| |

|

|

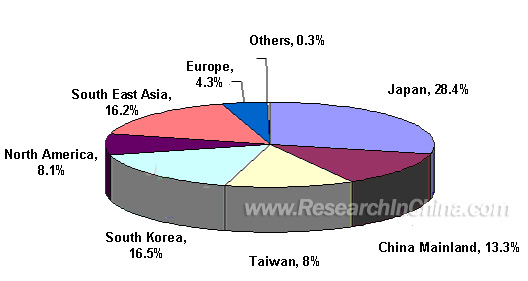

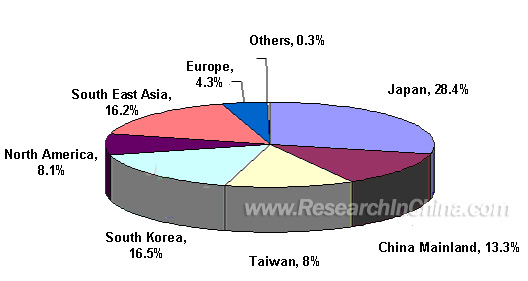

Global FPC Production Value Proportion by Regions in 2005

Considering the global shipment of flexible printed circuit (hereafter FPC), Japan takes the largest share of 28.4%, followed by South Korea with a share of 16.5%. A number of Japanese manufacturers have set up FPC factories in South East Asia, thus caused a high market share for the region. The market shares held by Taiwan and Mainland China are 13.3% and 12.8% respectively, the low figure was mainly attributable to low-price products which were the mainstream in these two regions. In comparison, products in Japan are mainly of high price.

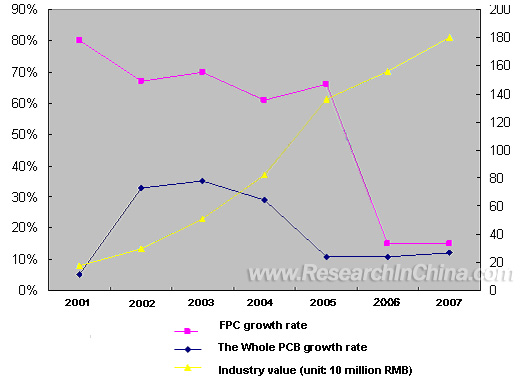

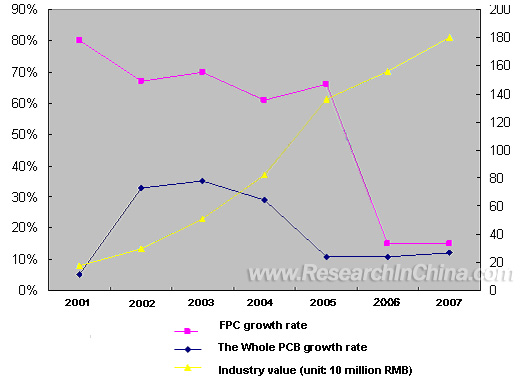

Growth Rate Comparison between FPC Output Value and Entire PCB Output Value in China, 2001-2007

Before 2006, the annual increase rate of China's FPC industry was more than 60%. However, the growth rate will drop to 15% after 2006. Two reasons contribute this: 1. from the end of 2003 to 2004, FPC industry had experienced a high-speed growth and drawn large investments. Besides, price war emerged at the end of 2005; 2. A sharp decline in market shares of domestically manufactured handsets in 2005 caused a rapid decrease in the output value of FPC industry. But annual growth rate of FPC output value was still higher in contrast with the entire PCB industry.

The clients for FPC in Mainland China are mainly handset manufacturers, especially those domestic manufacturers with their own handset brands. The clients for FPC in Taiwan are mobile phone manufacturers of both domestic and foreign brands. Moreover, manufacturers of LCD, LCD TV, Notebook PC, Digital camera, display equipment drive IC, Plasma TV; DV, etc are also clients for FPC in Taiwan.

The competition in FPC industry mainly depends on: 1. equipment; 2. personnel skill, especially machine operators; 3. control of raw material; 4. mastery of development direction.

Equipment determines technical ability scale and quality control ability. In FPC industry, equipment investment takes the most share of total investment. Suzhou Weixunxin Factory plans to invest USD 21 million into equipment. In contrast, the largest investment into domestic FPC industry only gets to USD 10 million or less. If manufacturers anticipate long-term growth in FPC industry, equipment investment can not be saved.

The key of FPC lies in the control on manufacturing technique. In reality, those quite simple techniques in theory are hard to be operated. So, talented persons play an important role in FPC industry. Manufacturers have to set up their own personnel training system to fill the vacancy quickly after core technician's leaving.

