| |

|

|

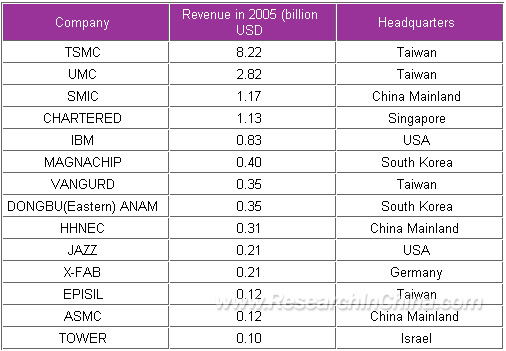

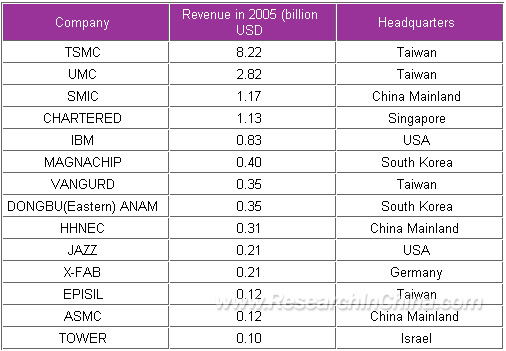

Revenue of World Top 14 Wafer Foundry Fabs, 2005

The wafer foundry industry can be divided into three camps. The first camp has a sole member of Taiwan Semiconductor Manufacturing Company Limited (TSMC), which has first class productivity and owns good quality fame worldwide. So it is always the first choice for many large IC design houses. Whenever the semiconductor industry suffers recession or declining market demand, large-sized IC design houses tend to order from TSMC. Therefore the more recessionary the semiconductor industry is, the more orders TSMC gets and accordingly the fewer other wafer foundry fab has.

The second camp includes United Microelectronics Company (UMC), Semiconductor Manufacturing International Corporation (SMIC), CHARTERED and IBM. The four wafer foundry fabs are usually the second choice or alternative for large IC design houses and the first choice for medium IC design houses. When recession falls in the semiconductor industry, these four companies are apt to be firstly impacted. To avoid such impact, they all have their own major clients with strong loyalty. The major clients of UMC are Media Tek and NOVATEK, both are included in the UMC camp. Media Tek is the worldwide largest DVD player IC manufacturer with a stable capacity of 50,000 --- 60,000 pieces per month. NOVATEK is the largest TFT-LCD driver IC manufacturer with a stable capacity of 30,000 pieces per month. While SMIC takes Infineon and ELPIDA as its major clients and maintains a relatively stable business relationship by offering memory foundry. CHARTERED, Infineon, Samsung and IBM have built a cross platform wafer foundry ally and the market demand is also growing steadily. IBM, however, provides CPU foundry services for game machine makers with super production capacity like Microsoft XBOX and Sony PS3.

Relying on the local industry chain, manufacturers in the third camp each have their own specialties and regional advantages. MAGNACHIP and VANGURD are both specialize in LCD driver IC foundry and meanwhile they cooperate with driver IC industry in South Korea and Taiwan. MAGNACHIP is also specialized in image sensor CMOS foundry like Dongbu Anam, which is also accomplished in automobile electronics. While HHNEC is strong in the Smart card domain,and JAZZ is sophisticated in RF IC foundry services. X-FAB is adept at mixed-signal and MEMS foundry. Episil is expert in power semiconductor components and Advanced Semiconductor Manufacturing Corporation Limited (ASMC) is skilled in analog IC foundry.

