| |

|

|

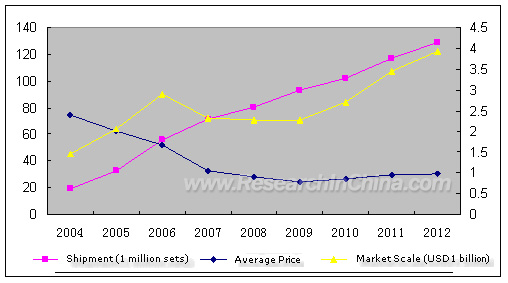

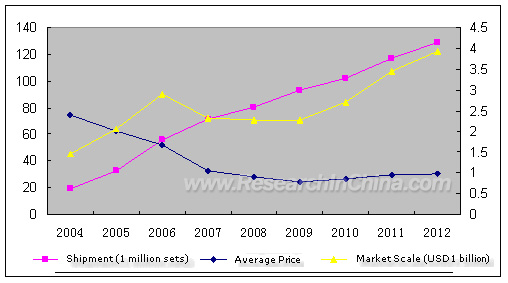

Statistics and Forecast of Global DTV Shipment and DTV IC Market Scale, 2004-2012

Note:

The market scale here refers to all IC components of DTV, including EMS memory, interface, MCU and audio frequency. Some unprofessional research organizations also count drive IC of LCD TV and plasma TV into DTV IC, but in reality it should not be counted, due to the fact that while producers buy liquid crystal panel and plasma panel, driver IC is already included in the panels. The digital TV here refers to integrated DTV, which can receive digital TV programs without any extra device. Therefore, the statistics here are smaller than those of the majority of research organizations.

In the era of CRT, the largest difference between digital TV and analog TV is digital TV has digital TV demodulation , MPEG-2 demodulation and video DAC. But in the era of flat panel TV, composed mainly of LCD TV and plasma TV, the situation has changed. All these display components are digital signal ones, indicating that the liquid crystal panel and plasma panel can correspond the digital signal directly, while the picture tube can not correspond digital signal. In the era of flat panel TV, the difference between digital TV and analog TV is digital TV has digital TV decode chip, MPEG-2 decode chip, so video DAC is not needed. But considering many analog video equipment, digital TV has a video ADC.

Currently, digital TV mainly has about seven chips, like Signal demodulator chip, video-control chip, MPEG-2 decode chip, video processing chip, HDMI interface chip, audio frequency treatment chip and audio frequency amplification chip. High-end DTVs with more than 37 inches in size mainly adopt separation design, requiring at least seven chips, and sometimes one more MCU chip is needed to make up for the performance of video-control IC. Medium- and high-level DTVs with 32-37-inch sizes usually integrates video control chip and video processing chip into a single chip, while DTVs with 20-32 inches in size usually integrates video-control chip, MPEG-2 decode chip and video processing chip into one single chip, sometimes HDMI interface chip is included. The future development trend is except high-end DTVs with more than 37 inches in size, the other sizes of TV will all adopt highly integrated single chip design, which integrates signal demodulator chip, video-control chip, MPEG-2 decode chip, video processing chip, HDMI interface chip and audio frequency processing chip into a single chip, namely SoC. The single chip design has sharply decreased the cost of DTV semiconductor and design difficulty.

The SoC trend has brought about a serious competition to the DTV industry. Media Tek and MStar Semiconductor initially launched the price war. In 2006, the prices of a chipset, including demodulator chip, video processing and controller chip and MPEG-2 decode chip but excluding tuner chip, were around US$40-US$50. In early 2007, the price dropped to US$20, which could be lower given a large order, and it fell to below US$15 at the end of 2007. The cut-throat competition was a heavy toll to the European and U.S. companies suffering huge losses.

Genesis was the first one to be beaten. From fiscal year 2006 onwards, the company was on the downward trend with its revenue and gross profit margin declining rapidly. Its revenue in the first half of fiscal year 2007 was US$100 million and its operation loss amounted to US$21.6 million. Both the revenue and profit had a big fall compared to the same period of the previous year. But Genesis as the former first LCD TV control IC manufacturer in the world had a powerful strength in technology, which made ST take over the company at the price of US$336 million at the end of 2007.

