China SCR Denitration Catalyst Industry Report, 2016-2020

-

Feb.2017

- Hard Copy

- USD

$2,000

-

- Pages:75

- Single User License

(PDF Unprintable)

- USD

$1,900

-

- Code:

BXM100

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,900

-

- Hard Copy + Single User License

- USD

$2,200

-

Catalyst is the core of the SCR flue gas denitration technology, occupying about 40% of total cost of investments into SCR flue gas denitration system. During 2012-2014, the continuous denitration transformation of thermal power plants stimulated China’s demand growth for SCR denitration catalyst, with the demand exceeding 250,000 cubic meters in 2014. However, the demand declined in 2015 as renovation work drew a close, then picked up in 2016, and is expected to see steady growth in the next few years, because:

First, China has put forward new standards for nitrogen oxide emissions of cement, glass, coke, diesel vehicle and other industries since 2015, which will give a new impetus to the growth of SCR denitration catalyst. Second,SCR denitration catalyst has a service life of 3-5 years in general, which means that the denitration catalyst installed since 2011 has to be updated. It is estimated that 270,000 cubic meters of SCR denitration catalyst require replacing by 2020, which will further boost the demand for denitration catalyst.

SCR denitration catalyst is divided into cellular, plate and corrugated types, of which the former two ones prevail in the current Chinese market, while the latter is rare. Based on demand, cellular SCR denitration catalyst held a market share of 64.4% in 2015, marking a dominant position. However, most companies prefer plate-type denitration catalyst which is more suitable for China's common medium and high-ash-content coal-fired conditions when the existing cellular SCR denitration catalyst expires. Therefore, the plate-type denitration catalyst will see a conspicuously growing market share in the next few years and stand at 43.9% or so by 2020.

With the people's more attention to the atmospheric environment in recent years, China has proposed more stringent requirements on management and use of denitration catalyst, and in August 2014 included waste gas denitration catalyst (vanadium and titanium-based) into hazardous waste, which opens up the potential market for disposal of waste gas denitration catalyst and provides more market opportunities for the promotion and application of new-type efficient non-toxic denitration catalyst. At present, Gemsky has developed non-toxic rare earth denitration catalyst.

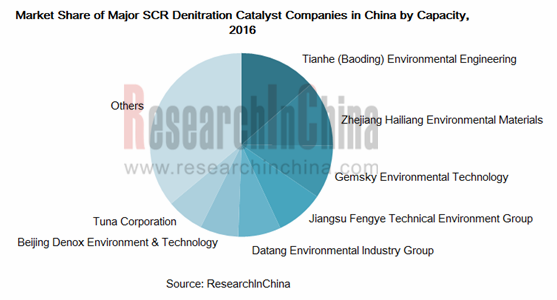

With the increasing demand for flue gas denitration in China, SCR denitration catalyst enterprises have been expanding in scale. In 2016, there were more than 10 SCR denitration catalyst producers each with annual capacity of over 20,000 cubic meters in China; 3 enterprises had the annual capacity of over 50,000 cubic meters apiece, occupying one-third of the total capacity cumulatively.

The report highlights the following:

China's current atmospheric governance, denitration catalyst policy and technology environment;

China's current atmospheric governance, denitration catalyst policy and technology environment;

China's SCR denitration catalyst capacity, output, demand and structure, price trend, corporate competition, denitration catalyst regeneration market and potentials, etc.;

China's SCR denitration catalyst capacity, output, demand and structure, price trend, corporate competition, denitration catalyst regeneration market and potentials, etc.;

China's titanium dioxide (an upstream raw material of SCR denitration catalyst) supply, demand and price trend; status quo of downstream thermal power denitrationinstallation, cement, glass, coke, diesel vehicles and the like;

China's titanium dioxide (an upstream raw material of SCR denitration catalyst) supply, demand and price trend; status quo of downstream thermal power denitrationinstallation, cement, glass, coke, diesel vehicles and the like;

Operation and SCR denitration catalyst business of 6 global and 15 Chinese key SCR denitration catalyst manufacturers.

