China Pesticide Industry Report, 2016-2020

-

Nov. 2016

- Hard Copy

- USD

$2,700

-

- Pages:171

- Single User License

(PDF Unprintable)

- USD

$2,500

-

- Code:

ZLC040

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,900

-

China’s pesticide industry has weathered the rough time of “overcapacity, market downturn, weak demand, price decline, stringent environmental policies, and fierce competition” over the past two years. Due to a greater pressure from safety production and environmental protection, rising costs, tepid domestic and foreign demands, and prohibition of and restrictions on highly toxic pesticides, the industry has been running with lower product prices. Overall, the pesticide enterprises now make meager profits or barely break even.

China produced 3.741 million tons and sold 3.495 million tons of chemical pesticide APIs in 2015, edging down 0.1% and 2.2% from a year ago, respectively. In addition, output of pesticide preparations represented by herbicides, insecticides, and bactericides all fell over the same period in 2014, standing at 1.774 million tons, 514,000 tons, and 182,000 tons, down 1.6%,8.5%and 20.8% respectively against the previous year.

Jiangsuis the country’s largest pesticide production base, not only the largest API producing region but also a major production region of herbicides, insecticides, and bactericides. The province produced 1.055 million tons of pesticide APIs, 419,000 tons of herbicides, 205,000 tons of insecticides, and 91,000 tons of bactericides in 2015, making up 28.2%, 23.6%,39.8%, and 49.7% of the country’s total, respectively.

The Action Program for Zero Growth of Pesticide Utilization by 2020 issued by the MoA in 2015 specifies that pesticide utilization will be effectively controlled and new pesticides vigorously promoted so as to reduce consumption and harm of pesticides.The country’s pesticide production and sales will maintain slight growth over a period of time, with chemical pesticide APIs reaching an estimated 3.768 million tons in production and 3.628 million tons in sales in 2020, respectively.

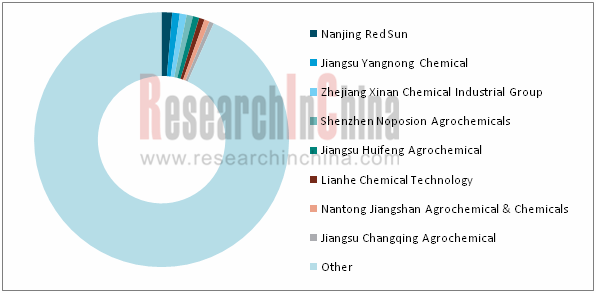

There are about 1,800 pesticide producers in China, represented by Nanjing Red Sun, Jiangsu Yangnong Chemical, Zhejiang Xinan Chemical Industrial Group, Shenzhen Noposion Agrochemicals, and Jiangsu Huifeng Agrochemical. The country’s No. 1 pesticide enterprise hasless than a 2 percent market share, showing a very low market concentration. As a series of measures on closing down backward production facilities and encouraging corporate merger and restructuring are implemented, the Chinese pesticide market concentration is expected to improve gradually.

Market Share of Major Pesticide Enterprises in China, 2016H1

?

?

Source: ResearchInChina

With introduction of support policies including new environmental policy and the Planning for the Development of Pesticide Industry during the 13th Five-Year Plan Period,a quick penetration of new formats like agricultural inputs E-commerce and “Internet + agriculture”, and rapid development of new models (farmers’ cooperative, crop solutions), the pesticide industry will see an accelerated elimination of backward capacity, constantly enhanced industrial transformation and upgrading, and an increased industry concentration.

China Pesticide Industry Report, 2016-2020 highlights the following:

Pesticide industry in China (production & sales, import & sales, operation, competitive landscape, etc.);

Pesticide industry in China (production & sales, import & sales, operation, competitive landscape, etc.);

Development environments (regulatory policies, industry policies, upstream & downstream sectors, etc.);

Development environments (regulatory policies, industry policies, upstream & downstream sectors, etc.);

Development trends;

Development trends;

16 major pesticide enterprises (operation, pesticide business, forecast & outlook, etc.)

16 major pesticide enterprises (operation, pesticide business, forecast & outlook, etc.)

