| |

|

|

Along with the fast progress of internet and mobile network in recent years, various kinds of e-commerce emerged, bringing more convenience and alternatives to people's life. Online payment and mobile payment, as incentive means to further development of e-commerce, will become the main payment means of e-commerce by and by.

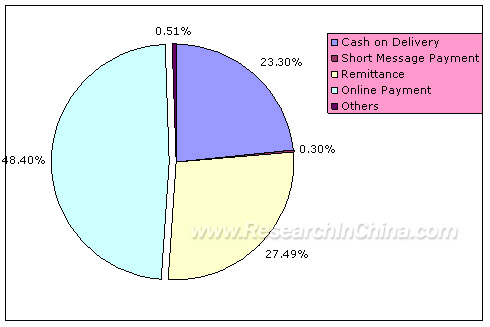

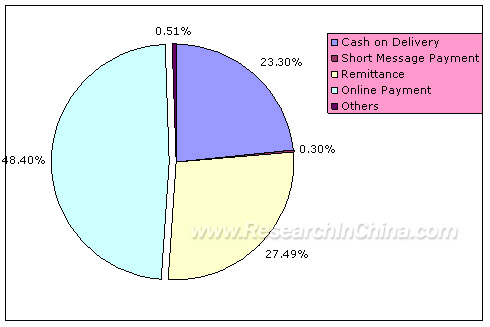

Payment options for Online Shopping

According to business mode, online payment can be divided into pre-payment, agency payment, online banking payment and online platform payment. Online platform payment undertaken by online payment platform operator, a third-party economic entity independent from bank and SP, acts as the role connect users, banks and SPs.

Major Chinese Online Payment Platform Operators

|

Company Name |

Platform Name |

Platform Features |

|

Zhejiang Alipay Co., Ltd. |

Alipay |

China’s largest online transaction platform; first to officially release VISA Verification Service in China. |

|

Capital Information Development Company |

Capinfo Easy-pay |

China’s first online payment platform with the realization of providing across bank and across region online transaction services for a variety of bank cards; unique for its twice balanced mode. |

|

Universal eCommerce China Limited |

IPS |

Apart from being an online safety payment platform with high-efficient handling of debit cards in China, IPS is also the first domestic platform to provide online real-time safety services for int’l cards. Due to its years’ experience in foreign card services, IPS becomes the first strategic and cooperative partner of VISA’s global e-commerce safety program in China. |

|

Beijing Cloudnet Internet Co., Ltd.

|

Pay@Net |

Without delayed bills, Pay@Net assumes one fourth of online payment in China; Real-time information feedback; 128 bit VeriSign Verification |

|

E.T Information Power Co., Ltd. |

1st-pay.net |

Characterized by automation, Intelligentization, individuation, easy operation and high security, 1st-pay.net covers the whole arena of e-commerce and spreads over its business to overseas markets in Asia, Australia, Europe and North America. |

The domestic online payment is mainly based on the debit card system. Thus, risks in online payment can be controlled effectively. But meanwhile, the profit of domestic payment service is also quite low. Nowadays, the industrialization of mobile payment application emerges as handsets gradually replace cash and credit card in the payment of some shops and automatic seller machines. At present, bank card circulation and handset users have increased to over 0.96 billion and 0.42 billion respectively in China, offering boundless commercial opportunities for the development of mobile payment industry in China. With the prevalence of mobile content and application charges based on SMS, mobile payment has gradually been accepted. However, in-depth applications of mobile payment still need to be cultivated.

Currently, there are five accesses to mobile payment: STK, IVR (Interactive Voice Response), USSD, WAP and WWW. IVR, STK and WWW are more frequently adopted. Mobile payment business mode has four categories: mobile paying service, mobile wallet service, mobile banking service and mobile credit platform. The former three have been practically applied. According to the roles acted, mobile payment industrial chain can be divided into three categories: mobile operators-based industrial chain, bank-based industrial chain and the one led by mobile payment operators. The cooperation of mobile operators and banks, with mobile payment platform operated by professional companies, can avoid inherent obstacles in information security, product development and resource sharing, etc. when third-party payment platform providers join in. Also it can realize the sharing and management of financial information service and banks’ intermediate businesses; and satisfy the great demand of users for mobile payment service and information security. Thereby, it is the most suitable business mode for mobile payment development in China.