Of FPC cost, raw material cost takes over 60%. Japanese manufacturers who control 80% of PI, key raw material of FPC, are well experienced in vertical integration with their manufacture ability of upstream raw materials. However, manufacturers in Mainland China enjoy no upstream resources. The leading position of Japanese manufacturers in FPC industry results from the control of upstream resources.

Another key raw material for FPC manufacturing rests with FCCL. Taiwan has the ability of mass-producing 3L FCCL with low technical level, satisfying about 70 percent of Taiwan enterprises' demand. As for 2L FCCL with high technical level, Taiwan Xinyang can afford the mass production but its output is limited. New Nippon Steel Corporation,the top manufacturer in 2L FCCL, takes more than 80% of market shares.

The development trend of FPC industry determines the future of enterprises. There are three development trends of FPC industry:

1. FPC adopting 2L FCCL. At present, price hampers 2L FCCL to be widely applied, resulting from the great demand of 2L FCCL and high gross profit of manufacturers. Once price competition begins, shipment will further enlarge with rapid fall in price. Despite many people consider that 3L FCCL will still be the mainstream, experts holds that the market will be developing faster than our expectation.

2. Rigid-Flex Printed Board. Rigid-Flex Printed Board gets greatly promoted by South Korean manufacturers due to the massive emergence of slide-lid mobile phones and rotary handsets. In China, only Yaxin owns large shipment of rigid-flex printed board. For most of FPC enterprises without Rigid Board experience, Rigid-Flex Printed Board is a great challenge.

3. High density FPC. With the coming of 3G era, the wiring density of handsets increases accordingly. The conventional density FPC has not been enough, resulting most 3G handsets are straight phones.

The FPC downstream is the superstar product, which determines FPC industry to be promising. The bright prospect of FPC industry is out of question, and the key point is how to catch up with the overall development of FPC industry.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Global FPC Production Value Proportion by Regions in 2005

Considering the global shipment of flexible printed circuit (hereafter FPC), Japan takes the largest share of 28.4%, followed by South Korea with a share of 16.5%. A number of Japanese manufacturers have set up FPC factories in South East Asia, thus caused a high market share for the region. The market shares held by Taiwan and Mainland China are 13.3% and 12.8% respectively, the low figure was mainly attributable to low-price products which were the mainstream in these two regions. In comparison, products in Japan are mainly of high price.

Growth Rate Comparison between FPC Output Value and Entire PCB Output Value in China, 2001-2007

Before 2006, the annual increase rate of China's FPC industry was more than 60%. However, the growth rate will drop to 15% after 2006. Two reasons contribute this: 1. from the end of 2003 to 2004, FPC industry had experienced a high-speed growth and drawn large investments. Besides, price war emerged at the end of 2005; 2. A sharp decline in market shares of domestically manufactured handsets in 2005 caused a rapid decrease in the output value of FPC industry. But annual growth rate of FPC output value was still higher in contrast with the entire PCB industry.

The clients for FPC in Mainland China are mainly handset manufacturers, especially those domestic manufacturers with their own handset brands. The clients for FPC in Taiwan are mobile phone manufacturers of both domestic and foreign brands. Moreover, manufacturers of LCD, LCD TV, Notebook PC, Digital camera, display equipment drive IC, Plasma TV; DV, etc are also clients for FPC in Taiwan.

The competition in FPC industry mainly depends on: 1. equipment; 2. personnel skill, especially machine operators; 3. control of raw material; 4. mastery of development direction.

Equipment determines technical ability scale and quality control ability. In FPC industry, equipment investment takes the most share of total investment. Suzhou Weixunxin Factory plans to invest USD 21 million into equipment. In contrast, the largest investment into domestic FPC industry only gets to USD 10 million or less. If manufacturers anticipate long-term growth in FPC industry, equipment investment can not be saved.

The key of FPC lies in the control on manufacturing technique. In reality, those quite simple techniques in theory are hard to be operated. So, talented persons play an important role in FPC industry. Manufacturers have to set up their own personnel training system to fill the vacancy quickly after core technician's leaving.

Of FPC cost, raw material cost takes over 60%. Japanese manufacturers who control 80% of PI, key raw material of FPC, are well experienced in vertical integration with their manufacture ability of upstream raw materials. However, manufacturers in Mainland China enjoy no upstream resources. The leading position of Japanese manufacturers in FPC industry results from the control of upstream resources.

Another key raw material for FPC manufacturing rests with FCCL. Taiwan has the ability of mass-producing 3L FCCL with low technical level, satisfying about 70 percent of Taiwan enterprises' demand. As for 2L FCCL with high technical level, Taiwan Xinyang can afford the mass production but its output is limited. New Nippon Steel Corporation,the top manufacturer in 2L FCCL, takes more than 80% of market shares.