1. Overview of Pesticide Industry

1.1 Definition

1.2 Classification

1.3 Industry Chain

2. Status Quo of China Pesticide Industry

2.1 Production

2.1.1 Pesticide APIs

2.1.2 Pesticide Preparations

2.1.3 Production by Province/City

2.2 Sales

2.3 Import & Export

2.3.1 Import

2.3.2 Export

2.3.3 Import & Export Prices

2.4 Operation

2.4.1 Number of Enterprises

2.4.2 Revenue

2.4.3 Profit

2.5 Competition Pattern

2.5.1 Global Market

2.5.2 Chinese Market

2.6 Entry Barriers

2.6.1 Strict Administrative Licensing

2.6.2 Higher Capital Barrier

2.6.3 Environmental Barriers

2.6.4 Obstacles in Introducing Advanced Technologies

2.6.5 Market Entry Barriers

3. Development Environment of China Pesticide Industry

3.1 Policy Environment

3.1.1 Regulatory Policy

3.1.2 Industry Policy

3.2 Upstream and Downstream Sectors

3.2.1 Upstream

3.2.2 Downstream

4. Trends of China Pesticide Industry

4.1 Overview

4.2 Pesticide API Capacity Transferring to China

4.2.1 Chinese Players Specializing in “Generic Drugs”

4.2.2 Low-cost Edge Backing Industry Transferring

4.3 Rising Boom of Pesticide Stimulating Industry Growth

4.4Supply and Demand

4.4.1 Accelerated Industrial Integration, Improved Supply Capabilities

4.4.2 Pesticide Product Mix Will Be Gradually Optimized

4.4.3 Steady Growth in Domestic and Overseas Demand from Pesticide Market

4.5 Policy Tendency

4.5.1 Further Policies to Be Tightened

4.5.2 Environmental Protection Management is Becoming Normalized and Internationalized

4.6 Herbicide and Bactericide are More Potential than Insecticide in the Long-term Development

5. Major Chinese Pesticide Players

5.1 Nanjing Red Sun

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 R&D

5.1.6 Pesticide Business

5.1.7 Forecast and Outlook

5.2 Nantong Jiangshan Agrochemical & Chemicals

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 R&D

5.2.6 Pesticide Business

5.2.7 Forecast and Outlook

5.3 Lier Chemical

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 R&D

5.3.6 Pesticide Business

5.3.7 Forecast and Outlook

5.4 Jiangsu Yangnong Chemical Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.4.3 Revenue Structure

5.4.4 Gross Margin

5.4.5 R&D

5.4.6 Pesticide Business

5.4.7 Forecast and Outlook

5.5 Jiangsu Changqing Agrichemical

5.5.1 Profile

5.5.2 Operation

5.5.3 Revenue Structure

5.5.4 Gross Margin

5.5.5 R&D

5.5.6 Pesticide Business

5.5.7 Forecast and Outlook

5.6 Zhejiang Xin’an Chemical Industrial Group

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 R&D

5.6.6 Pesticide Business

5.6.7 Forecast and Outlook

5.7 Zhejiang ShenghuaBiok Biology

5.7.1 Profile

5.7.2 Operation

5.7.3 Revenue Structure

5.7.4 Gross Margin

5.7.5 R&D

5.7.6 Pesticide Business

5.7.7 Forecast and Outlook

5.8 Hubei Sanonda Co., Ltd.

5.8.1 Profile

5.8.2 Operation

5.8.3 Revenue Structure

5.8.4 Gross Margin

5.8.5 R&D

5.8.6 Pesticide Business

5.8.7 Forecast and Outlook

5.9 Jiangsu Huifeng Agrochemical Co., Ltd.

5.9.1 Profile

5.9.2 Operation

5.9.3 Revenue Structure

5.9.4 Gross Margin

5.9.5 R&D

5.9.6 Pesticide Business

5.9.7 Forecast and Outlook

5.10 Hunan Haili

5.10.1 Profile

5.10.2 Operation

5.10.3 Revenue Structure

5.10.4 Gross Margin

5.10.5 R&D

5.10.6 Pesticide Business

5.10.7 Forecast and Outlook

5.11 Limin Chemical

5.11.1 Profile

5.11.2 Operation

5.11.3 Revenue Structure

5.11.4 Gross Margin

5.11.5 R&D

5.11.6 Pesticide Business

5.11.7 Forecast and Outlook

5.12 Lianhe Chemical Technology

5.12.1 Profile

5.12.2 Operation

5.12.3 Revenue Structure

