Global and China Lithium Iron Phosphate ((LiFePO4) Material and Battery Industry Report, 2012-2015

-

May.2013

- Hard Copy

- USD

$2,200

-

- Pages:112

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

LPJ025

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,400

-

In 2012, global lithium iron phosphate industry continued enjoying a strong development momentum. Regionally speaking, however, the growth of lithium iron phosphate industry claimed severe differentiation. In regions beyond China, since the EV industry, the biggest lithium iron phosphate battery consumption market, developed not as well as expected, industrial players are confronted with the risk of withdrawing from the market or even bankrupting as a result of increasingly growing loss. At the same time, in contrast, counterparts from Chinese mainland and Taiwan witnessed smooth development, thanks to mature lithium battery industry as well as developed EV industry. Thus, the lithium iron phosphate industry is increasingly shifting to mainland China and Taiwan.

In recent years, there have been a great many of enterprises embarking on the lithium iron phosphate business in mainland China. Coupled with constant capacity expansion, China’s lithium iron phosphate capacity continued rising. Owing to the fact that new comers lag behind in terms of production technology, product quality and production stability, both their real output and sales volume are well below the designed capacity. Equipped with strong technical force reserves and a great many of patents, Taiwanese enterprises featuring larger production scale are more competitive in the market.

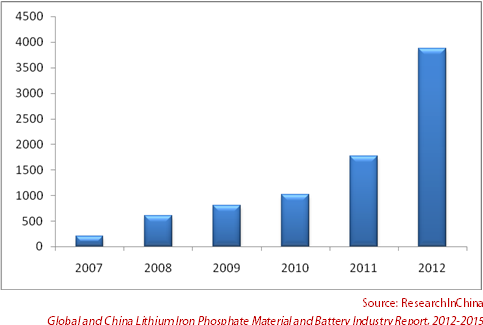

Lithium Iron Phosphate Sales Volume in China, 2007-2012 (ton)

?

In 2012, China lithium iron phosphate battery market pattern made little change, claiming that lithium iron phosphate battery products makers failed to see explosive growth as previous years which signaled rational development tendency. In addition, the cardinal number of EV in China is relatively small, so the absolute amount is not large despite output spurt. Therefore, the EV industry has yet to become a strong pillar to spur on the demand for lithium iron phosphate battery products. In contrast, energy saving and communication fields are would-be lithium iron phosphate battery consumption market with huge potential. And it is only a matter of time before this becomes a reality. In general, the lithium iron phosphate battery industry is at the pre-boom stage and has yet to be full-fledged.

The report touches on status quo of global and China lithium iron phosphate material and battery industry, highlights three trans-national enterprises including A123 Systems, Valence and Phostech, four Taiwanese ones such as Formosa, ALeees, Tatung Fine Chemicals and Hirose Tech as well as 22 mainland Chinese industrial players like Pulead Technology Industry Co., Ltd, Shenzhen Bei Terui New Energy Material Co., Ltd, Tianjin STL Energy Technology Co., Ltd. and BYD.

A123 Systems, the industrial leader worldwide, is one among two enterprises in the world possessing key lithium iron phosphate patents. However, due to bleak market environment and poor management, the company had long been at a loss, yielding a fast-growing deficit until Jan.2013 when it was took over by Wanxiang Group.

Formosa is a well-known Taiwanese lithium iron phosphate producer that offers a large part of its products for customers from Chinese mainland. In 2011, it was the runner-up among lithium iron phosphate suppliers targeting mainland China when it comes to market share. In 2012, the company’s lithium iron phosphate capacity hit 4,800 t/a after capacity expansion, making it possible to become the largest lithium iron phosphate producer in Taiwan. And Formosa is projected to increase its capacity, of corporate planning, to 12,000 t/a by 2014 in an aim to become a would-be largest lithium iron phosphate producer the world over.

BYD boasts the largest lithium iron phosphate battery maker in China. But the aggressive development policy in past two years shouldered much of the blame for its exacerbating profitability. After the rock bottom in 2012, the profitability of the company turned around in 2013Q1, with the net income surging by 188.9% year-on-year to RMB156 million. In 2013, the company’s sales volume of lithium battery-powered EV is estimated to record 8,000, a targeted year-on-year rise of 233.3%.

