| |

|

|

Along with the fast-progressing internet and mobile network in recent years, various kinds of e-commerce emerged, which makes people's life more convenient and colorful. Online payment and mobile payment, being incentive to further development of e-commerce, will become the main payment means of e-commerce by and by.

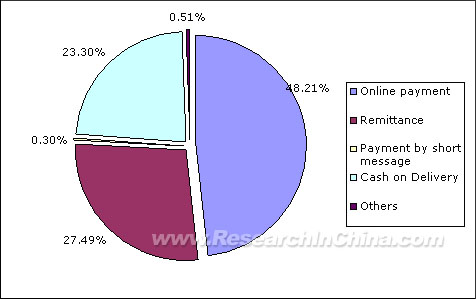

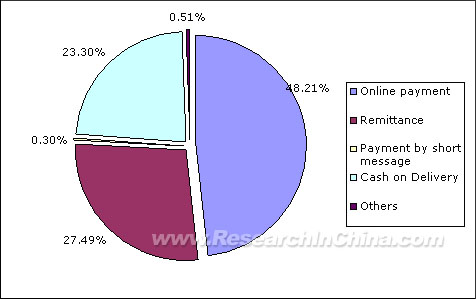

Payment Options for Online Shopping

According to business mode, online payment can be divided into pre-payment, agency payment, online banking payment and online platform payment. Of which, online platform payment undertaken by online payment platform operator, being an third-party economic entity independent from bank and SP, acts as the role connect users, banks and SPs.

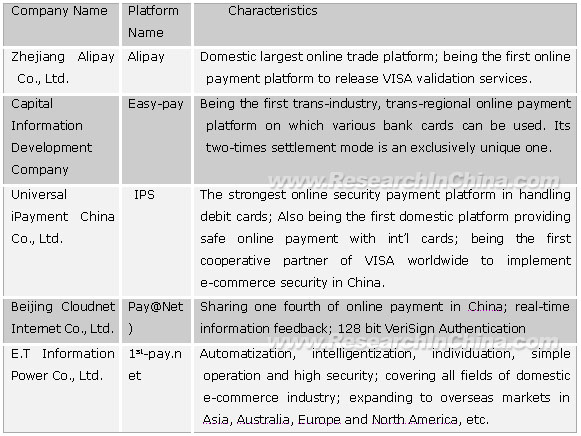

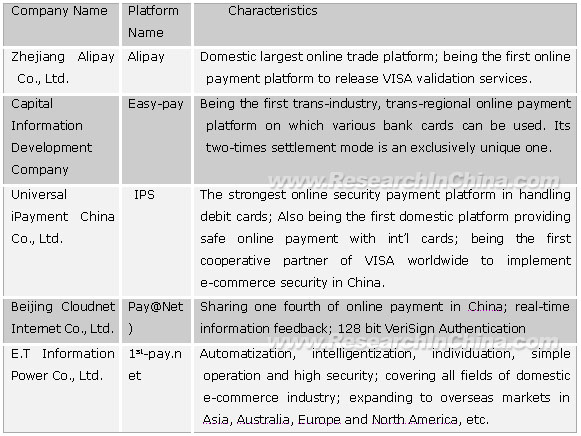

Major Chinese Online Payment Platform Operators

The domestic online payment is mainly based on the debit card system. Thus, risks in online payment can be controlled effectively. But meanwhile, the profit of domestic payment service is also quite low, only taking 0.5% of total trading volume.

Nowadays, the industrialization of mobile payment application emerges as handsets gradually replace cash and credit card in the payment of some shops and automatic seller machines. At present, bank card circulation and handset users have increased to over 0.76 billion and 0.3 billion respectively in China, offering boundless commercial opportunities for the development of mobile payment industry in China. With the prevalence of mobile content and application charges based on SMS, mobile payment has been accepted by and by. However, in-depth applications of mobile payment still need to be cultivated.

Currently, there are five access methods of mobile payment: STK, IVR (Interactive Voice Response), USSD, WAP and WWW. Of which, IVR, STK and WWW are mainly adopted.

Mobile payment business mode has four categories: mobile paying service, mobile wallet service, mobile banking service and mobile credit platform. The former three have been practically applied.

Abide by different roles, mobile payment industrial chain can be divided into three categories: mobile operators-based industrial chain, bank-based industrial chain and the one led by mobile payment operators. The cooperation of mobile operators and banks, with mobile payment platform operated by professional companies, can avoid inherent obstacles in information security, product development and resource sharing, etc. when third-party payment platform providers join in. Also it can realize the sharing and management of financial information service and banks' intermediate businesses; and satisfy to the maximum the great demand of users for mobile payment service and information security. Thereby, it is the most suitable business mode for mobile payment development in China.