5.12.4 Gross Margin

5.12.5 R&D

5.12.6 Pesticide Business

5.12.7 Forecast and Outlook

5.13 Lanfeng Biochemical

5.13.1 Profile

5.13.2 Operation

5.13.3 Revenue Structure

5.13.4 Gross Margin

5.13.5 R&D

5.13.6 Pesticide Business

5.13.7 Forecast and Outlook

5.14 Noposion Corporation

5.14.1 Profile

5.14.2 Operation

5.14.3 Revenue Structure

5.14.4 Gross Margin

5.14.5 R&D

5.14.6 Pesticide Business

5.14.7 Forecast and Outlook

5.15 ENN

5.15.1 Profile

5.15.2 Operation

5.15.3 Revenue Structure

5.15.4 Gross Margin

5.15.5 R&D

5.15.6 Pesticide Business

5.15.7 Forecast and Outlook

5.16 Sichuan Guoguang Agrochemical

5.16.1 Profile

5.16.2 Operation

5.16.3 Revenue Structure

5.16.4 Gross Margin

5.16.5 R&D

5.16.6 Pesticide Business

5.16.7 Forecast and Outlook

Classification and Main Varieties of Pesticides

Pesticide Industry Chain

Production of Chemical Pesticide APIs (Equivalent to 100% Active Ingredient) in China, 2006-2016

Production of Major Pesticide Preparations in China by Type, 2006-2016

Production of Chemical Pesticide APIs (Equivalent to 100% Active Ingredient) in China by Region, 2015

Output Structure of Chemical Pesticide APIs (Equivalent to 100% Active Ingredient) in China by Region, 2015

China’s Herbicide Production by Region, 2015

China’s Herbicide Production Structure by Region, 2015

China’s Insecticide Production by Region, 2015

China’s Insecticide Production Structure by Region, 2015

China’s Bactericide Production by Region, 2015

China’s Bactericide Production Structure by Region, 2015

Sales Volume of Chemical Pesticide APIs (Equivalent to 100% Active Ingredient) in China, 2006-2016

China’s Import Volume of Pesticides, 2010-2016

China’s Import Value of Pesticides, 2010-2016

China’s Export Volume of Pesticides, 2010-2016

China’s Export Value of Pesticides, 2010-2016

Import and Export Prices of Pesticides in China, 2010-2016

Number of Enterprises in China Pesticide Industry, 2006-2016

Proportion of Loss-generating Enterprises in China Pesticide Industry, 2006-2016

Operating Revenue of China Pesticide Industry, 2006-2016

Total Profit of China Pesticide Industry, 2006-2016

Profit Margin of China Pesticide Industry, 2006-2016

Gross Margin of Pesticide Business of Major Companies in China Pesticide Industry, 2013-2016

Global Top 20 Pesticide Manufacturers, 2015

Revenue of Major Pesticide Companies in China, 2011-2016

Net Income of Major Pesticide Enterprises in China, 2011-2016

Pesticide Revenue of Major Pesticide Companies in China, 2013-2016

Market Share of Major Pesticide Companies in China, 2013-2016

Pesticide Output of Major Pesticide Companies in China, 2013-2015

Pesticide Sales Volume of Major Pesticide Companies in China, 2013-2015

Pesticide Enterprises Listed and to Be Listed and Their Fund-Raising Projects, 2015

Regulatory Policies and Main Content in China Pesticide Industry

Major Policies on China Pesticide Industry, 2005-2016

Output of Chemical Pesticide API (100% Effective Ingredients) in China, 2015-2020E

Sales Volume of Chemical Pesticide API (100% Effective Ingredients) in China, 2015-2020E

Pesticide Patented Products Expired in China, 2013-2017

Key Merger and Reorganization Events in China Pesticide Industry, 2008-2015

Companies (1-7 Batches) Voluntarily Renouncing Pesticide Production Qualification in China, 2016

Comparison between New Version Pesticide Management Regulations (Draft) and Old Version

Development Targets of the Development Plan for Pesticide Industry in the Thirteenth Five-Year Plan Period