1. Overview of LiFePO4 Battery

1.1 Overview

1.1.1 Definition

1.1.2 Merits and Demerits

1.2 Industry Chain

2. Market of LiFePO4 Materials in China and Worldwide

2.1 Global Market

2.1.1 Market Position

2.1.2 Sales Volume

2.1.3 Competition Pattern

2.2 Chinese Market

2.2.1 Regional Distribution

2.2.2 Sales Volume

2.2.3 Major Enterprises

2.3 Price of LiFePO4 Materials

2.4 Patent Barriers of LiFePO4 Materials

2.4.1 Dispute on Patent

2.4.2 Latest Development

Summary

3. Industry of LiFePO4 Battery in China

3.1 Supply

3.2 Demand

3.2.1 Electric Car

3.2.2 Electric Tools

3.2.3 Electric Bicycle

3.2.4 Energy Storage Equipment

3.2.5 Communication Industry

Summary

4. Key LiFePO4 Materials Manufacturers

4.1 A123 Systems

4.1.1 Profile

4.1.2 Operation

4.1.3 Subsidiaries in China

4.2 Valence

4.2.1 Profile

4.2.2 Operation

4.2.3 Latest Products

4.2.4 Subsidiaries in China

4.3 Phostech

4.3.1 Profile

4.3.2 LiFePO4 Business

4.3.3 Phostech in China

4.4 Formosa Energy & Material Technology Co., Ltd.

4.4.1 Profile

4.4.2 Operation

4.4.3 Capacity

4.5 ALeees

4.5.1 Profile

4.5.2 Operation

4.5.3 LiFePO4 Material Business

4.5.4 Development Dynamic in 2011-2012

4.6 Tatung Fine Chemicals Co., Ltd.

4.6.1 Profile

4.6.2 LiFePO4 Business

4.7 Hirose Tech Co., Ltd.

4.7.1 Profile

4.7.2 Operation

4.7.3 Capacity

4.7.4 Competition Vantage

4.8 Tianjin STL Energy Technology Co., Ltd.

4.9 Pulead Technology Industry Co., Ltd.

4.9.1 Profile

4.9.2 Subsidiaries

4.9.3 LiFePO4 Battery Business

4.9.4 Project under Construction

4.10 Shenzhen Bei Terui New Energy Material Co., Ltd

4.10.1 Profile

4.10.2 Operation

4.10.3 Strategy

4.11 HeFei GuoXuan High-Tech Power Energy Co., Ltd.

4.11.1 Profile

4.11.2 Operation

4.11.3 Market Expansion

4.11.4 Innovation of Technology & Business Model

4.11.5 Strategy

4.12 Hunan Shanshan Toda Advanced Materials Co., Ltd.

4.12.1 Profile

4.12.2 Revenue Structure

4.13 Xinxiang Huaxin Energy Materials Co., Ltd.

4.14 ShenZhen TianJiao Technology Development Ltd.

4.14.1 Profile

4.14.2 Operation

4.14.3 Linyi Gelon Battery Material Co., Ltd.

4.15 Yantai Zhuoneng Battery Material Co., Ltd.

4.15.1 Profile

4.15.2 Operation

4.15.3 Main Clients

4.15.4 R&D Projects in 2011-2012

4.16 NanoChem Systems (Suzhou) Co., Ltd.

4.17 Xinxiang Chuangjia Power Supply Material Co., Ltd.

4.18 Hunan Haorun Technology Co., Ltd.

Summary

5. Key LiFePO4 Battery Manufacturers

5.1 BYD

5.1.1 Profile

5.1.2 Operation

5.1.3 LiFePO4 Battery Business

5.1.4 Application Case of Iron Battery of BYD

5.2 China BAK Battery

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 R&D

5.2.5 LiFePO4 Battery Business

5.3 Tianjin Lishen Battery Joint-Stock Co., Ltd.

5.3.1 Profile

5.3.2 Operation

5.3.3 More Investment in Motive Power Battery

5.3.4 LiFePO4 Battery Business

5.4 Shenzhen Mottcell Battery Technology Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 History of LiFePO4 Battery

5.4.4 Application Case

5.5 Wanxiang EV Co., Ltd.

5.5.1 Profile

5.5.2 Application Case

5.5.3 Competitive Edge

5.6 CENS Energy-Tech Co., Ltd.

5.6.1 Profile

5.6.2 Application Cases of LiFePO4 Batteries

5.7 Hipower New Energy Group Co., Ltd.

5.7.1 Profile

5.7.2 LiFePO4 Battery Business

5.8 Crown Shuo (Suzhou) New Energy Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Projects in 2012

5.9 Pihsiang Energy Technology

5.9.1 Profile

5.9.2 Competitive Edge

5.9.3 Investment in 2011-2012

5.10 Qingdao Hongnai New Energy

5.11 Huanyu Power Source Co., Ltd.

5.11.1 Profile

5.11.2 LiFePO4 Battery Business

Summary

Classification of Motive Power Battery

Performance of All kinds of Lithium Batteries

Industry Chain of LiFePo4 Battery

Consumption Proportion of Cathode Material for Lithium Batteries in the World, 2007-2012

Sales Volume of LiFePo4 and Its Proportion of Cathode Material around the World, 2007-2012

Three Major Industrial Bases for Lithium Battery Cathode Materials in China

Sales Volume of LiFePo4 and Its Proportion of Cathode Material in China, 2007-2011

