| |

|

|

Mobile handset RF is composed of front-end model (FEM), transceiver and power amplifier. The core of FEM is aerial switch with low technology content, so this report mainly focused on the transceiver and power amplifier.

Transceiver is a key component of mobile handset. It is also a relatively independent component, so non-handset manufacturers can also find a place of their own in this field.

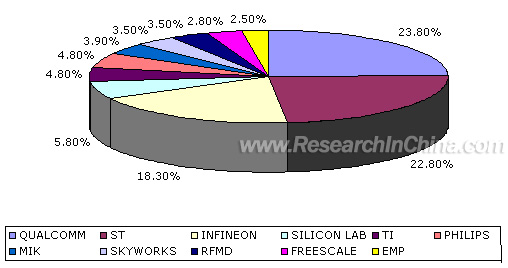

Global Market Share Distribution of Mobile Handset transceiver Manufacturers

QUALCOMM lists at No. 1 by the strength of its monopoly power in CDMA domain. In 2005, its shipment reached 182 million flakes and its CDMA transceiver shared over 80% of the market. In addition to CDMA mobile handset, QUALCOMM also produces transceivers aiming at CDMA/GSM. ST ranks at No. 2 by custom transceivers for Nokia, followed by Infineon who has Nokia, Panasonic, Siemens and BenQ as its clients. SILICON LAB is supported by Samsung and LG rely on its CNOS technologies. Except QUALCOMM, the platform-relying handset baseband manufacturers such as TI and Philips were not able to gain a good market share. Independent transceiver suppliers nevertheless shared 50% in the market.

SILICON LAB and Infineon are the earliest two transceiver manufacturers adopting CMOS techniques. Although the specifications of handset-purposed RF IC are extremely strict, however, the technical obstacles have been addressed.. After purchasing Berkana, QUALCOMM also adopts CMOS techniques in an extensive and intensive way. Some newly-founded RF manufacturers, without exception, all adopt RF CMOS techniques, even more advanced 65μm RF CMOS techniques. Old brands such as Philips, FREESCALE, ST and RENESAS maintained traditional technologies, which is mainly SiGe BiCMOS techniques. Nokia still massively draws upon ST RF transceivers. This suggests that some large handset manufacturers are still hold tentative attitude towards RF CMOS whereas Chinese manufacturers, Samsung and LG are more willing to accept new things.

In the infancy of 3G, multi-mode handsets are in great popularity. Lowly-integrated transceivers usually need four or five pieces of IC, which have negative influence on design sophistication, adjusting, size and power consumption. Therefore, RF CMOS has a good prospect. Yet it still needs observing. Nokia's mass application of RF CMOS transceivers can be the signal to judge RF CMOS maturity.

Power amplifier needs special techniques. GaAs semiconductor still keeps absolutely mainstream position in the field of handset-purposed power amplifiers. Power amplifiers influence handsets' signal, voice quality and power consumption to a great extent. Handset manufacturers are very careful in choosing power amplifiers. They will not adopt other techniques without 4-5 years' trial. SiGe develops smoothly in the domain of Bluetooth, WLAN and GPS but will have no further development in the handset field.

The power amplifier industry is even more particular, with all the manufacturers being independent and seldom exploiting products relevant to mobile handsets. The reason is that GaAs is too special for silicon wafer manufacturers to acquaint in a short term.

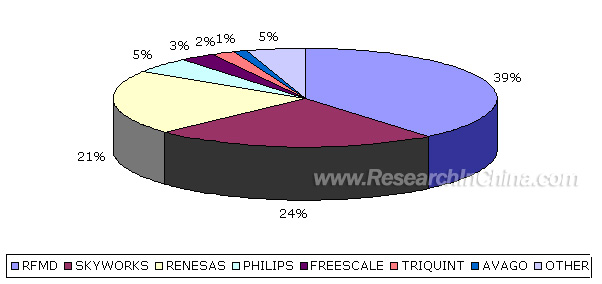

Global Market Share Distribution of Handset-purposed Power Amplifiers in 2005

RFMD ranks at the first globally. It has the six largest handset manufacturers worldwide as its clients and supplies power amplifiers to over 80% of Nokia's mobile handsets. SKYWORKS lists at No.2 globally with LG, Lenovo and Samsung as its key clients. Amoi and Siemens are key clients of Renesas and it is also the supplier of Nokia's partial low-price handsets. PHILIPS has Samsung and Bird as its main clients and FREESCALE has MOTO and Bird.