International Treaties in Global Pesticide Industry

Chinese Pesticide-related Environmental Policies

Revenue and Net Income of Nanjing Red Sun, 2011-2016

Revenue of Nanjing Red Sun by Product, 2013-2016

Revenue Structure of Nanjing Red Sun by Product, 2013-2016

Revenue of Nanjing Red Sun by Region, 2013-2016

Revenue Structure of Nanjing Red Sun by Region, 2013-2016

Gross Margin of Nanjing Red Sun, 2013-2016

R&D Costs of Nanjing Red Sun, 2013-2016

Pyridine Base Industry Chain of Nanjing Red Sun

Hydrocyanic Acid Industry Chain of Nanjing Red Sun

Pyrethroid Industry Chain of Nanjing Red Sun

Capacity of Nanjing Red Sun by Product

Performance of major subsidiaries of Nanjing Red Sun, 2015-2016

Revenue and Net Income of Nanjing Red Sun, 2015-2020E

Revenue and Net Income of Nantong Jiangshan Agrochemical & Chemicals, 2011-2016

Revenue of Nantong Jiangshan Agrochemical & Chemicals by Product, 2013-2016

Revenue Structure of Nantong Jiangshan Agrochemical & Chemicals by Product, 2013-2016

Revenue of Nantong Jiangshan Agrochemical & Chemicals by Region, 2013-2016

Revenue Structure of Nantong Jiangshan Agrochemical & Chemicals by Region, 2013-2016

Gross Margin of Nantong Jiangshan Agrochemical & Chemicals by Product, 2013-2016

R&D Costs and % of Total Revenue of Nantong Jiangshan Agrochemical & Chemicals, 2013-2016

Pesticide Output and Sales Volume of Nantong Jiangshan Agrochemical & Chemicals, 2013-2015

Revenue and Net Income of Nantong Jiangshan Agrochemical & Chemicals, 2015-2020E

Revenue and Net Income of Lier Chemical, 2011-2016

Revenue of Lier Chemical by Product, 2013-2016

Revenue Structure of Lier Chemical by Product, 2013-2016

Revenue of Lier Chemical by Region, 2013-2016

Revenue Structure of Lier Chemical by Region, 2013-2016

Gross Margin of Lier Chemical by Product, 2013-2016

R&D Costs and % of Total Revenue of Lier Chemical, 2013-2016

Pesticide Output and Sales Volume of Lier Chemical, 2012-2015

Glufosinate Capacity of Lier Chemical, 2012-2017E

Revenue and Net Income of Jiangsu Kuaida Agrochemical, 2013-2016

Revenue and Net Income of Lier Chemical, 2015-2020E

Revenue and Net Income of Jiangsu Yangnong Chemical, 2011-2016

Revenue Breakdown of Jiangsu Yangnong Chemical by Product, 2013-2016

Revenue Structure of Jiangsu Yangnong Chemical by Product, 2013-2016

Revenue Breakdown of Jiangsu Yangnong Chemical by Region, 2013-2016

Revenue Structure of Jiangsu Yangnong Chemical by Region, 2013-2016

Gross Margin of Jiangsu Yangnong Chemical by Product, 2013-2016

R&D Costs and % of Total Revenue of Jiangsu Yangnong Chemical, 2013-2016

Output and Sales Volume of Pesticide Products of Jiangsu Yangnong Chemical, 2012-2015

Capacity of Main Pesticide Products of Jiangsu Yangnong Chemical

Revenue and Net Income of Major Subsidiaries of Jiangsu Yangnong Chemical, 2014-2016

Revenue and Net Income of Jiangsu Yangnong Chemical, 2015-2020E

Revenue and Net Income of Jiangsu Changqing Agrichemical, 2011-2016

Revenue Breakdown of Jiangsu Changqing Agrichemical by Product, 2013-2016

Revenue Structure of Jiangsu Changqing Agrichemical by Product, 2013-2016

Revenue Breakdown of Jiangsu Changqing Agrichemical by Region, 2013-2016

Revenue Structure of Jiangsu Changqing Agrichemical by Region, 2013-2016

Gross Margin of Jiangsu Changqing Agrichemical by Product, 2013-2016

R&D Costs and % of Total Revenue of Jiangsu Changqing Agrichemical, 2013-2016

Output and Sales Volume of Pesticide Products of Jiangsu Changqing Agrichemical, 2014-2015

Revenue and Net Income of Major Subsidiaries of Jiangsu Changqing Agrichemical, 2015

Revenue and Net Income of Jiangsu Changqing Agrichemical, 2015-2020E

Revenue and Net Income of Zhejiang Xin’an Chemical Industrial Group, 2011-2016

Revenue Breakdown of Zhejiang Xin’an Chemical Industrial Group by Product, 2013-2016

Revenue Structure of Zhejiang Xin’an Chemical Industrial Group by Product, 2013-2016

