Global and China Machine Tool Report, 2014-2016

-

Jan.2015

- Hard Copy

- USD

$2,400

-

- Pages:121

- Single User License

(PDF Unprintable)

- USD

$2,250

-

- Code:

BXM077

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,400

-

- Hard Copy + Single User License

- USD

$2,600

-

Affected by the factors such as the slowdown in macro-economic growth, the decelerated growth of fixed-assets investment, and rapid capacity expansion of downstream sectors in the early stage, China’s machine tool industry has showed a significant decline since 2011. In 2012-2013, the output of metal working machine tools in China dropped by respectively 7.0% and 6.1%. This is particularly true of metal cutting machine tools, whose output fell by 7.3% and 8.9%, respectively.

In the past two years, the weakened demand from the domestic market has led to a decline in imports, with the import volume of metal working machine tools in 2013 falling by 31.4% from a year ago, the first double-digit decline in China's machine tool imports for the past decade except the 2009 financial crisis.

Meanwhile, the import structure of China's machine tool products also changed significantly. The demand for high-precision, high-speed, highly efficient, and intelligent medium and high-end CNC machine tools has increased remarkably. In 2013, this kind of machine tool was largely imported by machining centers (horizontal-type, vertical-type, and gantry-type), with the full-year import value amounting to USD3.38 billion. That was followed by laser process machines and CNC horizontal lathes, etc.

In the first half of 2014, China’s machine tool industry continued to present low growth, but the output rose considerably and the exports turned from negative to positive. It is predicted that machine tool industry for the whole year will return to 2011 levels.

Amid sluggish recovery of the global economy and downturn of China's machine tool market, many foreign companies are stepping up the layout in China. In 2013, Yamazaki Mazak’s new plant in Dalian was completed and put into production; DMG MORI SEIKI’s plant in Tianjin was opened; the German company Trumpf acquired a 72% interest in Jiangsu Jinfangyuan CNC Machine Co.,Ltd. In 2014, ROTTLER worked with Shandong Yonghua Machinery Co. Ltd. to jointly build precision machine tools under the brand name of ROTTLER?YONGHUA in an attempt to develop China’s high-end machine tool market, such as aerospace, shipbuilding, automobiles, and rail transit.

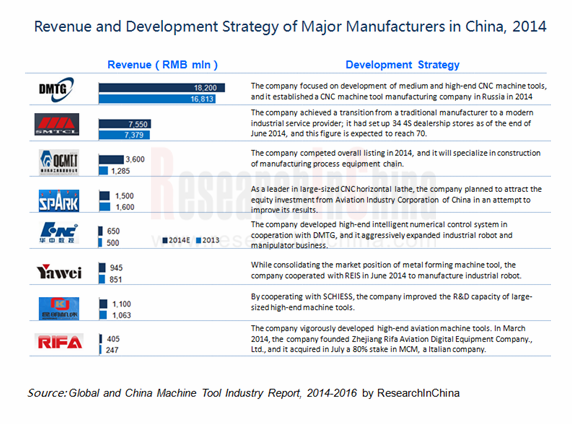

On the other hand, the domestic machine tool enterprises have accomplished transformation and upgrading by adjusting product structure, extending industrial chain, expanding overseas market, and innovating technologies. In 2014, DMTG, together with a third party, established a CNC machine tool company in Russia; SMTCL independently developed i5 numerical control system and achieved mass production; Qinchuan Machine Tool Group completed overall listing; Spark Machine Tool proposed to bring in AVIC’s equity investment.

Global and China Machine Tool Industry Report, 2014-2016 compiled by ResearchInChina mainly focuses on the following:

Production and marketing, import and export, and corporate landscape of machine tools worldwide;

Production and marketing, import and export, and corporate landscape of machine tools worldwide;

Policies, operation, import & export, and competition of machine tool industry in China;

Policies, operation, import & export, and competition of machine tool industry in China;

Production, sales, import & export, and key enterprises of metal cutting machine tool, metal forming machine tool, and CNC machine tool industries in China;

Production, sales, import & export, and key enterprises of metal cutting machine tool, metal forming machine tool, and CNC machine tool industries in China;

Operation of 8 global key enterprises and their business in China, etc.;

Operation of 8 global key enterprises and their business in China, etc.;

Operation, revenue structure, development strategy, etc. of 18 key enterprises in China.