Major Chinese Mobile Payment Platform Operators

|

Company Name |

Platform Name |

Join-in Agencies |

Charge Standard |

|

Beijing Union Mobile Pay Co., Ltd. |

Mobile wallet |

Taikang Life, www.TOL24.com,

China Dotman, Cloudnet,

China Charity Federation |

5 Yuan/month; 0.1 Yuan for each short message; Receiving messages is free of charge; Communication fee of using mobile wallet by the way of JAVA is charged by common standards; and 0.3 Yuan/minute for dialing 12588. |

|

China Dotman Co., Ltd. |

Monca Payment Center |

Ourgame.com, Netease, Sina, etc. Almost 50 ICPs. |

Without service fee, communication fee is usually charged by operators |

|

Guangzhou Huanxin Company. |

Golden Wallet |

China Post, digital card supplier,

Ping An Insurance,

WeWay Software |

Without service charges, communication fee is usually charged by operators |

|

Shanghai Smartpay Jieyin Co., Ltd. |

Jieyin Smartpay |

Lottery centers in Hebei, Jiangsu and Liaoning provinces;

Hebei Quantong Telecom,

Shanghai Dazhong Gas;

Shanghai Gas Pudong Sales Company;

Digitalways Department of Shanghai Telecom Co., Ltd; Shanghai Digitalways Information Service Co., Ltd;

Shanghai Hotline II;

EBay; Lycos, etc. |

0.20 Yuan for each successfully received SMS and usually 0.10 Yuan according to the related rule is charged by the mobile carrier for each SMS sending instruction

|

|

Yeepay Co., Ltd. |

Yeepay |

50 or more medium-and-small commercial agencies joined in. |

The access modes can be divided into

Self-help access, protocol access and customized development. The first is free accessed, without annual service charges. However, 5% of commission charge is required. As to the latter two, the charges will be done according to the agreement between two parties. |

With its fast development, online/mobile payment has become the preferred payment means for a great number of online consumers. Even so, it doesn't' hamper the rising of new online shopping transaction pattern. In July, 2006, China UnionPay and dangdang.com cooperated to open the new e-commerce payment service "online shopping; offline swipe card payment" that is based on smart swipe card telephone. Noticeably, the payment via this transaction system is affiliated with no commission charge. Then August, 2006, China UnionPay opened 20 thousand swipe card telephones in Beijing, Shanghai and Shenzhen cities, serving more than 400 thousand users. As is said by Liang Jian—the general manager of China UnionPay's holding company Shanghai Card Information Service Co., Ltd., 100 thousand swipe card telephones will have been opened in Beijing, Shanghai, Guangzhou and Shenzhen cities by the end of 2006, spreading the services over to three million online users. Yet, this new payment pattern stirred the dissatisfaction of commercial banks and third-party operators because of their declining revenues.

The market access qualifications being studied by the People's Bank of China and China Banking Regulatory Commission and the involvement of China UnionPay in the market of online payment will inevitably result in the reshuffle of China's online payment market. To survive in the market of online payment, the third-party payment institutions have to make greater effort to win in the fierce competition.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Along with the fast progress of internet and mobile network in recent years, various kinds of e-commerce emerged, bringing more convenience and alternatives to people's life. Online payment and mobile payment, as incentive means to further development of e-commerce, will become the main payment means of e-commerce by and by.

Payment options for Online Shopping

According to business mode, online payment can be divided into pre-payment, agency payment, online banking payment and online platform payment. Online platform payment undertaken by online payment platform operator, a third-party economic entity independent from bank and SP, acts as the role connect users, banks and SPs.

