Smart Cockpit Design Trend Research: Moving to the third living space

With the continuous development of cockpit hardware and software technology, intelligent cockpit design is evolving, pivoting from functionality to "user experience". Intelligent cockpits are becoming more and more secure, smart and comfortable.

In terms of perception, the cockpit display is not limited to multi screens and large screens, 3D screens and high-definition screens are also emerging.

For cockpit display, multi screens and large screens still prevail. From 2020 to 2021, emerging automakers and traditional automakers have successively launched a number of models equipped with multiple screens and joint screens. For example, Hongqi E-HS9 was equipped with 8 screens at the end of 2020. In 2021, Human Horizons mass-produced and delivered HiPhi X equipped with 9 screens. At the same time, the screen size in the car is getting larger and larger. The center console of Xingyue L, launched in July 2021, has a 1-meter IMAX screen. The center console of Ford EVOS that is planned to be launched in October 2021 will feature a 27-inch 4K display. Cadillac Lyriq to be launched in 2022 will have a 33-inch all-in-one display.

In addition, the screen layout has become more novel and unique. In early 2021, Mercedes-Benz revealed the MBUX Hyperscreen, whose three displays merge almost seamlessly into one another to create an impressive screen band over 141 centimeters wide: Driver display (screen diagonal: 12.3 inch), central display (17.7 inch) and front passenger display (12.3 inch) appear as one visual unit. Three screens sit under a common bonded irregular curved cover glass. For particularly brilliant display quality OLED technology is used for the central and front passenger displays. The MBUX Hyperscreen embodies a strong sense of technology.

EQS Smart Cockpit of Mercedes-Benz

Source: Internet

The IM L7, which is planned to be mass-produced in 2022, is equipped with a 39-inch smart scenario screen and a 12.8-inch AMOLED center console screen. The 39-inch screen is composed of two joint screens, which can be raised and lowered separately with multiple display modes and allow the content to be switched without boundaries.

Smart Cockpit of IM L7

Source: Internet

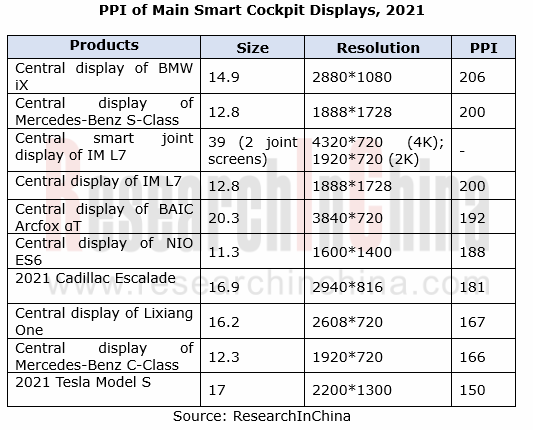

Driven by high-definition mobile phone displays, consumers have more views on the resolution of automotive displays. Low-resolution displays can no longer meet the needs of the current users. Automotive displays tend to feature higher resolution, higher contrast, wider field of view, more optical indicators, and faster response. In the BMW iX scheduled to be launched at the end of 2021, the new iDrive 8 will come with horizontal curved dual screens: a 12.3-inch LCD cluster screen and 14.9-inch IVI screen (the angle is slightly inclined towards the driver). BMW says screens used in the new system will have a pixel density of 206 pixels per inch (PPI).

HMI capabilities develop from functional perception interaction to cognitive and active interaction

The HMI UI interface design for automobiles is changing on the basis of practical functions. With more and more functions, smart cars are getting cleverer, and the underlying data is more and more abundant. In the future, interface interactions will be more concise, 3D intuitive, younger, transparent, digitized, and symbolized, flattened and the like. In June 2020, Banma SmartDrive released the Venus Intelligent System whose UI interface adopts the design concept of A-B parallel worlds. World A takes a "map as a desktop", while World B uses a waterfall layout. Users can intuitively find commonly used functions on the interface, and even set the display interface as what they want.

Venus Intelligent System of Banma SmartDrive - AB Worlds

Source: Banma SmartDrive

MBUX Hyperscreen can display the desired personalized functions for users on the main interface of the central screen at an appropriate time, enabling "zero-layer" operation without scrolling or turning pages, bringing relaxed and intimate HMI experience.

