| |

|

|

For most mobile handsets, baseband is the most expensive semiconductor device. As the price TFT-LCD display is declining, baseband semiconductor is becoming the most expensive mobile handset device. Moreover, baseband determines the choice of mobile phone platforms, as well as the function and performance of mobile phones. Therefore, it is definitely the heart of mobile phone.

The market pattern of baseband semiconductors is changing. In the 2G market, especially the China market, the emergence of MediaTek caused a great change. It has swept the Chinese market with its low price, high concentration, abundant functions, high performance, perfect service etc.

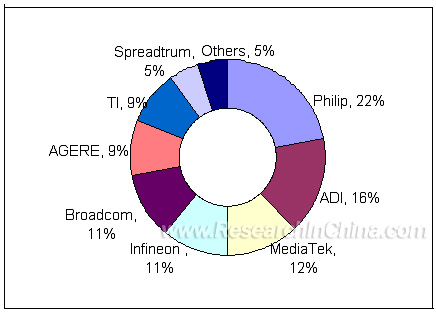

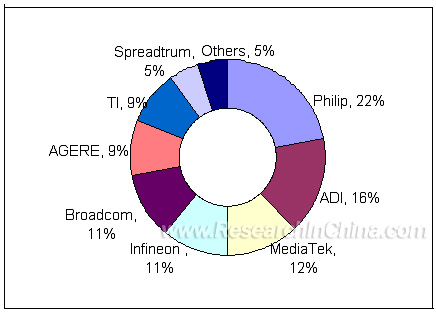

Baseband semiconductors distribution of Chinese local-made mobile handsets in 2004

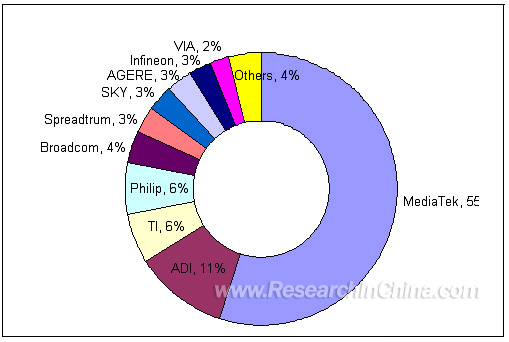

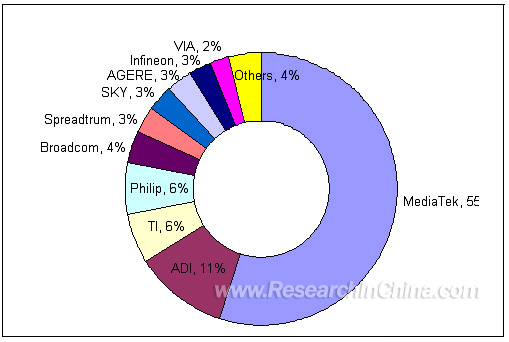

Baseband semiconductors distribution of Chinese local-made mobile handsets in 2005

According to the Ministry of Information Industry, mobile phone sales in China in 2005 added up to 140 million units (including smuggling and underground market). The market share of imported brands (including smuggling market) was 65%. The baseband semiconductors shipment of MediaTek in 2005 was 30 million pieces, among which, 90% went to China mainland with a market share of 55%. The other large providers include ADI, TI and Philips.

The surge of Mediatek market share from 13% in 2004 to 55% in 2005 is a miracle. Its shipment increased from 3.4 million pieces to 27 million pieces. And the handset models of MT6228 and MT6229 developed by MediaTek will carry on the myth of MT6218 and MT6219 in 2006.

ADI and Spreadtrum are now really influenced by MediaTek. ADI pays much attention on Asian market. However, because its software development highly depends on TTPCOM with such problems as long development period, high technical difficulty and high cost, its clients such as LG turned to MediaTek. Spreadtrum, which concentrates on Chinese local mobile phone manufacturers, had to reduce the price due to the fierce competition with MediaTek.

The decline of Philips was mainly caused by a sharp shipment decrease of CECW who adopts Philips platform, and also by the fact that it pays less attention to the semiconductor sector. Moreover, although under pressure, TI has successfully positioned itself on high-end products, especially in the field of smart mobile phone. And SKYWORKS has gained a strong support from Techfaith, thus maintaining a steady market share.

