| |

|

|

Serving the operation of active electronic groupware, chip passive components are essentially unable to electronically start up, switch on/off, control the rapidity and function independently. At present, three categories of passive components i.e. MLCC (multi-layer ceramic capacitor), chip resistor and chip inductor are available in the market. Yet, chip passive components are mainly undertaken by Japan and Taiwan manufacturers, which are now transferring gradually to China mainland. As a result, the output of passive components in China mainland is also growing correspondently.

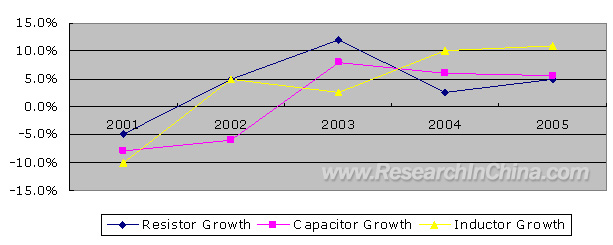

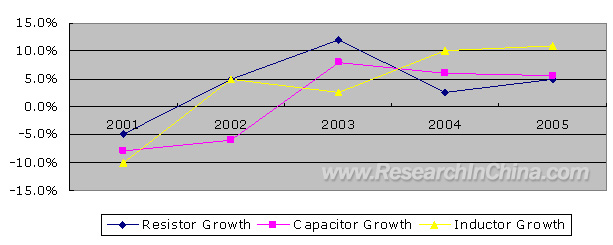

The total output value of the above three passive components had a moderately growth in 2005 compared to the preceding year. In 2005, the passive component industry achieved US$32.8 billion, with a year-on-year growth rate of 4.8%. Due to high standardization and mature technologies, resistors can be easily mass produced, resulting to a sharp price drop. In 2005, the total output value of resistors was US$ 5.6 billion, with a year-on-year increase rate of 1.99%. The price of capacitor dropped slightly as portable products grow rapidly. Its growth rate in 2005 had little fluctuation compared to that of 2004, and the total output value of capacitors reached USD15.6 billion in 2005, increasing by 2.5% over the previous year. As for inductors, most products were customized thus the price declined so slightly, and maintained a highest growth rate. The global output value of inductors was US$ 6.5 billion in 2005, with a rise of 6.14% compared to 2004. According to IEK, the total output value of chip passive components will add up to US$ 35.3 billion in 2006, with a year-over-year growth rate of 7.6%.

Growth Rate Changes of Global Passive Components Market, 2001-2005

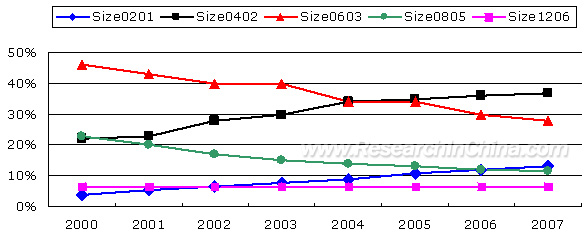

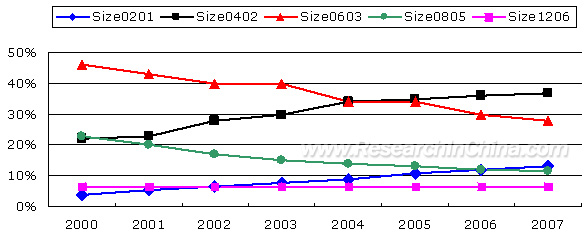

As downstream products are developing towards lightness, thinness, shortness and smallness, the dimensions of passive components is also tending to be little by little. After 1998 size 0603 created the record to won advantages over size 0806, size 0402 for the first time exceeded size 0603 in 2005. In the near future size 0402 is bound to outweigh size 0603 in the market demand and leads the trend for a certain period. While products of size 0201 share less popularity are mainly applied to 3G handsets and high-level consumer electronics. Currently, size 0201 can be produced only by Japan manufacturers while Taiwan manufacturers still take size 0805 and size 0603 as their pillar products. It is not until the recent two years that size 0402 products began to rise. As for 0201 lineup, the shipment of goods accounts for less than one percent of the total.

