Worldwide rapid development of e-business booms up electronic payment and online transfer in which the online banking plays an important role. Electronic money, e-money for short, which was brought together with online banking, provides strong support for electronic payment with its specific online payment functions. As final executant of electronic payment and balancing, online banks act as a bridge between buyers and sellers, through which the most pivotal factor and highest level in e-business e-payment service is provided.

Three periods exist in online banking development: the first is computer-aided banking management from 1950s to the late 1980s; the second is electronic banking or informationized financial from late 1980s to middle of 1990s; the third is online banking from late 1990s until now.

There are two patterns of online banking: online-only and e-branch. Online-only bank refers to financial institutions that provide saving, inquiry, transfer and other services only through online. Such bank widely exists in the USA and Europe. In China, because it is regulated in Temporary Methods of online banking Business Management of People's Bank of China (PBC), there's no legal environment for online-only bank. Practically, from the positive attitude of China's national commercial banks and consuming habits of clients, there's no commercial space for online-only bank in China.

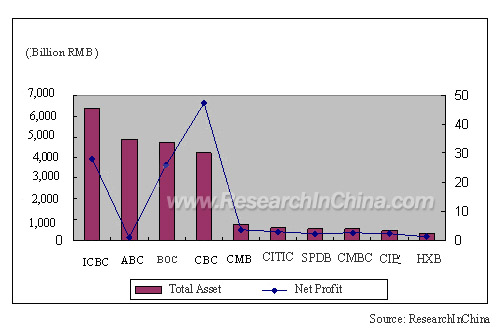

Present development situation of China banks is that four state-owned commercial banks take the leading position, middle and small commercial banks coexist with joint ventures and service items increase with the users. According to the data from CBRC (China Banking Regulatory Commission ), the total China's banking asset was 37 trillion in which ICBC (Industry and Commercial Bank of China ) shared RMB6.4 trillion, ABC (Agricultural Bank of China ) RMB4.8 trillion, BOC (Bank of China )RMB4.7 trillion, and CBC (Construction Bank of China ) RMB4.2 trillion, while other small and middle commercial banks and joint ventures share less thanRMB1 trillion, in which CMB (China Merchants Bank ) hold the highest asset of RMB0.7657 trillion.

Total asset and net profit of the four state-owned commercial banks and typical small and middle commercial banks in 2005

(Note: SPDB: Shanghai Pudong Development Bank; CMBC: China Minsheng Banking Corp.Ltd; CIB: Industrial Bank Co.,Ltd; HXB:Hua Xia Bank)

BOC and CMB started their online banking service in 1998, then ICBC、CBC、BOCOM( Bank of Communications),CEB(China Everbright Bank) and ABC followed. BEA was authorized by PBC to open individual online banking business in Aug 2002. HSBC provided individual online banking service for local and international customers formally in Dec 2002.Citibank was authorized by PBC to provide both enterprise and individual online banking service. From Jan 2004, Hangseng began to provide individual online banking service in Shenzhen, Shanghai, Guangzhou, Fuzhou and other places. User number of online banking has increased at a high speed in recent years, especially in developed cities; online banking enjoys a high popularization. Until 2005, there were 740,000 enterprise online banking users and the revenue of enterprise online banking in 2005 was 70 trillion. At the end of 2005, the user number reached 34 million and the overall turnover surpassed RMB 2 trillion.

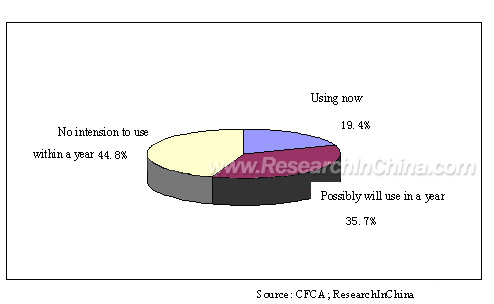

Use of individual online banking in ten developed cities of China, 2005

Till the end of 2005, number of China's netizen has exceeded 100 million and China's annual turnover of e-business was more than 0.68 trillion. Huge number of netizen is a guarantee for the development of China's online banking while at the same time the large scale of e-business and online banking also mutually promote development of each other.

Laws and regulations of China's online banking are being improved continuously.

Since 1990s, with the worldwide rise of electronic bank, China's electronic bank businesses of commercial bank developed rapidly. In order to regulate commercial banks to develop business through the Internet, PBC issued Temporary Methods of Online banking Business Management in June 2001.

Bill of Electronic Signature has been in enforcement since Apr 1, 2005. Good online credit mechanism and fruitful net transaction channels are thus established, through which the history lack of law guarantee is ended and the development of e-business and online banking is promoted.

In order to control risk of electronic bank business, CBRC issued Electronic Bank Business Management Methods and Electronic Bank security Assessment Direction in late 2005 and early 2006. Both of the two regulations began to affect since Mar 1, 2006.

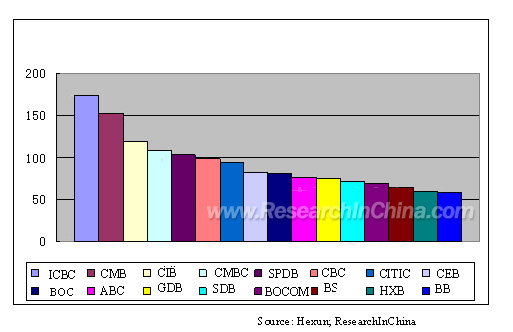

In early 2006, Hexun introduced an activity of China online banking evaluation. 16 Chinese major commercial banks were involved. Through investigating both domestic and overseas individual online banking relative functions comprehensive evaluations with an excluded index system (consisted of more than 30 indicators and more than 200 items) from three aspects public confidence indicator, platform performance indicator and business performance indicator. ICBC and CMB got the first and second position with exclusive advantage while CIB, CMBC and SPDB performed prominently.

Ranking of individual online bankings of each bank in China

Note: GDB: Guangdong Development Bank SDB: Shenzhen Development Bank Co, .Ltd

BS: Bank of Shanghai; BB: Bank of Beijing

|