Capacity of Key LiFePo4 Materials Manufacturers in China, 2011-2015

Capacity of Key LiFePo4 Materials Manufacturers in Taiwan, 2011-2015

Sales Volume of Lithium Irion Phosphate in China and Beyond, 2007-2012

Key LiFePo4 Battery Manufacturers in China

Market Size Forecast of LiFePo4 Battery Used in Electric Car in China

EV/HEV Output in China, 2004-2013

Electric Tool Output in China, 2009-2015E

Electric Bicycle Output in China, 2004-2015

Wind Power/PV Installed Capacity in China, 2006-2012

Number of Newly-Built Communiation Base Stations, Inventories and Demand for Batteries in China, 2006-2012

History of A123Systems

Revenue and Gross Profit of A123Systems, FY2007-FY2012

Revenue of Subsidiaries of A123Systems in China

Project Investment of Changzhou Gaobo, 2005-2008

Revenue and Net Income of Valence, FY2008-FY2012

Operation of Valence’s Subsidiaries in China

History of Phostech

Distribution of Global Customers of Phostech

Patents of Formosa Energy & Material Technology, 2009-2012

Capacity of Formosa Energy & Material Technology, 2009-2014

Sales Volume of LiFePO4 Material of Aleees, 2010-2012

History of LiFePo4 R&D of Tatung Fine Chemicals

LiFePo4 Materials and Cells Developed by Tatung Fine Chemicals

Revenue of Tatung Fine Chemicals, 2009-2015

Monthly Revenue from LiFePO4 Material Business of Tatung Fine Chemicals, 2011

Finanical Status of Hirose, 2009-2012

LiFePO4 Capacity Planning of Hirose Tech, 2012-2017

Lithium Iron Phosphate Capacity of STL, 2006-2015E

Lithium Iron Phosphate Cathode Material Capacity of Pulead Technology Industry, 2007-2013

Major Production Bases of Shenzhen BTR

Net Income of Shenzhen BeiTerui, 2008-2015

LiFePo4 Development of BeiTerui

Revenue and Net Income of GuoXuan High-Tech, 2009-2012

Marketing of Guoxuan High-Tech Major Products

Lithium Battery Business of Ningbo Shanshan, 2012

Revenue and Net Income of Hunan Shanshan, 2009-2015.

Cathode Material Sales Volulume of Hunan Shanshan Toda Advanced Materials, 2009-2012

Main lithium Iron Phosphate Products of Hunan Shanshan

Capacity of Main Products of Xinxiang Huaxin

History of Tianjiao Technology

Capacity of Main Products of TianJiao Technology, 2012

Revenue and Net Income of Tianjiao Technology, 2008-2015E

Revenue of Yantai Zhuoneng Battery Material and Its Capacity from Lithium Iron Phosphate Business, 2011-2014E

Major Customers of Yantai ZhuoNeng Battery Material

Capacity of Lithium Iron Phosphate Manufactuers in China (Including Taiwan), 2012

Revenue and Net Income of BYD, 2008-2015

Revenue Breakdown of BYD by Product, 2012

Sales Volume of F3DM of BYD, 2010-2012

Revenue of China BAK, FY2009-FY2015

Revenue of China BAK by Product, FY2009-FY2012

Revenue of China BAK by Region, FY2009-FY2012

Revenue Structure of BAK by Region, FY2009-FY2012

R&D Costs and % of Total Revenue of China BAK, FY2010-FY2012

Revenue of Tianjin Lishen, 2008-2015

History of LiFePo4 Battery of Shenzhen Mottcell

Patents of Shenzhen Mottcell Battery Technology, 2009-2013

LiFePo4 Battery Application of CENS Energy-Tech

HiPower New Energy Group

Development History of LiFePo4 Battery Business of Pihsiang Energy Technology

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

China Coal Tar Industry Report, 2020-2025

Coal tar is a thick dark liquid which is a by-product of the production of coke and coal gas from coal. It can be classified by the dry distillation temperature into low-temperature coal tar, medium-t...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Needle Coke Industry Report, 2019-2025

Needle coke with merits of good orientation and excellent conductivity and thermal conductivity, is mainly used in graphite electrodes for electric steelmaking and lithium battery anode materials.

A...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

China Coal Tar Industry Report: Upstream (Coal, coke), Downstream (Phenol Oil, Industrial Naphthalene, Coal Tar Pitch), 2019-2025

Coal tar is a key product in coking sector. In 2018, China produced around 20 million tons of coal tar, a YoY drop of 2.4% largely due to a lower operating rate of coal tar producers that had to be su...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

China Coal Tar Industry Report, 2017-2021

Coal tar, one of by-products in raw coal gas generated from coal pyrolysis in coking industry, accounts for 3%-4% of the output of coal as fired and is a main raw material in coal chemical industry.

...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...