| |

|

|

This report comprehensively analyzes 7 mobile storage chip makers, 11 flash memory card makers and the existing 5 Microdrive makers. It also elaborates the trends and competition of flash memory and Microdrive markets.

1. Current competition between flash memory and Microdrive focuses on 2GB: Microdrives dominate 2GB+ market while flash cards occupy 2GB- market.

The advantage of Microdrives against flash memories lies in the capacity-to-price ratio. Due to constant decreasing on price and increasing on capacity of flash memories, Microdrives lost the advantage concerning capacity/price ratio in the 1-2GB market and below. Thus the development direction for Microdrive should be high capacity. Taking into account the current situation, only in the 2GB+ market can Microdrives be competitive. This has been proved by Apple’s iPod mini MP3 players, which adopt Hitachi's 1-inch Microdrives with capacities of 4GB and 6GB. Microdrive MP3 players with capacity below 2GB are rare now in the marketplace. Toshiba, under the pressure of decreasing price of flash memory, has given up its 0.85-inch 2GB products and turned to 4GB.

2. SD and MMC are the major two camps in the future flash memory market

Limited by its inherent constraints in capacity and compatibility, SM was rare in the marketplace in 2004 and even vanished in the configurations of new released consumer electronics in 2005. SM has been displaced by xD cards, which are mainly adopted by Olympus and Fuji's DCs. The MS series are configured in Sony’s products. MS and xD hold certain market share, but they have no big development space and will not become the mainstream.

Although CF cards had once become the mainstream, they are now not possible to be implemented on mobile phones for their own limitation of size. On top of that, CF is challenged by Microdrives in the 2GB+ market and SD in the 2GB- market. Currently, SD has taken CF's position and become the mainstream flash storage card. In the long-run, CF, whether on price or capacity, is unable to compete with microdives. CF's future seems very uncertain.

At present, SD has taken the biggest market share in mobile storage sector, followed closely by MMC, each having its own advantages. The reason why SD is so strong is that: first, SD is leading in technology and has won large market space by vigorous market promotion; second, the SD camp holds a monopoly position in the consumer electronics market, thus SD is widely adopted in digital products worldwide. But MMC has its advantage of open standard and no patent fees charged, which is very competitive in the market. Moreover, as the MMC camp strengthens their market promotion, MMC has won support from the majority of mobile phone makers such as Nokia, Samsung, LG and Siemens. In China market, MMCA acts even more diligently. Some Chinese mobile phone manufacturers have shown great interest in MMC cards. The government and operators also think highly of MMC's open standard. Konka is the first Chinese mainland mobile phone maker to join MMCA, while TCL, OKWAP, CECT, Lonovo and Dopod have released their models with MMC card embedded. From the very beginning, SDA has laid special stress on copyright protection. And also MMCA will release their version 2.0 with comprehensive encryption function in 2005. Competition in the future mobile storage market will be the two camps centering on low-cost, security and high-speed functions. And Chinese companies are more concerned about cost, and at the same time, they are more willing to adopt open standard. Thus MMC is predicted to be more popular in China.

3. T-Flash rises suddenly as a new force in the mobile phone storage market. The future will be dominated by T-Flash, RS-MMC and miniSD.