Operation, revenue structure, development strategy, etc. of 18 key enterprises in China.

1 Overview of Machine Tool Industry

1.1 Definition and Classification

1.2 Status in National Economy

1.3 Industry Chain

2 Status Quo of Global Machine Tool Industry

2.1 Development

2.2 Production

2.3 Consumption

2.4 Import and Export

2.4.1 Import

2.4.2 Export

2.4.3 Trade Balance Analysis

2.5 Key Enterprises

3 Development Environment of Machine Tool Industry in China

3.1 Macro-environment

3.1.1 GDP

3.1.2 Fixed-asset Investment

3.2 Policy Environment

4 Development of Machine Tool Industry in China

4.1 International Status

4.2 Industry Operation

4.3 Import and Export

4.3.1 Export

4.3.2 Imports

4.4 Competition Pattern

4.4.1 Enterprise Pattern

4.4.2 Regional Pattern

5 Status Quo of Major Machine Tool Market in China

5.1 Metal Cutting Machine Tools

5.1.1 Production and Marketing

5.1.2 Import and Export

5.1.3 Major Product Market

5.1.4 Key Enterprises

5.2 Metal Forming Machine Tools

5.2.1 Production

5.2.2 Import and Export

5.2.3 Key Enterprises

5.3 CNC Machine Tools

5.3.1 Overview

5.3.2 Production

5.3.3 Import and Export

5.3.4 Key Enterprises

6 Major Global Machine Tool Manufacturers

6.1 Yamazaki Mazak

6.1.1 Profile

6.1.2 Operation

6.1.3 Development in China

6.2 Trumpf

6.2.1 Profile

6.2.2 Operation

6.2.3 Development in China

6.3 Amada

6.3.1 Profile

6.3.2 Operation

6.3.3 Development in China

6.4 Komatsu

6.4.1 Profile

6.4.2 Operation

6.4.3 Development in China

6.5 DMG MORI SEIKI AKTIENGESELLSCHAFT

6.5.1 Profile

6.5.2 Operation

6.5.3 Development in China

6.6 DMG MORI SEIKI

6.6.1 Profile

6.6.2 Operation

6.6.3 Development in China

6.7 Jtekt

6.7.1 Profile

6.7.2 Operation

6.7.3 Development in China

6.8 Okuma

6.8.1 Profile

6.8.2 Operation

6.8.3 Development in China

7 Major Chinese Machine Tool Manufacturers

7.1 SMTCL

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 Development Strategy

7.2 Shenji Group Kunming Machine Tool Co., Ltd.

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Gross Margin

7.2.5 Development Strategy

7.3 Qinchuan Machine Tool & Tool Group Share Co., Ltd

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 Development Strategy

7.4 Jiangsu Yawei Machine Tool Co., Ltd.

7.4.1 Profile

7.4.2 Operation

7.4.3 Revenue Structure

7.4.4 Gross Margin

7.4.5 Development Strategy

7.5 NHNC

7.5.1 Profile

7.5.2 Operation

7.5.3 Revenue Structure

7.5.4 Gross Margin

7.5.5 R&D

7.5.6 Development Strategy

7.6 Qinghai Huading Industries Co., Ltd.

7.6.1 Profile

7.6.2 Operation

7.6.3 Revenue Structure

7.6.4 Key Projects

7.6.5 Development Strategy

7.7 Weihai Huadong CNC Incorporated Company

7.7.1 Profile

7.7.2 Operation

7.7.3 Revenue Structure

7.7.4 Gross Margin

7.8 TONTEC Technology Investment Group Co Ltd

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Gross Margin

7.8.5 Development Strategy

7.9 Zhejiang RIFA Digital Precision Machinery Company Ltd.

7.9.1 Profile

7.9.2 Operation

7.9.3 Revenue Structure

7.9.4 Gross Margin

7.9.5 Development Strategy

7.10 Unlisted Companies

7.10.1 DMTG

7.10.2 Qiqihar Heavy CNC Equipment Co., Ltd.

7.10.3 BYJC

7.10.4 Qier Machine Tool Group Co., Ltd.

7.10.5 JIER Machine-Tool Group Co., Ltd.

7.10.6 CHMTI

7.10.7 Spark Machine Tool Co., Ltd.

7.10.8 Yunnan CY Group Co., Ltd.

7.10.9 Shanghai Machine Tool Works Ltd.

8 Summary and Forecast

8.1 Market

8.2 Enterprise

8.2.1 Overseas enterprises

8.2.2 Domestic enterprises

Classification of Machine Tools

Demand for Machine Tool from Major Industries

Machine Tool Industry Chain

Major Economic Indicators for Machine Tool (Metal Working Machine) Worldwide, 2011-2013

