| |

|

|

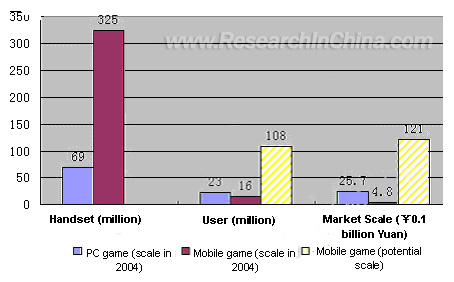

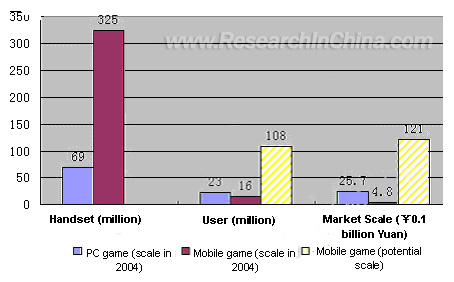

According to the statistics of Ministry of Information Industry, by December of 2004, the quantity of PCs in China was 69 million units, and the number of PC gamers reached 23 million, with a market scale of 2.57 billion RMB. The PC online game market is still in the rapid progress of development. Even being estimated simply by the penetration rate of online game in 2004, the potential of mobile game market is sensational. The results are shown as the figure below. If all the current 325 million Chinese mobile phone users upgrade their handsets to the medium or high-end handsets with the game functions (the current high-end handset will be the low-end handset after several years) in the next few years, there will be 108 million mobile gamers in China, and the market scale of mobile game will reach 12.1 billion RMB for each year.

The Market Scale for Mobile Game in 2004 and Potential Market Scale in the Following Years

The growth momentum of mobile game service in the world is far ahead of other mobile data services, showing very promising prospects. There were 180 million mobile gamers in 2003, and the figure will exceed 1 billion by 2009.

After having reviewed the development of the global mobile game industry, and according to the specific processes of the factors such as users, mobile phone terminal platforms, network and distribution, we divided the development of mobile game industry into three stages: introduction stage, growing stage and mature stage. Currently, China's mobile game industry is in the growing stage, having a high development potential. However, the maturation of China's mobile game industry is subject to many factors such as mobile network, mobile phone terminal platforms and distribution channels.

In order to fully understand the market trends, subscribers' demands, industrial environment, competition pattern and industry chain development of China's mobile game industry, from Mar-May 2005, RIC has conducted an in-depth research on the subjects related to mobile gamers and to mobile game enterprises.

Market research

To conduct the market research, we adopted 4 different research methods, including street interviews, online investigations, interviews to experts and enterprises and key group conferences.

Street interviews were mainly done in Beijing. We got 498 questionnaires all together, with 477 of them valid. We conducted the online investigations with Digifun Corporation (www.digifun.cn). Street interviews and online investigations were targeted to the mobile gamers especially those who preferred to download mobile games, covering the aspects such as the mobile game quality, channels to know the mobile games, download channels, game prices and game expenses.

