| |

|

|

1. Development trend of handset-purpose display direct the way of medium-small sized panel technologies for the future

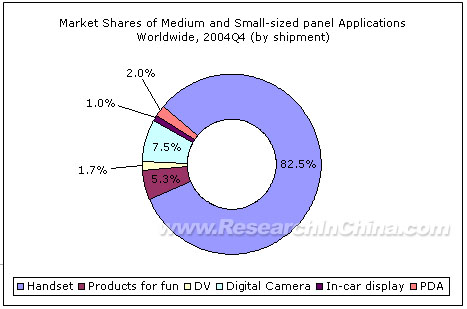

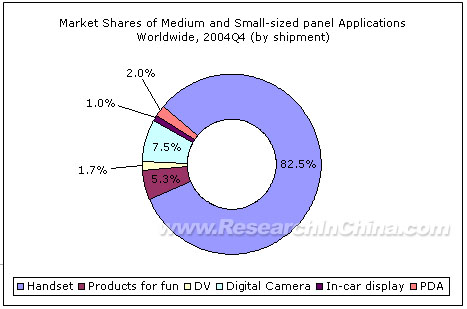

From the figure above, a big portion of medium-small sized panels are applied in the mobile phone field. Considering long-term demand potential, handset-purpose panels will continue its fastest growth among all related products.

In 2005, the global handset market increased to about 700 million units, with a growth rate of 10% or so. If a handset is equipped with a display (excluding double-display phone models), the mobile phone market is, undoubtedly, the largest potential market for medium-small sized display. Therefore, the development trend of handset-purpose display direct the way of medium-small sized panel technologies for the future.

2. TFT-LCD will be the leading technology in the application field of mobile phones

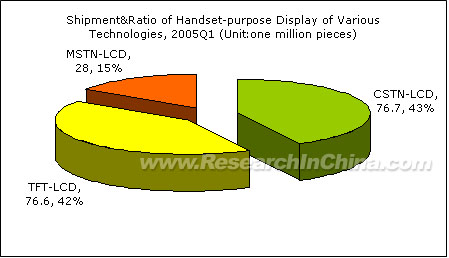

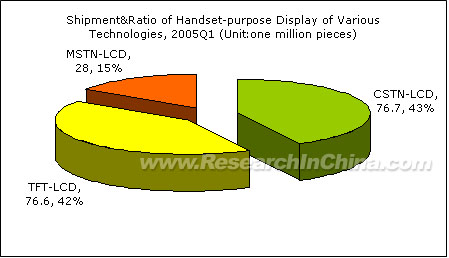

In 1Q, 2005, the global shipment of handset main screen reached about 181 million pieces. Of which, TFT-LCD and CSTN enjoy nearly equal shares. The ratio of TFT-LCD applications in mobile phones was approximate to 46% in whole year 2005, ten percent higher compared to 36% in 2004. As estimated in 2008, the figure will rise to 59%. Among newly-released handsets in 2004, more than 36% mobile phones of world’s top handset manufacturers were equipped with TFT-LCD panels. Of which, Nokia reached 67%; Motorola 71%; Samsung and SonyEricsson 80% Respectively; even Sharp 100%. It is the general trend of handset-purpose TFT-LCD to replace CSTN-LCD by and by.

3. Auto display market enjoys the largest development potential

In general, auto display market (including STN, TFT, VFD and OLED) grew by 10% in 2005 compared to 2004, which was attributable to the gradual prevalence of a-Si TFT display applications in automotive market. As rapid progression of in-car applications such as navigation system and back-seat entertainment system, a-Si TFT display amount increased by 13% during 2004-2005.

Currently, medium-small sized LCD panel began to be applied in in-car display screen. With the rising of GPS and in-car audio-visual entertainment market, in-car display screen has been prevalent in public transportation and family-purpose vehicles, etc. In 2004, 16 percent of over 60 million cars worldwide had been equipped with in-car display screens.

