| |

|

|

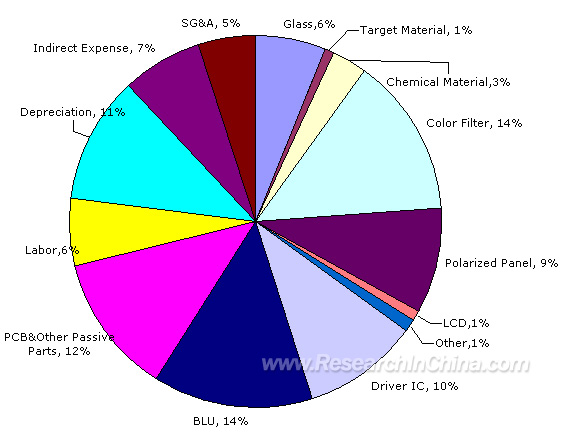

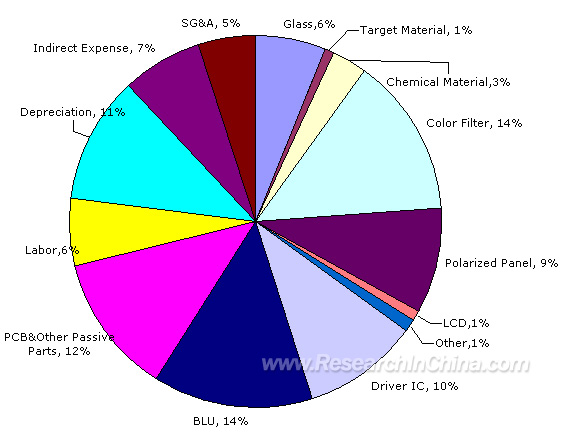

17-inch TFT-LCD Panel Cost Structure (5G Line)

The labor cost only accounts for 6% of the total cost, while the cost of raw materials accounts for 70%. To reduce the cost of 17-Inch TFT-LCD panel production, the key is to reduce the cost of raw materials. This is the reason why TFT-LCD panel manufacturers must have perfect the supply chain.

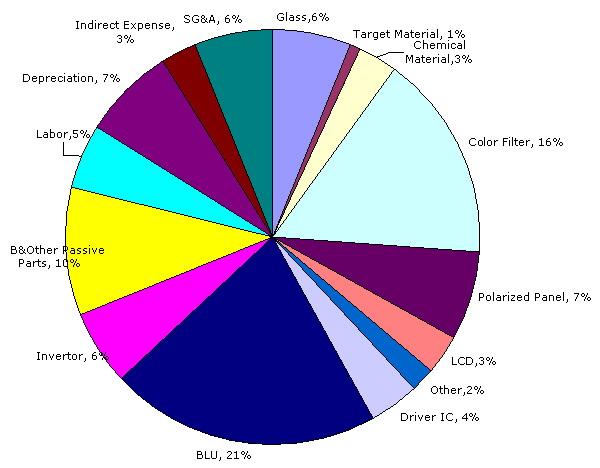

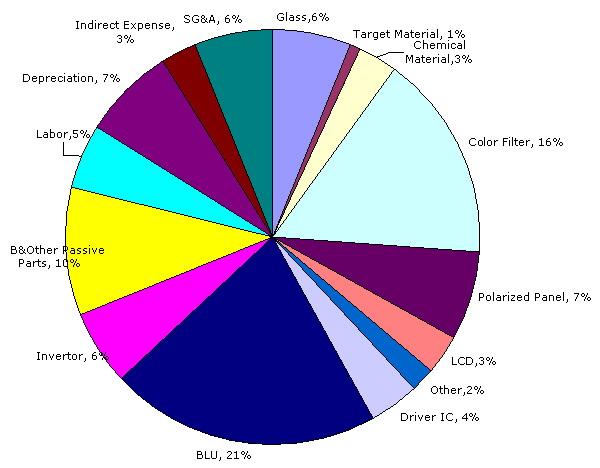

32-inch LCD-TV Panel Cost Structure (6G Line)

The raw materials cost of 32-inch LCD-TV accounts even higher of 79% of the total cost. TFT-LCD industry is an upstream-dominant industry. On the one hand, only a few manufacturers exist in the upstream market, less than 10 manufacturers in each field of color filter, glass substrate, driver IC, backlight unit, polarized panel and liquid crystal. Moreover, Top 5 in each filed are having about 70% to 100% market shares. On the other hand, the photoresist for color filter, CCFL lamp for BLU and TAC for polarized panel, are monopolized by less than five manufacturers. Therefore, this report mainly focuses on the upstream domain.