Key parts of the research

•The relationship between mobile price level and mobile online game

•The methods of mobile game download

•Time and place to apply mobile game

•The average time spent on mobile game each week

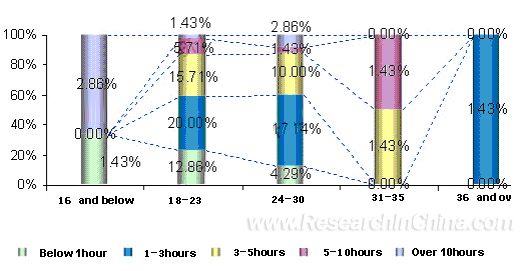

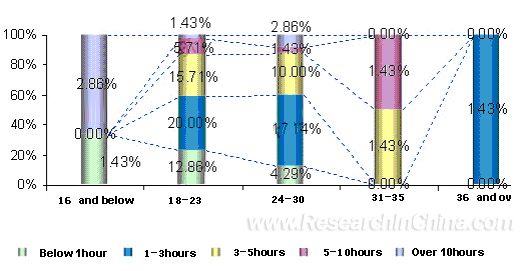

•The average time spent on mobile game each week by age groups

•The average expense spent on mobile game download each month

•The relationship between the expense on mobile game and the monthly incomes

•The affordable price of downloading a single game

•The relationship between monthly incomes and single mobile game

•The mobile games known to the interviewees

•The popular business types of mobile online games

•The favorable styles of mobile game

•The styles of mobile game favored by female

•The styles of mobile game favored by male

•The favorable forms of mobile games

•The channels to know mobile games

•The shortcomings of mobile game

•The insights into the prospect of mobile game

Averaged Time Spent on Mobile Game Each Week for Different Age Groups

Based on the survey, our analysts have drawn many important conclusions. For instance, the participants of mobile games and PC/TV games are different, as for mobile games, female gamers account for a larger percentage of 43.6%, and prefer the entertainment and intelligent games. Paying attention to the gender differences of mobile gamers and developing more mobile games suitable for females will bring new opportunities to game developers.

Interview with experts and enterprises is an in-depth communication for mobile game enterprises and experts in the industry. In the research, we had received the supports from 20 companies such as Kingsoft, DigiFUN, Handinfo, Sina Mobile, Tanglongkeji, Levono Mobile, Jotobo, Channel M Tech, Chinam, SUNV, Xbell, And Feather-snake, for which we would like to say thanks here.

The key group conference is a centralized round table communication on the predefined topics among a discussion team of experienced players, experts and market analysts. During the key group conference, quite a few useful conclusions had come out.

The most concerned issues of mobile game enterprises include when mobile game industry will mature, the promotion methods and sales channel expansion of mobile games, and etc. Most enterprises and experts all believe that mobile online game would have a good prospect, because it saves the issue of piracy that happened in single game. A few enterprises look down upon high-end mobile games, arguing that the terminals are low in quantity and high in price, but too high to popular, and it would be very difficult to make profit.

Industry chain of mobile game

The huge potential of the mobile game market attracts the attention of many enterprises and investors. According to our primary research, there are over 100 service providers (SPs) that have already launched mobile game products, and almost all the SPs with a certain scale had the plan to develop mobile games. Moreover, due to the fact that elementary mobile games are easy to develop and require a small investment, there are hundreds of small-scaled companies that are willing to develop mobile games for the SPs.

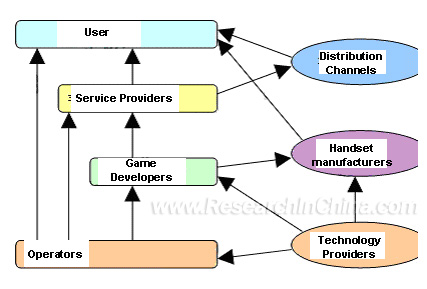

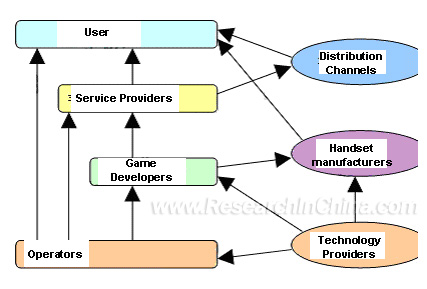

The main value chains of Chinese mobile game industry comprise mobile operator, mobile game developer, mobile game service provider, mobile gamer. The secondary value chains consist of distribution channels, handset manufacturers, and providers of patent technologies related to mobile game. The development of the entire industry chains of mobile game can not be separated from the consistent development of every industry chain

Structure of China's Mobile Game Industrial Value Chain

The unquestionable dominant role of mobile operators in the entire industry chains makes them the key in the development of the entire industry chains, e.g. improving billing system, including the making of transparent billing method and open transaction platform, needs the effective role of operators.

The booming development of online game has changed the attitude of the state towards the entire game industry from discrimination to advocacy, the relevant administration departments began to use for reference the promotion policy implemented in the game industry of South Korea at the level of national culture strategy, launched a series of booster projects for promoting “national game”, and brought the relevant projects into “863 plans.”

Game industry virtually still belongs to culture industry, with a foothold in the contents of national culture, and is more easily recognized by players and the society. As a result, the loyalty of the players is consolidated, and the social risk posed by social backlash is avoided. At present, the most contents of Chinese mobile game are still adapted or directly introduced from foreign game, with gaps in indigenous contents to a certain degree. If CP can find foothold in indigenous culture, fill up the current gap in the market, the potential opportunity for market development must be higher, and it deserves more attentions from ambitious investment institutions.