Revenue Breakdown of Zhejiang Xin’an Chemical Industrial Group by Region, 2013-2016

Revenue Structure of Zhejiang Xin’an Chemical Industrial Group by Region, 2013-2016

Gross Margin of Zhejiang Xin’an Chemical Industrial Group by Product, 2013-2016

R&D Costs and % of Total Revenue of Zhejiang Xin’an Chemical Industrial Group, 2013-2016

Pesticide Output and Sales Volume of Zhejiang Xin’an Chemical Industrial Group, 2013-2015

Revenue and Net Income of Zhejiang Xin’an Chemical Industrial Group, 2015-2020E

Revenue and Net Income of Zhejiang ShenghuaBiok Biology, 2011-2016

Revenue Breakdown of Zhejiang ShenghuaBiok Biology by Product, 2013-2016

Revenue Structure of Zhejiang ShenghuaBiok Biology by Product, 2013-2016

Revenue Breakdown of Zhejiang ShenghuaBiok Biology by Region, 2013-2016

Revenue Structure of Zhejiang ShenghuaBiok Biology by Region, 2013-2016

Gross Margin of Zhejiang ShenghuaBiok Biology by Product, 2013-2016

R&D Costs and % of Total Revenue of Zhejiang ShenghuaBiok Biology, 2013-2016

Revenue and Net Income of Zhejiang ShenghuaBiok Biology, 2015-2020E

Main Product System of Hubei Sanonda

Revenue and Net Income of Hubei Sanonda, 2011-2016

Revenue Breakdown of Hubei Sanonda by Product, 2013-2016

Revenue Breakdown of Hubei Sanonda by Region, 2013-2016

Gross Margin of Hubei Sanonda by Product, 2013-2016

R&D Costs and % of Total Revenue of Hubei Sanonda, 2013-2016

Capacity of Main Products of Hubei Sanonda

Operating Results of Main Subsidiaries of Hubei Sanonda, 2015

Revenue and Net Income of Hubei Sanonda, 2015-2020E

Revenue and Net Income of Jiangsu Huifeng Agrochemical, 2011-2016

Revenue Breakdown of Jiangsu Huifeng Agrochemical by Product, 2013-2015

Revenue Structure of Jiangsu Huifeng Agrochemical by Product, 2013-2015

Revenue Structure of Jiangsu Huifeng Agrochemical by Product, 2016H1

Revenue Breakdown of Jiangsu Huifeng Agrochemical by Region, 2013-2016

Revenue Structure of Jiangsu Huifeng Agrochemical by Region, 2013-2016

Gross Margin of Jiangsu Huifeng Agrochemical by Product, 2013-2015

R&D Costs and % of Total Revenue of Jiangsu Huifeng Agrochemical, 2013-2016

Capacity of Main Pesticide Products of Jiangsu Huifeng Agrochemical

Output and Sales Volume of Agrochemical Products of Jiangsu Huifeng Agrochemical, 2014-2015