Operational Performance of Global Top 8 Large-Sized TFT-LCD Manufacturers, Q1 2006

|

|

Samsung

LCD |

LG

Philips |

AUO |

CMO |

CPT |

QDI |

Hannstar |

BOE |

|

Revenue

(RMB Billion) |

23.4 |

21.5 |

15.8 |

11.3 |

5.8 |

4.9 |

3.9 |

2.4 |

|

Net Profit

(RMB Billion) |

0.95 |

0.45 |

1.88 |

1.7 |

0.01 |

-0.04 |

0.11 |

-0.57 |

|

Net Operating Margin |

4% |

2% |

12% |

15.4% |

0.1% |

-0.09% |

2.7% |

-24% |

Although the revenues of AUO and CMO were far behind of Samsung and LG Philips, CMO and AUO's gross margin was 7 and 6 times more than that of LG Philips respectively. Nevertheless, almost all secondary-line manufacturers suffered a loss.

The high gross profit was mainly resulted from the good layout on raw materials, but not relying on low labor cost. Except for glass, AUO and CMO can produce all other upstream raw materials. Considering the cost of raw materials accounting for more than 70% of the total cost of LCD panel, manufacturers in Taiwan naturally make more profits than Samsung and LG Philips. Take AUO as an example, the Wellypower, affiliated with AUO, can provide CCFL lamps; the Daxon which was invested by AUO, can produce polarized panel. Moreover, AUO can self-provide color filters, the Corning, locating in the same industrial park with AUO, can provide glass substrate, the Novatek, also affiliated with AUO, is the largest TFT-LCD Driver IC manufacturer in the world.

Compared to AUO and CMO, secondary manufacturers suffer great loss. BOE has a huge deficit of RMB 570 million, and its revenue is the least. SVA Group also suffers a lot. BOE takes 17-inch TFT-LCD panel as its knockout product, while SVA NEC regards 15-inch TFT-LCD panel as its leading product. Nevertheless, the market development of 15-inch TFT-LCD panel is quite limited, only having thin profit margin.

|

|

Glass Substrate |

Backlight Unit (BLU) |

Color Filter |

Driver IC |

Polarized Panel |

|

SVA NEC |

NEG

|

CCFL: Stanley

Module: Stanley |

Taiwan Sinteck |

NEC |

Nitto Denko |

|

BOE |

Corning |

Module: Korea NANO HITEC KONTERO, SNL, STS, SHY |

Taiwan Sinteck, Japanese DNP |

OKI |

LG Chem |

|

CMO |

AGC, Corning |

Chilin(Subsidiary of CMO) |

Self-Manufactured |

Himax(Subsidiary of CMO) |

Self-Manufactured |

|

AUO |

NEG,Corning |

CCFL:Wellypower |

Cando |

Novatek |

Daxon |

Except for glass substrate, Taiwan manufacturers can produce other raw materials by themselves, whose quality is better than original auxiliary components made by Korean manufacturers. Manufacturers can hold purchase right under the condition of mastering the core technology of TFT-LCD panel, as technical engineers finally decide the purchase of raw materials. As long as manufacturers reserve purchase right, they are able to compete in the upstream market. The technology of BOE comes from Hydis, while SVA's technology is from NEC. It is well-known that NEC has already completely withdrawn from LCD market. Therefore BOE's technology is stronger than that of SVA. The most important process for producing TFT-LCD panel is Array, similar with the process of wafer fabrication. What differs is that wafer is put on silicon chip while TFT-LCD on glass substrate. Taiwan manufacturers have rich experience in producing wafer as well as manufacturers in Korea and Japan. But mainland manufacturers pretty lack of experience in manufacturing wafer.