Operation and SCR denitration catalyst business of 6 global and 15 Chinese key SCR denitration catalyst manufacturers.

1 Overview of SCR Denitration Catalyst

1.1 Introduction

1.1.1 SCR Denitration Catalyst

1.1.2 SCR Denitration Principle

1.1.3 SCR Denitration Process

1.2 Industry Chain

2 Development Environment of SCR Denitration Catalyst in China

2.1 Policy

2.2 Technology

2.2.1 Denitration Technology

2.2.2 Denitration Catalyst Regeneration Technology

2.3 Current Air Pollution Control

2.3.1 Nitrogen Oxide (NOx) Emission

2.3.2 Environmental Protection Investment

3 Status Quo of SCR Denitration Catalyst in China

3.1 Overview

3.2 Market Supply and Demand

3.2.1 Supply

3.2.2 Demand

3.3 Price Trend

3.4 Competitive Landscape

3.4.1 Corporate Competition

3.4.2 Regional Competition

3.5 SCR Catalyst Regeneration

3.5.1 Market Situation

3.5.2 Potential Scale

4 Upstream and Downstream of SCR Denitration Catalyst in China

4.1 Upstream

4.1.1 Overview

4.1.2 Titanium Dioxide

4.2 Downstream

4.2.1 Thermal Power

4.2.2 Cement

4.2.3 Glass

4.2.4 Coking

4.2.5 Diesel Vehicles

5 Key Global Denitration Catalyst Manufacturers

5.1 Nippon Shokubai

5.1.1 Profile

5.1.2 Operation

5.1.3 Catalyst Business

5.2 Johnson Matthey

5.2.1 Profile

5.2.2 Operation

5.2.3 Catalyst Business

5.3 HaldorTopsoe

5.3.1 Profile

5.3.2 Operation

5.3.3 Business in China

5.4 Cornetech

5.5 HITACHI

5.6 CoaLogix

6 Key Chinese Denitration Catalyst Manufacturers

6.1 Tianhe (Baoding) Environmental Engineering Co., Ltd.

6.1.1 Profile

6.1.2 SCR Denitration Catalyst Business

6.2 Jiangsu Fengye Technical Environment Group Co., Ltd

6.2.1 Profile

6.2.1 SCR Denitration Catalyst Business

6.3 Datang Environmental Industry Group Co., Ltd

6.3.1 Profile

6.3.2 Operation

6.3.3 SCR Denitration Catalyst Business

6.4 Tuna Corporation

6.4.1 Profile

6.4.2 Operation

6.4.3 SCR Denitration Catalyst Business

6.5 Beijing GuodianLongyuan Environmental Engineering Co., Ltd

6.5.1 Profile

6.5.2 SCR Denitration Catalyst Business

6.6 State Power Investment Corporation Yuanda Environmental Protection Co., Ltd

6.6.1 Profile

6.6.2 Operation

6.6.3 SCR Denitration Catalyst Business

6.7 China Huadian Engineering Co., Ltd

6.7.1 Profile

6.7.2 SCR Denitration Catalyst Business

6.8 Shanxi Tongmei Electric Power Environmental Protection Technology Co., Ltd

6.8.1 Profile

6.8.2 SCR Denitration Catalyst Business

6.9 Beijing Denox Environment & Technology Co., Ltd.

6.9.1 Profile

6.9.2 Operation

6.9.3 SCR Denitration Catalyst Business

6.10 Fujian Longking Co., Ltd.

6.10.1 Profile

6.10.2 Operation

6.10.3 SCR Denitration Catalyst Business

6.11 JYT Corporation

6.11.1 Profile

6.11.2 Operation

6.11.3Non-toxic Denitration Catalyst Business

6.12 Xi'an Qiyuan Mechanical and Electrical Equipment Co., Ltd.

6.12.1 Profile

6.12.2 Operation

6.12.3 SCR Denitration Catalyst Business

6.13 Chengdu Dongfang KWH Environmental Protection Catalysts Co., Ltd. (DKC)

6.14 Zhejiang Hailiang Environmental Materials Co., Ltd.

6.15 Shandong Hongchuang Environmental Protection Co., Ltd.

6.16 Wuxi Huaguang New Power Environmental Protection Technology Co., Ltd. (under Wuxi Huaguang Boiler Co., Ltd.)

7 Summary and Forecast

7.1 Summary

7.1.1 Market

7.1.2 Enterprises

7.2 Trend Forecast

Cellular, Plate-type and Corrugated Catalyst

Working Principle of SCR Denitration

SCR Denitration Process of Typical Thermal Power Plant

SCR Denitration Catalyst Industry Chain