For consumers, the cost of in-car display screen is far lower than purchasing an automobile. Thus, the most important factor rests with effect presentation for customers who will purchase matching fittings, with the price being the second to be considered. So, great efforts deserve to be made in high-end display technologies.

4. Traditional CSTN manufacturers began TFT production in succession

With the layout of next-generation TFT-LCD production lines on after another, and under the influence of what is called “LCD cycle”, big-sized TFT-LCD price is continuously declining. Many big-sized TFT manufacturers transformed below 4th-generation production lines into medium-small sized panel manufacturing, thus a sharp drop in the price of medium-small sized panels and promoting divers applications of medium-small sized products.

Confronted with TFT-LCD competition, many conventional CSTN manufacturers also embarked on TFT production either via purchasing TFT-LCD production lines, for instance, Taiwanese Wintek purchased 1st-generation line from Sharp and started TFT panel production in 4Q, 2004; or via assembling panels ordered from TFT-LCD makers who will then provide their clients with TFT-LCD modules, taking Samsung SDI, Picvue Electronics, Hyundai LCD and Truely Semiconductor for examples.

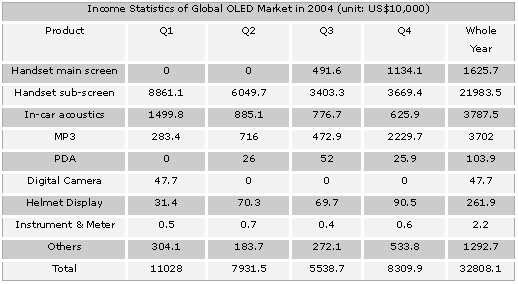

5. Due to technical bottleneck of OLED, remarkable market growth takes time.

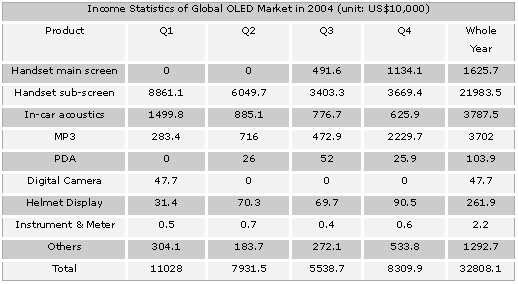

The sharp declining of OLED market lies in great changes of handset market. To begin with, a big change occurred to the appearance style of mobile phones. In 2H 2004, most handsets were designed with straight style and slide style. 1st Nokia, 4th Siemens and 5th SonyEricsson all supported straight-designed mobile phones. In contrast, 2nd largest Samsung was in favor of slide screen. Thereby, foldable handsets decreased sharply; Secondly, a change occurred to the display content of handset sub-screen. As handsets are integrated with divers functions, sub-screen can perform color pictures and mobile images instead of only time reminding. OLED are less and less used on account of its low display differentiation which is not suitable for images; thirdly, the average price of handsets dropped. Manufacturers pay more attention to cost control. Neither was OLED sub-screen competitive to TFT-LCD sub-screen nor it enjoys cost advantages over uni-color STN-LCD and multi-color STN-LCD.

OLED development deserves much consideration. Sticking to developing active OLED, the market is inevitably confined to handset main screen. At present, OLED can not be competitive with TFT-LCD, whether in cost, endurance, differentiation or in color display and power consumption. OLED shares no more market shares in short term as TFT-LCD price keeps decreasing. Sticking to developing passive OLED, the market mainly lies in fields of automobile and MP3. In two years, OLED will be unfortunately out of date because of MP3 developing towards MP4 and PMP.

Nowadays, OLED manufacturers have to focus on MP3 market and need further research on active OLED display technologies. The ultimate battlefield still lies in the market of handset main screens.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

1. Development trend of handset-purpose display direct the way of medium-small sized panel technologies for the future

From the figure above, a big portion of medium-small sized panels are applied in the mobile phone field. Considering long-term demand potential, handset-purpose panels will continue its fastest growth among all related products.

