The industrial value added to RMB 629.995 billion in China food industry in 2005, increasing 18.08% year-on-year; the sales rate was 98.6% and the total pretax profit was RMB 336.5 billion, increasing 21.6 year-on-year; the total import and export was USD 44.97 billion, increasing 13.7% year-on-year; and employees in this industry reached 4.53 million.

China has taken the leading position in some major food and beverage products. For example, the total production of edible vegetable oil, beverage and gourmet power each hit 16.12 million ton, 33.8 million ton and 1.36 million ton in 2005.

Food expenditure took largest ratio of about 40% of the total consumption expenditure in 2005. Chinese food structure has changed a lot. Expenditure on self-efficient food is gradually lowered down while demand for nutritious, convenient and green leisure food is in great potential. Traditional food is now developing towards cleanness, nutrition and health.

Chinese major convenient foods market is in perfect competition and monopolistic competition, relatively the former takes priority, which is decided by their characteristics of primary products processing, low industrial added value and low market entry threshold.

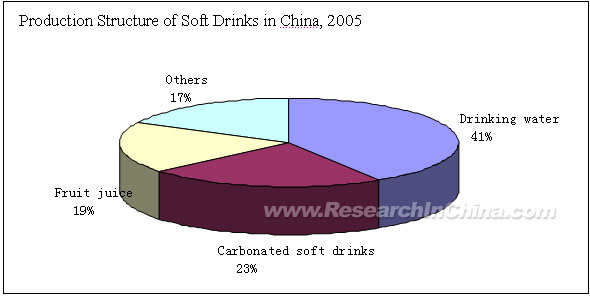

Chinese beverage expenditure is still out of basic consumption needs, with an average consumption amount far less than the world average level. It can be predicted that still great potential is to be explored in the market and the developing prospect is optimistic. Chinese beverage has developed from single drink to a variety of drinks including carbonated soft drink, fruit juice and vegetable juice. In 2005, the production of soft drink in China was 33.8 million ton, increasing 24.08% year-on-year. The total product value and sales revenue was RMB 109.079 billion and RMB 113.950 billion, increasing 25.82% and 24.97% respectively.

Production Structure of Soft Drinks in China, 2005

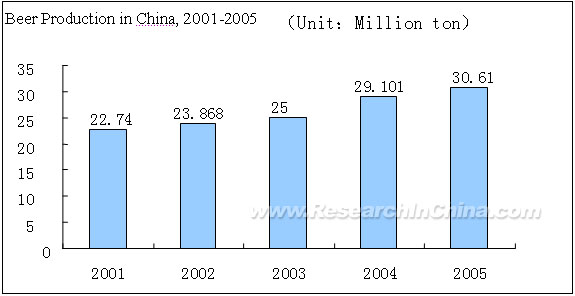

While in the alcoholic drinks market, beer production in China increased 10.3% year-on-year in 2005 to 30.61 billion liter, thus took the world leading position for the fourth successive year. White wine production amounted to a total of 3.4937 billion liter, increasing 15.03% year-on-year. The economical benefit in wine realized a sudden growth. Sales revenue of large-scaled white wine manufacturers added up to RMB 72.265 billion. In 2005, grape wine industry kept a rapid development too. The total production of grape wine reached 434.3 million liter and realized a profit of RMB 1.256 billion, increasing 25.40% and 58.78% year-on-year respectively.

Beer Production in China, 2001-2005

Chinese food and beverage market maintain rapid growth in 2006. In H1 2006, the listed companies overall realize an income of RMB 50.637 billion from major business, increasing 16.85% year-on-year; they achieved a profit of RMB 15.056 billion, increasing 22.11% year-on-year; their major business rate was 29.73%, slightly increasing 1.28% year-on-year. During this period the cost rate lowered down by 0.8%, and the overall net benefit increased 77.47% year-on-year.

The production and sale volume of China food and beverage industry keeps rising and it is forecasted that in the next few years such rise will continue at even a higher speed. Investment opportunities lie in this industry once investors see the tendency clearly and work out feasible risk-resistance policies to follow.

As for the sub-industries, the first half of 2006 saw a rapid growth resumed in white wine and beer industry. Especially in white wine industry, both output increase and growth rate appeared a rising tendency. In addition, rate of return on sales (pretax) saw an obvious increase. While domestic grape wine industry was impacted by the imported grape wine thus decelerated the sales. But we still take an optimistic attitude toward Chinese grape wine market in the long run.

Prices of white wine generally raise a lot. Dairy products thus confront great pressure from cost. Dairy manufacturers one by one enhance their production ability of good yoghourt to earn more profit. Beer industry keeps a rise of about 16%, slightly declined compared to the growth in last year and the growth of industry revenue. The competition is still fierce despite a moderate relaxation.

This report explains and analyses the status quo, the changes of various economical indicators, the development status of related industry, market status of key regions, leading enterprises, consumer strategies and competition strategies of China food and beverage industry, based on National Bureau of Statistics of China, Light Industry Statistics Bureau, China Beverage Organization, and China Economics Information Center. It also makes prudent judgments towards the development trend of the industry and seeks new growth points for investors. In addition, it objectively comments on the common benefits and possible risks. It is of great reference value if you are trying to decide when, what, how and how much to invest in China food and beverage industry. It is forecasted that the investment opportunities will still lie in the beverage production industry, mainly in alcohol production from 2006 to 2007. Investment opportunities in beverage production are far more than in food processing and food production. Attention should be paid to big companies at the same time much care should also be given to the opportunities in segmented market.

|