| |

|

|

During the period 2003 to 2005, international fertilizer market witnessed a full recovery. Meanwhile, China's fertilizer prices increased and the profitability of China's fertilizer industry improved significantly, resulting in rapid expansion of production capacity and increasingly severe competition in the industry. China's newly-added production capacity hit four million tons in 2006, when it was already clear that China was under pressure of oversupply of urea. In 2007, China added another five million tons of urea to its total production capacity. In 2008-2010, China's newly-added production capacity of urea is expected to reach 11.1 million tons, based on planned projects and projects under construction.

In addition, China's fertilizer market will confront a competition from foreign-invested companies. According to Chinese government commitments in entry into the World Trade Organization, starting from December 11, 2006, China began fully opening its wholesale and retail market of fertilizer industry, and influx of foreign capital has intensified the market competition in the industry.

China produces about 260 varieties of pesticides. The product structure has improved greatly. But highly-poisonous pesticides still amount to the majority. Currently, among the three main categories of pesticides in China, output ratio of insecticide, herbicide and bactericide is about 60:30:10, which still lags far behind the reasonable ratio of 30:50:20 in the developed countries.

This report makes an in-depth study on all investment projects of 32 listed companies in China's fertilizer and pesticide industry from 2000 to 2008 and also makes summary of investment trends of China's fertilizer and pesticide industry as well as investment features and investment trends of the listed companies.

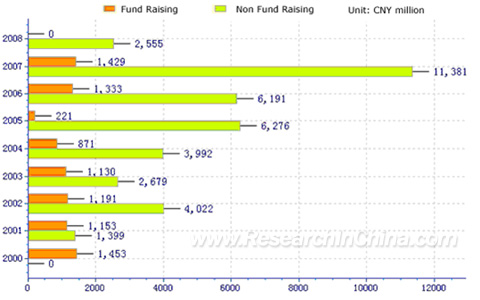

Project Investment of China Listed Fertilizer & Pesticide Companies, 2000-2008H1

Source: ResearchInChina

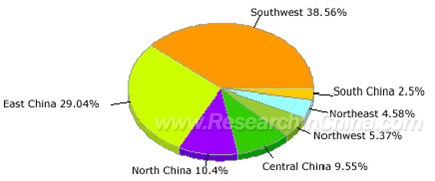

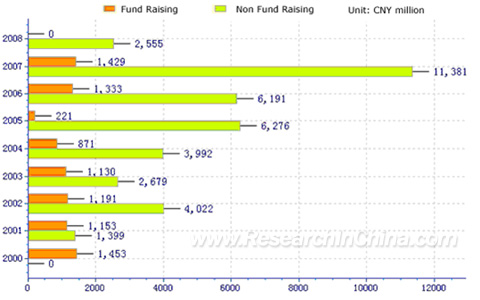

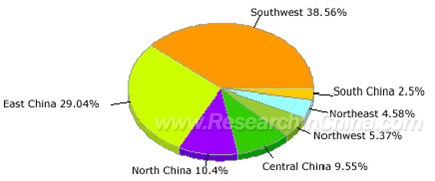

From 2000 to 2008, total investment of China's listed fertilizer and pesticide companies has been rising steadily. The investment value jumped to CNY12.81 billion in 2007 from CNY1.453 billion in 2000, among which, the biggest proportion went to Southwest China, accounting for 38.56% of the total, followed by East China, North China and Central China with a share of 29.04%, 10.4% and 9.55% respectively.

Investment Distribution of China Fertilizer and Pesticide Industry (by Region), 2000-2008

Source: ResearchInChina

This report makes an in-depth analysis on all investment projects financed by 32 listed companies in China's fertilizer and pesticide industry. For example, Sichuan Lutianhua Co., Ltd. (000912) is referred in this report.