In 2005, the global handset market increased to about 700 million units, with a growth rate of 10% or so. If a handset is equipped with a display (excluding double-display phone models), the mobile phone market is, undoubtedly, the largest potential market for medium-small sized display. Therefore, the development trend of handset-purpose display direct the way of medium-small sized panel technologies for the future.

2. TFT-LCD will be the leading technology in the application field of mobile phones

In 1Q, 2005, the global shipment of handset main screen reached about 181 million pieces. Of which, TFT-LCD and CSTN enjoy nearly equal shares. The ratio of TFT-LCD applications in mobile phones was approximate to 46% in whole year 2005, ten percent higher compared to 36% in 2004. As estimated in 2008, the figure will rise to 59%. Among newly-released handsets in 2004, more than 36% mobile phones of world’s top handset manufacturers were equipped with TFT-LCD panels. Of which, Nokia reached 67%; Motorola 71%; Samsung and SonyEricsson 80% Respectively; even Sharp 100%. It is the general trend of handset-purpose TFT-LCD to replace CSTN-LCD by and by.

3. Auto display market enjoys the largest development potential

In general, auto display market (including STN, TFT, VFD and OLED) grew by 10% in 2005 compared to 2004, which was attributable to the gradual prevalence of a-Si TFT display applications in automotive market. As rapid progression of in-car applications such as navigation system and back-seat entertainment system, a-Si TFT display amount increased by 13% during 2004-2005.

Currently, medium-small sized LCD panel began to be applied in in-car display screen. With the rising of GPS and in-car audio-visual entertainment market, in-car display screen has been prevalent in public transportation and family-purpose vehicles, etc. In 2004, 16 percent of over 60 million cars worldwide had been equipped with in-car display screens.

For consumers, the cost of in-car display screen is far lower than purchasing an automobile. Thus, the most important factor rests with effect presentation for customers who will purchase matching fittings, with the price being the second to be considered. So, great efforts deserve to be made in high-end display technologies.

4. Traditional CSTN manufacturers began TFT production in succession

With the layout of next-generation TFT-LCD production lines on after another, and under the influence of what is called “LCD cycle”, big-sized TFT-LCD price is continuously declining. Many big-sized TFT manufacturers transformed below 4th-generation production lines into medium-small sized panel manufacturing, thus a sharp drop in the price of medium-small sized panels and promoting divers applications of medium-small sized products.

Confronted with TFT-LCD competition, many conventional CSTN manufacturers also embarked on TFT production either via purchasing TFT-LCD production lines, for instance, Taiwanese Wintek purchased 1st-generation line from Sharp and started TFT panel production in 4Q, 2004; or via assembling panels ordered from TFT-LCD makers who will then provide their clients with TFT-LCD modules, taking Samsung SDI, Picvue Electronics, Hyundai LCD and Truely Semiconductor for examples.

5. Due to technical bottleneck of OLED, remarkable market growth takes time.

The sharp declining of OLED market lies in great changes of handset market. To begin with, a big change occurred to the appearance style of mobile phones. In 2H 2004, most handsets were designed with straight style and slide style. 1st Nokia, 4th Siemens and 5th SonyEricsson all supported straight-designed mobile phones. In contrast, 2nd largest Samsung was in favor of slide screen. Thereby, foldable handsets decreased sharply; Secondly, a change occurred to the display content of handset sub-screen. As handsets are integrated with divers functions, sub-screen can perform color pictures and mobile images instead of only time reminding. OLED are less and less used on account of its low display differentiation which is not suitable for images; thirdly, the average price of handsets dropped. Manufacturers pay more attention to cost control. Neither was OLED sub-screen competitive to TFT-LCD sub-screen nor it enjoys cost advantages over uni-color STN-LCD and multi-color STN-LCD.