Changes in Dimensions of Global Chip Passive Components, 2000-2007

Capacitors are mainly used for electric storage. Its product categories can be divided into Al-Electrolytic capacitor, Tantalum electrolytic capacitor, MLCC (multi-layer ceramic capacitor), and plastic film capacitor, in which MLCC is a sort of chip component. MLCC is stacked across by ceramic layers and interior metal electrode layers. Each ceramic layer is held between two parallel electrodes, giving rise to a flat capacitor. The linkage of interior electrode and exterior electrode makes each capacitor parallel connected. With the fast advancement of ceramic stack technology in recent years, the capacitance values rises accordingly, gradually replacing the medium and low-capacitance capacitors. As electronic products are developing toward thinness, lightness, shortness and smallness, the application will be widely used. For instance, a handset is usually attached with 150-300 MLCC; desktop PC 300-350 MLCC; and laptop 500-600 MLCC. Additionally, multi-layer ceramic capacitors are also used a lot in consumer electronics such as MP3/MP4 players, digital camera, and LCD TV, etc.

In recent years, MLCC supply has been over its demand although there is a steady growth in the demand. The supply/demand ratio was 120% in 2005, and this percentage will decrease to 108% in 2006 under the control of manufacturers on their production capabilities. Thus, the pressure of excessive supply is being eased. From MLCC prices of Yageo, the demand and the supply has nearly been in balance for three consecutive quarters since 2005Q3, indicating a positive turning point. The 2006H2 will witness the best distribution of consumer electronics. The demand and supply will remained basically balanced, and prices are to be rising steadily then. Inevitably, the concentration of market shares will be intensified in the future and the price-negotiating abilities of downstream manufacturers will be further weakened. Therefore, MLCC price will remain stable in a long period of time.

As for chip resistors, the low technical requirements admit of large shipment of standard products, resulting in a fierce price competition in the market. Being advantageous in the manufacturing cost, Taiwan producers are gradually taking market shares held by Japan producers. Taiwan manufacturers accounts for 50% of market shares. Yageo is the world largest chip resistor manufacturer, with a global market share of 30%. News spreads that Yageo will merge Ralec and its monthly output of chip resistors will increase from 25 billion to 33.6 billion unit, increasing by 8.6 billion. Thus its leading position among chip resistor manufacturers is consolidated. The monthly output of Walsin Technology can get to 8 billion units, and the figure will rise to 13 billion units after purchasing Kamaya. Further, its output will be expanded to 18 billion units at the end of the year. The output of TA-I Technology reaches 15 billion units per month and will be expanded to 18 billion units at the end of the year. Seen from the growing of chip resistor industry, the expanded production capabilities of Taiwan manufacturers far exceed the increasing demand. Such practice is aimed at forcing Japan competitors out of chip resistor market. It can be forecasted that chip resistor prices will keep declining in the future. Once Taiwan manufacturers hold more than 70% shares of chip resistor market, the price-cutting competition will be alleviated significantly. At last, the price will remain stable.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Serving the operation of active electronic groupware, chip passive components are essentially unable to electronically start up, switch on/off, control the rapidity and function independently. At present, three categories of passive components i.e. MLCC (multi-layer ceramic capacitor), chip resistor and chip inductor are available in the market. Yet, chip passive components are mainly undertaken by Japan and Taiwan manufacturers, which are now transferring gradually to China mainland. As a result, the output of passive components in China mainland is also growing correspondently.

The total output value of the above three passive components had a moderately growth in 2005 compared to the preceding year. In 2005, the passive component industry achieved US$32.8 billion, with a year-on-year growth rate of 4.8%. Due to high standardization and mature technologies, resistors can be easily mass produced, resulting to a sharp price drop. In 2005, the total output value of resistors was US$ 5.6 billion, with a year-on-year increase rate of 1.99%. The price of capacitor dropped slightly as portable products grow rapidly. Its growth rate in 2005 had little fluctuation compared to that of 2004, and the total output value of capacitors reached USD15.6 billion in 2005, increasing by 2.5% over the previous year. As for inductors, most products were customized thus the price declined so slightly, and maintained a highest growth rate. The global output value of inductors was US$ 6.5 billion in 2005, with a rise of 6.14% compared to 2004. According to IEK, the total output value of chip passive components will add up to US$ 35.3 billion in 2006, with a year-over-year growth rate of 7.6%.

