phone lens market, glass lens manufacturers are taking obvious advantages; the optical giants like Fujinon, Konica Minolta, and Largan almost monopolize the market.

Market shares of major 1.3-megapixel lens manufacturers, 2005Q2

As for assembly industry, Flextronics has become the largest camera phone module manufacturer in the world after it acquired the CMOS image sensor department of Agilent, and the image sensor testing plant of ASE; however, it does not have very efficient R&D. Altus, affiliated to Foxconn Group, developed fast, and its market share has risen from 4% in 2004 to 9% in the second half of 2005 with a shipment of 41 million sets. Meanwhile, domestic manufacturers are declining sharply. During the first half of 2005, the operation revenue of Macat’s major businesses was 157 million Yuan, a 40% decrease year-on-year; the profit of its major businesses was 3.55 million Yuan, a 82% decrease year-on-year; and its net losses were 14 million Yuan, a 286% increase year-on-year. This is mainly caused by the loss of its major client Agilent, which turned to Fextronics.

Market shares of major camera module assembly manufacturers, second half of 2005

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1.Overview of Global Mobile Phone Market, 2005 2.Introduction to the Camera Phone Module Industry

2.1 CMOS image sensor IC companies

2.2 Lens manufacturers

2.3 Camera phone module assembly manufacturers

2.3.1 Camera phone module assembly technologies

2.3.2 Camera phone module assembly manufacturers 3.Introduction to Major Camera Phone Module Manufacturers

3.1 Primax

3.2 Premier

3.3 Chicony

3.4 Lite-On Semiconductor

3.5 Creative Sensor Inc.

3.6 Altus

3.7 Asia Optical

3.8 Macat

3.9 ATC Optoelectronics (Suzhou) Co., Ltd

3.10 Kantatsu (Pinghu) Co., Ltd

3.11 Guangzhou Vtrek

3.12 Hunan Huanqiu Electronics

3.13 Hansung ELCOMTEC Photonics Co., Ltd

3.14 Cowell World Optech

3.15 Sunyang Digital Image

3.16 Hansung Elcomtec

3.17 Kaier 4.Camera Phone Lens Manufacturers

4.1 Genius

4.2 Largan

4.3 Asia Optical

4.4 MaxEmil

4.5 Kinko Optical

4.6 BASO Precision Optics Ltd

4.7 Hokuang Optics

4.8 Kintin Optotronic Co., Ltd

4.9 E-Pin Optical

4.10 Green Point

4.11 iMagic

4.12 Samsung Electro-Mechanics

4.13 Sekonix

4.14 Cowell World Optech

4.15 Phoenix Optical

4.16 Enplas

4.17 Fujinon

4.18 Konica Minolta

4.19 Kolen 5.CMOS Image Sensor Manufacturers

5.1 OmniVision

5.2 Flextronics

5.3 Micron

5.4 ST Microelectronics

5.5 Magnachip

5.6 Samsung Electro-Mechanics

5.7 IC Media

5.8 Pixart

5.9 TASC

5.10 ElecVision

5.11 TransChip

5.12 Cypress Semiconductor

5.13 Toshiba

5.14 Sony

5.15 Galaxycore

5.16 Pixelplus

5.17 Superpix Micro Technology |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Statistics of the mobile phone shipment worldwide, by technology type, 2005

Mobile phone shipment worldwide, by region, 2005

Sales and growth rate of the global top 5 mobile phone manufacturers, 2005

Structure of CMOS camera phone module industry chain

Market share distribution of 0.3-megapixel lens manufacturers, 2005Q2

Market share distribution of 1.3-megapixel lens manufacturers, 2005Q2

Market shares distribution of 2-megapixel lens manufacturers, 2005Q2

Market shares distribution of camera module assembly manufacturers, second half of 2005

Lens shipment of Genius, 2004-2006

Capacity expansion plan of Asia Optical, 2005-2006

Operation achievement of Kinko Optical, FY2002-2005

Operating income of Omnivision, 2004Q2-2005Q4

Forecast of global camera phone shipment, 2002-2008

Regional distribution of Micron's operating income, FY2004-2005

Relationship between CMOS sensor IC and wafer plant

Genius' camera phone lens products

Major clients of Genius

Largan's camera phone lens products

Characteristics of Largan's 1.3-megapixel camera phone lens

Characteristics of Largan's 2-megapixel (or above) camera phone lens

Monthly output of Asia Optical

Lens models of Maxemil

Major businesses of Kinko Optical

Production capacity of BASO Precision Optics

Product series of Pixelplus 1.3-megapixel CMOS image sensors

Product series of Pixelplus 2-megapixel CMOS image sensors

Product series of Pixelplus 3.2-megapixel CMOS image sensors

|

2005-2008 www.researchinchina.com All Rights Reserved

|