OLED development deserves much consideration. Sticking to developing active OLED, the market is inevitably confined to handset main screen. At present, OLED can not be competitive with TFT-LCD, whether in cost, endurance, differentiation or in color display and power consumption. OLED shares no more market shares in short term as TFT-LCD price keeps decreasing. Sticking to developing passive OLED, the market mainly lies in fields of automobile and MP3. In two years, OLED will be unfortunately out of date because of MP3 developing towards MP4 and PMP.

Nowadays, OLED manufacturers have to focus on MP3 market and need further research on active OLED display technologies. The ultimate battlefield still lies in the market of handset main screens.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1 Industrial status and key technologies for medium-small sized display

1.1 Medium-small sized LCD technologies

1.1.1 Structure of LCD industry

1.1.2 Comparison of major technologies for medium-small sized LCD display

1.1.3 Classification & comparison of TFT-LCD technologies

1.1.4 Developments of medium-small sized LCD industry (Japan—the most powerful in CSTN production--is retreating from this field, transferring manufacturing equipment to Mainland China. Global medium-small sized TFT-LCD production is led by Japan.)

1.2 OLED

1.2.1 OLED classification (small-molecule and poly-molecule OLED; active and passive OLED)

1.2.3 Performance comparison between OLED and LCD

1.3 VFD

1.3.1 Structure & principles of VFD

1.3.2 Current status of VFD industry 2 Medium-small sized display market status and development trend

2.1 Market status of medium-small sized panel applications worldwide

2.2 Market shares of divers display technologies

2.3 Product applications in major fields

2.3.1 Mobile phone

(CSTN and TFT-LCD being the mainstream at present; display screens of newly-released handset worldwide in 2004 are led by TFT; 3G development encourages handset display screen to be bigger, quicker and clearer.)

2.3.2 In-car display market (Current status of in-car display market; in-car display sizes and differentiation ratio)

2.3.3 DV, DC and PDA (led by TFT)

2.4 OLED panel market 3 Major medium-small sized display manufacturers

3.1 Leading manufacturers in medium-small sized TFT-LCD

3.1.1 Hitachi

3.1.2 Sharp

3.1.3 Casio

3.1.4 ST LCD

3.1.5 Toshiba-Panasonic Display Tech Co.

3.1.6 Sanyo-Epson Image Units Co.

3.1.7 Samsung electronic

3.1.8 AU Optronics Corp

3.1.9 Toppoly

3.1.10 Philips semiconductor

3.1.11 Prime View International

3.1.12 Others

3.2 Leading manufacturers in medium-small sized TFT-LCD

3.2.1 Shenghua tech

3.2.2 Tianma

3.2.3 Hyundai LCD

3.2.4 Picvue Electronics

3.2.5 Samsung SDI (including OLED、VFD)

3.2.6 Huasheng Tech

3.2.7 Trulysemi

3.2.8 Lanser DisplayTech, Changchun

3.2.9 Quantai

3.2.10 AUO

3.2.11 Optrex

3.3 Major OLED manufacturers

3.3.1 Pioneer

3.3.2 RiTdisplay

3.3.3 OPTO

3.4 Major VFD manufacturers

3.4.1 Futaba

3.4.2 Shanghai Samsung Vacuum Device (SSVD)

3.4.3 ZBOE

3.4.4 Shanghai Zhongying Vacuum Fluorescent Display Co., Ltd. 4 Handset-use display panel drive IC industry and market status

4.1 Small-sized panel drive IC industry

4.1.1 Major drive IC manufacturers

4.1.2 Requirements for small-sized TFT-LCD drive IC manufacturers

4.1.3 Interface standards for handset-use display panel driver IC

4.2 Market status of small -sized panel driver IC

4.2.1 Market shares of driver IC manufacturers

4.3 Leading manufacturers in LCD and OLED drive IC

4.3.1 Renesas

4.3.2 Solomon Systech

4.3.3 Leadis

4.3.4 Product view of other small-sized TFT-LCD drive IC manufacturers 5 Conclusions and viewpoints

|

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Performance merits & demerits of medium-small sized color LCD panel