This report also emphatically introduces more than 40 SPs and more than 20 CPs in Chinese mobile game industry, including the business scales and backgrounds, main products, operational models and market policies of these companies, and is a good reference for investment institutions who plan to invest in Chinese mobile game industry and want to know the competition landscape in game industry.

The development of Chinese mobile game industry has attracted attentions from international capitals, and many venture capital investors have entered Chinese mobile game market one after another. In April of 2004, Softbank invested more than USD 2 million in M Dream of Hangzhou. On May 17th, M Dream was listed on Growth Enterprise Board of Hong Kong Stock Exchange through new face in the name of “8100.HK”. In April of 2004, Moloon was awarded an investment of UST 5 million by IDG

Although, at present, mobile game is not comparable to PC game, and its function of displaying, making entry through keyboard, and audio processing capability pose certain restriction, the feature of being able to operate and access internet anytime anywhere largely extend the time and space for the people to enjoy leisure time, the mobile terminals featuring dominant game function have been gradually recognized in the market, multimedia function is evolving towards being one of the standard functions in a handset, and the technical bottleneck that restricts the development of mobile game will be broken through. Although there are still many bottlenecks in the current mobile game industry to restrict its development, mobile game has been showing the extraordinary development speed, its market potential is very huge, and will be the new source of growth in mobile value added service market

|

|

|

|

|

If this report could not still meet your requirement, or

you have any comments or suggestions on it, please leave a

message to us.

|

2005-2007 www.researchinchina.com All Rights Reserved

| |

|

|

| |

|

According to the statistics of Ministry of Information Industry, by December of 2004, the quantity of PCs in China was 69 million units, and the number of PC gamers reached 23 million, with a market scale of 2.57 billion RMB. The PC online game market is still in the rapid progress of development. Even being estimated simply by the penetration rate of online game in 2004, the potential of mobile game market is sensational. The results are shown as the figure below. If all the current 325 million Chinese mobile phone users upgrade their handsets to the medium or high-end handsets with the game functions (the current high-end handset will be the low-end handset after several years) in the next few years, there will be 108 million mobile gamers in China, and the market scale of mobile game will reach 12.1 billion RMB for each year.

The Market Scale for Mobile Game in 2004 and Potential Market Scale in the Following Years

The growth momentum of mobile game service in the world is far ahead of other mobile data services, showing very promising prospects. There were 180 million mobile gamers in 2003, and the figure will exceed 1 billion by 2009.

After having reviewed the development of the global mobile game industry, and according to the specific processes of the factors such as users, mobile phone terminal platforms, network and distribution, we divided the development of mobile game industry into three stages: introduction stage, growing stage and mature stage. Currently, China's mobile game industry is in the growing stage, having a high development potential. However, the maturation of China's mobile game industry is subject to many factors such as mobile network, mobile phone terminal platforms and distribution channels.

In order to fully understand the market trends, subscribers' demands, industrial environment, competition pattern and industry chain development of China's mobile game industry, from Mar-May 2005, RIC has conducted an in-depth research on the subjects related to mobile gamers and to mobile game enterprises.

Market research

To conduct the market research, we adopted 4 different research methods, including street interviews, online investigations, interviews to experts and enterprises and key group conferences.

Street interviews were mainly done in Beijing. We got 498 questionnaires all together, with 477 of them valid. We conducted the online investigations with Digifun Corporation (www.digifun.cn). Street interviews and online investigations were targeted to the mobile gamers especially those who preferred to download mobile games, covering the aspects such as the mobile game quality, channels to know the mobile games, download channels, game prices and game expenses.

Key parts of the research

•The relationship between mobile price level and mobile online game

•The methods of mobile game download

•Time and place to apply mobile game

•The average time spent on mobile game each week

•The average time spent on mobile game each week by age groups

•The average expense spent on mobile game download each month

•The relationship between the expense on mobile game and the monthly incomes

•The affordable price of downloading a single game

•The relationship between monthly incomes and single mobile game

•The mobile games known to the interviewees

•The popular business types of mobile online games

•The favorable styles of mobile game

•The styles of mobile game favored by female

•The styles of mobile game favored by male

•The favorable forms of mobile games

•The channels to know mobile games

•The shortcomings of mobile game

•The insights into the prospect of mobile game

Averaged Time Spent on Mobile Game Each Week for Different Age Groups

Based on the survey, our analysts have drawn many important conclusions. For instance, the participants of mobile games and PC/TV games are different, as for mobile games, female gamers account for a larger percentage of 43.6%, and prefer the entertainment and intelligent games. Paying attention to the gender differences of mobile gamers and developing more mobile games suitable for females will bring new opportunities to game developers.