Additionally, establishing industry chain is not simply attracting manufacturers to move into its own industrial park. What the most important is that manufacturers must master its own technology and productivity, and then have power to occupy upstream market. Like AUO in Taiwan, it is the parent company of Daxon and Cando, big shareholder of Wellypower as well as an affiliated company of Novatek. Whereas, even if BOE or SVA NEC attracts overseas providers to move into China, these overseas providers will still transfer their profits to overseas markets. Since price given to BOE or SVA NEC won't be lower at all, the possibility of loss exists.

Manufacturers couldn't make huge profits unless they completely master technology and production capability, but it needs a long course and huge financial support.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

17-inch TFT-LCD Panel Cost Structure (5G Line)

The labor cost only accounts for 6% of the total cost, while the cost of raw materials accounts for 70%. To reduce the cost of 17-Inch TFT-LCD panel production, the key is to reduce the cost of raw materials. This is the reason why TFT-LCD panel manufacturers must have perfect the supply chain.

32-inch LCD-TV Panel Cost Structure (6G Line)

The raw materials cost of 32-inch LCD-TV accounts even higher of 79% of the total cost. TFT-LCD industry is an upstream-dominant industry. On the one hand, only a few manufacturers exist in the upstream market, less than 10 manufacturers in each field of color filter, glass substrate, driver IC, backlight unit, polarized panel and liquid crystal. Moreover, Top 5 in each filed are having about 70% to 100% market shares. On the other hand, the photoresist for color filter, CCFL lamp for BLU and TAC for polarized panel, are monopolized by less than five manufacturers. Therefore, this report mainly focuses on the upstream domain.

Operational Performance of Global Top 8 Large-Sized TFT-LCD Manufacturers, Q1 2006

|

|

Samsung

LCD |

LG

Philips |

AUO |

CMO |

CPT |

QDI |

Hannstar |

BOE |

|

Revenue

(RMB Billion) |

23.4 |

21.5 |

15.8 |

11.3 |

5.8 |

4.9 |

3.9 |

2.4 |

|

Net Profit

(RMB Billion) |

0.95 |

0.45 |

1.88 |

1.7 |

0.01 |

-0.04 |

0.11 |

-0.57 |

|

Net Operating Margin |

4% |

2% |

12% |

15.4% |

0.1% |

-0.09% |

2.7% |

-24% |

Although the revenues of AUO and CMO were far behind of Samsung and LG Philips, CMO and AUO's gross margin was 7 and 6 times more than that of LG Philips respectively. Nevertheless, almost all secondary-line manufacturers suffered a loss.

The high gross profit was mainly resulted from the good layout on raw materials, but not relying on low labor cost. Except for glass, AUO and CMO can produce all other upstream raw materials. Considering the cost of raw materials accounting for more than 70% of the total cost of LCD panel, manufacturers in Taiwan naturally make more profits than Samsung and LG Philips. Take AUO as an example, the Wellypower, affiliated with AUO, can provide CCFL lamps; the Daxon which was invested by AUO, can produce polarized panel. Moreover, AUO can self-provide color filters, the Corning, locating in the same industrial park with AUO, can provide glass substrate, the Novatek, also affiliated with AUO, is the largest TFT-LCD Driver IC manufacturer in the world.

Compared to AUO and CMO, secondary manufacturers suffer great loss. BOE has a huge deficit of RMB 570 million, and its revenue is the least. SVA Group also suffers a lot. BOE takes 17-inch TFT-LCD panel as its knockout product, while SVA NEC regards 15-inch TFT-LCD panel as its leading product. Nevertheless, the market development of 15-inch TFT-LCD panel is quite limited, only having thin profit margin.