Growth Rate Changes of Global Passive Components Market, 2001-2005

As downstream products are developing towards lightness, thinness, shortness and smallness, the dimensions of passive components is also tending to be little by little. After 1998 size 0603 created the record to won advantages over size 0806, size 0402 for the first time exceeded size 0603 in 2005. In the near future size 0402 is bound to outweigh size 0603 in the market demand and leads the trend for a certain period. While products of size 0201 share less popularity are mainly applied to 3G handsets and high-level consumer electronics. Currently, size 0201 can be produced only by Japan manufacturers while Taiwan manufacturers still take size 0805 and size 0603 as their pillar products. It is not until the recent two years that size 0402 products began to rise. As for 0201 lineup, the shipment of goods accounts for less than one percent of the total.

Changes in Dimensions of Global Chip Passive Components, 2000-2007

Capacitors are mainly used for electric storage. Its product categories can be divided into Al-Electrolytic capacitor, Tantalum electrolytic capacitor, MLCC (multi-layer ceramic capacitor), and plastic film capacitor, in which MLCC is a sort of chip component. MLCC is stacked across by ceramic layers and interior metal electrode layers. Each ceramic layer is held between two parallel electrodes, giving rise to a flat capacitor. The linkage of interior electrode and exterior electrode makes each capacitor parallel connected. With the fast advancement of ceramic stack technology in recent years, the capacitance values rises accordingly, gradually replacing the medium and low-capacitance capacitors. As electronic products are developing toward thinness, lightness, shortness and smallness, the application will be widely used. For instance, a handset is usually attached with 150-300 MLCC; desktop PC 300-350 MLCC; and laptop 500-600 MLCC. Additionally, multi-layer ceramic capacitors are also used a lot in consumer electronics such as MP3/MP4 players, digital camera, and LCD TV, etc.

In recent years, MLCC supply has been over its demand although there is a steady growth in the demand. The supply/demand ratio was 120% in 2005, and this percentage will decrease to 108% in 2006 under the control of manufacturers on their production capabilities. Thus, the pressure of excessive supply is being eased. From MLCC prices of Yageo, the demand and the supply has nearly been in balance for three consecutive quarters since 2005Q3, indicating a positive turning point. The 2006H2 will witness the best distribution of consumer electronics. The demand and supply will remained basically balanced, and prices are to be rising steadily then. Inevitably, the concentration of market shares will be intensified in the future and the price-negotiating abilities of downstream manufacturers will be further weakened. Therefore, MLCC price will remain stable in a long period of time.

As for chip resistors, the low technical requirements admit of large shipment of standard products, resulting in a fierce price competition in the market. Being advantageous in the manufacturing cost, Taiwan producers are gradually taking market shares held by Japan producers. Taiwan manufacturers accounts for 50% of market shares. Yageo is the world largest chip resistor manufacturer, with a global market share of 30%. News spreads that Yageo will merge Ralec and its monthly output of chip resistors will increase from 25 billion to 33.6 billion unit, increasing by 8.6 billion. Thus its leading position among chip resistor manufacturers is consolidated. The monthly output of Walsin Technology can get to 8 billion units, and the figure will rise to 13 billion units after purchasing Kamaya. Further, its output will be expanded to 18 billion units at the end of the year. The output of TA-I Technology reaches 15 billion units per month and will be expanded to 18 billion units at the end of the year. Seen from the growing of chip resistor industry, the expanded production capabilities of Taiwan manufacturers far exceed the increasing demand. Such practice is aimed at forcing Japan competitors out of chip resistor market. It can be forecasted that chip resistor prices will keep declining in the future. Once Taiwan manufacturers hold more than 70% shares of chip resistor market, the price-cutting competition will be alleviated significantly. At last, the price will remain stable. |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Market scale and trends of chip passive components

1.1 Overview of passive components industry

1.2 Global layout of passive components market in 2005

1.2.1 Global layout of MLCC market in 2005

1.2.2 Global layout of chip resistor market in 2005

1.2.3 Global layout of chip inductor market in 2005

1.3 Current development of MLCC industry

1.4 Development trends of MLCC industry in 20062. Manufacturers in Japan

2.1 Murata

2.2 TDK

2.3 Kyocera

2.4 Taiyo Yuden

2.5 Rohm Electronics

2.6 Nichicon

2.7 Panasonic Electronic Devices (Tianjin) 3. Taiwan Manufacturers

3.1 Yageo

3.2 Chilisin Electronics

3.3 Walsin Technology

3.4 TA-I Technology

3.5 RALED Electronic

3.6 Thinking Electronic

3.7 Holy Stone

3.8 Lelon 4. Manufacturers in China Mainland

4.1 Feng Hua Advanced Technology

4.2 Shenzhen CSG Electronics

4.3 Yinhe Technology

4.4 EYang Technologies

4.5 CoilTech (Pan Yu) Electronics

4.6 Pro-An Electronics

4.7 Shenzhen JingQuanLi Electronics 5. Euro-American manufacturers and others

5.1 EPCOS

5.2 Vishay

5.3 SEMCO

5.4 AVX/Kyocera

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Changes in the growth rate of global passive components market, 2001-2005