Total Output Value of Machine Tools Worldwide, 2008-2015E

Output Value of Machine Tools Worldwide (by Country/Region), 2013

Output Value of Machine Tools (by Continent) and % of Total Worldwide, 2013

Consumption of Machine Tools Worldwide, 2008-2015E

Consumption of Machine Tools Worldwide (by Country/Region), 2012-2014

Per Capita Machine Tool Consumption in Major Countries/Regions, 2013

Import Value and YoY Growth of Machine Tools Worldwide (by Country/Region), 2013

Export Value and YoY Growth of Machine Tools Worldwide (by Country/Region), 2013

Top 10 Global Machine Tool Manufacturers by Output Value, 2012

China’s GDP Growth Rate, 2011-2014

Growth Rate of Fixed-asset Investment in China’s Machinery Industry, 2009-2014

Growth Rate of Fixed-asset Investment in China’s Machine Tool Industry, 2009-2014

Main Policies on Machine Tool Industry in China, 2011-2014

China’s Global Ranking in Machine Tool Industry, 2013

Major Economic Indicators for Machine Tool Industry in China, 2012-2014

Major Economic Indicators for Metal Cutting Machine Tool and Metal Forming Machine Tool Industries, 2010-2014

Import and Export Value of Machine Tools in China, 2009-2014

Export Volume and Value of Metal Working Machine Tools in China, 2008-2014

Export Value and YoY Growth of Machine Tools in China (by Product), 2013

Import Value of Metal Working Machine Tools in China, 2008-2014

Import Value and YoY Growth of Machine Tools in China (by Product), 2013

Output and Sales Volume of Metal Cutting Machine Tools in China, 2009-2014

Output of Metal Cutting Machine Tools in China (by Province/Municipality), 2012-2014

Import and Export Value of Metal Cutting Machine Tools in China, 2007-2013

Import and Export Value of Metal Cutting Machine Tool Products in China, 2011-2013

Output and Output Value of Major Metal Cutting Machine Tool Products in China, 2012

TOP10 Metal Cutting Machine Tool Enterprises in China by Output Value, 2014H1

Output and YoY Growth of Metal Forming Machine Tools in China, 2009-2014

Output of Metal Forming Machine Tools (by Province/Municipality), 2012-2014

Import and Export Value of Metal Forming Machine Tools in China, 2007-2013

Output of CNC Machine Tools in China, 2008-2014

CNC Proportion of CNC Metal Cutting Machine Tools in China, 2006-2015E

Output of CNC Metal Cutting Machine Tools in China (by Province/Municipality) and % of Nationwide Total, 2013

Import and Export Value of CNC Machine Tools (Metal Working Machine) in China, 2010-2013

Import and Export Value of CNC Metal Cutting Machine Tools in China (by Product), 2010-2013

Yamazaki Mazak’s Production Base Distribution Worldwide, 2014

Yamazaki Mazak’s Enterprise Distribution in China, 2014

Trumpf’s Sales Value, FY2008/2009-FY2013/2014

Trumpf’s Order Amount, FY2008/2009-FY2013/2014

Trumpf’s Enterprise Distribution in China, 2014

Amada’s Revenue and Net Income, FY2009-FY2014

Amada’s Order Amount (by Product), FY2012-FY2014

Amada’s Revenue (by Product), FY2010-FY2014

Amada’s Revenue (by Region), FY2010-FY2014

Amada’s Enterprise Distribution in China, 2014

Komatsu's Revenue and Net Income, FY2007-FY2014

Komatsu’s Revenue (by Segment), FY2007-FY2013

Revenue Structure of Komatsu (by Region), FY2013

Business Structure of Dmg Mori Seiki Aktiengesellschaft

Main Business Indicators of Dmg Mori Seiki Aktiengesellschaft, 2008-2014

Revenue of Dmg Mori Seiki Aktiengesellschaft (by Segment), 2008-2014

Order Amount of Dmg Mori Seiki Aktiengesellschaft (by Segment), 2008-2014

Machine Tool Revenue and Order Amount of Dmg Mori Seiki Aktiengesellschaft (by Region), 2012-2014