Source: ResearchinChina

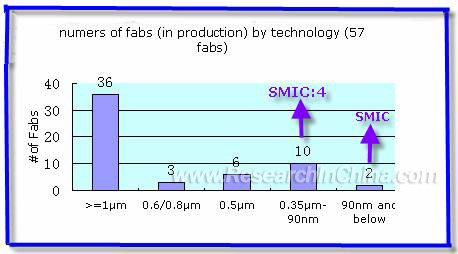

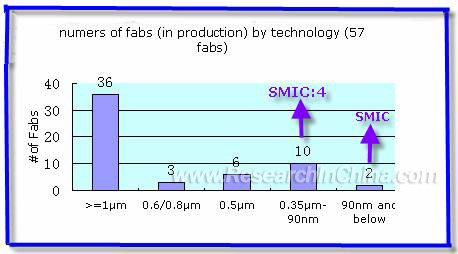

The development of wafer foundry industry in China mainland is greatly hampered by IC design houses in China Mainland. Among those 500 IC design houses, only at most 50 are able to have mass productions. Over 90% of those companies are just conceptual ones relying on loans or external investments. Considering those 50 design houses are having mass productions, more than 90% of them are focus on logical IC rather than analog IC. For logical IC, wafer size and manufacturing techniques determine the production cost. 12-inch and 90nm or 65nm wafer is the lowest-cost solution for logical IC. In logical IC field, wafer foundry fabs in China mainland are all of weak competitiveness except SMIC. 45 out of 57 wafer fabs in China mainland are still manufacturing products over 0.5nm.

In China mainland, many blindly started wafer production lines focus on foundry services. As most of the investment is from loans, it is quite hard to bring any profits.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Revenue of World Top 14 Wafer Foundry Fabs, 2005

The wafer foundry industry can be divided into three camps. The first camp has a sole member of Taiwan Semiconductor Manufacturing Company Limited (TSMC), which has first class productivity and owns good quality fame worldwide. So it is always the first choice for many large IC design houses. Whenever the semiconductor industry suffers recession or declining market demand, large-sized IC design houses tend to order from TSMC. Therefore the more recessionary the semiconductor industry is, the more orders TSMC gets and accordingly the fewer other wafer foundry fab has.

The second camp includes United Microelectronics Company (UMC), Semiconductor Manufacturing International Corporation (SMIC), CHARTERED and IBM. The four wafer foundry fabs are usually the second choice or alternative for large IC design houses and the first choice for medium IC design houses. When recession falls in the semiconductor industry, these four companies are apt to be firstly impacted. To avoid such impact, they all have their own major clients with strong loyalty. The major clients of UMC are Media Tek and NOVATEK, both are included in the UMC camp. Media Tek is the worldwide largest DVD player IC manufacturer with a stable capacity of 50,000 --- 60,000 pieces per month. NOVATEK is the largest TFT-LCD driver IC manufacturer with a stable capacity of 30,000 pieces per month. While SMIC takes Infineon and ELPIDA as its major clients and maintains a relatively stable business relationship by offering memory foundry. CHARTERED, Infineon, Samsung and IBM have built a cross platform wafer foundry ally and the market demand is also growing steadily. IBM, however, provides CPU foundry services for game machine makers with super production capacity like Microsoft XBOX and Sony PS3.

Relying on the local industry chain, manufacturers in the third camp each have their own specialties and regional advantages. MAGNACHIP and VANGURD are both specialize in LCD driver IC foundry and meanwhile they cooperate with driver IC industry in South Korea and Taiwan. MAGNACHIP is also specialized in image sensor CMOS foundry like Dongbu Anam, which is also accomplished in automobile electronics. While HHNEC is strong in the Smart card domain,and JAZZ is sophisticated in RF IC foundry services. X-FAB is adept at mixed-signal and MEMS foundry. Episil is expert in power semiconductor components and Advanced Semiconductor Manufacturing Corporation Limited (ASMC) is skilled in analog IC foundry.

Source: ResearchinChina

The development of wafer foundry industry in China mainland is greatly hampered by IC design houses in China Mainland. Among those 500 IC design houses, only at most 50 are able to have mass productions. Over 90% of those companies are just conceptual ones relying on loans or external investments. Considering those 50 design houses are having mass productions, more than 90% of them are focus on logical IC rather than analog IC. For logical IC, wafer size and manufacturing techniques determine the production cost. 12-inch and 90nm or 65nm wafer is the lowest-cost solution for logical IC. In logical IC field, wafer foundry fabs in China mainland are all of weak competitiveness except SMIC. 45 out of 57 wafer fabs in China mainland are still manufacturing products over 0.5nm.