Interview with experts and enterprises is an in-depth communication for mobile game enterprises and experts in the industry. In the research, we had received the supports from 20 companies such as Kingsoft, DigiFUN, Handinfo, Sina Mobile, Tanglongkeji, Levono Mobile, Jotobo, Channel M Tech, Chinam, SUNV, Xbell, And Feather-snake, for which we would like to say thanks here.

The key group conference is a centralized round table communication on the predefined topics among a discussion team of experienced players, experts and market analysts. During the key group conference, quite a few useful conclusions had come out.

The most concerned issues of mobile game enterprises include when mobile game industry will mature, the promotion methods and sales channel expansion of mobile games, and etc. Most enterprises and experts all believe that mobile online game would have a good prospect, because it saves the issue of piracy that happened in single game. A few enterprises look down upon high-end mobile games, arguing that the terminals are low in quantity and high in price, but too high to popular, and it would be very difficult to make profit.

Industry chain of mobile game

The huge potential of the mobile game market attracts the attention of many enterprises and investors. According to our primary research, there are over 100 service providers (SPs) that have already launched mobile game products, and almost all the SPs with a certain scale had the plan to develop mobile games. Moreover, due to the fact that elementary mobile games are easy to develop and require a small investment, there are hundreds of small-scaled companies that are willing to develop mobile games for the SPs.

The main value chains of Chinese mobile game industry comprise mobile operator, mobile game developer, mobile game service provider, mobile gamer. The secondary value chains consist of distribution channels, handset manufacturers, and providers of patent technologies related to mobile game. The development of the entire industry chains of mobile game can not be separated from the consistent development of every industry chain

Structure of China's Mobile Game Industrial Value Chain

The unquestionable dominant role of mobile operators in the entire industry chains makes them the key in the development of the entire industry chains, e.g. improving billing system, including the making of transparent billing method and open transaction platform, needs the effective role of operators.

The booming development of online game has changed the attitude of the state towards the entire game industry from discrimination to advocacy, the relevant administration departments began to use for reference the promotion policy implemented in the game industry of South Korea at the level of national culture strategy, launched a series of booster projects for promoting “national game”, and brought the relevant projects into “863 plans.”

Game industry virtually still belongs to culture industry, with a foothold in the contents of national culture, and is more easily recognized by players and the society. As a result, the loyalty of the players is consolidated, and the social risk posed by social backlash is avoided. At present, the most contents of Chinese mobile game are still adapted or directly introduced from foreign game, with gaps in indigenous contents to a certain degree. If CP can find foothold in indigenous culture, fill up the current gap in the market, the potential opportunity for market development must be higher, and it deserves more attentions from ambitious investment institutions.

This report also emphatically introduces more than 40 SPs and more than 20 CPs in Chinese mobile game industry, including the business scales and backgrounds, main products, operational models and market policies of these companies, and is a good reference for investment institutions who plan to invest in Chinese mobile game industry and want to know the competition landscape in game industry.

The development of Chinese mobile game industry has attracted attentions from international capitals, and many venture capital investors have entered Chinese mobile game market one after another. In April of 2004, Softbank invested more than USD 2 million in M Dream of Hangzhou. On May 17th, M Dream was listed on Growth Enterprise Board of Hong Kong Stock Exchange through new face in the name of “8100.HK”. In April of 2004, Moloon was awarded an investment of UST 5 million by IDG

Although, at present, mobile game is not comparable to PC game, and its function of displaying, making entry through keyboard, and audio processing capability pose certain restriction, the feature of being able to operate and access internet anytime anywhere largely extend the time and space for the people to enjoy leisure time, the mobile terminals featuring dominant game function have been gradually recognized in the market, multimedia function is evolving towards being one of the standard functions in a handset, and the technical bottleneck that restricts the development of mobile game will be broken through. Although there are still many bottlenecks in the current mobile game industry to restrict its development, mobile game has been showing the extraordinary development speed, its market potential is very huge, and will be the new source of growth in mobile value added service market