For customer who purchased this report can have a free list of Semiconductor component configuration of 100 mobile handset models launched in Chinese market, 90% of the models been selected were launched in 2005, some of them are still waiting to be launched.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Mobile handset RF is composed of front-end model (FEM), transceiver and power amplifier. The core of FEM is aerial switch with low technology content, so this report mainly focused on the transceiver and power amplifier.

Transceiver is a key component of mobile handset. It is also a relatively independent component, so non-handset manufacturers can also find a place of their own in this field.

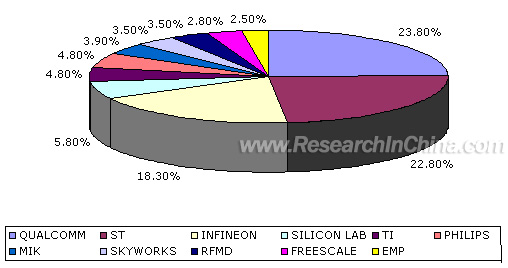

Global Market Share Distribution of Mobile Handset transceiver Manufacturers

QUALCOMM lists at No. 1 by the strength of its monopoly power in CDMA domain. In 2005, its shipment reached 182 million flakes and its CDMA transceiver shared over 80% of the market. In addition to CDMA mobile handset, QUALCOMM also produces transceivers aiming at CDMA/GSM. ST ranks at No. 2 by custom transceivers for Nokia, followed by Infineon who has Nokia, Panasonic, Siemens and BenQ as its clients. SILICON LAB is supported by Samsung and LG rely on its CNOS technologies. Except QUALCOMM, the platform-relying handset baseband manufacturers such as TI and Philips were not able to gain a good market share. Independent transceiver suppliers nevertheless shared 50% in the market.

SILICON LAB and Infineon are the earliest two transceiver manufacturers adopting CMOS techniques. Although the specifications of handset-purposed RF IC are extremely strict, however, the technical obstacles have been addressed.. After purchasing Berkana, QUALCOMM also adopts CMOS techniques in an extensive and intensive way. Some newly-founded RF manufacturers, without exception, all adopt RF CMOS techniques, even more advanced 65μm RF CMOS techniques. Old brands such as Philips, FREESCALE, ST and RENESAS maintained traditional technologies, which is mainly SiGe BiCMOS techniques. Nokia still massively draws upon ST RF transceivers. This suggests that some large handset manufacturers are still hold tentative attitude towards RF CMOS whereas Chinese manufacturers, Samsung and LG are more willing to accept new things.

In the infancy of 3G, multi-mode handsets are in great popularity. Lowly-integrated transceivers usually need four or five pieces of IC, which have negative influence on design sophistication, adjusting, size and power consumption. Therefore, RF CMOS has a good prospect. Yet it still needs observing. Nokia's mass application of RF CMOS transceivers can be the signal to judge RF CMOS maturity.

Power amplifier needs special techniques. GaAs semiconductor still keeps absolutely mainstream position in the field of handset-purposed power amplifiers. Power amplifiers influence handsets' signal, voice quality and power consumption to a great extent. Handset manufacturers are very careful in choosing power amplifiers. They will not adopt other techniques without 4-5 years' trial. SiGe develops smoothly in the domain of Bluetooth, WLAN and GPS but will have no further development in the handset field.

The power amplifier industry is even more particular, with all the manufacturers being independent and seldom exploiting products relevant to mobile handsets. The reason is that GaAs is too special for silicon wafer manufacturers to acquaint in a short term.

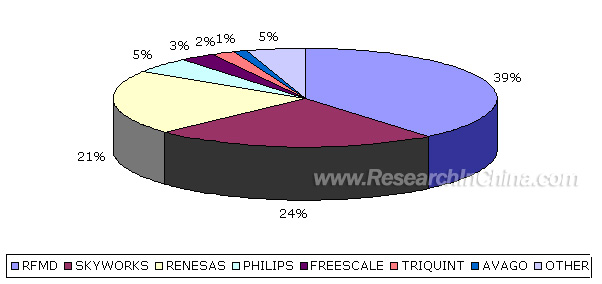

Global Market Share Distribution of Handset-purposed Power Amplifiers in 2005

RFMD ranks at the first globally. It has the six largest handset manufacturers worldwide as its clients and supplies power amplifiers to over 80% of Nokia's mobile handsets. SKYWORKS lists at No.2 globally with LG, Lenovo and Samsung as its key clients. Amoi and Siemens are key clients of Renesas and it is also the supplier of Nokia's partial low-price handsets. PHILIPS has Samsung and Bird as its main clients and FREESCALE has MOTO and Bird.

