The development of Information Technology (IT) helps to improve info creativity and tech innovation, and to accelerate info spreading. With a better than ever circumstance offered by IT, informationization and cyberization in China's banking are developing rapidly nowadays.

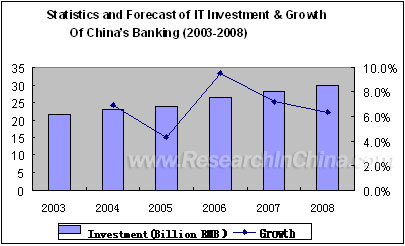

China's financing system is facing an epochal reformation. Due to the global competition, reformation on shareholding structure and the trend of multiple banking, China's financing industry is in great need of informationization. The total investment in IT from banking reached RMB 23 billion.

The history of China's banking informationization can trace back to the late 70's last century. People were accustomed to call informationization "electronic" before 2000, focusing much more on computer processing business; After 2000, the word "informationization" takes the place of "electronic", which means new and further application of IT appears in banking along with the new market atmosphere and the announcement of new policy. The reformation on shareholding system of China's four biggest commercial banks is not only a revolution from state-owed banks to modernized banks, but also a kind of motive to achieve banking informationization. Furthermore more demands will arise together with multiple banking services. It is forecasted that the total investment in China's banking informationization will be as much as RMB 30 billion.

Hot points in development of China's banking IT may include the following: for instance the development and popularization of China's modern payment system, the adoption and popularization of individual credit system, the constructer of banking supervisor system, the use of risk management IT system in joint-stock commercial banks, the set up of failed-over system, the network build-up of rural credit cooperatives and comprehensive business structure of new generation, ITSM consultation and implementation, trial promotion programs of the EMV transfer and commercial tax control, the informationization of management decision, and integration of banking application.

Enterprise Application Integration (EAI) is essential in the progress of banking information. By means of integration with applications and the functions, it unifies and automates business flows.

EAI, as an importance means of application integration, has been used successfully in China's main banks such as Citic Industrial Bank. It is believed that the more people use it, the better it will perform in banking informationization procedure. The market attitude toward EAI has been changed from "accepting such conception" (the initial phase) to "actively popularizing such production" (the developing phase). EAI breaks the info bulwark among different applications, setting up IT resource share and a high-speed business info linkage. And finally it automatically completes the core business flow across applications, networks, regions and branches. The basic strategy adopted in banking EAI integration can be Proof of Concept (POC).

This report surveys on status quo of "integrated" state-owed banks, joint-stock commercial banks, city commercial banks and rural trust cooperatives and analyses the key market demand for EAI through a wide view angle from service mode change, system data share, personnel cooperation and Swift standard application to service channel integration. It explains the status quo of applying EAI in China's banking, including market scale, market phase and related application characteristics. It forecasts EAI market trend in China's banking for 2006-2008 and analyses the competition structure and assess the main producers' competitive, offering you an important clue before making a decision.

|