Manufacturing proportion of Taiwan passive components in Mainland China, 2005

RCL Micromation development course

Monthly output of world top seven MLCC manufacturers in 2005

Market shares of world top five MLCC manufacturers in 2005

Changes happened to Taiwan MLCC industry

Market shares of leading chip resistor manufacturers in 2005

Market shares of leading chip inductor manufacturers in 2005

Market shares of various capacitors worldwide

Price fluctuations of Q102--Q206MLCC

World MLCC demand & supply by quarters, 2004~2005

Financial operation of Murata, FY2003-2005

Product distribution of Murata in Japan and overseas markets, FY2004-2005

Statistics on sales turnover of Murata by products, FY2005

Application fields of Murata products in FY2005

Growth rate of product in various application fields, FY 2004-2005

Sales income of Murata (Beijing), 1997-2005

Annual sales revenue of TDK, FY2001-2005

Sales revenue of TDK by products, FY2005

Net profits of TDK, FY2001-2005

Overseas distribution of TDK, FY2001-2005

Changes in sales revenue, pretax current profit and current net profit of Kyocera these years

Sale revenues of Shanghai Kyocera, 2001-2005

Net income, pretax earnings ratio and net income rates of Taiyo Yuden, FY2003-2005

Proportion of sales income of Taiyo Yuden by products, FY2003-2005

Operating revenues and profit margins of Rohm Electronics, FY2000-2005

Business performance of NICHICON, FY2000-2005

Operating revenues of Yageo Group, 2004-2005

Proportion of sales income of Yageo Group by regions, 2004-2005

Operating income and gross profit margin of Chilisin, 2000-2005

Quarterly operating income of Walsin Technology, 2005-2006

Changes in MLCC productivity of Walsin Technology, 2000-2006

Changes in chip resistors productivity of Walsin Technology, 2000-2006

Operating revenues and gross profit margin of TA-I Technology, 2000-2006Q1

Operating profits and gross profit margins of Ralec, 2000-2006Q1

Business performance of Thinking Electronic, 2000-2006Q1

Business performance of Holy Stone, 2000-2006Q1

Proportion of Lelon Electronics' business performance by product, 2005

Magnitude of Lelon Electronics' business performance by product, 2005

Subdivided market application fields of Lelon Electronics products

Revenue proportion of Lelon's leading products

Business performance of Lelon Electronics, 2000-2006Q1

Operating revenues and profit margins of Fenghua Advanced Technology, 2003-2005

Electronic components business performance of Yinhe Technology, FY2002-2005

Electronic components business performance of Yinhe Technology, 2005Q1-2006Q1

Regional markets of Pro-An Electronics

Sales offices and plants of EPCOS in China

Business performance of EPCOS, FY2002-2006

Subdivided business performance of EPCOS by products, FY2003-2005

Subdivided business performance of EPCOS by regions, FY2002-2005

MLCC sales performance and forecast of Samsung Electro, 2004-2006

Oversea layout of Samsung Electro

Sales performance of Samsung Electro by different regions, 2004-2005

Global running trend of MLCC ASP, 1Q04-2Q06

Forecasted growth of downstream application of various passive components in 2006

Sales income and growth rates of TDK in Xiamen, 2000-2005

Productivity of leading products and their global ranks of Yageo Group in2005

Chilisin's gross profits and total value of inductor production and sales, 2004-2005

Production capacities of Chilisin's key plants

New customer development of Chilisin Electronics

Main R&D centers and R&D fields of Walsin Technology

Production capacities of key production centers of TA-I Technology, 2005Q3~2006Q1

Investments of Holy Stone in China mainland in 2005

Total output layout of Lelon Electronics, 2005-2006

Business performance of CoilTech (Pan Yu) Electronics

Business performance of Shenzhen JingQuanLi Electronics

|

2005-2008 www.researchinchina.com All Rights Reserved

|