Pixelworks was the second unfortunate fellow, whose revenue in TV field amounted to US$90 million in 2005 and shrank to only US$19.8 million in 2007. The European manufacturers also suffered losses in tandem with U.S. companies. Micronas, the world's largest DTV audio frequency IC manufacturer with its headoffice based in Switzerland, had a loss of CHF17 million in 2006, and its loss soared to CHF543 million in 2007, which has placed the company on the brink of bankruptcy. AMD/ATI was the next. The consumer electronics division of AMD/ATI had its first loss, while ATI with its target pinpointing at the ultra high-end produces suffered the least impact. Trident, relying on the powerful partners like Sony and Samsung, had a good performance, but it is also facing a tough time ahead. Its revenue in fiscal year 2008 is expected to grow 7% only, while the growth rate was 58% in fiscal year 2007. The rapid growth has been restricted by the manufacturers in Taiwan.

The global TV market has mainly the following manufacturers, like Sony, Panasonic, Sharp, Samsung, LG, Philip and TTE. In the era of CRT, Sony was the top TV brand with all its IC developed independently. In the era of panel TV, Sony lagged behind. It started to compete with low prices with all its IC for TV outsourced. Samsung and Sharp are the loyal clients of Trident, while LG depends on Genesis, Trident and Broadcom. Philip relies on NXP. Only Panasonic develops all its IC independently. The manufacturers in Mainland China are eager to adopt the products of Media Tek and MStar Semiconductor. Nearly all the flat panel TVs of Konka adopts MStar Semiconductor's IC, while TTE and Changhong prefer Media Tek. However, MStar Semiconductor enjoys 65% of the flat panel TV market share in Mainland China. Currently, Media Tek is entering the U.S. market through the TV OEMs in Taiwan, but the progress is not as smooth as MStar Semiconductor's exploitation in mainland market.

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2008 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

Statistics and Forecast of Global DTV Shipment and DTV IC Market Scale, 2004-2012

Note:

The market scale here refers to all IC components of DTV, including EMS memory, interface, MCU and audio frequency. Some unprofessional research organizations also count drive IC of LCD TV and plasma TV into DTV IC, but in reality it should not be counted, due to the fact that while producers buy liquid crystal panel and plasma panel, driver IC is already included in the panels. The digital TV here refers to integrated DTV, which can receive digital TV programs without any extra device. Therefore, the statistics here are smaller than those of the majority of research organizations.

In the era of CRT, the largest difference between digital TV and analog TV is digital TV has digital TV demodulation , MPEG-2 demodulation and video DAC. But in the era of flat panel TV, composed mainly of LCD TV and plasma TV, the situation has changed. All these display components are digital signal ones, indicating that the liquid crystal panel and plasma panel can correspond the digital signal directly, while the picture tube can not correspond digital signal. In the era of flat panel TV, the difference between digital TV and analog TV is digital TV has digital TV decode chip, MPEG-2 decode chip, so video DAC is not needed. But considering many analog video equipment, digital TV has a video ADC.

Currently, digital TV mainly has about seven chips, like Signal demodulator chip, video-control chip, MPEG-2 decode chip, video processing chip, HDMI interface chip, audio frequency treatment chip and audio frequency amplification chip. High-end DTVs with more than 37 inches in size mainly adopt separation design, requiring at least seven chips, and sometimes one more MCU chip is needed to make up for the performance of video-control IC. Medium- and high-level DTVs with 32-37-inch sizes usually integrates video control chip and video processing chip into a single chip, while DTVs with 20-32 inches in size usually integrates video-control chip, MPEG-2 decode chip and video processing chip into one single chip, sometimes HDMI interface chip is included. The future development trend is except high-end DTVs with more than 37 inches in size, the other sizes of TV will all adopt highly integrated single chip design, which integrates signal demodulator chip, video-control chip, MPEG-2 decode chip, video processing chip, HDMI interface chip and audio frequency processing chip into a single chip, namely SoC. The single chip design has sharply decreased the cost of DTV semiconductor and design difficulty.

The SoC trend has brought about a serious competition to the DTV industry. Media Tek and MStar Semiconductor initially launched the price war. In 2006, the prices of a chipset, including demodulator chip, video processing and controller chip and MPEG-2 decode chip but excluding tuner chip, were around US$40-US$50. In early 2007, the price dropped to US$20, which could be lower given a large order, and it fell to below US$15 at the end of 2007. The cut-throat competition was a heavy toll to the European and U.S. companies suffering huge losses.

Genesis was the first one to be beaten. From fiscal year 2006 onwards, the company was on the downward trend with its revenue and gross profit margin declining rapidly. Its revenue in the first half of fiscal year 2007 was US$100 million and its operation loss amounted to US$21.6 million. Both the revenue and profit had a big fall compared to the same period of the previous year. But Genesis as the former first LCD TV control IC manufacturer in the world had a powerful strength in technology, which made ST take over the company at the price of US$336 million at the end of 2007.