|

|

Glass Substrate |

Backlight Unit (BLU) |

Color Filter |

Driver IC |

Polarized Panel |

|

SVA NEC |

NEG

|

CCFL: Stanley

Module: Stanley |

Taiwan Sinteck |

NEC |

Nitto Denko |

|

BOE |

Corning |

Module: Korea NANO HITEC KONTERO, SNL, STS, SHY |

Taiwan Sinteck, Japanese DNP |

OKI |

LG Chem |

|

CMO |

AGC, Corning |

Chilin(Subsidiary of CMO) |

Self-Manufactured |

Himax(Subsidiary of CMO) |

Self-Manufactured |

|

AUO |

NEG,Corning |

CCFL:Wellypower |

Cando |

Novatek |

Daxon |

Except for glass substrate, Taiwan manufacturers can produce other raw materials by themselves, whose quality is better than original auxiliary components made by Korean manufacturers. Manufacturers can hold purchase right under the condition of mastering the core technology of TFT-LCD panel, as technical engineers finally decide the purchase of raw materials. As long as manufacturers reserve purchase right, they are able to compete in the upstream market. The technology of BOE comes from Hydis, while SVA's technology is from NEC. It is well-known that NEC has already completely withdrawn from LCD market. Therefore BOE's technology is stronger than that of SVA. The most important process for producing TFT-LCD panel is Array, similar with the process of wafer fabrication. What differs is that wafer is put on silicon chip while TFT-LCD on glass substrate. Taiwan manufacturers have rich experience in producing wafer as well as manufacturers in Korea and Japan. But mainland manufacturers pretty lack of experience in manufacturing wafer.

Additionally, establishing industry chain is not simply attracting manufacturers to move into its own industrial park. What the most important is that manufacturers must master its own technology and productivity, and then have power to occupy upstream market. Like AUO in Taiwan, it is the parent company of Daxon and Cando, big shareholder of Wellypower as well as an affiliated company of Novatek. Whereas, even if BOE or SVA NEC attracts overseas providers to move into China, these overseas providers will still transfer their profits to overseas markets. Since price given to BOE or SVA NEC won't be lower at all, the possibility of loss exists.

Manufacturers couldn't make huge profits unless they completely master technology and production capability, but it needs a long course and huge financial support. |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1 Brief Introduction to Large-Sized TFT-LCD Industry Chain