In China, there are 4-5 corporations specializing in the development of TD-SCDMA baseband. Although TD-SCDMA attracts more and more attention, it still has a high risk. The maturity of TD-SCDMA and support level of operators are all still having many undetermined factors. Operators are all expected to establish 3G network with lowest cost, strongest performance. Even if the license for TD-SCDMA will be issued in 2006, it still does not imply the success of TD-SCDMA

But there is no doubt that WCDMA license will be definitely issued in 3G market in China. WCDMA also faces a couple of challenges such as an expensive patent (Qualcomm), a large investment requirement and a furious competition. Three Taiwan corporations have entered the field of WCDMA baseband, including MediaTek.

The most suitable time-to-market for TD-SCDMA baseband manufacturers will be shortly before or after the issue of TD-SCDMA license. For most investors and security analysts, issue of TD-SCDMA license means absolute success of TD-SCDMA, due to their superficial knowledge of the market and technology.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

For most mobile handsets, baseband is the most expensive semiconductor device. As the price TFT-LCD display is declining, baseband semiconductor is becoming the most expensive mobile handset device. Moreover, baseband determines the choice of mobile phone platforms, as well as the function and performance of mobile phones. Therefore, it is definitely the heart of mobile phone.

The market pattern of baseband semiconductors is changing. In the 2G market, especially the China market, the emergence of MediaTek caused a great change. It has swept the Chinese market with its low price, high concentration, abundant functions, high performance, perfect service etc.

Baseband semiconductors distribution of Chinese local-made mobile handsets in 2004

Baseband semiconductors distribution of Chinese local-made mobile handsets in 2005

According to the Ministry of Information Industry, mobile phone sales in China in 2005 added up to 140 million units (including smuggling and underground market). The market share of imported brands (including smuggling market) was 65%. The baseband semiconductors shipment of MediaTek in 2005 was 30 million pieces, among which, 90% went to China mainland with a market share of 55%. The other large providers include ADI, TI and Philips.

The surge of Mediatek market share from 13% in 2004 to 55% in 2005 is a miracle. Its shipment increased from 3.4 million pieces to 27 million pieces. And the handset models of MT6228 and MT6229 developed by MediaTek will carry on the myth of MT6218 and MT6219 in 2006.

ADI and Spreadtrum are now really influenced by MediaTek. ADI pays much attention on Asian market. However, because its software development highly depends on TTPCOM with such problems as long development period, high technical difficulty and high cost, its clients such as LG turned to MediaTek. Spreadtrum, which concentrates on Chinese local mobile phone manufacturers, had to reduce the price due to the fierce competition with MediaTek.

The decline of Philips was mainly caused by a sharp shipment decrease of CECW who adopts Philips platform, and also by the fact that it pays less attention to the semiconductor sector. Moreover, although under pressure, TI has successfully positioned itself on high-end products, especially in the field of smart mobile phone. And SKYWORKS has gained a strong support from Techfaith, thus maintaining a steady market share.

In China, there are 4-5 corporations specializing in the development of TD-SCDMA baseband. Although TD-SCDMA attracts more and more attention, it still has a high risk. The maturity of TD-SCDMA and support level of operators are all still having many undetermined factors. Operators are all expected to establish 3G network with lowest cost, strongest performance. Even if the license for TD-SCDMA will be issued in 2006, it still does not imply the success of TD-SCDMA

But there is no doubt that WCDMA license will be definitely issued in 3G market in China. WCDMA also faces a couple of challenges such as an expensive patent (Qualcomm), a large investment requirement and a furious competition. Three Taiwan corporations have entered the field of WCDMA baseband, including MediaTek.

The most suitable time-to-market for TD-SCDMA baseband manufacturers will be shortly before or after the issue of TD-SCDMA license. For most investors and security analysts, issue of TD-SCDMA license means absolute success of TD-SCDMA, due to their superficial knowledge of the market and technology.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Brief Introduction of Baseband

1.1 Definition and functions of baseband

1.2 DSP applications

1.3 Changes of baseband in 3G generation

1.4 Design separation or integration of baseband and application processor 2. Baseband Market

2.1 3G mobile phone market

2.2 2.5G baseband market pattern

2.3 3G baseband market pattern 3. Baseband Manufacturers

3.1 Qualcomm

3.2 TI

3.3 Freescale

3.4 Agere

3.5 Ericsson Mobile Platforms

3.6 ADI

3.7 Infineon

3.8 Broadcom

3.9 Philips

3.10 SKYWORKS

3.11 Commit

3.12 CYIT

3.13 Spreadtrum

3.14 T3G

3.15 Silicon Laboratories

3.16 VIA Telecom

3.17 EONEX

3.18 ICERA

3.19 MediaTek 4. Baseband Periphery Manufacturers

4.1 ARM

4.2 TTPCOM 5. Cost Analysis of Mobile Phone Semiconductor

5.1 Cost analysis of mobile phone

5.2 Cost analysis examples of mobile phone semiconductor and mobile phone disassembly

5.2.1 Bird D660

5.2.2 Sony Ericsson V800

5.2.3 Nokia 7600

5.2.4 Toshiba V603T

5.2.5 Nokia 9500

5.2.6 Motorola V3 |

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Basic Structure of a Handset

