August 23, 2011 (Chinavestor) Shares of China Life Insurance Co. Ltd. (601628.SH)(NYSE:LFC) fell on Tuesday after the company released financials results for the first six months of the year. Highlights. While total revenues grew to RMB227.466 billion from RMB215.391 billion, representing a 5.6% increase, the company paid out RMB59.4 billion for life insurance death and other benefits vs. RMB36.4 billion in last year. This resulted in a decrease of operating profits and net income as well.

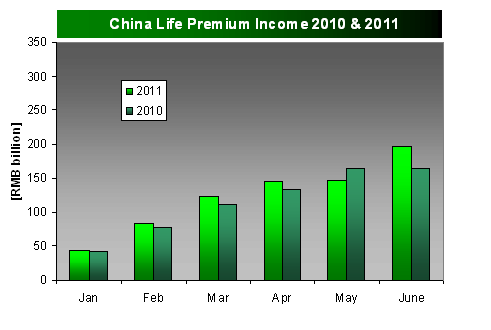

The revenue side of the business looks all right at this point.Thanks to a sound June, total premiums income, e.g. value of policies sold, surpassed that of 2010. Net premiums earned from individual life insurance business increased from RMB175.5 billion to RMB186.8 billion for the first six months of 2011.This represented an increase of 6.5% year-over-year.

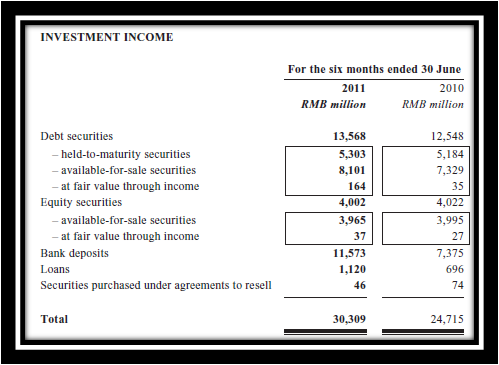

Investment income grew 22.6% from RMB24.7 billion to RMB30.3 billion.

But despite a solid top line growth, the company reported a decrease in its bottom line. Net profit RMB12,964 million, a 28.1% decrease year-on-year. According to the financial report, "This was primarily due to the decline of investment yield and increase in impairment losses caused by the fluctuation in the capital markets, and the increase of the traditional insurance contract liabilities caused by the downward slope of the “yield curve of reserve computation benchmark for insurance contracts” published on “China Bond” website.

What's really hurting is "During the Reporting Period, profit before income tax of the Company in the individual life insurance business decreased by 35.5% year-on-year. This was primarily due to the influence imposed on individual life insurance segment from the decline of investment yield and increase in impairment losses caused by the fluctuation in the capital markets, and the increase of the traditional insurance contract liabilities caused by the downward slope of the “yield curve of reserve computation benchmark for insurance contracts” published on “China Bond” website."

Profit of the individual life insurance business went from RMB19.14 billion to RMB14.9 billion. This is due to an increase of payments for life insurance death and other benefits. China Life Insurance (NYSE:LFC) paid out RMB59.4 billion vs. RMB36.4 billion in 2010 H1. This item is responsible for the fall of operating profits!

So deteriorating profitability is not investment income related! And if that's the case, it is bad news for the company. This suggests the Company has significant liability stemming from paying out a larger portion of its income for insurance claims. This puts pressure on the profitability of the company going forward. This is the real issue in here, investor!