The development trend of FPC industry determines the future of enterprises. There are three development trends of FPC industry:

1. FPC adopting 2L FCCL. At present, price hampers 2L FCCL to be widely applied, resulting from the great demand of 2L FCCL and high gross profit of manufacturers. Once price competition begins, shipment will further enlarge with rapid fall in price. Despite many people consider that 3L FCCL will still be the mainstream, experts holds that the market will be developing faster than our expectation.

2. Rigid-Flex Printed Board. Rigid-Flex Printed Board gets greatly promoted by South Korean manufacturers due to the massive emergence of slide-lid mobile phones and rotary handsets. In China, only Yaxin owns large shipment of rigid-flex printed board. For most of FPC enterprises without Rigid Board experience, Rigid-Flex Printed Board is a great challenge.

3. High density FPC. With the coming of 3G era, the wiring density of handsets increases accordingly. The conventional density FPC has not been enough, resulting most 3G handsets are straight phones.

The FPC downstream is the superstar product, which determines FPC industry to be promising. The bright prospect of FPC industry is out of question, and the key point is how to catch up with the overall development of FPC industry.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Introduction to global PCB Industry

1.1. PCB industrial layout worldwide

1.2. Overview of PCB industry in China

1.3. Global pattern of traditional PCB (Rigid board) industry

1.4. Global FPC industry pattern 2. FPC Introduction

2.1. FPC variety and development

2.2. Recent situation of global FPC industry

2.3. Downstream market of global FPC industry

2.4. Brief introduction to Rigid-Flex Printed Board

2.5. Application field and market study of Rigid-Flex Printed Board

2.6. Study on high density FPC and application field

2.7. Development trend and technical requirements of High density FPC 3. Study on FPC Upstream Industry

3.1. Study on FCCL industry

3.1.1. FCCL structure

3.1.2. 2L FCCL and 3L FCCL

3.2. FCCL manufacturers

3.2.1. Taiflex Scientific

3.2.2. ThinFlex Co., Ltd.

3.2.3. Guangzhou Hongren Electronic Industry Co., Ltd.

3.2.4. Asia Electronic Materials Co., Ltd

3.2.5. Kunshan Yasen Electronic Materials Co., Ltd.

3.2.6. Jiujiang Flex Co., Ltd.

3.2.7. Zhongshan Dongyi Electronic Materials Co., Ltd.

3.2.8. Haiso Electronic Chemicals Co., Ltd.

3.2.9. Shenzhen Danbang FCCL Co., Ltd.

3.2.10. DuPont Wirex Co., Ltd.

3.2.11. Rogers Chang Chun Technology Co., Ltd.

3.2.12. Microcosm Technology Co., Ltd. 4. FPC Manufacturers

4.1. Nippon Mektron

4.2. Zhuhai Zixiang Electronic Technology Co., Ltd

4.3. Mektec Corporation

4.4. Fujikura

4.5. Sony Chemical

4.6. Sony KMG Electronics (Suzhou) Co., Ltd.

4.7. Nitto Denko

4.8. Nitto Denko (Suzhou) Co., Ltd.

4.9. Sumitomo Denko

4.10. Parlex

4.11. Parlex (Shanghai) Circuit Co., Ltd.

4.12. M-Flex

4.13. M-FLEX Multi-Fineline Electronic (Suzhou) Co., Ltd.

……

4.42. Young Poong

4.43. Interflex

4.44. SI Flex

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Production value, product structure and forecast of PCB manufacturers in Mainland China during 2000-2010

Statistics on PCB manufacturers' investors by regions in China

Income distribution of traditional PCB industry worldwide

Output value of global traditional PCB industry by regions during 1982-2004

Output value of global FPC industry by regions in 2005

FPC sales in America in each quarter from 1980-2005Q2

Flow chart of FPC manufacturing

Growth rates of FPC and traditional PCB shipment per month from Jan 2003-Aug 2005

BOOK/BILL ratio of FPC industry per month from Jan 2004-Aug 2005

Production value and forecast of global FPC industry during 2002-2005

Area distribution of global PCB industry

PCB manufacturers worldwide in Mar 2005 and statistics on income and employees in 2004

Top ten PCB manufacturers worldwide by earnings in 2004

FPC applications by plating hole density

Layers and slices of various FPC electronic products

Performance comparison of 2L FCCL and 3L FCCL

Three approaches to 2L FCCL manufacturing

Technical level of major FCCL manufacturers in Taiwan

Shipment of handset circuit board of Huatong in Taiwan and Mainland China from 2003-2005Q2

Output capability of Huatong factory in 2005Q2

|

2005-2008 www.researchinchina.com All Rights Reserved

|