Major Chinese Online Payment Platform Operators

|

Company Name |

Platform Name |

Platform Features |

|

Zhejiang Alipay Co., Ltd. |

Alipay |

China’s largest online transaction platform; first to officially release VISA Verification Service in China. |

|

Capital Information Development Company |

Capinfo Easy-pay |

China’s first online payment platform with the realization of providing across bank and across region online transaction services for a variety of bank cards; unique for its twice balanced mode. |

|

Universal eCommerce China Limited |

IPS |

Apart from being an online safety payment platform with high-efficient handling of debit cards in China, IPS is also the first domestic platform to provide online real-time safety services for int’l cards. Due to its years’ experience in foreign card services, IPS becomes the first strategic and cooperative partner of VISA’s global e-commerce safety program in China. |

|

Beijing Cloudnet Internet Co., Ltd.

|

Pay@Net |

Without delayed bills, Pay@Net assumes one fourth of online payment in China; Real-time information feedback; 128 bit VeriSign Verification |

|

E.T Information Power Co., Ltd. |

1st-pay.net |

Characterized by automation, Intelligentization, individuation, easy operation and high security, 1st-pay.net covers the whole arena of e-commerce and spreads over its business to overseas markets in Asia, Australia, Europe and North America. |

The domestic online payment is mainly based on the debit card system. Thus, risks in online payment can be controlled effectively. But meanwhile, the profit of domestic payment service is also quite low. Nowadays, the industrialization of mobile payment application emerges as handsets gradually replace cash and credit card in the payment of some shops and automatic seller machines. At present, bank card circulation and handset users have increased to over 0.96 billion and 0.42 billion respectively in China, offering boundless commercial opportunities for the development of mobile payment industry in China. With the prevalence of mobile content and application charges based on SMS, mobile payment has gradually been accepted. However, in-depth applications of mobile payment still need to be cultivated.

Currently, there are five accesses to mobile payment: STK, IVR (Interactive Voice Response), USSD, WAP and WWW. IVR, STK and WWW are more frequently adopted. Mobile payment business mode has four categories: mobile paying service, mobile wallet service, mobile banking service and mobile credit platform. The former three have been practically applied. According to the roles acted, mobile payment industrial chain can be divided into three categories: mobile operators-based industrial chain, bank-based industrial chain and the one led by mobile payment operators. The cooperation of mobile operators and banks, with mobile payment platform operated by professional companies, can avoid inherent obstacles in information security, product development and resource sharing, etc. when third-party payment platform providers join in. Also it can realize the sharing and management of financial information service and banks’ intermediate businesses; and satisfy the great demand of users for mobile payment service and information security. Thereby, it is the most suitable business mode for mobile payment development in China.

Major Chinese Mobile Payment Platform Operators

|

Company Name |

Platform Name |

Join-in Agencies |

Charge Standard |

|

Beijing Union Mobile Pay Co., Ltd. |

Mobile wallet |

Taikang Life, www.TOL24.com,

China Dotman, Cloudnet,

China Charity Federation |

5 Yuan/month; 0.1 Yuan for each short message; Receiving messages is free of charge; Communication fee of using mobile wallet by the way of JAVA is charged by common standards; and 0.3 Yuan/minute for dialing 12588. |

|

China Dotman Co., Ltd. |

Monca Payment Center |

Ourgame.com, Netease, Sina, etc. Almost 50 ICPs. |

Without service fee, communication fee is usually charged by operators |

|

Guangzhou Huanxin Company. |

Golden Wallet |

China Post, digital card supplier,

Ping An Insurance,

WeWay Software |

Without service charges, communication fee is usually charged by operators |

|

Shanghai Smartpay Jieyin Co., Ltd. |

Jieyin Smartpay |

Lottery centers in Hebei, Jiangsu and Liaoning provinces;

Hebei Quantong Telecom,

Shanghai Dazhong Gas;

Shanghai Gas Pudong Sales Company;

Digitalways Department of Shanghai Telecom Co., Ltd; Shanghai Digitalways Information Service Co., Ltd;

Shanghai Hotline II;

EBay; Lycos, etc. |

0.20 Yuan for each successfully received SMS and usually 0.10 Yuan according to the related rule is charged by the mobile carrier for each SMS sending instruction

|

|

Yeepay Co., Ltd. |

Yeepay |

50 or more medium-and-small commercial agencies joined in. |

The access modes can be divided into

Self-help access, protocol access and customized development. The first is free accessed, without annual service charges. However, 5% of commission charge is required. As to the latter two, the charges will be done according to the agreement between two parties. |