In China mainland, many blindly started wafer production lines focus on foundry services. As most of the investment is from loans, it is quite hard to bring any profits. |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. The Semiconductor Market

1.1 Forecast of the Semiconductor Industry,2006-2010

1.2 Forecast of the Downstream Semiconductor Market,2006

1.3 Status Quo of Global Wafer Foundry Industry

1.4 Status Quo of Global Semiconductor Equipment Industry

1.5 China's Semiconductor Market2. Overview of the Wafer Foundry Industry

2.1 Wafer Manufacturing Techniques

2.2 Global Wafer Industry and Main Wafer Manufacturers

2.3 Policy Environment in China's Semiconductor Industry

2.4 Status Quo and Forecast of China's Wafer Manufacturing Industry 3. Wafer Fabs

3.1 Semiconductor Manufacturing International Corporation (SMIC)

3.2 Shanghai Hua Hong NEC Electronics Company. Limited (HHNEC)

3.3 Grace Semiconductor Manufacturing Corporation (GRACE)

3.4 China Resources Microelectronics (Holdings) Limited (CRM)

3.5 Shanghai Advanced Semiconductor Manufacturing Co.,Ltd (ASMC)

3.6 Hejian Technology (Suzhou) Co.,Ltd

3.7 BCD Semiconductor Manufacturing Limited (BCD Semi)

3.8 Founder Microelectronics Corporation Limited

3.9 Zhongning Microelectronics Company

3.10 Nantong Green Mountain Integrated Corp.,Ltd (GMIC)

3.11 Nanotech Corporation

3.12 Zhuhai Nanker Integrated Circuit Co.,Ltd

3.13 Comfort Superpower Semiconductor (Beijing) Co.,Ltd

3.14 Technology Semiconductor Limited in Shenyang (TSLS)

3.15 Optoelectronics (Dalian) Co.,Ltd

3.16 Xi'an Xiyue Electronics Technology Co.,Ltd

3.17 Jilin Sino Microelectronics Co.,Ltd

3.18 Dandong Anshun Microelectronics Co.,Ltd

3.19 Lite-On Semiconductor Corp.

3.20 Fujian Fushun Microelectronics Co.,Ltd

3.21 Hangzhou Lion Microelectronics Co.,Ltd

3.22 Hangzhou Silan Integrated Circuit Co.,Ltd

3.23 Hynix-ST Semiconductor Co.,Ltd

3.24 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

3.25 United Microelectronics Company (UMC)

3.26 Chartered Semiconductor Manufacturing Ltd (Chartered)

3.27 DongbuAnam Semiconductor Co.,Ltd (DongbuAnam)

3.28 Advanced Semiconductor Manufacturing Corporation Limited (ASMC)

3.29 Jazz Semiconductor

3.30 MagnaChip

3.31 Silterra

3.32 X-Fab

3.33 1st silicon (Malaysia)

3.34 Tower Semiconductor

3.35 Episil Technologies

3.36 IBM |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Cycle Period of the Semiconductor Industry, 1960-2005

Nine Research Institutes' Growth Forecast of the Semiconductor Industry, 2006

Market Share Forecast of Globally Various Semiconductor Components, 2006

Growth Forecast of Globally Various Semiconductor Components, 2006

Investment Cycle Prosperity of Global Semiconductor, Q1, 2003-Q2, 2006

Statistics & Forecast of Semiconductor Annual Market Growth, 1990-2010

Market Share Forecast of Global Semiconductor Components, 2010

Shipment Growth of Major Terminal Electronic Products, 2006

Market Share Forecast of Semiconductor Downstream Applying, 2010

Market Share Forecast of Semiconductor by Regions, 2010

Diameter Proportion of Global Wafer Productivity, Q1, 2000 -Q4, 2005

Newly Put-into-production Wafer Manufacturers, 2006

Income of Global Top Five Semiconductor Packaging and Testing Manufacturers, 2000 Q1-2005 Q4