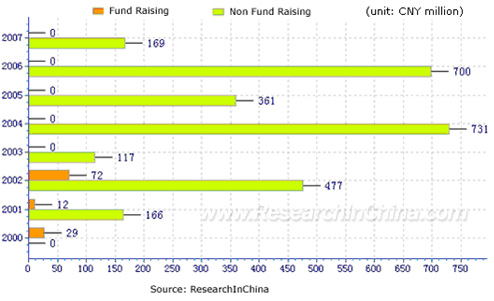

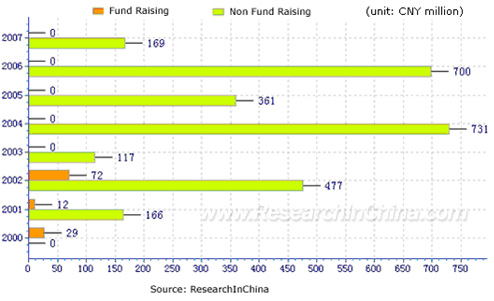

Investment Trend of Sichuan Lutianhua Co., Ltd., 2000-2008H1

Investment Features of Sichuan Lutianhua Co., Ltd:

Main Business: production and sales of fertilizer and chemical materials; diversification direction: natural gas chemical industry and coal chemical industry.

The company's main products include urea, compound fertilizer, nitric acid, ammonium nitrate and 1,4-butanediol. Its annual production capacity of synthetic ammonia and urea reaches one million tons and 1.6 million tons respectively. It is the largest urea manufacturer in China. In the future, the company will endeavor to exploit natural gas chemical, coal chemical and phosphorus chemical field and develop methanol, 1,4-butanediol and their downstream products.

Meanwhile, the company also plans to penetrate northwestern market as part of its national layout, so as to strengthen its leading status in urea manufacturing.

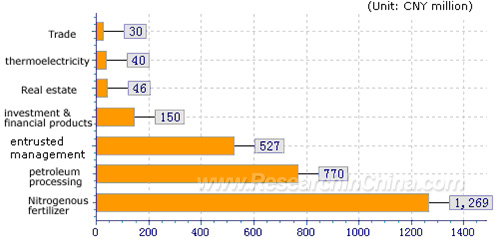

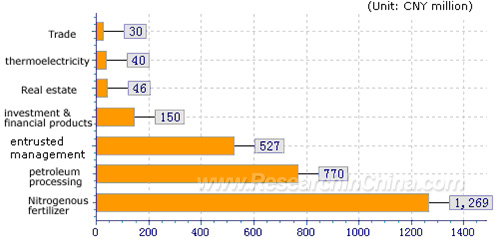

Investment Distribution of Sichuan Lutianhua (by Segment), 2000-2008

Source: ResearchInChina

Note: when you purchase this report, we can update the data to the most recent quarter.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

During the period 2003 to 2005, international fertilizer market witnessed a full recovery. Meanwhile, China's fertilizer prices increased and the profitability of China's fertilizer industry improved significantly, resulting in rapid expansion of production capacity and increasingly severe competition in the industry. China's newly-added production capacity hit four million tons in 2006, when it was already clear that China was under pressure of oversupply of urea. In 2007, China added another five million tons of urea to its total production capacity. In 2008-2010, China's newly-added production capacity of urea is expected to reach 11.1 million tons, based on planned projects and projects under construction.

In addition, China's fertilizer market will confront a competition from foreign-invested companies. According to Chinese government commitments in entry into the World Trade Organization, starting from December 11, 2006, China began fully opening its wholesale and retail market of fertilizer industry, and influx of foreign capital has intensified the market competition in the industry.

China produces about 260 varieties of pesticides. The product structure has improved greatly. But highly-poisonous pesticides still amount to the majority. Currently, among the three main categories of pesticides in China, output ratio of insecticide, herbicide and bactericide is about 60:30:10, which still lags far behind the reasonable ratio of 30:50:20 in the developed countries.

This report makes an in-depth study on all investment projects of 32 listed companies in China's fertilizer and pesticide industry from 2000 to 2008 and also makes summary of investment trends of China's fertilizer and pesticide industry as well as investment features and investment trends of the listed companies.

Project Investment of China Listed Fertilizer & Pesticide Companies, 2000-2008H1

Source: ResearchInChina

From 2000 to 2008, total investment of China's listed fertilizer and pesticide companies has been rising steadily. The investment value jumped to CNY12.81 billion in 2007 from CNY1.453 billion in 2000, among which, the biggest proportion went to Southwest China, accounting for 38.56% of the total, followed by East China, North China and Central China with a share of 29.04%, 10.4% and 9.55% respectively.