1.1 Analysis of Large-Sized TFT-LCD Panel Cost Structure 2 Upstream Industry Chain of Large-Sized TFT-LCD

2.1 Glass Substrate

2.1.1 Overview of Glass Substrate

2.1.2 Glass Substrate Market

2.2 Glass Substrate Manufacturers

2.2.1 Coring Incorporated

2.2.2 Nippon Sheet Glass Co. Ltd (NSG)

2.2.3 Nippon Electric Glass Co., Ltd (NEG)

2.2.4 Asahi Glass Co., Ltd (AGC)

2.3 Color Filter

2.3.1 Overview of Color Filter

2.3.2 Development Trend of Color Filter

2.3.3 Color Filter Market

2.4 Color Filter Manufacturers

2.4.1 Cando Corporation

2.4.2 Dai Nippon Printing Co., Ltd (DNP)

2.4.3 Sintek Photronic Corp.

2.4.4 Toppan Printing Co., Ltd

2.4.5 Allied Material Technology Corp.

2.4.6 Sumitomo Chemical Co., td

2.5 Polarized Panel

2.5.1 Overview of Polarized Panel

2.5.2 Polarized Panel Market

2.6 Polarized Panel Manufacturers

2.6.1 Nitto Denko Corporation

2.6.2 Optimax Technology Corporation

2.6.3 LG Chem, Ltd.

2.6.4 Sann Lii Co., Ltd

2.6.5 Sumitomo Chemical Co., Ltd

2.6.6 Daxon Technology Inc.

2.6.7 Ace Digitech

2.6.8 Jinwei

2.7 Backlight Unit (BLU)

2.7.1 Overview of Backlight Unit

2.7.2 CCFL Market Overview

2.7.3 BLU Market Overview

2.8 CCFL Manufacturers

2.8.1 Harison-toshiba

2.8.2 Sanken

2.8.4 Panasonic

2.8.5 NEC

2.8.6 Stanley

2.8.7 Kumho

2.8.8 Heesung

2.8.9 Wooree ETI

2.8.10 Wellypower

2.9 Backlight Unit Manufacturers

2.9.1 Coretronic

2.9.2 Forhouse

2.9.3 Radiant

2.9.4 Kenmos

2.9.5 Forward

2.9.6 K-Bridge

2.9.7 Taesan LCD

2.9.8 Wooyoung

2.9.9 DS-LCD

2.9.10 Hansol LCD

2.9.11 Chilin

2.9.12 Heesung Electronics

2.9.13 Yuka

2.9.14 L & F

2.10 Optical Film

2.10.1 Overview of Optical Film

2.10.2 Optical Film Manufacturers: 3M

2.10.3 Efun

2.10.4 Keiwa

2.10.5 Tsujiden

2.10.6 SKC

2.11 Driver IC

2.11.1 Principle

2.11.2 Overview of Driver IC

2.11.3 Features of Large-Sized TFT-LCD Driver IC

2.11.4 Large-Sized TFT-LCD Driver IC Package

2.11.5 Cost Structure

2.11.6 Foundry Services

2.11.7 Driver IC Market

2.12 Driver IC Manufacturers

2.12.1 MagnaChip

2.12.2 NEC

2.12.3 Samsung

2.12.4 DenMos

2.12.5 Novatek

2.12.6 Cheertek

2.12.7 Himax 3 Large-Sized TFT-LCD Panel Manufacturers

3.1 Fabrication Process of Large-Sized TFT-LCD Panel

3.2 AUO

3.2.1 QDI

3.3 CMO

3.4 CPT

3.5 HannStar

3.6 InnoLux

3.7 BOE

3.8 IVO

3.9 SVA-NEC |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

17-inch TFT-LCD Panel Cost Structure (6G Line)

32-inch TFT-LCD Panel Cost Structure (5G Line)

BOM Structure of 17-inch TFT-LCD Panel (5G Line)

BOM Structure of 32-inch TFT-LCD Panel (6G Line)

Sketch of TFT-LCD Upstream Industry Chain

Price of Glass Substrate by size, Q4 2005-Q1 2006 (unit: yen)

Global Demand & Supply of TFT-LCD Glass Substrate, Q1 2005-Q4 2007

Market Shares and Forecast of Global Top 5 TFT-LCD Glass Substrate Manufacturers

Quality Characteristic of Corning EAGLE2000™ Products

Corning Operating Performance, 2003-2005

Corning Operating Performance of Display Division, 2003-2005

Change of Corning Investment on R & D, 2001-2005

Corning Operating Revenue Distribution by Regions, 2003-2005

NSG Operating Performance, 2000-2004

NSG Information & Electronics Operating Performance, 2000-2004

NEG Operating Performance, 2001-2005

NEG Operating Performance of Plane & Photoelectrical Division, 2001-2004

AGC Global Business Distribution

Global Operating Networks of AGC Display Glass Substrate

Global Market Performance of AGC Display Glass Substrate

Current Production Expansion Plan of AGC TFT Glass Substrate, 2005-2007

Production Expansion Plan of AGC TFT Glass Substrate after Demand increases

Forecast of AGC Large-Sized Display Glass Substrate Output, 2004-2007

Forecast of AGC TFT Plane Aggregate Demand, 2004-2007

AGC TFT Glass Substrate Shipment, Q3 2004-Q4 2005

AGC Operating Performance, 1998-2006

Global Market Shares of AGC Flat Glass, Auto Glass and CRT Glass in 2005

Global Market Shares of AGC TFT Glass Substrate, PDP Glass Substrate & ETFE, 2005

AGC Operating Revenue Distribution by Division, 2004-2006

AGC Operating Revenue Distribution by Regions, 2004-2006

AGC Operating Revenue Distribution by Regions and Divisions in 2005

Change of ACG Investment on R & D, 2004-2006

Structure of Color Filter

Microstructure of Ink-Jet Color Filter

Contrast between Ink-Jet and Printing Color Filters

Ink-Jet Color Filter Chamber by Industrial Technology Research Institute of Taiwan

Forecast and Proportion of Purchased and Self-made Color Filters, Q3 2005-Q3 2008