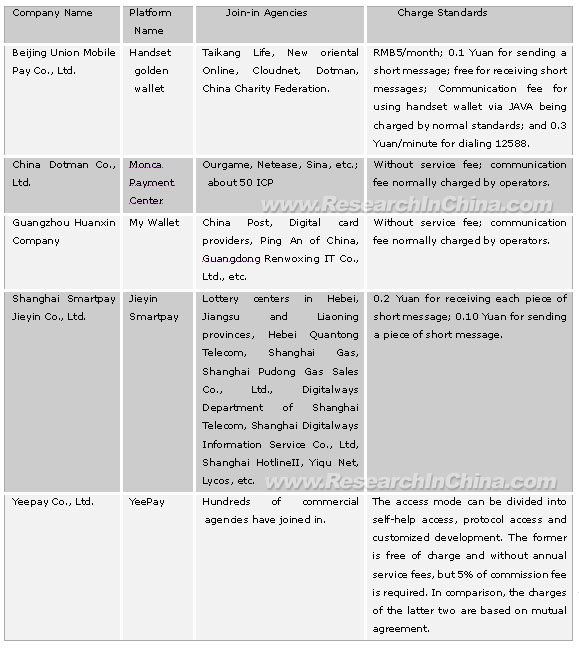

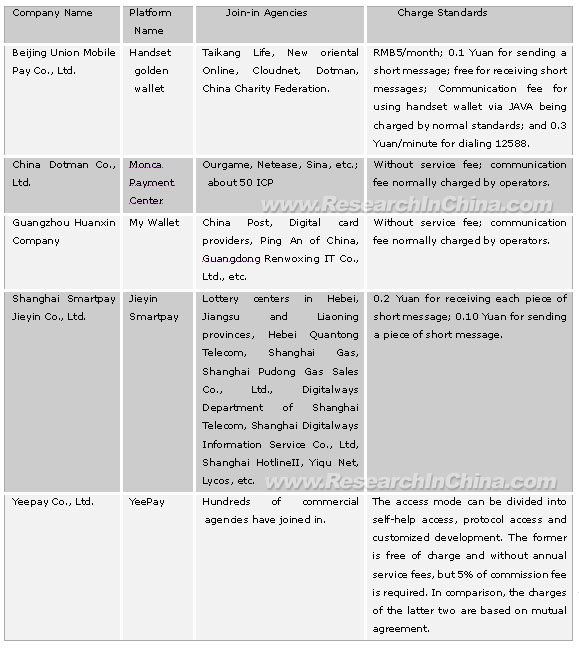

Major Chinese Mobile Payment Platform Operators

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Along with the fast-progressing internet and mobile network in recent years, various kinds of e-commerce emerged, which makes people's life more convenient and colorful. Online payment and mobile payment, being incentive to further development of e-commerce, will become the main payment means of e-commerce by and by.

Payment Options for Online Shopping

According to business mode, online payment can be divided into pre-payment, agency payment, online banking payment and online platform payment. Of which, online platform payment undertaken by online payment platform operator, being an third-party economic entity independent from bank and SP, acts as the role connect users, banks and SPs.

Major Chinese Online Payment Platform Operators

The domestic online payment is mainly based on the debit card system. Thus, risks in online payment can be controlled effectively. But meanwhile, the profit of domestic payment service is also quite low, only taking 0.5% of total trading volume.

Nowadays, the industrialization of mobile payment application emerges as handsets gradually replace cash and credit card in the payment of some shops and automatic seller machines. At present, bank card circulation and handset users have increased to over 0.76 billion and 0.3 billion respectively in China, offering boundless commercial opportunities for the development of mobile payment industry in China. With the prevalence of mobile content and application charges based on SMS, mobile payment has been accepted by and by. However, in-depth applications of mobile payment still need to be cultivated.

Currently, there are five access methods of mobile payment: STK, IVR (Interactive Voice Response), USSD, WAP and WWW. Of which, IVR, STK and WWW are mainly adopted.

Mobile payment business mode has four categories: mobile paying service, mobile wallet service, mobile banking service and mobile credit platform. The former three have been practically applied.

Abide by different roles, mobile payment industrial chain can be divided into three categories: mobile operators-based industrial chain, bank-based industrial chain and the one led by mobile payment operators. The cooperation of mobile operators and banks, with mobile payment platform operated by professional companies, can avoid inherent obstacles in information security, product development and resource sharing, etc. when third-party payment platform providers join in. Also it can realize the sharing and management of financial information service and banks' intermediate businesses; and satisfy to the maximum the great demand of users for mobile payment service and information security. Thereby, it is the most suitable business mode for mobile payment development in China.

Major Chinese Mobile Payment Platform Operators

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1 Overview of mobile & online payment industry