For customer who purchased this report can have a free list of Semiconductor component configuration of 100 mobile handset models launched in Chinese market, 90% of the models been selected were launched in 2005, some of them are still waiting to be launched.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Fundamentals of RF Semiconductor

1.1 RF Circuit Structure

1.2 RF Semiconductor Techniques

1.2.1 GaAs

1.2.2 SiGe

1.2.3 RF CMOS

1.2.4 Ultracmos

1.2.5 Si BiCMOS

1.3 RF Semiconductor in 3G Era

1.4 Polar Modulation

1.4.1 Fundamentals of Polar Modulation

1.4.2 Status Quo of Polar Modulation

1.5 DigRF2. Overview of Global Handset RF Semiconductor Market 3. Global Handset RF Semiconductor Manufacturers

3.1 SKYWORKS

3.2 ST

3.3 INFINEON

3.4 Silicon Lab

3.5 RFMD

3.6 TI

3.7 PHILIPS

3.8 FREESCALE

3.9 AVAGO

3.10 QUALCOMM

3.11 ANADIGICS

3.12 TRIQUINT

3.13 MAXIM

3.14 Sirific Wireless

3.15 Sequoia Communications

3.16 Tropian

3.17 RENESAS

3.18 SiGe Semiconductor

3.19 WIN Semiconductor

3.20 Advanced Wireless Semiconductor Company (AWSC)

3.21 MC Devices (Shenzhen)

3.22 Airoha Technology Corp.

3.23 Beijing LHWT Microelectronics Inc.

3.24 Epic Communications, Inc. (Epicom)

3.25 Yuantonix, Inc.

3.26 Comlent Technology, Inc. (Comlent)

3.27 Rising Micro-Electronics Co., Ltd. (RME)

3.28 RDA Microelectronics

3.29 Hangzhou Sicom RF Technology, Inc.

3.30 Shanghai Tsinghuachip |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Framework of Typical Wireless Terminal Equipment RF

Technological Diagram of Typical Wireless Communication Equipment Terminal RF components