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

1. Mobile Game Overview

1.1 Definitions

1.2 Mobile game classification

1.3 Mobile game characteristics 2. Mobile Game Market Status and Trends

2.1 Global market

2.2 Japan and South Korea

2.2.1 Japan

2.2.2 South Korea

2.3 Europe and the U.S.A

2.3.1 Europe

2.3.2 U.S.A

2.4 Mobile Game in China

2.4.1 Number of mobile phone subscribers and mobile gamers

2.4.2 Online Game Market

2.4.3 Mobile game market scale

2.4.4 Current development phase and future trends

2.5 Main factors affecting mobile game development 3. Analysis on Mobile Game Industry Value Chain in China

3.1 Composition of mobile game industry chain

3.1.1 Operators

3.1.2 Mobile game service providers

3.1.3 Mobile game developers

3.1.4 Mobile gamers

3.1.5 Mobile phone manufacturers

3.1.6 Distribution channel

3.1.7 Mobile game related technology providers

3.2 Market performance of main SPs and their major products

3.2.1 SMS games

3.2.2 WAP games

3.2.3 IVR games

3.2.4 JAVA/BREW games

3.2.5 Online games

3.3 Main CPs and their products

3.3.1 Lvfanqie Co., Ltd.

3.3.2 Memestar

………………………

3.3.25 E-Bear Digital Mobile Software Inc. 4. Investment Analysis on Mobile Game Industry in China

4.1 Industry environment

4.1.1 National policies

4.1.2 Operators' policies

4.2 SWOT analysis on mobile game industry in China

4.3 Main investment institutions in mobile game industry in China

4.4 Revenue growth of mobile game industry in China 5. Competition Analysis on Mobile Game Market

5.1 General competition pattern

5.2 Operator's marketing strategies and competition status

5.2.1 Marketing and development strategies of China Mobile

5.2.2 Marketing and development strategies of China Unicom

5.2.3 Mobile game market scale and segmentation of China Mobile

5.2.4 Mobile game market scale and segmentation of China Unicom

5.2.5 Preinstalled mobile games on the Web Portal of China Mobile

5.2.6 Preinstalled games on the Web Portal of China Unicom

5.3 Market strategies and competition status of major SPs

5.4 Mobile game promotion channel and mobile game websites

5.4.1 Major mobile game promotion channels

5.4.2 Major mobile game websites 6. Analysis on Mobile Game Products

6.1 Embedded games on mobile phones

6.2 Downloadable mobile games

6.3 Mobile game technology platform and development trends

6.4 Mobile games development

6.5 Mobile game chips development 7. Mobile Gamer Survey

7.1 Players structure

7.1.1 By gender

7.1.2 By age

7.1.3 By education degree

7.1.4 By profession

7.1.5 By monthly income

7.2 Mobile phone penetration rate

7.3 mobile games download channels

7.4 Time and place of playing games

7.5 Average time spent on playing downloaded mobile games per week

7.6 Fees

7.7 User demand and preferences 8. Research Conclusions and Investment Suggestions

8.1 Conclusions

8.2 How to invest in mobile game industry

8.3 Operating modes and market strategies of mobile game firms

8.3.1 Operating modes

8.3.2 Market strategies

8.4 Mobile game products orientation and user orientation

|

|

|

|

|

2005-2006 www.researchinchina.com All Rights Reserved |

|

| |

|

|

| |

|

Global Market Trends for Mobile Games

Forecast on Mobile Game Market in Japan

Development History of South Korea's Mobile Game Industry and Prospects

Forecast on European Mobile Game Market

Mobile Games launched by American Mobile Operators in 2003

Forecast on U.S.A Mobile Game Market Scale

Forecast on China Unicom CDMA1x Subscriber number, 2003-2006

Development Phases of Mobile Game Industry

Composition of China Mobile Game Industry Chain

Number of Embedded Games on Mobile Phones in China, 2002-2004

Mobile Game Market Scale and Forecast of China Mobile

SMS Game Market Scale of China Mobile

WAP Game Market Scale of China Mobile

JAVA Game Market Scale of China Mobile

Mobile Game Market Scale and Forecast of China Unicom

SMS Game Market Scale of China Unicom

WAP Game Market Scale of China Unicom

BREW Game Market Scale of China Unicom

Initialized Mobile Game at Montnet

Relations between Mobile Phone Price and online Mobile Games

|

2005-2008 www.researchinchina.com All Rights Reserved

|