Policies on SCR Denitration Catalyst Industry in China, 2011-2016

Classification of Denitration Technologies

Technology Sources of Major SCR Denitration Catalyst Enterprises in China

Before and After SCR Catalyst Regeneration

SCR Catalyst Regeneration Methods

China’s NOx Emissions, 2010-2020E

China’s NOx Emission Sources, 2013-2016

Proportion of NOx Emissions (by Sector), 2016

China’s Total Investment in Environmental Pollution Control and % of GDP, 2010-2016

China’s Air Pollution Control Industry Scale, 2010-2020E

Additional and Transformation Scale of Chinese Desulfurization and Denitration Market, 2010-2020E

Development Course of China’s Denitration Industry

China’s SCR Denitration Catalyst Market Size, 2010-2020E

China’s SCR Denitration Catalyst Capacity, 2010-2017

China’s SCR Denitration Catalyst Output, 2010-2017

China’s Demand for SCR Denitration Catalyst, 2010-2020E

China’s Demand for SCR Denitration Catalyst (by Source), 2010-2020E

China’s Demand for SCR Denitration Catalyst (by Product), 2010-2020E

Average Price of SCR Denitration Catalyst in China, 2011-2017

Price of Plate-type SCR Denitration Catalyst in China, 2011-2017

Global Major SCR Denitration Catalyst Enterprises and Technologies

Capacity of Major SCR Catalyst Producers in China, 2016

Major Cellular SCR Denitration Catalyst Enterprises and Their Capacity in China, 2016

Major Plate-type SCR Denitration Catalyst Enterprises and Their Capacity in China, 2016

Number of SCR Catalyst Enterprises in China (by Region), 2016

SCR Denitration Catalyst Regeneration Manufacturers and Their Capacity in China, 2016

Raw Materials of Denitration Catalyst

China’s Titanium Dioxide Output and YoY Growth, 2010-2020E

Competitive Landscape of Global Major Manufacturers in Titanium Dioxide Market, 2017

Price Trend of Titanium Dioxide in China, 2010-2017

Capacity of Flue Gas Denitration Units Put into Operation by Thermal Power Plants in China, 2011-2016

China’s Thermal Power Installed Capacity, 2011-2020E

Capacity of China’s Thermal Power SCR Denitration Units, 2013-2016

Capacity of Flue Gas Denitration Units Put into Operation by Thermal Power Plants, 2015

Accumulative Capacity of Flue Gas Denitration Units Put into Operation by Thermal Power Plants, by the end of 2015

Capacity of Flue Gas Denitration Units Signed by Thermal Power Plants, 2015

Cement Kiln Denitration Process Chart

China’s Cement Output, 2010-2017

Glass Kiln Denitration Process Chart

Coking Flue Gas Desulfurization and Denitration Integration Process

Demand of Chinese Vehicles for Denitration Catalyst, 2013-2020E

Business Structure of Nippon Shokubai

Net Revenue and Net Income of Nippon Shokubai, FY2010-FY2016

Revenue (by Division) of Nippon Shokubai, FY2012-FY2016

Catalyst Products of Nippon Shokubai

Business Structure of Nippon Shokubai, FY2015

Global Business Distribution of Nippon Shokubai, FY2015

Global Business Distribution of Johnson Matthey

Revenue and Net Income of Johnson Matthey, FY2013- FY2017

Revenue of Johnson Matthey (by Business), FY2014- FY2017

Catalyst Products of Johnson Matthey

Branches of Johnson Matthey in China and Their Business Scope

Global Business Distribution of Topsoe

Revenue and Net Income of HaldorTopsoe, 2012-2016

Revenue of HaldorTopsoe (by Business), 2014-2015

Major Subsidiaries of Tianhe Environmental Engineering

SCR Denitration Catalyst Production Bases and Capacity of Tianhe Environmental Engineering, 2016