With its fast development, online/mobile payment has become the preferred payment means for a great number of online consumers. Even so, it doesn't' hamper the rising of new online shopping transaction pattern. In July, 2006, China UnionPay and dangdang.com cooperated to open the new e-commerce payment service "online shopping; offline swipe card payment" that is based on smart swipe card telephone. Noticeably, the payment via this transaction system is affiliated with no commission charge. Then August, 2006, China UnionPay opened 20 thousand swipe card telephones in Beijing, Shanghai and Shenzhen cities, serving more than 400 thousand users. As is said by Liang Jian—the general manager of China UnionPay's holding company Shanghai Card Information Service Co., Ltd., 100 thousand swipe card telephones will have been opened in Beijing, Shanghai, Guangzhou and Shenzhen cities by the end of 2006, spreading the services over to three million online users. Yet, this new payment pattern stirred the dissatisfaction of commercial banks and third-party operators because of their declining revenues.

The market access qualifications being studied by the People's Bank of China and China Banking Regulatory Commission and the involvement of China UnionPay in the market of online payment will inevitably result in the reshuffle of China's online payment market. To survive in the market of online payment, the third-party payment institutions have to make greater effort to win in the fierce competition.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1 Overview of mobile & online payment industry

1.1 Mobile payment

1.2 Online payment2 Mobile/online payment varieties and business flows

2.1 Classification of mobile payment

2.1.1 Mobile payment varieties by access method

2.1.2 Mobile payment varieties by business mode

2.1.2.1 Handset payment business

2.1.2.2 Handset wallet business

2.1.2.3 Handset banking business

2.1.2.4 Handset credit platform business

2.2 Mobile payment flow

2.3 Classification and work flow of online payment

2.3.1 Varieties by payment amount

2.3.2 Varieties by payment time

2.3.3 Varieties by business mode

2.4 Applications of various e-commerce payments 3 Mobile/online payment market development

3.1 Mobile payment market

3.1.1 Mobile payment development worldwide

3.1.1.1 Development of handset wallet

3.1.1.2 Development of handset banking

3.1.1.3 Combination of Japanese handsets with RFIC

3.1.2 Mobile payment development in China

3.2 Online payment market

3.2.1 Paypal development in America

3.2.2 Development of online payment in China 4 Macro-environment of mobile payment market in China

4.1 Positive factors to develop mobile/online payment in China

4.2 Negative factors

4.2.1 Political aspect

4.2.2 Economic aspect

4.2.3 Security aspect

4.2.4 Consumer culture aspect

4.2.5 Technical aspect

4.2.6 Industrial chain aspect

4.3 Summary 5 Industrial chain of mobile/online payment in China

5.1 Industrial chain of mobile payment

5.1.1 Types of industrial chain

5.1.1.1 Industrial chain led by mobile operator

5.1.1.2 Industrial chain led by banks

5.1.1.3 Industrial chain led by mobile payment platform operators

5.1.2 Development trend of industrial chains

5.1.3 Development strategies of mobile payment operators and bank developments

5.1.3.1 Development strategy of China Mobile

5.1.3.2 Development strategy of China Unicom

5.1.3.3 Development strategy of banks for mobile payment

5.2 Industrial chain of online payment 6 Mobile operators and mobile payment

6.1 China Mobile's progression in mobile payment market

6.2 China Unicom's progression in mobile payment market 7 Major domestic mobile/online payment providers

7.1 Mobile payment platform operators

7.1.1 Beijing Union Mobile Pay Co., Ltd.

7.1.2 China Dotman Co., Ltd.

7.1.2.1 Corporate overview

7.1.2.2 Introduction to Monca Payment Center platform

7.1.3 Guangzhou Huanxin Company

7.1.4 Shanghai Smartpay Jieyin Co., Ltd

7.1.4.1 Corporate overview

7.1.4.2 Jieyin mobile payment platform

7.1.5 Yeepay Co., Ltd.

7.1.5.1 Corporate overview

7.1.5.2 Introduction to Yeepay payment platform