Cando Operating Performance, 2002-2005

Market Shares of Global Color Filter Manufacturers in 2004

DNP Operating Performance by Divisions, 2003-2006

DNP Operating Revenue by Divisions in 2006

DNP Operating Revenue Distribution by Divisions, 2005-2006

Sintek Operating Performance, 2002-Q1 2006

Sintek Clients Distribution, 2004-Q1 2006

TOPPAN Operating Performance, 2002-2006

AMTC Operating Performance, 2002-2005

Market Shares of Color Filter Markers in Taiwan in 2004

Structure of Common Polarized Panel

Sketch of N-TAC Retardation Film Structure

Sketch of X-PLATE Retardation Film Structure

Cost Structure of Polarized Panel

Raw Materials Cost Structure of Polarized Panel

Market Scale and Forecast of Mainland Large-Sized TFT-LCD Polarized Panel

Sketch of BLU Structure

Contrast of CCFL, EEFL, LED, OLED and FEL

Market Shares of Global CCFL/EEFL Manufacturers, Q1 2006

Market Shares of Global CCFL/EEFL Manufacturers for Laptops and Computers, Q4 2005

Market Shares of Global CCFL/EEFL Manufacturers for LCD-TV, Q4 2005

Market Shares of Global Manufacturers to Produce CCFL/EEFL for Computer Display, Q4 2005

Forecast of CCFL Supply and Demand, Q3 2006-Q4 2007

Market Shares of Global BLU Manufacturers by Shipment in 2005

Market Shares of LCD-TV BLU Manufacturers by Shipment in 2005

Sanken Operating Performance, 2004-2006

Sanken Products Distribution, 2004-2006

Sanken CCFL Capacity Planning, 2006-2009

Forecast of Global TAC Supply and Demand, Q1 2005- Q4 2006

Equivalent Circuit of TFT-LCD Panel

Internal Frame of Large-Sized TFT-LCD Driver IC

Route Map of Driver IC Package’s Development

Forecast and Revenue of Large-Sized TFT-LCD Driver IC (by Shipment), 2004-2009

Market Shares of Global Large-Sized TFT-LCD Driver IC Manufacturers (by shipment) in2005

MagnaChip Operating Performance, 2003-Q1 2006

Change of Magnachip Investment on R & D, 2003-Q1 2006

MagnaChip Major Products Distribution, 2003-2005

MagnaChip Regional Operating Revenue Distribution, 2003-2005

NCE Operating Performance, 2005-2007

NCE Operating Performance by Division, 2005-2006

Forecast of NCE Operating Performance by Division, 2006-2007

NEC Operating Performance, 2005-2007

NEC Operating Performance, Q1 2004-Q4 2006

NEC Products Distribution, Q1 2006-Q4 2006

NEC Products Distribution, 2005-2006

NEC Semiconductor Market Distribution, 2005-2006

Samsung Display Driver IC Production Planning

Market Application of Samsung LCD Driver IC

Novatek Operating Performance, 2002-2006

Novatek Products Distribution, Q1 2005-Q4 2006

Market Share of Global Large-Sized Driver IC

Global TFT-LCD Large-Sized Panel Driver IC Demand, 2003-2007

Global LCD-TV Demand, 2003-2006

Global NB Demand, 2003-2006

Global LCD Display Demand, 2003-2006

Cheertek Operating Performance, 2002-Q1 2006

Himax Operating Performance, 2003-Q1 2006

Change of Himax Investment on R & D, 2003-Q1 2006

Hixmax Operating Revenue Proportion by Product, 2003-2005

Hixmax Clients Distribution, 2003-2005

Sketch of Large-Sized TFT-LCD Structure

Flow Sketch of Array

Flow Sketch of Cell

Flow Sketch of Module

Monthly Capacity Planning of AUO Factories

AUO Operating Performance, 2003-Q1 2006

AUO Large-Sized TFT-LCD Panel Shipment Proportion by Application, Q1 2003-Q4 2005

AUO Operating Revue Proportion by Application, Q1 2003-Q4 2005

AUO Shipment and Average Sales Price of Large-Sized TFT-LCD Panel, Q1 2003-Q4 2005