Investment Distribution of China Fertilizer and Pesticide Industry (by Region), 2000-2008

Source: ResearchInChina

This report makes an in-depth analysis on all investment projects financed by 32 listed companies in China's fertilizer and pesticide industry. For example, Sichuan Lutianhua Co., Ltd. (000912) is referred in this report.

Investment Trend of Sichuan Lutianhua Co., Ltd., 2000-2008H1

Investment Features of Sichuan Lutianhua Co., Ltd:

Main Business: production and sales of fertilizer and chemical materials; diversification direction: natural gas chemical industry and coal chemical industry.

The company's main products include urea, compound fertilizer, nitric acid, ammonium nitrate and 1,4-butanediol. Its annual production capacity of synthetic ammonia and urea reaches one million tons and 1.6 million tons respectively. It is the largest urea manufacturer in China. In the future, the company will endeavor to exploit natural gas chemical, coal chemical and phosphorus chemical field and develop methanol, 1,4-butanediol and their downstream products.

Meanwhile, the company also plans to penetrate northwestern market as part of its national layout, so as to strengthen its leading status in urea manufacturing.

Investment Distribution of Sichuan Lutianhua (by Segment), 2000-2008

Source: ResearchInChina

Note: when you purchase this report, we can update the data to the most recent quarter. |

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Investment Direction of China Fertilizer and Pesticide Industry

1.1 Overview of Fertilizer and Pesticide Industry

1.2 Features of Investment in Fertilizer and Pesticide Projects 2. Investment Direction of Listed Chemical/Nitrogenous Companies