7.1.6 China M-WORLD Co., Ltd

7.1.6.1 Corporate overview

7.1.6.2 Introduction to mobile banking platform

7.2 Online payment platform operators

7.2.1 Zhejiang Alipay Co., Ltd.

7.2.1.1 Corporate overview

7.2.1.2 Brief introduction to Alipay platform

7.2.1.3 Payment flow of Taobao's Alipay

7.2.2 Capital Information Development Company

7.2.2.1 Corporate overview

7.2.2.2 Introduction to Capinfo Easy-pay platform

7.2.2.3 Transaction flows of Capinfo B2C online payment

7.2.3 Universal iPayment China Co., Ltd.

7.2.3.1 Corporate overview

7.2.3.2 Introduction to payment platform

7.2.4 Beijing Cloudnet Internet Co., Ltd.

7.2.4.1 Corporate overview

7.2.4.2 Introduction to Pay@Net

7.2.5 E.T Information Power Co., Ltd.

7.2.5.1 Corporate overview

7.2.5.2 Brief introduction to 1st-pay.net payment platform

7.3 Payment system providers

7.3.1 Suntek Technology Co., Ltd.

7.3.1.1 Corporate overview

7.3.1.2 Relevant products

7.3.1.3 Company analysis

7.3.2 Bewinner Communication

7.3.2.1 Corporate overview

7.3.2.2 Relevant products

7.3.2.3 Company analysis

7.3.3 Unisphere Networks

7.3.3.1 Corporate overview

7.3.3.2 Relevant products

7.3.3.3 Company analysis

7.3.4 LianLongBoTong Co., Ltd.

7.3.4.1 Corporate overview

7.3.4.2 Relevant products

7.3.4.3 Company analysis

7.3.5 Etonenet

7.3.5.1 Corporate overview

7.3.5.2 Relevant products

7.3.5.3 Company analysis

7.3.6 Huawei Technology

7.3.7 Pay365

7.3.7.1 Corporate overview

7.3.7.2 Introduction to Pay365 platform

7.4 Brief summary 8 Foreign mobile payment providers

8.1 Mobipay

8.2 Simpay

8.3 PayBox

8.4 NTT DoCoMo

8.5 SK Telecom

8.6 KTF

8.7 IBM

8.8 Nokia

8.9 HP

8.10 Ericsson

8.11 Frontline Technologies (China) Co., Ltd.

8.12 Motorola

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Proportion of online payment in online shopping

Payment modes for users when online shopping

Main structure of USSD system

Mobile payment flow

Prevalent mobile payment flow

Mobile framework of mobile payment

Pre-paid card payment flow

Agency payment flow

Online payment flow of China's Merchants Bank

Payment flow of online payment platform

Proportion of various e-commerce payments by diverse services

Proportion of various e-commerce payments by different regions

Industrial chain led by mobile operators

Industrial chain led by banks

Industrial chain led by mobile payment platform operators

Overall development of industrial chains

Mutual development of operators and banks

Logic framework of Golden Wallet Platform

Business process of Golden Wallet Platform

Payment flow of Alipay platform

Transaction flows of Capinfo B2C online payment

Online payment flow of Pay@Net

Business composition and gross profit margin of Suntek Technology

Operating revenue and costs of Suntek Technology

Framework of Bewinner mobile payment system

Ticket booking system of Unisphere Networks

Payment platform system of Unisphere Networks

Topological structure of MDCL mobile small-amount payment system

Systematic structure of mobile small-amount payment system

Comparison between USSD and SMS

Varieties of mobile payment

Varieties of online payment

Economic indicators of PayPal in 2005

Negative factors in security

Affected factors in mobile/online payment in China

Types and characteristics of mobile payment industrial chain

Contrastive analysis on mobile payment business

Major customers of Beijing Union Mobile Pay Co., Ltd

Cooperative partners of Shanghai Smartpay Jieyin Co., Ltd

Introduction to main business of YeePay platform

Charges of YeePay platform

Card categories supported by YeePay platform

Functions of Alipay platform

Introduction to product series of Pay@Net

Beijing Cloudnet Internet Co., Ltd.

Business varieties of 1st-payment.net

Charge standards for handset golden secretary

Comparison of domestic mobile payment platform operators

Major mobile/online system providers in domestic market

Major online payment platform operators in domestic market

Distinct features of MDCL small-amount payment system

|

2005-2008 www.researchinchina.com All Rights Reserved

|