1.1 Mobile payment

1.2 Online payment2 Mobile/online payment varieties and business flows

2.1 Classification of mobile payment

2.1.1 Mobile payment varieties by access method

2.1.2 Mobile payment varieties by business mode

2.1.2.1 Handset payment business

2.1.2.2 Handset wallet business

2.1.2.3 Handset banking business

2.1.2.4 Handset credit platform business

2.2 Mobile payment flow

2.3 Classification and work flow of online payment

2.3.1 Varieties by payment amount

2.3.2 Varieties by payment time

2.3.3 Varieties by business mode

2.4 Applications of various e-commerce payments 3 Mobile/online payment market development

3.1 Mobile payment market

3.1.1 Mobile payment development worldwide

3.1.1.1 Development of handset wallet

3.1.1.2 Development of handset banking

3.1.1.3 Combination of Japanese handsets with RFIC

3.1.2 Mobile payment development in China

3.2 Online payment market

3.2.1 Paypal development in America

3.2.2 Development of online payment in China 4 Macro-environment of mobile payment market in China

4.1 Positive factors to develop mobile/online payment in China

4.2 Negative factors

4.2.1 Political aspect

4.2.2 Economic aspect

4.2.3 Security aspect

4.2.4 Consumer culture aspect

4.2.5 Technical aspect

4.2.6 Industrial chain aspect

4.3 Brief summary 5 Industrial chain of mobile/online payment in China

5.1 Industrial chain of mobile payment

5.1.1 Types of industrial chain

5.1.1.1 Industrial chain led by mobile operators

5.1.1.2 Industrial chain led by banks

5.1.1.3 Industrial chain led by mobile payment platform operators

5.1.2 Development trend of industrial chains

5.1.3 Development strategies of mobile payment operators and bank developments

5.1.3.1 Development strategy of China Mobile

5.1.3.2 Development strategy of China Unicom

5.1.3.3 Development strategy of banks for mobile payment

5.2 Industrial chain of online payment 6 Mobile operators and mobile payment

6.1 China Mobile's progression in mobile payment market

6.2 China Unicom's progression in mobile payment market 7 Major domestic mobile/online payment providers

7.1 Mobile payment platform operators

7.1.1 Beijing Union Mobile Pay Co., Ltd.

7.1.2 China Dotman Co., Ltd.

7.1.3 Golden China Co., Ltd.

7.1.4 Shanghai Smartpay Jieyin Co., Ltd.

7.1.5 Yeepay Co., Ltd.

7.1.6 LianLongBoTong Co., Ltd.

7.2 Online payment platform operators

7.2.1 Zhejiang Alipay Co., Ltd.

7.2.1.1 Corporate overview

7.2.1.2 Brief introduction to Alipay platform

7.2.1.3 Payment flow of Taobao's Alipay

7.2.2 Capital Information Development Company

7.2.2.1 Corporate overview

7.2.2.2 Introduction to Capinfo Easy-pay platform

7.2.2.3 Transaction flows of Capinfo B2C online payment

7.2.3 Universal iPayment China Co., Ltd.

7.2.4 Beijing Cloudnet Internet Co., Ltd.

7.2.5 E.T Information Power Co., Ltd.

7.3 Payment system providers

7.3.1 Suntek Technology Co., Ltd.

7.3.2 Bewinner Communication

7.3.3 Unisphere Networks

7.3.4 LianLongBoTong Co., Ltd.

7.3.5 Etonenet

7.3.6 Huawei Technology

7.3.7 Pay365

7.4 Brief summary 8 Foreign mobile payment providers

8.1 Mobipay

8.2 Simpay

8.3 PayBox

8.4 NTT DoCoMo

8.5 SK Telecom

8.6 KTF

8.7 IBM

8.8 Nokia

8.9 HP

8.10 Ericsson

8.11 Frontline Technologies (China) Co., Ltd.

8.12 Motorola

|

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Proportion of online payment in online shopping

Payment modes for users when online shopping

Main structure of USSD system

Mobile payment flow

Prevalent mobile payment flow

Mobile framework of mobile payment

Pre-paid card payment flow

Agency payment flow

Online payment flow of China's Merchants Bank

Payment flow of online payment platform

Proportion of various e-commerce payments by diverse services

Proportion of various e-commerce payments by different regions

Industrial chain led by mobile operators

Industrial chain led by banks

Industrial chain led by mobile payment platform operators

Overall development of industrial chains

Mutual development of operators and banks

Logic framework of Golden Wallet Platform

Business process of Golden Wallet Platform

Payment flow of Alipay platform

Transaction flows of Capinfo B2C online payment

Online payment flow of Pay@Net

Business composition and gross profit margin of Suntek Technology

Operating revenue and costs of Suntek Technology

Framework of Bewinner mobile payment system

Ticket booking system of Unisphere Networks

Payment platform system of Unisphere Networks

Topological structure of MDCL mobile small-amount payment system

Systematic structure of mobile small-amount payment system

Comparison between USSD and SMS

Varieties of mobile payment

Varieties of online payment

Economic indicators of PayPal in 2005

Negative factors in security

Affected factors in mobile/online payment in China

Types and characteristics of mobile payment industrial chain

Contrastive analysis on mobile payment business

Major customers of Beijing Union Mobile Pay Co., Ltd.

Cooperative partners of Shanghai Smartpay Jieyin Co., Ltd.

Introduction to main business of YeePay platform

Charges of YeePay platform

Card categories supported by YeePay platform

Functions of Alipay platform

Introduction to product series of Pay@Net

Beijing Cloudnet Internet Co., Ltd.

Business varieties of 1st-payment.net

Charge standards for handset golden secretary

Comparison of domestic mobile payment platform operators

Major mobile/online system providers in domestic market

Major online payment platform operators in domestic market

Distinct features of MDCL small-amount payment system

|

2005-2008 www.researchinchina.com All Rights Reserved

|