2.1 Investment Projects of Sichuan Meifeng Chemical Industry Co., Ltd.

2.1.1 Investment Direction

2.1.2 Investment Features

2.2 Investment Projects of Shandong Luxi Chemical Co., Ltd.

2.2.1 Investment Direction

2.2.2 Investment Features

2.3 Investment Projects of Sichuan Lutianhua Co., Ltd.

2.3.1 Investment Direction

2.3.2 Investment Features

2.4 Investment Projects of Guangxi Hechi Chemical Co., Ltd.

2.4.1 Investment Direction

2.4.2 Investment Features

2.5 Investment Projects of Shaanxi Xinghua Chemical Co., Ltd.

2.5.1 Investment Direction

2.5.2 Investment Features

2.6 Investment Projects of Hubei Yihua Chemical Industry Co., Ltd.

2.6.1 Investment Direction

2.6.2 Investment Features

2.7 Investment Projects of Yun Tian Hua Co., Ltd.

2.7.1 Investment Direction

2.7.2 Investment Features

2.8 Investment Projects of Guizhou Chitianhua Co., Ltd.

2.8.1 Investment Direction

2.8.2 Investment Features

2.9 Investment Projects of JianFeng Chemicals Co., Ltd.

2.9.1 Investment Direction

2.9.2 Investment Features

2.10 Investment Projects of Hebei Cangzhou Chemical Group

2.10.1 Investment Direction

2.10.2 Investment Features

2.11 Investment Projects of Liuzhou Chemical Industry Co., Ltd.

2.11.1 Investment Direction

2.11.2 Investment Features

2.12 Investment Projects of Hunan Tianrun Chemical Development Co., Ltd.

2.12.1 Investment Direction

2.12.2 Investment Features

2.13 Investment Projects of Shandong Hualu Hengsheng Group Co., Ltd.

2.13.1 Investment Direction

2.13.2 Investment Features

2.14 Investment Projects of Batian Ecological Engineering Co., Ltd.

2.14.1 Investment Direction

2.14.2 Investment Features

2.15 Investment Projects of Jiangxi Changjiu Biochemical Co., Ltd.

2.15.1 Investment Direction

2.15.2 Investment Features

2.16 Investment Projects of Liaotong Chemical Co., Ltd.

2.16.1 Investment Direction

2.16.2 Investment Features

2.17 Investment Projects of Sichuan Chemical Works Group Ltd.

2.17.1 Investment Direction

2.17.2 Investment Features 3. Investment Direction of Listed P and K Fertilizer Companies

3.1 Investment Projects of Liuguo Chemical Industry Co., Ltd.

3.1.1 Investment Direction

3.1.2 Investment Features

3.2 Investment Projects of Shandong Lubei Enterprise Group General Company

3.2.1 Investment Direction

3.2.2 Investment Features

3.3 Investment Projects of Qinghai Sat Lake Potash Fertilizer Co., Ltd.

3.3.1 Investment Direction

3.3.2 Investment Features 4. Investment Direction of Listed Pesticide Companies

4.1 Investment Projects of Hunan Haili chemical industry stock Co., Ltd.

4.1.1 Investment Direction

4.1.2 Investment Features

4.2 Investment Projects of Shandong Dacheng Pesticide Co., Ltd.

4.2.1 Investment Direction

4.2.2 Investment Features

4.3 Investment Projects of Hubei Sanonda Co., Ltd.

4.3.1 Investment Direction

4.3.2 Investment Features

4.4 Investment Projects of Nantong Jiangshan Agochemical & Chemical Co., Ltd.

4.4.1 Investment Direction

4.4.2 Investment Features

4.5 Investment Projects of Shandong Victory Co., Ltd.

4.5.1 Investment Direction

4.5.2 Investment Features

4.6 Investment Projects of Jiangsu Red Sun Group

4.6.1 Investment Direction

4.6.2 Investment Features

4.7 Investment Projects of Zhejiang Xin'an Chemical Industrial Group Co., Ltd.

4.7.1 Investment Direction

4.7.2 Investment Features

4.8 Investment Projects of Anhui Huaxing Chemical Industry Co., Ltd.

4.8.1 Investment Direction

4.8.2 Investment Features

4.9 Investment Projects of Zhejiang Shenghua Biok Biology Co., Ltd

4.9.1 Investment Direction

4.9.2 Investment Features

4.10 Investment Projects of Noposion Co., Ltd.

4.10.1 Investment Direction

4.10.2 Investment Features

4.11 Investment Projects of Jiangsu Yangnong Chemical Co., Ltd.

4.11.1 Investment Direction

4.11.2 Investment Features

4.12 Investment Projects of Shandong Huayang Technology Co., Ltd.

4.12.1 Investment Direction

4.12.2 Investment Features

|

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Annual Investment of Listed Firms in Fertilizer and Pesticide Industry, 2000-2008

Investment Distribution of Listed Firms in the Industry (by region), 2000-1H2008

Top 10 Regions in Terms of Investment of Listed Firms in the Industry, 2000-2008

Investment Distribution of Listed Firms in the Industry (by Region), 2000-2008

Top 10 Companies in Terms of Investment (by Investment Purpose), 2000-2008

Top 10 Companies in Terms of Investment Distribution (by Purpose), 2000-2008

Investment of Listed Firms in the Industry by Segmented Industry, 2000-2008

Investment Distribution of Listed Firms by Segmented Industry, 2000-2008

Top 10 Companies in Terms of Investment in the Industry, 2000-2008

Investment by Non Fund Raising of Listed Firms in the Industry, 2006Q1-2008Q2

Investment by Non Fund Raising of Listed Firms by Region, 2006Q1-2008Q2

Top 5 Regions in Terms of Non Fund Raising Investment, 2006Q1-2008Q2

Top 5 Companies in Terms of Non Fund Raising Investment, 2006Q1-2008Q2

Top 5 Firms in Terms of Non Fund Raising Investment (by Segmented Industry), 2006Q1-2008Q2

