Amid the stable growing domestic consumer market

Gross profit margin stable Revenue increased by 33.2%

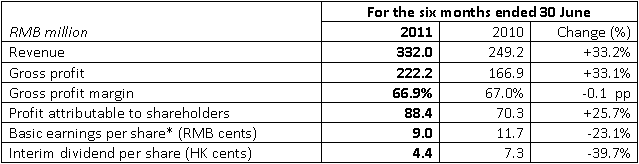

Financial Highlights:

* Basic earnings per share decreased due to the increased number of shares after IPO in November 2010

(22 August 2011 - Hong Kong) Evergreen International Holdings Limited ("Evergreen Intl" or the "Company", together with its subsidiaries, the "Group"; stock code: 238), one of the leading menswear enterprises and brands operators in the PRC covering the middle-upper to high-end segments of the menswear market, is pleased to announce its interim results for the six months ended 30 June 2011.

During the period, Evergreen Intl recorded a revenue of approximately RMB332.0 million (1H2010: 249.2 million), representing a year-on-year growth of 33.2%, mainly attributable to the increase in sales volume. Gross profit amounted to approximately RMB222.2 million, up by 33.1% year-on-year. Gross profit margin for the Group remained relatively stable compared to same period of last year at 66.9%. Net profit attributable to shareholders amounted to RMB88.4 million, representing an increase of 25.7% compared with the corresponding period of the previous year. Basic earnings per share were RMB 9.0 cents. To thank the shareholders for their support towards Evergreen Intl, the Board of Directors declared an interim dividend of HK4.4 cents per share.

Commenting on the interim results, Mr. Chan Yuk Ming, Chairman and Executive Director of Evergreen Intl, said, "During the period under review, the domestic menswear market continued to grow at a relatively fast pace. The Group's two proprietary brands, business formal and casual menswear brand V.E. DELURE and contemporary and chic casual menswear brand TESTANTIN, both achieved desirable sales growth, each with over 30% same-store sales growth. Despite the Group's major raw material costs soared constantly and the increase in wages intensified the production costs pressure, however, leveraging on the advantages and influences of our brands, the Group maintained a relatively steady gross profit margin through increasing the number of self-operated stores and implementing effective cost control measures."

In the first half of 2011, V.E. DELURE and TESTANTIN have generated RMB265.6 million and RMB42.7 million in revenue respectively, representing year-on-year growth of 29.0% and 40.0%. V.E. DELURE sold 71,028 units of apparel with an ASP of RMB2,084. While TESTANTIN sold 16,295 units of apparel with an ASP of RMB1,288.

As at 30 June 2011, the Group had 89 distributors operating in 24 provinces and autonomous regions, and had a total of 136 self-operated stores and 224 distributors stores, an increase of 19.3% and 4.7%, covering 170 cities as compared to 163 cities compared to 31 December 2010. The Group's current strategy for sales network expansion is to open self-operated stores in high-tier cities, while penetrating into the market of cities of slower development through distributors. In line with its business expansion strategies and to improve operating efficiency, the Group continued to optimize the retail and sales network based on the needs and different target markets of its brands. During the period, V.E. DELURE self-operated stores increased from 92 to 105, while distributors stores increased from 148 to 153. The Group's store opening strategy for V.E. DELURE is to increase the proportion of self-operated stores in order to enhance its brand image and operating efficiency. TESTANTIN self-operated stores increed from 19 to 28, while distributors stores increased from 66 to 71. Although more self-operated stores were opened, but the strategy of using distributors stores as the major sales channel for the TESTANTIN brand remain unchanged.

The Group considers stores as one of the important channels to promote and enhance brand image. Since 2010, the Group has engaged an overseas experienced display space specialist to assist with enhancing our dual brands' store image, in order to promote the brands more effectively and attract more customers. During the period, 17 outlets have completed shopfront upgrade. In the second half of 2011, more than 30 outlets will participate in the window display upgrade scheme to expand display space, further enhancing their high-end image.

The Group's sales fair for the 2012 Spring/Summer seasons was completed in July 2011, with an increase in both the average selling prices and sales order volume. Revenue from sales orders was in line with expectation, up 34% year-on-year.

Mr. Chan concluded, "The Group is highly confident in the development of China's menswear market. With the national consumption capability on the rise, consumers' pursuit for higher quality and chic products and the continued expansion of domestic demand underlined by the State policies, it is believed that the menswear market will enjoy faster growth and higher development potential, of which the development of the middle to high-end menswear market will greatly benefit from. Riding on the back of these advantages, the Group can showcase the exceptional products of its brands, capturing bigger business opportunities to provide consumers with more prestigious, contemporary and classic apparel, so as to maintain our position as one of the premium high-end menswear brand operators in China. "