DMIPS Consumption in Different Applications

ARM' Prediction of MODEM Development in the Future

Brief Introduction to ARM1156

Statistics and Forecast of Global 3G Mobile Phone Shipment, 2002-2009

Statistics and Forecast of Global CDMA & WCDMA Phones Shipment, 2003-200

Global Market Share Distribution of Major CDMA2000 Phone Manufacturers in 2005

Global Market Share Distribution of Major CDMA Phone Manufacturers in 2005

Market Share Distribution of Major 2.5G Baseband Manufacturers in 2005

Market Share Forecast of Major 2.5G Baseband Manufacturers in 2006

Market Share of Major Baseband Manufacturers in China

Market Share of Major WCDMA Baseband Manfacturer in 2004

Qualcomm's Major Clients

Road Map of Qualcomm's Baseband Products

Multimedia Functions for Qualcomm's Different Baseband Platforms

Qualcomm's CDMA EV-DO Operational Partners

Manfacturers adopting Qualcomm's 6025 & 6000 chip

Qualcomm's WCDMA Operational Partners

Patent Licensed Manfacturers of Qualcomm's WCDMA

Manufacturers Adopting Qualcomm's WCDMA Chip

Total Operation Income and Growth Rate of Wireless Division for Texas, 2002-2004

Growth Rate of Six Largest Global Wireless CMOS Chip Enterprises, 2003-2004 Income Structure of Texas, 2001-2004

Interior Structure and Exterior Applications of OMAPV2230

Interior Module and Exterior Applications of OMAPV1030

Software Construction of OMAPV1030

Internal Structure of OMAP733

Internal Structure of OMAP730

Internal Structure of OMAP750

Internal Structure of OMAP850

GPS5300 Application modules

Internal Structure of BRF6100/BRF6150

WLAN Solution Scheme of Texas

Q3 2004-Q3 2005, Freescale's Sales Volume and Profit

3G Mobile Phones Adopting Freescale Chip

Freescale 3G Mobile Phone Framework

Freescale 3G Mobile Phone Design Software

Internal Structure of MXC275-30

Platform Framework of MXC275-30

Communication betwwen MXC275-30 and MCU

I25-21 Software Construction

I250-21 Platform Construction

Agere's revenue structure, 2004 -2005

Sceptre TC module

Internal Structure of Sceptre HP

Internal Structure of Sceptre HPE

Vision Software Structure

Internal Structure of VisionX115

Global Income Distribution of Ericsson

EMP Mobile Phone Platform Roadmap

Software structure of U100

EMP 3G Platform Roadmap

Software Structure of EMP 3G Platform

Software Structure of EMP IP Multimedia Subsystem

Multimedia Functions of EMP 3G Platform Products

Multimedia Software Structure of EMP Platform

Structure of U250 Platform

Incomes and Gross Profit of ADI , 2003-2005

Global Income Distribution of ADI , 2003-2005

Application Structure of ADI Products in 2005

Structure of ADI Softfone Platform

ADI Entrance-level Mobile Platform Module

ADI Platform for Distinctive Mobile Phones

ADI Platform for Distinctive EDGE Mobile Phones

ADI Smartphone Platform

ADI WCDMA Mobile Phone Platform

ADI TD-SCDMA Mobile Phone Platform

AD6525 Functional Modules

AD6525 Application Connection Modules

Internal Module of AD6537

Application Structure of AD6720

Reference Design of ADI TD-SCDMA Mobile Phone

Internal Structure of ADI TD-SCDMA 6901

Q1 2004- Q3 2005, Income and EBIT Statistic of Infineon Communications Division

Product Roadmap of Infineon Single-Chip RF Transceiver

Internal Application Structure of PMB7870

Application Structure of PMB7870

Platfor Structure of E-GOLD V3

Internal Structure of PMB8876

Internal Structure of PMB6811

Internal Structure of PMB6258

Internal Structure of E-GOLDLITE

Income & Gross Profit of Broadcome, 1Q 2003-3Q 2005 (11 Continuous Quarters)