Regional Distribution of Semiconductor Equipment Market, 2004 & 2005

Regional Distribution of Wafer Equipment Market, 2004 & 2005

Regional Distribution of Testing Equipment Market, 2004 & 2005

Regional Distribution of Packaging Equipment Market, 2004 & 2005

Market Share Trend of Global Wafer, Packaging, Testing and Other Semiconductor Equipments, 2004-2008

Promising Semiconductor Manufacturers of China, 2005

Flow Chart of Processing Original Wafer

Flow Chart of Planting Wafer into the Circuit

Demand & Supply Forecast of China's IC Market, 2005-2010

Income Statistics and Forecast of China's IC Design Companies, 2000-2009

Wafer Size Distribution of China's 57 Wafer Manufacturers

Technological Capability Distribution of China's 57 Wafer Manufacturers

Technical Route of China's Wafer Manufacturers

Income and Profit Statistics of SMIC, 2000-2005

Organization of SMIC

Rapid Mature Course of SMIC

Productivity Analysis of SMIC, 2004-2005

Quality Standards Achieved by SMIC

Downstream Applying Structure of SMIC Products, Q1, 2005-Q1, 2006

SMIC International Product Structure, Q1, 2005 - Q1, 2006

SMIC Client Type Structure, Q1, 2005 -Q1, 2006

SMIC Income Regional Structure, Q1, 2005 - Q1, 2006

SMIC Wafer Delivery and Productivity Utilizing Rate, Q1, 2005- Q1, 2006

SMIC Product Technique Distribution, Q1, 2005 - Q1, 2006

SMIC Logical Product Technique Distribution, Q1, 2005 -Q1, 2006

Technical Status of SMIC

Figure: Technical Route of Shanghai Huahong NEC Electronic Co, Ltd.

MLM Technology

Logical Techniques Development Scheme of Grace Semiconductor Manufacturing Corporation