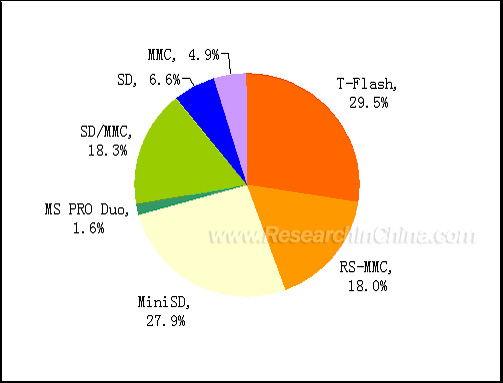

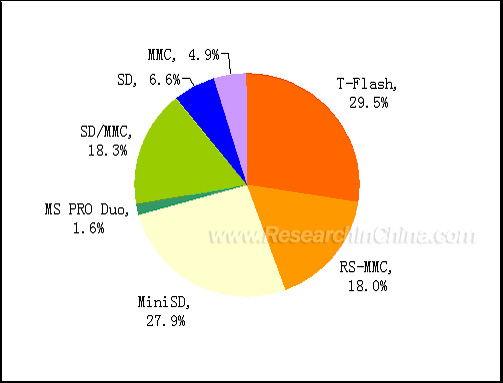

Market Share of Various Storage Cards in Newly-Released Phones in China, 2005

T-Flash card released by SanDisk in 2004 is currently is the smallest storage card in size. As soon as it was released, it won support from such big makers as Motorola and Samsung and soon gained the dominant position in the market. Among the newly-released phones with storage cards surveyed in 2005, T-Flash accounted for 29.5%, miniSD 27.9% and RS-MMC 18%, making a total of 75.4%. Sony's memory stick is mainly adopted by Sony Ericsson, which is gradually turning to middle- and low-end products. Thus the proportion of expensive Sony memory stick will not increase but decline. Memory stick will not widely used in mobile phones in the future. In view of the features of mobile phones, mobile phone storage devices will be smaller and less power-consumption. Thus standard SD and MMC will fade out from the future mobile phone storage card market.

4. 1-inch hard disk is more promising than 0.85-inch hard disk

At present, 0.85-inch hard drives are expensive but with small capacity, while flash memories are decreasing in price and increasing in capacity, posing great pressure on 0.85-inch hard disk. 0.85-inch hard disk's advantage in size makes it target on mobile phones, however, large capacity storage requirement on mobile phones doesn't occur. Currently, big capacity with small size storage demand mainly comes from multimedia players. However, portable multimedia players don't have the critical requirement of size as mobile phones do; therefore, the size advantage of 0.85-inch Microdrives is not so outstanding in multimedia player market. This explains why Hitachi Global Storage Technologies and Seagate Technology prefer 1-inch Microdrive to 0.85-inch Microdrive. 1-inch Microdrives have higher capacity/price ratio. On June 8 2005, Seagate released a 1-inch 8GB hard disk with higher speed and better performance, further expanding the gap between hard disk and flash memory. Whereas, the capacity of 0.85-inch hard disk is hard to increase, and will soon feel the pressure from flash memory.

5. Mobile phones with Microdrives may be as popular as iPod

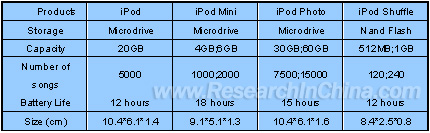

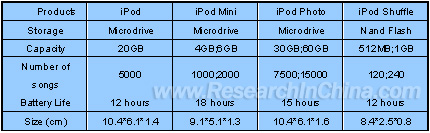

Apple's iPod Products Configurations

The future of Microdrive on mobile phones depends on whether it can copy the pattern of iPod hard disk MP3 players. We argue that just like hard disk and flash memory products co-exist on the MP3 player market, it will be the same on mobile phone storage market. Microdrive must take the direction of large capacity on mobile phones. Currently, Samsung and Nokia have released their Microdrive mobile phones: V5400 and N91 with capacity 1.5GB and 4GB respectively. Hitachi and Toshiba’s perpendicular recording technology will make 1-inch Microdrive leap in capacity. We forecast 10GB, or even 20GB Microdrives will occur in the coming 1 to 3 years. This creates condition for the development of Microdrive phones.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

This report comprehensively analyzes 7 mobile storage chip makers, 11 flash memory card makers and the existing 5 Microdrive makers. It also elaborates the trends and competition of flash memory and Microdrive markets.

1. Current competition between flash memory and Microdrive focuses on 2GB: Microdrives dominate 2GB+ market while flash cards occupy 2GB- market.

The advantage of Microdrives against flash memories lies in the capacity-to-price ratio. Due to constant decreasing on price and increasing on capacity of flash memories, Microdrives lost the advantage concerning capacity/price ratio in the 1-2GB market and below. Thus the development direction for Microdrive should be high capacity. Taking into account the current situation, only in the 2GB+ market can Microdrives be competitive. This has been proved by Apple’s iPod mini MP3 players, which adopt Hitachi's 1-inch Microdrives with capacities of 4GB and 6GB. Microdrive MP3 players with capacity below 2GB are rare now in the marketplace. Toshiba, under the pressure of decreasing price of flash memory, has given up its 0.85-inch 2GB products and turned to 4GB.