Major Machine Tool Companies of Dmg Mori Seiki Aktiengesellschaft, 2014

Net Sales and Net Income of DMG MORI SEIKI, FY2008-FY2014

Revenue Structure of DMG MORI SEIKI (by Region), FY2009-FY2014

Machine Tool Order Amount and Structure of DMG MORI SEIKI, FY2009-FY2013

DMG MORI SEIKI’s Plant in Tianjin

Jtekt’s Revenue and Net Income, FY2010-FY2014

Jtekt’s Revenue (by Segment), FY2014

Jtekt’s Revenue (by Region), FY2010-FY2014

Jtekt’s Enterprise Distribution in China,

Okuma’s New Order Amount, FY2008-FY2014

Okuma’s Revenue and Net Income, FY2008-FY2014

Okuma’s Revenue (by Region), FY2012-FY2013

Okuma’s Revenue (by Product), 2008-2013

Okuma’s Machine Tool Market Structure, FY2013

Okuma’s Sales Outlet Distribution in China

SMTCL’s Revenue and Net Income, 2008-2014

SMTCL’s Operating Revenue (by Product), 2010-2014

SMTCL’s Operating Revenue (by Region), 2010-2014

SMTCL’s Gross Margin, 2008-2014

SMTCL’s Gross Margin (by Product), 2010-2014

Revenue and Net Income of Kunming Machine Tool, 2008-2014

Kunming Machine Tool’s Order Amount and CNC Proportion, 2007-2014

Operating Revenue of Kunming Machine Tool (by Product), 2010-2014

Kunming Machine Tool’s Gross Margin, 2008-2014

Revenue and Net Income of Qinchuan Machine Tool Group, 2008-2014

Operating Revenue of Qinchuan Machine Tool Group (by Segment), 2010-2014

Main Business Structure of Qinchuan Machine Tool Group (by Region), 2010-2014

Gross Margin of Qinchuan Machine Tool Group (by Segment), 2012-2014

Revenue and Net Income of Jiangsu Yawei Machine Tool, 2009-2014

Operating Revenue of Jiangsu Yawei Machine Tool (by Region), 2008-2014

Gross Margin of Jiangsu Yawei Machine Tool, 2008-2014

NHNC’s Revenue and Net Income, 2008-2014

NHNC’s Operating Revenue (by Product), 2009-2014

NHNC’s Operating Revenue (by Region), 2010-2014

NHNC’s Gross Margin, 2008-2014

NHNC’s Gross Margin (by Product), 2009-2014

NHNC’s R&D Costs and % of Total Revenue, 2011-2014

Revenue and Net Income of Qinghai Huading, 2008-2014

Operating Revenue of Qinghai Huading (by Segment), 2011-2014

Revenue of Qinghai Huading’s Major Machine Tool Subsidiaries, 2011-2014

Operating Revenue of Qinghai Huading (by Region), 2011-2014

Revenue and Net Income of Huadong CNC, 2008-2014

Operating Revenue of Huadong CNC (by Product), 2011-2014

Operating Revenue of Huadong CNC (by Region), 2011-2014

NHNC’s Gross Margin, 2008-2014

NHNC’s Gross Margin (by Product), 2011-2014

Revenue and Net Income of TONTEC, 2009-2014

Operating Revenue of TONTEC (by Product), 2011-2013

Operating Revenue of TONTEC (by Region), 2011-2014

TONTEC’s Gross Margin for Machine Tool, 2010-2014

Revenue and Net Income of RIFA Digital Precision Machinery, 2008-2014

Operating Revenue of RIFA Digital Precision Machinery (by Product), 2011-2014

Operating Revenue of RIFA Digital Precision Machinery (by Region), 2011-2014

Gross Margin of RIFA Digital Precision Machinery, 2010-2014

Gross Margin of RIFA Digital Precision Machinery (by Product), 2011-2014

DMTG’s Major Product Production Modes and Production Subsidiaries

Main Operating Indicators of DMTG, 2010-2014

DMTG’s Operating Revenue and Gross Margin (by Product), 2012-2014

Main Economic Indicators of Qiqihar Heavy CNC Equipment, 2010-2014

BYJC’s Main Subsidiaries

JIER Machine-Tool’s Major Clients

Spark Machine Tool’s Revenue, 2004-2014

Output and YoY Growth of Metal Cutting Machine Tool in China, 2011-2016E

Revenue and Market Share of Major Metal Cutting Machine Tool Manufacturers in China, 2013

Global and China CNC Machine Tool Industry Report, 2022-2027

As typical mechatronics products, CNC machine tools are a combination of mechanical technology and CNC intelligence. The upstream mainly involves castings, sheet metal parts, precision parts, function...