Technical Characteristics of Fengye’s SCR Denitration Catalyst

Fengye’s SCR Denitration Catalyst Production Bases and Capacity, 2016

Development History of Datang Environmental Industry

Revenue and Gross Margin of Datang Environmental Industry, 2013-2016

Operating Revenue of Datang Environmental Industry (by Business), 2013-2016

Denitration Catalyst Capacity and Output of Datang Environmental Industry, 2013-2016

Denitration Catalyst Deliveries of Datang Environmental Industry, 2013-2016

Average Selling Price of Denitration Catalyst of Datang Environmental Industry, 2013-2016

Tuna’s Major Economic Indicators, 2013-2016

Tuna’s Operating Revenue Structure (by Business), 2013-2016

Tuna’s Fund-raising Construction Projects

Tuna’s Denitration Catalyst Revenue and Gross Margin, 2013-2016

Tuna’s Denitration Catalyst Sales Volume and Price, 2013-2016

Tuna’s Revenue from Top 5 Denitration Catalyst Clients and % of Total Revenue, 2014-2016

SCR Catalyst Capacity of Jiangsu Longyuan, 2011-2016

Revenue and Net Income of Yuanda Environmental Protection, 2011-2016

Operating Revenue of Yuanda Environmental Protection (by Business), 2015-2016

Denitration Catalyst Output and Sales Volume of Yuanda Environmental Protection, 2014-2016

Denitration Catalyst Product Specifications of Yuanda Environmental Protection

Major Subsidiaries of SPIC Yuanda Environmental Protection Catalyst Co., Ltd.

Denox’s Revenue and Net Income, 2012-2016

Denox’s SCR Denitration Catalyst Capacity, 2013-2016

Denox’s SCR Denitration Catalyst Sales Volume and Price, 2012-2016

Revenue and Net Income of Fujian Longking, 2011-2016

Operating Revenue and Gross Margin of Fujian Longking (by Business), 2014-2016

Major Economic Indicators of Fujian Longking, 2015-2016

JYT’s Revenue and Net Income, 2011-2016

JYT’s Four Major Businesses

JYT’s Operating Revenue and Gross Margin (by Business), 2015-2016

Major Economic Indicators of JYT’s Non-toxic Denitration Catalyst, 2014-2016

Operating Revenue and Gross Margin of Qiyuan Mechanical and Electrical Equipment (by Business), 2013-2016

Market Share of Major SCR Denitration Catalyst Companies in China, 2016

China’s SCR Denitration Catalyst Market Structure, 2015-2020E

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

China Coal Tar Industry Report, 2020-2025

Coal tar is a thick dark liquid which is a by-product of the production of coke and coal gas from coal. It can be classified by the dry distillation temperature into low-temperature coal tar, medium-t...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Needle Coke Industry Report, 2019-2025

Needle coke with merits of good orientation and excellent conductivity and thermal conductivity, is mainly used in graphite electrodes for electric steelmaking and lithium battery anode materials.

A...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

China Coal Tar Industry Report: Upstream (Coal, coke), Downstream (Phenol Oil, Industrial Naphthalene, Coal Tar Pitch), 2019-2025

Coal tar is a key product in coking sector. In 2018, China produced around 20 million tons of coal tar, a YoY drop of 2.4% largely due to a lower operating rate of coal tar producers that had to be su...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

China Coal Tar Industry Report, 2017-2021

Coal tar, one of by-products in raw coal gas generated from coal pyrolysis in coking industry, accounts for 3%-4% of the output of coal as fired and is a main raw material in coal chemical industry.

...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...