2. SD and MMC are the major two camps in the future flash memory market

Limited by its inherent constraints in capacity and compatibility, SM was rare in the marketplace in 2004 and even vanished in the configurations of new released consumer electronics in 2005. SM has been displaced by xD cards, which are mainly adopted by Olympus and Fuji's DCs. The MS series are configured in Sony’s products. MS and xD hold certain market share, but they have no big development space and will not become the mainstream.

Although CF cards had once become the mainstream, they are now not possible to be implemented on mobile phones for their own limitation of size. On top of that, CF is challenged by Microdrives in the 2GB+ market and SD in the 2GB- market. Currently, SD has taken CF's position and become the mainstream flash storage card. In the long-run, CF, whether on price or capacity, is unable to compete with microdives. CF's future seems very uncertain.

At present, SD has taken the biggest market share in mobile storage sector, followed closely by MMC, each having its own advantages. The reason why SD is so strong is that: first, SD is leading in technology and has won large market space by vigorous market promotion; second, the SD camp holds a monopoly position in the consumer electronics market, thus SD is widely adopted in digital products worldwide. But MMC has its advantage of open standard and no patent fees charged, which is very competitive in the market. Moreover, as the MMC camp strengthens their market promotion, MMC has won support from the majority of mobile phone makers such as Nokia, Samsung, LG and Siemens. In China market, MMCA acts even more diligently. Some Chinese mobile phone manufacturers have shown great interest in MMC cards. The government and operators also think highly of MMC's open standard. Konka is the first Chinese mainland mobile phone maker to join MMCA, while TCL, OKWAP, CECT, Lonovo and Dopod have released their models with MMC card embedded. From the very beginning, SDA has laid special stress on copyright protection. And also MMCA will release their version 2.0 with comprehensive encryption function in 2005. Competition in the future mobile storage market will be the two camps centering on low-cost, security and high-speed functions. And Chinese companies are more concerned about cost, and at the same time, they are more willing to adopt open standard. Thus MMC is predicted to be more popular in China.

3. T-Flash rises suddenly as a new force in the mobile phone storage market. The future will be dominated by T-Flash, RS-MMC and miniSD.

Market Share of Various Storage Cards in Newly-Released Phones in China, 2005

T-Flash card released by SanDisk in 2004 is currently is the smallest storage card in size. As soon as it was released, it won support from such big makers as Motorola and Samsung and soon gained the dominant position in the market. Among the newly-released phones with storage cards surveyed in 2005, T-Flash accounted for 29.5%, miniSD 27.9% and RS-MMC 18%, making a total of 75.4%. Sony's memory stick is mainly adopted by Sony Ericsson, which is gradually turning to middle- and low-end products. Thus the proportion of expensive Sony memory stick will not increase but decline. Memory stick will not widely used in mobile phones in the future. In view of the features of mobile phones, mobile phone storage devices will be smaller and less power-consumption. Thus standard SD and MMC will fade out from the future mobile phone storage card market.

4. 1-inch hard disk is more promising than 0.85-inch hard disk

At present, 0.85-inch hard drives are expensive but with small capacity, while flash memories are decreasing in price and increasing in capacity, posing great pressure on 0.85-inch hard disk. 0.85-inch hard disk's advantage in size makes it target on mobile phones, however, large capacity storage requirement on mobile phones doesn't occur. Currently, big capacity with small size storage demand mainly comes from multimedia players. However, portable multimedia players don't have the critical requirement of size as mobile phones do; therefore, the size advantage of 0.85-inch Microdrives is not so outstanding in multimedia player market. This explains why Hitachi Global Storage Technologies and Seagate Technology prefer 1-inch Microdrive to 0.85-inch Microdrive. 1-inch Microdrives have higher capacity/price ratio. On June 8 2005, Seagate released a 1-inch 8GB hard disk with higher speed and better performance, further expanding the gap between hard disk and flash memory. Whereas, the capacity of 0.85-inch hard disk is hard to increase, and will soon feel the pressure from flash memory.