Revenue and Net Income of Jiangsu Huifeng Agrochemical, 2015-2020E

Revenue and Net Income of Hunan Haili Chemical, 2011-2016

Revenue of Hunan Haili Chemical by Product, 2013-2016

Revenue Structure of Hunan Haili Chemical by Product, 2013-2016

Revenue of Hunan Haili Chemical by Region, 2013-2016

Revenue Structure of Hunan Haili Chemical by Region, 2013-2016

Gross Margin of Hunan Haili Chemical by Product, 2013-2016

R&D Costs and % of Total Revenue of Hunan Haili Chemical, 2013-2016

Pesticide Output and Sales Volume of Hunan Haili Chemical, 2013-2015

Revenue and Net Income of Hunan Haili Chemical, 2015-2020E

Revenue and Net Income of Limin Chemical, 2011-2016

Revenue of Limin Chemical by Product, 2014-2016

Revenue Structure of Limin Chemical by Product, 2014-2016

Revenue of Limin Chemical by Region, 2013-2016

Revenue Structure of Limin Chemical by Region, 2013-2016

Gross Margin of Limin Chemical by Product, 2014-2016

R&D Costs and % of Total Revenue of Limin Chemical, 2013-2016

Output and Sales Volume of Major Products of Limin Chemical, 2013-2015

Overseas Layout of Limin Chemical

Revenue and Net Income of Limin Chemical, 2015-2020E

Production Bases of Lianhe Chemical Technology

Revenue and Net Income of Lianhe Chemical Technology, 2011-2016

Revenue of Lianhe Chemical Technology by Product, 2013-2016

Revenue Structure of Lianhe Chemical Technology by Product, 2013-2016

Revenue of Lianhe Chemical Technology by Region, 2013-2016

Revenue Structure of Lianhe Chemical Technology by Region, 2013-2016

Gross Margin of Lianhe Chemical Technology by Product, 2013-2016

R&D Costs and % of Total Revenue of Lianhe Chemical Technology, 2013-2016

Pesticide Output and Sales Volume of Lianhe Chemical Technology, 2012-2015

Revenue and Net Income of Lianhe Chemical Technology, 2014-2020E

Revenue and Net Income of Lanfeng Biochemical, 2011-2016

Revenue of Lanfeng Biochemical by Product, 2013-2016

Revenue of Lanfeng Biochemical by Product, 2013-2016

Revenue of Lanfeng Biochemical by Region, 2013-2016

Revenue Structure of Lanfeng Biochemical by Region, 2013-2016

Gross Margin of Lanfeng Biochemical by Product, 2013-2016

R&D Costs and % of Total Revenue of Lanfeng Biochemical, 2013-2016

Pesticide Output and Sales Volume of Lanfeng Biochemical, 2012-2015

Revenue and Net Income of Lanfeng Biochemical, 2015-2020E

Revenue and Net Income of Noposion, 2011-2016

Revenue of Noposion by Product, 2013-2016

Revenue Structure of Noposion by Product, 2013-2016

Revenue of Noposion by Region, 2013-2016

Revenue Structure of Noposion by Region, 2013-2016

Gross Margin of Noposion by Product, 2013-2016

R&D Costs and % of Total Revenue of Noposion, 2013-2016

Revenue and Net Income of Noposion, 2015-2020E

ENN’s Main Layout

Revenue and Net Income of ENN, 2011-2016

Revenue of ENN by Product, 2013-2016

Revenue Structure of ENN by Product, 2013-2016

Revenue of ENN by Region, 2013-2016

Revenue Structure of ENN by Region, 2013-2016

Gross Margin of ENN by Product, 2013-2016

R&D Costs and % of Total Revenue of ENN, 2013-2016

Pesticide Output and Sales Volume of ENN, 2012-2015

Operation of Pesticide-related Subsidiaries of ENN, 2015 (Unit: RMB mln)

Revenue and Net Income of ENN, 2015-2020E

Main Products of Guoguang Agrochemical

Revenue and Net Income of Sichuan Guoguang Agrochemical, 2011-2016

Revenue of Sichuan Guoguang Agrochemical by Product, 2013-2016

Revenue Structure of Sichuan Guoguang Agrochemical by Product, 2013-2016

Revenue Structure of Sichuan Guoguang Agrochemical by Region, 2013-2016

Gross Margin of Sichuan Guoguang Agrochemical by Product, 2014-2016

R&D Costs of Sichuan Guoguang Agrochemical, 2013-2016

Progress of Fund-raising Projects of Sichuan Guoguang Agrochemical as of H1 2016

Capacity of Major API and Preparation Products of Sichuan Guoguang Agrochemical

Output and Sales Volume of Pesticide Products of Sichuan Guoguang Agrochemical, 2014-2015

Revenue and Net Income of Sichuan Guoguang Agrochemical, 2015-2020E

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

China Coal Tar Industry Report, 2020-2025

Coal tar is a thick dark liquid which is a by-product of the production of coke and coal gas from coal. It can be classified by the dry distillation temperature into low-temperature coal tar, medium-t...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Needle Coke Industry Report, 2019-2025

Needle coke with merits of good orientation and excellent conductivity and thermal conductivity, is mainly used in graphite electrodes for electric steelmaking and lithium battery anode materials.

A...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

China Coal Tar Industry Report: Upstream (Coal, coke), Downstream (Phenol Oil, Industrial Naphthalene, Coal Tar Pitch), 2019-2025

Coal tar is a key product in coking sector. In 2018, China produced around 20 million tons of coal tar, a YoY drop of 2.4% largely due to a lower operating rate of coal tar producers that had to be su...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

China Coal Tar Industry Report, 2017-2021

Coal tar, one of by-products in raw coal gas generated from coal pyrolysis in coking industry, accounts for 3%-4% of the output of coal as fired and is a main raw material in coal chemical industry.

...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...