Technical principles of a-Si TFT-LCD and LTPS TFT-LCD

Cost structure comparison of 17-inch and 1.8-inch TFT-LCD

Statistics on output of major medium-small sized TFT-LCD panel manufacturers worldwide

Applications and technical restrictions of OLED display panel

Current OLED products and OLED panel suppliers

Price trend of handset-use display panel of different technologies

Total revenue of global OLED market in 2004

TFT-LCD production line of Hitachi Display

Various production lines of Hitachi Display

Handset-purpose display products of Hitachi Display

DSC display products of Hitachi Display

Hitachi's display products for outdoor facilities

Sharp's TFT-LCD production line

Sharp's small-sized LCD factories

Handset-use small-sized LCD products of Sharp

Portable AV-use medium-small sized LCD products of Sharp

Sharp's medium-small sized LCD products for FA and other products

Handset-use LCD products of Casio

Casio's LCD products for DCS and vidicon

Casio's LCD products for image information, FA testing equipment and fun electronics

ST's LCD products for PDA, DSC and handset

DSC-use LCD products

TFT-LCD production line of TMD

TMD's display products for handset and PDA

TMD's display products for car navigation and AV

LCD production line of Sanyo Epson

Sanyo Epson's display products for handset and mobile terminal

Car-use display products of Sanyo Epson

Sanyo Epson's display products for mini-type AV equipment

3D display products planned by Sanyo Epson

Overview of all TFT-LCD production lines in Japan

Handset-use TFT-LCD products of Samsung Electronics

Handset-use LCD products of AUO

AUO's LCD products for digital camera and photography

AUO's LCD products for automobile and portable DVD

TFT-LCD production line of AUO

Handset-use TFT-LCD products of Toppoly

Toppoly's TFT-LCD products for digital camera

PDA-use LCD products of Toppoly

Toppoly's display products for vehicles

Total income and gross profit of Prime View International

Product series of Prime View International (common)

Product series of Prime View International (wide)

Downstream manufacturers related to products of Prime View International

TFT-LCD production line of NEC LCD

Statistics& forecast of Shenghua Tech’s revenue from each product category, 2003-2005

Production lines of Shenghua Tech

Color STN-LCD products of Shenghua Tech

TFT-LCD products of Shenghua Tech

Statistics on gross profit margins of Tianma, 2002-2004

Handset-use LCD products of Tianma

LCD production line of Hyundai

Color STN-LCD products of Hyundai

General view of TFT-LCD module products

LCD production line of Picvue

Handset-use LCD products of Picvue

Color STN single display products of Picvue

Color STN dual display products of Picvue

LCD production line of Samsung SDI

LCD shipment of Samsung SDI

OLED products of Samsung SDI

LCD production line of Huasheng Technology

Standard products of Huasheng Technology

Product categories and production capacity of Trulysemi

Production lines of Trulysemi

Handset-use LCD products of Trulysemi

STN-LCD products of Lanser DisplayTech, Changchun for handset main screen

Downstream manufacturers related to products of Quantai

Current STN panel production line of AUO

TFT-LCD products of Optrex

CSTN-LCD products of Optrex

TFT panel series of Pioneer

Other products of RiTdisplay

Handset-use products of RiTdisplay

Production bases of RiTdisplay

Relation between handset panel suppliers, drive IC manufacturers& handset manufacturers

Small-sized TFT-LCD single chip drive IC products of Renesas

Small-sized TFT-LCD door drive IC products of Renesas

Small-sized TFT-LCD original drive IC products of Renesas

Small-sized TFT-LCD (with EMS memory) original drive IC products of Renesas

|

2005-2008 www.researchinchina.com All Rights Reserved

|