Global and China Hydraulic Industry Report, 2021-2026

Hydraulic components are key parts for mobile machineries including construction machinery, agricultural and forestry machinery, material handling equipment and commercial vehicle. The global construc...

China Motion Controller Industry Report, 2021-2026

The motion control system is the core component of intelligent manufacturing equipment, usually composed of controllers, motors, drivers, and human-computer interaction interfaces. Through the control...

Global and China Industrial Robot Servo Motor Industry Report, 2021-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the slow progress of 3C electronics a...

Global and China Industrial Laser Industry Report, 2020-2026

As one of the most advanced manufacturing and processing technologies in the world, laser technology has been widely used in industrial production, communications, information processing, medical beau...

Global and China Mining-use Autonomous Driving Industry Report, 2020-2021

Demand and policies speed up landing of Autonomous Driving in Mining

Traditional mines have problems in recruitment, efficiency, costs, and potential safety hazards, while which can be solved by aut...

Autonomous Agricultural Machinery Research Report, 2020

Autonomous Agricultural Machinery Research: 17,000 sets of autonomous agricultural machinery systems were sold in 2020, a year-on-year increase of 188%

Autonomous agricultural machinery relies heavil...

Global and China CNC Machine Tool Industry Report, 2020-2026

As a typical type of mechatronic products, CNC machine tools combine mechanical technology with CNC intelligence. The upstream mainly involves castings, sheet weldments, precision parts, functional pa...

Global and China Hydraulic Industry Report, 2020-2026

Hydraulic parts, essential to modern equipment manufacturing, are mostly used in mobile machinery, industrial machinery and large-sized equipment. Especially, construction machinery consumes the overw...

Global and China Industrial Robot Speed Reducer Industry Report, 2020-2026

Controller, servo motor and speed reducer, three core components of industrial robot, technologically determine key properties of an industrial robot, such as work accuracy, load, service life, stabil...

Global and China Industrial Robot Servo Motor Industry Report, 2020-2026

As the actuator of control system, servo motor is one of the three crucial parts to industrial robot and its development is bound up with industrial robots. Given the agonizingly slow progress of 3C e...

Global and China Laser Processing Equipment Industry Report, 2020-2026

Laser processing which offers centralized and stable laser beams is applicable to high hardness, high melting point materials that are hard to be processed with traditional technologies. By purpose, l...

Global and China Forklift Industry Report, 2020-2026

In 2019, a total of 1,493,271 forklifts were sold worldwide, up 0.25% year on year, including 647,229 ones or 43.3% sold in Asia.

As the largest producer and seller of forklifts around the globe, Chi...

Global and China Injection Molding Machine Industry Report, 2020-2026

Injection molding machine plays a crucial role in plastics processing machinery, constituting 40% to 50% of the total output value of plastics processing machinery in China. In 2019, injection molding...

China Motion Controller Industry Report, 2019-2026

The motion control market is growing alongside machine tools, robotics, packaging machinery, semiconductors, electronics, among others, being vulnerable to fluctuations in downstream market. In 2018, ...

China Smart Meter Industry Report, 2020-2026

In 2019, instrument and meter companies (each with annual revenue over RMB20 million) in China collectively registered RMB724.26 billion in revenue and RMB70.04 billion in net income, up by 5.5% and 5...

Global and China Agricultural Machinery Industry Report, 2020-2026

Affected by insufficient demand for traditional products, adjustment of purchase subsidy policies, and lower prices of grain crops, China’s agricultural machinery sales remain a downward trend.

In 20...

Global and China Elevator Industry Report, 2019-2025

About 800,000 elevators were sold across the world in 2018, up 1% from a year ago thanks to the robust demand from China, India and the United States, and the ownership of elevators rose to virtually ...