Pixelworks was the second unfortunate fellow, whose revenue in TV field amounted to US$90 million in 2005 and shrank to only US$19.8 million in 2007. The European manufacturers also suffered losses in tandem with U.S. companies. Micronas, the world's largest DTV audio frequency IC manufacturer with its headoffice based in Switzerland, had a loss of CHF17 million in 2006, and its loss soared to CHF543 million in 2007, which has placed the company on the brink of bankruptcy. AMD/ATI was the next. The consumer electronics division of AMD/ATI had its first loss, while ATI with its target pinpointing at the ultra high-end produces suffered the least impact. Trident, relying on the powerful partners like Sony and Samsung, had a good performance, but it is also facing a tough time ahead. Its revenue in fiscal year 2008 is expected to grow 7% only, while the growth rate was 58% in fiscal year 2007. The rapid growth has been restricted by the manufacturers in Taiwan.

The global TV market has mainly the following manufacturers, like Sony, Panasonic, Sharp, Samsung, LG, Philip and TTE. In the era of CRT, Sony was the top TV brand with all its IC developed independently. In the era of panel TV, Sony lagged behind. It started to compete with low prices with all its IC for TV outsourced. Samsung and Sharp are the loyal clients of Trident, while LG depends on Genesis, Trident and Broadcom. Philip relies on NXP. Only Panasonic develops all its IC independently. The manufacturers in Mainland China are eager to adopt the products of Media Tek and MStar Semiconductor. Nearly all the flat panel TVs of Konka adopts MStar Semiconductor's IC, while TTE and Changhong prefer Media Tek. However, MStar Semiconductor enjoys 65% of the flat panel TV market share in Mainland China. Currently, Media Tek is entering the U.S. market through the TV OEMs in Taiwan, but the progress is not as smooth as MStar Semiconductor's exploitation in mainland market.

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Overview of DTV

1.1 Definition

1.1.1 Advantages and Characteristics

1.1.2 Terrestrial Transmission Standard

1.2 DTV IC

1.2.1 Design of Digital LCD TV

2. Global TV Market and TV Industry

2.1 Development Trend

2.2 Industry Overview

2.2.1 LCD Panel Industry

2.2.2 LCD TV Market and Its Development

2.2.3 LCD TV Assembly Plants in Taiwan 3. Status Quo and Future of DTV IC Market 4. Examples of Advanced TV Design

4.1 Samsung LN-T4665F

4.2 Samsung HPT5064

4.3 Konka

4.4 LG 26LC2D

4.5 VIZIO L37HDTV 5. Advanced TV IC Manufacturers

5.1 TRIDENT

5.2 GENESIS (ST)

5.3 ZORAN

5.4 MStar Semiconductor

5.5 Media Tek

5.6 Cheertek

5.7 MICROTUNE

5.8 Samsung

5.9 MICRONAS

5.10 NXP

5.11 SILICONIMAGE

5.12 BRODCOM

5.13 AMD/ATI

5.14 Chengdu West Star

5.15 Renesas

5.16 Pixelworks

|

|

|

|

|

2005-2008 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Regional Distribution of Global Mobile Phone TV Standard

Regional Distribution of Global Digital TV Standard

Principle of DMB-TH System Transmitter

Sketch of Digital TV Module

Market Shares of Key Global LCD Panel Manufacturers, Mar., 2008

Monthly Shipment of LCD TV Panel, Apr. 2007-Mar. 2008

Monthly Structure of LCD TV Panel by Size, Apr. 2007-Mar. 2008

Monthly Market Share of Key LCD TV Panel Manufacturers, Apr. 2007-Mar. 2008

Statistics and Forecast of Global DTV Shipment and DTV IC Market Scale, 2004-2012

Forecast of Average Price of Digital TV IC, 2005-2011

Forecast of Market Share of Key Global DTV IC Manufacturers, 2008

Forecast of Market Share of Key Global DTV Video Processing and Control IC Manufacturers, 2008

Internal Framework of HPT5064

Internal Framework of 26LC2D

Internal Framework of L37HDTV

Internal Framework of L37HDTV Main Board

Structure of L37HDTV Video Circuit Board

Revenue of Trident by Region, 2007-2008

Internal Framework of SVP-CX

Typical Application of SVP-PX

Typical Application of HiDTV

Statistics and Forecast of Revenue and Gross Profit Margin of Genesis, FY2003-2008

Revenue of Genesis by Region, 2007-H12008FY

Typical Application of FLI8638

Internal Framework of FLI8638

Revenues of Zoran, 2000-2007

Revenue of Zoran by Region, 2007

|

2005-2008 www.researchinchina.com All Rights Reserved

|