Figure: Flash Memory Techniques Development Scheme of Grace

Shareholding Structure of ASMC Pre-listed

Shareholding Structure of ASMC Post-listed

History of ASMC

BCD Product Classification

BCD Product Classification I

BCD Product Classification II

BCD Product Classification III

Sales Rate and Net Profit of Optoelectronic 1998-2002

Operation Income and Gross Profit of Sino Microelectronics, Ltd

Operation Income of Sino Microelectronics, Ltd, by Region

Company Organization of Lion Microelectronics, Co, Ltd

Income & Profit Statistics of TSMC

TSMC Structure of Product Technology, Q1, 2005-Q1, 2006

TSMC Product Applying Structure, Q1, 2005 -Q1, 2006

TSMC Income Regional Structure, Q1, 2005 -Q1, 2006

TSMC Client Structure, Q1, 2005 -Q1, 2006

TSMC Product Technology Route Map

TSMC Service Route Map

TSMC Staff Educational Background

Income and Gross Profit of UMC 2000-2005

Productivity Change of UMC 2000-2005

Educational Background of UMC Personnel 2004-2005

Regional Income Structure of UMC Q1, 2006

Client Structure of UMC Q1, 2006

Product Structure of UMC Q1, 2006

Technical Structure of UMC Q1, 2006

Technical Route of UMC

Income and Net Profit of Chartered Semiconductor Manufacturing1998-2005

Events of Cooperation between CSM and IBM Q 1, 2004- Q1, 2006

Partners in Various Fields of CSM

Landscape of Five Wafer Fabs of CSM

Special Technical Route of CSM

Productivity of CSM 2003-2006

Statistics of CSM 0.13-micron Technical Productivity

Statistics of CSM Profit & Cash Flow Q2, 2005-Q2, 2006

Statistics of CSM Income Q2, 2006-Q2, 2006

Technical Route of DongbuAnam Semiconductor

Income, Gross Profit and Productivity Utility of VIS Q1, 2005-Q1, 2006

Product Technical Structure of VIS Q1, 2005-Q1, 2006

Downstream Applying Structure of VIS Q1, 2005-Q1, 2006

Specific Applying Structure of VIS Q1, 2005-Q1, 2006

Quarterly Income Statistics of VIS Q2, 2003-Q1, 2006

Technical Route of VIS OTP and Flash Memory

Technical Route of VIS High Voltage

Technical Route of VIS Logical High-precision Analog, Mixed Signal and RFCMOS

Technical Route of VIS JAZZ Semiconductor MEMS

Technical Route of VIS JAZZ High Voltage and Analog

Technical Route of VIS JAZZ BCD

MagnaChip Business Performance, 2003-Q1, 2006

MagnaChip R&D Input Changes, 2003-Q1, 2006

Principal Product Ratio of MagnaChip Revenue Fiscal Year 2003-2005

Regional Distribution of MagnaChip Revenue Fiscal Year 2003-2005

Technical Route of Silterra Logical and Mixed Signal

Technical Route of Silterra High Voltage Skill

X-FAB Technical Route

X-FAB MEMS Technical Route

1stSilicon Logical and Mixed Technical Route

1stSilicon Special Tech Route

Tower Semiconductor Technical Route

Tower Semiconductor Micro Flash Tech Route

IBM Wafer Foundry Technical Route

Global Top 20 Semiconductor Manufacturers, 2005

Output Value Distribution of China's Semiconductor Industry, 2005

Sales Income and Growth of China's IC Industry, 2001-2010

Top 20 Semiconductor Suppliers of China mainland, 2004 & 2005

China's Top Ten Semiconductor Manufacturers in 2005

Quantitative Ranking of Global 300mm Wafer Manufacturers, 2005

Mainstream R&D Technology and Client Distribution of Principal Global Wafer Foundry Fabs, 2005

Global Top 15 Wafer Foundry Fabs, 2005

China's Main 6-inch, 8-inch and 12-inch Wafer Manufacturers in Operation

China's 6-inch, 8-inch and 12-inch Wafer Manufacturers under Construction

China's 4-inch, 5-inch and 6-inch Wafer Manufacturers

Main Wafer Foundry Fabs of Grace

Features of Grace 0.25 Micron Techniques

Parameters of Grace 0.25 Micron Units

Parameters of Grace 0.15 Micron Units

Parameters of 0.15 Micron Units (EDR)

Product Types of China's Resources Semiconductor

BCD Productivity Overview

Electronic Product Specifications of Lion

Wafer Fabs of TSMC

Personnel Organization of TSMC

Technical Features of TSMC 90 nm

Technical Features of TSMC Mixed Signal

Technical Features of TSMC Mems

Technical Features of TSMC BiCMOS

Technical Features of TSMC High Voltage Skill

Wafer Fabs of UMC

UMC Major Investors and Cash Flow

UMS Staff Structure 2004-2006

Technical Features of UMS Mixed Signal/RFCMOS

Technical Features of UMS CMOS Image Sensor

Features of UMS High Voltage Skill

Features of Dongbu-Anam High Voltage Skill

Features of VIS Logical Circuit Design

Features of VIS Mixed Circuit Design

Features of VIS High Voltage Circuit Design

Technical Features of JAZZ Semiconductor BiCMOS and SiGe Foundry

Technical Features of JAZZ Semiconductor RFCMOS and Fixed Signal Foundry

Technical Features of JAZZ Semiconductor Digital CMOS Foundry

Technical Features of 1stSilicon

Episil Profit and Lose Q2, 2004-Q1, 2006

IBM Income from Wafer Foundry 2001-2005

Design Service Suppliers of IBM Wafer Foundry

Brief Introduction of IBM130 Nanometer Platform

Technical Features of IBM130 Nanometer Platform Logic IC

Technical Features of IBM130 Nanometer Skill Double Pole IC

Design Tools in IBM130 Nanometer Skill Platform

Property Overview of IBM130 Nanometer CMOS Image Sensor

|

2005-2008 www.researchinchina.com All Rights Reserved

|