5. Mobile phones with Microdrives may be as popular as iPod

Apple's iPod Products Configurations

The future of Microdrive on mobile phones depends on whether it can copy the pattern of iPod hard disk MP3 players. We argue that just like hard disk and flash memory products co-exist on the MP3 player market, it will be the same on mobile phone storage market. Microdrive must take the direction of large capacity on mobile phones. Currently, Samsung and Nokia have released their Microdrive mobile phones: V5400 and N91 with capacity 1.5GB and 4GB respectively. Hitachi and Toshiba’s perpendicular recording technology will make 1-inch Microdrive leap in capacity. We forecast 10GB, or even 20GB Microdrives will occur in the coming 1 to 3 years. This creates condition for the development of Microdrive phones.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1.Market status of mobile storage chips

1.1 Definitions

1.2 Market overview

1.2.1 Recovery of semiconductor industry and development of flash memory chips

1.2.2 Competition between NAND and NOR

1.2.3 Market analysis of mobile storage chips

1.3 Survey of major manufacturers

1.3.1 Samsung

1.3.2 Toshiba

1.3.3 Renesas

1.3.4 Hynix

1.3.5 Infineon

1.3.6 ST

1.3.7 Micron 2.Status analysis of mobile storage card industry

2.1 Definitions and classification

2.1.1 CF card

2.1.2 SM card

2.1.3 MMC card

2.1.4 SD card

2.1.5 Memory Stick

2.1.6 XD card

2.1.7 TF card

2.1.8 Microdrive

2.2 Comparison analysis of various storage cards

2.3 Standardization of mobile storage cards

2.3.1 CFA

2.3.2 SSFDC forum

2.3.3 MMCA

2.3.4 SDA

2.3.5 CE-ATA 3.Key manufacturers of flash memory storage cards

3.1 SanDisk

3.1.1 Company background

3.1.2 Financial analysis

3.1.3 Latest events

3.1.4 Main products

3.2 Twinmos

3.2.1 Company background

3.2.2 Main products

3.2.3 Latest events

3.2.4 Related manufacturers Chinese Mainland

3.3 Lexar

3.4 Kingmax

3.5 Kingston

3.6 PRETEC

3.7 ATP

3.8 Transcend

3.9 PQI

3.10 SONY

3.11 Panasonic

3.12 Hitachi 4.Key manufacturers of Microdrive

4.1 Hitachi Global Storage Technologies

4.1.1 Company background

4.1.2 Main products

4.1.3 Latest events

4.2 Toshiba

4.2.1 Company background

4.2.2 Main products

4.2.3 Latest events

4.2.4 Core technology

4.3 Seagate

4.3.1 Company background

4.3.2 Main products

4.3.3 Financial analysis

4.3.4 Latest events

4.4 cornice

4.4.1 Company background

4.4.2 Main products

4.4.3 Latest events

4.5 GSMAGIC

4.5.1 Company background

4.5.2 Main products

4.5.3 Financial analysis

4.5.4 Core technology

4.5.5 Latest events

4.6 Samsung

4.7 Western Digital

4.8 Fujitsu 5.Mobile storage market trend

5.1 Main application markets of mobile storage card

5.1.1 DC storage card market trend

5.1.2 Mobile phone storage card market trend

5.1.3 MP3 and MP4 storage market development

5.2 Development trend of mobile storage card

5.2.1 Development trend of flash memory storage card

5.2.2 Microdrive development trend |

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Manufacturers mass production programming

NAND flash memory market value estimation

Samsung main products sales proportion

Samsung financial status

Samsung Q1 semiconductor sales 2005

Renesas flash memory development direction

Renesas flash Memory products

Hynix Q1 profit margin 2005

Infineon Q1 division sales 2005

ST Q1 net revenues 2005

Micron Q1 net sales and revenues 2005

2005 Q1 NAND flash memory manufacturers ranking

NAND flash prices in China and Hong Kong, May 2005

Gross profit of Samsung main products operating revenues

Samsung NAND production volume estimation 2005

Samsung 2005 NAND Flash supply and demand estimation

Toshiba annual revenues

Main products of Toshiba NAND flash memory

Hynix parent company 2005 Q1 revenue

Hynix NAND Flash products

Infineon division net sales distribution

Main products of Infineon NAND flash memory

ST 2004 product division net revenues and operating profits

ST products

Micron 2005 Q1 revenues status

Features of Micron 2Gbit NAND Flash products

Key manufacturers and quotations in CF card market

MMC card market key manufacturers and quotations

SD card market key manufacturers and quotations

|

2005-2008 www.researchinchina.com All Rights Reserved

|