Broadcom's Income Structure

ML2011 Application Framework

ML2011 Internal Structure

BCM2121 Application Framework

BCM2121 Internal Structure

BCM2132 Application Framework

BCM2132 Internal Structure

BCM2140 Application Framework

BCM2140 Internal Structure

Income & Gross Profit of Philips Semiconductor Divison, 2000-2004

1H 2005, Income Structure of Philips semiconductor Division

1H 2005, Sales Channel of Philips semiconductor Division

1H 2005, Technologic Structure of Philips Semiconductor Products

1H 2005, Global Income Distribution of Philips semiconductor

Mobile Phones Models Adopted Philips Baseband in 2005

Internal Structure of PCF5213

Nexperia System Solution 5210

Revenue of Skyworks,2002-2005

Profit of Skyworkds, 2002-2005

Internal Framework of CX805-50

Application Framework of SKY832

Internal Framework of SKY832

Working Years Structure of Commit's Employees

Age Structure of Commmit's Employees

Education Level Structure of Commit's Employees

Internal Framework of Commit's TD-SCDMA/GSM/GPRS Dual-mode Baseband

Software Structure of Commit's Neptune Platform

Organizational Structure of T3G

R&D Power of T3G

Internal Framework of T3G's TD-SCDMA Baseband Processor

Application Framework of T3G's TD-SCDMA Baseband Processor

Protocol of T3G's TD-SCDMA Baseband Processor

Reference Design of T3G's TD-SCDMA Mobile Phone

Products Roadmap of T3G

Revenue of Silicon Laboratories, 2001-2004

Internal Structure of SI4905

PCB Picture for the Reference Design of AeroFONE Mobile Phones

Software Structure for the Reference Design of AeroFONE Mobile Phones

Internal Framework of CBP4.0

Software Structure of Eonex's Products

Revenue and Gross Profit of Media Tek, 1999-2005

Revenue and Annual Growth Rate of Media Tek, 1993-1994

After-tax Profit and Annual Growth Rate of Media Tek, 1990-1994

Monthly Mobile Phone Chip Shipment of Media Tek, Jan-Dec 2005

Application Framework of MT6218B

Internal Framework of MT6218B

Memory Management of MT6218B

Internal Framework of MT6219

Pin of MT6219

ARM Product Structure

ARM Product Roadmap

Roadmap of ARM Mobile Phone Products

ARM Revenues, 2000-2004

ARM Incomes Gained from Patent Licensing Fee, 2000-2004

R&D Expenditure of ARM, 2000-2004

Income Structure of ARM in 2004

ARM Products Applications Structure in 2004

Income Distribution of ARM Products in 2004

Core Structure of ARM Mobile Phones

Roadmap of TTPCOM Mobile Phone Baseband

TTPCOM Communication Protocol Roadmap

Structure of TTPCOM Dual-Module Protocol

TTPCOM AJAR Product Roadmap

TTPCOM AJAR Platform

Appearance of Bird D660

Appearance of SonyErisson V800

Breakdown of Sony Ericsson V800

Breakdown of ToshibaV603T

Breakdown of Nokia 9500

Breakdown of Motorola V3

IC Board of Bird D220

IC Board of Bird M10

Relationship among Major Baseband Manufacturers and Their Clients

Overview of Qualcomm's Subsidiary Companies

Qualcomm's Income Structure, Jan.-Sep 2005

Qualcomm's Chip Shipment and Its Global Market Share, Jan-Sep 2002-2005

Performance of Qualcomm's Baseband Products

Mobile Phone Manfacturers and Models Adopting Qualcomm's Chip

Texas Mobile Phone Platforms List

Characteristics of OMAP Baseband Processor Series

Components Performance of Frescale Platform I200-20, I250-20 and I250-21

ADI Mobile Platform Products

ADI Mobile Phone Baseband Products

Primary Baseband Products of Broadcom

Overview of Broadcom's Acquisitions

Philips Baseband Products List

Baseband Products of Skyworks

Eonex's Products

Brief Introduction of Icera Corporation

Bird D660 BOM

Semiconductor Components of Sony Ericsson V800

Semiconductor BOM of Nokia 7600

Semiconductor Components of Toshiba V603T

Semiconductor Components of Nokia 9500

Semiconductor Components of Motorola V3

Semiconductor Components of Amoi A660

Semiconductor Components of Bird D220

Semiconductor Components of Bird M10

Semiconductor Components of Bird V109

Semiconductor Components of Bird V99

Semiconductor Components of Bird M08

|

2005-2008 www.researchinchina.com All Rights Reserved

|