AUO Shipment and Sales Price per unit area of Large-Sized TFT-LCD Panel, Q1 2003-Q4 2005

AUO Shipment Operating Revenue of Medium and Small-Sized TFT-LCD Panel, Q1 2003- Q4 2005

QDI Operating Performance, 2003-2005

Quarterly Capital Expenditure of Global Major Panel Manufacturers, 2004-2006

CMO Operating Performance, 2002-2005

CMO Shipment and Average Sales Price, Q1 2004-Q4 2005

CMO Operating Revenue Application Percentage by Product, Q1 2004- Q4 2005

Sales of CMO LCD Panel by Size, Q1 2004- Q4 2005

Capacity Plan of CPT Factories

Capital Expenditure Plan of CPT Factories

CPT Operating Performance, 2003-2005

CPT TFT-LCD Operating Revenue by Division, 2003-2005

CPT TFT-LCD Shipment and Average Sales Price, Q1 2003- Q4 200

CPT Large-Sized TFT-LCD Shipment by Application, Q3 2005- Q4 2005

CPT Large-Sized TFT-LCD Shipment by Size, Q3 2005- Q4 2005

Hannstar Operating Performance, 2003-2005

Hannstar Panels Shipment and Average Sales Prices, Q3 2004- Q4 2005

Hannstar Operating Revenue by Application, Q3 2004- Q4 2005

Hannstar Operating Revenue by Size, Q3 2004- Q4 2005

Physical Features of Corning E2000™ Products

NSG Company Profile

Distribution of NSG Divisions

NSG Display Glass Substrate Products

NEG Company Profile

Profile of AGC

Contrast of the Four Color Filter Fabrication Methods

Shareholders of Cando

Cando Company Profile

DNP Company Profile

Toppan Company Profile

AMTC Company Profile

Color Filter Capacity of AMTC and Sintek

Sanken Company Profile

NEC CCFL Features

Driver IC Numbers by Resolution

Main global TFT-LCD Driver IC Package Manufacturers

Cost Structure of 384- Feet & 642 -Feet Driver IC

Relations between Large-Sized TFT-LCD Driver IC Manufacturers and Large-Sized TFT-LCD Panel Manufacturers

Global TFT-LCD Driver IC OEM wafer Manufacturers

MagnaChip Large-Sized 6Bit TFT Source Driver IC Products

MagnaChip Large-Sized 8Bit TFT Source Driver IC Products

MagnaChip Large-Sized TFT Gate Driver IC Products

MagnaChip Medium TFT Driver IC Products

NEC Company Profile

NEC Electronics Company Profile

NEC Electronics Digital Source Driver IC (CMOS I/F) Products

NEC Electronics Digital Source Driver IC (mini-LVDS I/F) Products

NEC Electronics Digital Source Driver IC (RSDS I/F) Products

NEC Electronics Analog Source Driver IC Products

NEC Electronics Gate Driver IC Products

Samsung LCD Driver IC Products

Samsung TFT Panel Driver IC Products

DenMOS TFT Source Driver Products

DenMOS TFT Gate Driver Products

Novatek Company Profile

Novatek Driver IC Products

Cheertek Multimedia IC Products

Cheertek TFT LCD Driver IC Products

Himax TFT-LCD Driver IC Products

AUO Company Profile

AUO Factory Profile

AUO Factory’s Production Size and Sector Divided

AUO Products Distribution

Part AUO Large-Sized TFT-LCD Products

QDI Profile

QDI Panel Capacity Overview

QDI Electronic Products

CMO Capacity Plan

CMO monthly Sales Revenue & Shipment, Jan 2005-Mar 2006

CMO Products

CPT Company Profile

CPT Factory Profile

CPT Products

CPTF Monthly Revenue & Shipment, Jan 2005-Mar 2006

Hannstar Company Profile

Hannstar Products

Hannsta Core Technologies

Hannstar Operating Performance, Jan 2006-Mar 2006

BOE Operating Performance in 2005

BOE Operating Performance, Q1 2006

|

2005-2008 www.researchinchina.com All Rights Reserved

|