Annual Investment of Sichuan Meifeng Chemical Industry Co., Ltd., 2000-2008

Sichuan Meifeng Investment Distribution by Region, 2000-2008

Sichuan Meifeng Investment Distribution by Investment Purpose, 2000-2008

Sichuan Meifeng Investment by Main Investment Purpose, 2000-2008

Sichuan Meifeng Investment Distribution by Segmented Industry, 2000-2008

Sichuan Meifeng Investment by Main Segmented Industry, 2000-2008

Sichuan Meifeng Main Investment Projects, 2000-2008

Sichuan Meifeng Latest Investment Projects, 2000-2008

Sichuan Meifeng Main M&A Projects, 2000-2008

Annual Investment of Shandong Luxi Chemical Co., Ltd., 2000-2008

Shandong Luxi Investment Distribution by Region, 2000-2008

Shandong Luxi Investment Distribution by Investment Purpose, 2000-2008

Shandong Luxi Investment by Main Investment Purpose, 2000-2008

Shandong Luxi Investment Distribution by Segmented Industry, 2000-2008

Shandong Luxi Investment by Main Segment Industry, 2000-2008

Shandong Luxi Main Investment Projects, 2000-2008

Shandong Luxi Latest Investment Projects, 2000-2008

Shandong Luxi Main M&A Projects, 2000-2008

Annual Investment of Sichuan Lutianhua Co., Ltd., 2000-2008

Sichuan Lutianhua Investment Distribution by Region, 2000-2008

Sichuan Lutianhua Investment Distribution by Investment Purpose, 2000-2008

Sichuan Lutianhua Investment by Main Investment Purpose, 2000-2008

Sichuan Lutianhua Investment Distribution by Segmented Industry, 2000-2008

Sichuan Lutianhua Investment by Main Segmented Industry, 2000-2008

Sichuan Lutianhua Main Investment Projects, 2000-2008

Sichuan Lutianhua Latest Investment Projects, 2000-2008

Annual Investment of Guangxi Hechi Chemical Co., Ltd., 2000-2008

Guangxi Hechi Investment Distribution by Region, 2000-2008

Guangxi Hechi Investment Distribution by Investment Purpose, 2000-2008

Guangxi Hechi Investment by Main Investment Purpose, 2000-2008

Guangxi Hechi Investment Distribution by Segmented Industry, 2000-2008

Guangxi Hechi Investment by Main Segmented Industry, 2000-2008

Guangxi Hechi Main Investment Projects, 2000-2008

Guangxi Hechi Latest Investment Projects, 2000-2008

Guangxi Hechi Main M&A Projects, 2000-2008

Annual Investment of Shaanxi Xinghua Chemical Co., Ltd., 2000-2008

Shaanxi Xinghua Investment Distribution by Region, 2000-2008

Shaanxi Xinghua Investment Distribution by Investment Purpose, 2000-2008

Shaanxi Xinghua Investment by Main Investment Purpose, 2000-2008

Shaanxi Xinghua Investment Distribution by Segmented Industry, 2000-2008

Shaanxi Xinghua Investment by Main Segmented Industry, 2000-2008

Shaanxi Xinghua Main Investment Projects, 2000-2008

Shaanxi Xinghua Latest Investment Projects, 2000-2008

Shaanxi Xinghua Main M&A Projects, 2000-2008

Annual Investment of Hubei Yihua Chemical Industry Co., Ltd., 2000-2008

Hubei Yihua Investment Distribution by Region, 2000-2008

Hubei Yihua Investment Distribution by Investment Purpose, 2000-2008

Hubei Yihua Investment by Main Investment Purpose, 2000-2008

Hubei Yihua Investment Distribution by Segmented Industry, 2000-2008

Hubei Yihua Investment by Main Segmented Industry, 2000-2008

Hubei Yihua Main Investment Projects, 2000-2008

Hubei Yihua Latest Investment Projects, 2000-2008

Hubei Yihua Main M&A Projects, 2000-2008

Annual Investment Yun Tian Hua Co., Ltd., 2000-2008

Yun Tian Hua Investment Distribution by Region, 2000-2008

Yun Tian Hua Investment Distribution by Investment Purpose, 2000-2008

Yun Tian Hua Investment by Main Investment Purpose, 2000-2008

Yun Tian Hua Investment Distribution by Segment Industry, 2000-2008

Yun Tian Hua Investment by Main Segment Industry, 2000-2008

Yun Tian Hua Main Investment Projects, 2000-2008

Yun Tian Hua Latest Investment Projects, 2000-2008

Yun Tian Hua Main M&A Projects, 2000-2008

|

2005-2008 www.researchinchina.com All Rights Reserved

|