Framework of Super-heterodyne

Framework of Homodyne

Framework and Typical Application Diagram of Harley

Framework of Weaver

Comparison between MOCVD and MBE

Comparison among HBT, PHEMT and MESFET Technologies

Analytical Comparison of Signal Frequency Spectrum between 2.5G/2.75G and 3G

Market Share of Global Handset-purposed Power Amplifiers, 2005

Market Share of China's Handset-purposed Power Amplifiers, 2005

Market Share of Global Handset-purposed Transceivers, 2005

Market Share of China's Handset-purposed Transceivers, 2005

Revenue Statistics of SKYWORKS, FY2002-2005

Gross Profit of SKYWORKS, FY2002-2005

Quarterly Product Structure Proportion of SKYWORKS, 2005

List of SKYWORKS CDMA RF Sub-system Products

Inner Framework of CX74107

Inner Framework of CX77328

HELIOS DIGRF RF System Framework

HELIOS EDGE RF Sub-system Framework

HELIOS MINI EDGE RF Sub-system Framework

HELIOS II EDGE RF Sub-system Framework

Inner Framework of RS23603

Revenue Structure of ST, 2005

Revenue Statistics of ST, 2003Q1-2005Q4

ST's Revenue from Mobile Communications, 2003Q1-2005Q4

Revenue Proportion of ST by regions, 2005

New Structure of ST

Regional Distribution of ST 6-inch Wafer Output

Departmental Revenue Statistics of INFINEON, 2003-2005

Regional Revenue Statistics of INFINEON, 2003-2005

Departmental Profit Statistics of INFINEON, 2003-2005

Inner Framework of PMB6272

Inner Framework of SMARTi 3G

Inner Framework of PMB6277

Inner Framework of PMB6271

Inner Framework of PMB6270

Revenue and Gross Profit Rate of Silicon Lab, 2001-2005

Inner Framework of SI4206

Inner Framework of SI4212

Figure: Inner Framework of SI4905

Inner Framework of SI4205

Revenue and Gross Profit Margin of RFMD, FY 2001-2005Q3

Product Structure Diagram, FY 2005

Inner Framework of POLARIS

Inner Framework of BRF6100/6150

Application Framework of BRF6150

Departmental Revenue Proportion of Philips, 2005

Income of Philips Semiconductor in Eight Consecutive Quarters

Gross Profit of Philips Semiconductor in Eight Consecutive Quarters

Product Application Proportion of Philips Semiconductor, 2005

Regional Revenue Proportion of Philips Semiconductor, 2005

Inner Framework of UAA3587

Inner Framework of BGY284E

Inner Framework of UAA3582

Revenue of FREESCALE, 2003-2005

Regional Revenue Proportion of GREESCALE, 2005

Quarterly Income and Gross Profit Margin of FREESCALE Wireless and Mobile Sector, 2005

Inner Framework of MMM6000 GSM/GPRS Quad-band Transceivers

MMM6007 WCDMA Triple-band Transceivers

Framework of FREESCALE WCDMA/EDGE RF System

Framework of FREESCALE GSM/GPRS/EDGE RF System

Framework of FREESCALE GSM/GPRS RF System

Inner Framework of WS1102

Inner Framework of ACPM-7881

Inner Framework of RTR6300

Inner Framework of RFR6000

Inner Framework of RFL6000

Inner Framework of RFR6250

Inner Framework of RTR6250

Inner Framework ofRTR6275

Market and Products of ANADIGICS

Key Clients of ANADIGICS

Income and Gross Profit Margin of ANADIGICS in Five Consecutive Quarters

Main Partners of ANADIGICS

Handset Application Cases of ANADIGICS Products

Sales Revenue Structure of ANADIGICS Wide-band Products, 2003-2005

Sales Revenue Structure of ANADIGICS Wireless Products, 2003-2005

ANADIGICS WCDMA/GSM Power Amplifiers

ANADIGICS Product Roadmap

Revenue and Gross Profit Margin of TRIQUINT, 2001-2005

Downstream Application Proportion of TRIQUINT Products, 2005

Regional Distribution of TRIQUINT Product Revenue, 2005

Revenue and Gross Profit Rate Changes of Maxim, 2001-2005

Global Regional Revenue Proportion of Maxim, 2005

MAXIM TD-SCDMA RF System Module Program

MAXIM CDMA2000 Dual-band RF Solution Module Program

MAXIM CDMA2000 Single-band RF Solution Module Program

MAXIM WCDMA RF Solution Module Program

Inner Framework of SW2210

Inner Framework of SW3200

Inner Framework of SW3210

GaAs Wafer Foundry Productivity Changes of WIN Semiconductor

HBT Technology Roadmap of WIN Semiconductor

HEMT Technology Roadmap of WIN Semiconductor

Product Cycle Time of WIN Semiconductor

Technology Roadmap of AWSC

Business Performance of AWSC, 2003-2005H1

Revenue Ratio of AWSC, 2003-2005H1

Share Holders of Airoha

Development Roadmap of Airoha Handset RF Products

Development Roadmap of Airoha WLAN RF Chip Products

Performance Comparison among Si BJT, SiGe HBT, RF CMOS, Bi CMOS, MES FET, PHEMT and GaAs HBT

Manufacturing Techniques and Components for Different RF Systems

RF Comparison among 2.5G, 2.75G and 3G

RF Frequency Comparison among 2.5G, 2.75G and 3G

RF System Requirement Comparison between 2.5G/2.75G and 3G

The Four Production Bases of SKYWORKS

Transceiver Products of INFINEON

Transceiver Products of Silicon Lab

Brief Introduction to MC13777/MC13712

Brief Introduction to MMM6010/6011/6025

RF Power Amplifier Products of AVAGO

Handset Transceiver Products of QUALCOMM

WCDMA Power Amplifier Products of ANADIGICS

Power Amplifier Products of TriQuint

Technical Features of WIN Semiconductor Transistors>

IC Products of MC Devices

Airoha Products

LHWT Microelectronic Products

Epicom Products

Yuantonix Handset-purposed Wireless Power Amplifier Products

Comlent Semiconductor Products

RME Microelectronic Products

RDA Products

Sicom Products

|

2005-2008 www.researchinchina.com All Rights Reserved

|