"Zero-layer" Interactive Interface of Mercedes-Benz MBUX Hyperscreen

Source: Internet

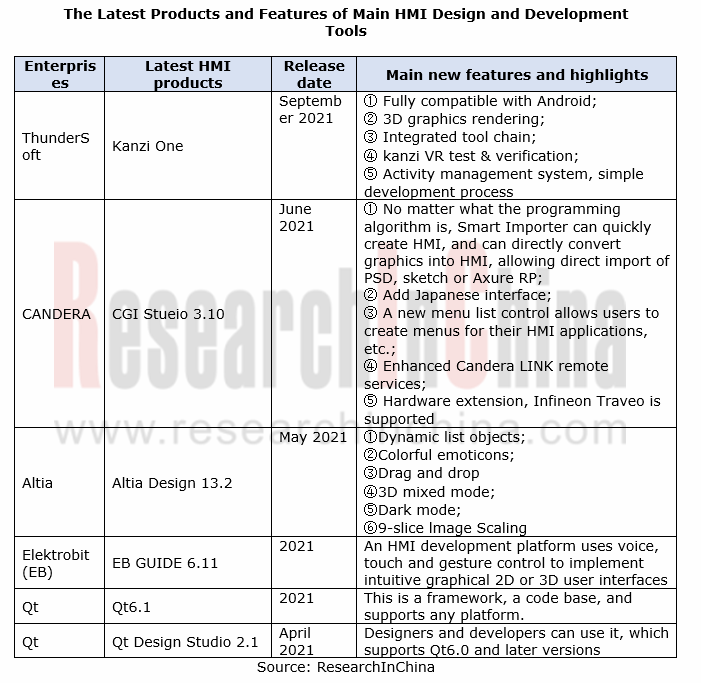

Innovation and breakthroughs in UI interface design are inseparable from the development of HMI design tools. In terms of HMI design and development tools, many companies have released the latest products. Lately, HMI design and development tools feature multiple platforms, multiple algorithms, reusable software framework, 3D interface design, etc. In addition, with the creation of the third space of the smart cockpit and the continuous improvement of entertainment, technology HMI design companies such as web game companies like Eptic Games have dabbled in the automotive market.

Through the fusion applications of AI, smart atmosphere lights, smart surface materials, fragrance systems, smart seats and other products and technologies, voice, AI assistants, face recognition, gestures, face, fingerprint, vital signs detection and other HMI technologies and models have been available in cars. The smart cockpit has certain HMI experience and scenario-based capabilities, and the cockpit scenario interaction is more intelligent, emotional, and humane. HiPhi X, which was mass-produced and delivered in 2021, can recognize the driver's expression, voice, heart rate, blood oxygen, blood pressure, breathing rate, etc. through 52 biosensors, and then adjust music and temperature, or take over the vehicle in dangerous situations.

At CES 2021, Samsung exhibited a digital cockpit equipped with Automotive Samsung Health, which analyzes passengers’ health status before boarding by utilizing a combination of cameras and wearable and mobile devices installed in the vehicle. In the car, it also regularly monitors passengers’ stress levels and will adjust the vehicle’s lighting, scent, or music in an effort to help them relax.

2021 Samsung Digital Cockpit with Automotive Samsung Health

Source: Internet

Source: Internet

With the HMI design concept focusing on "user experience", HMI is developing from basic functional perception interaction to cognitive and active interaction through AI, in-car and out-of-car perception technologies.

Smart cockpits realize custom programming through SOA software

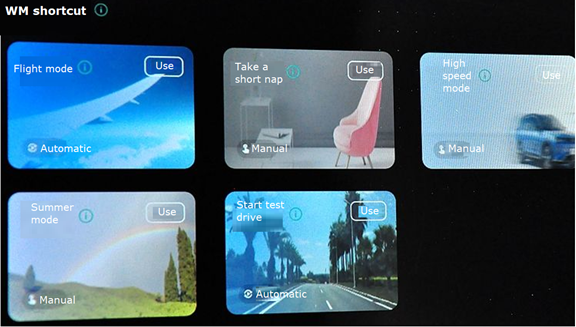

Since smart cockpits are designed as per human-oriented user experience, personalization will become a major development trend of smart cockpits in the future. In addition to the basic personalized custom settings such as the initial IVI system and buttons, the software architecture can help realize the personalized custom settings of multiple scenarios in the car. For example, the WM W6, which was launched at the Shanghai Auto Show in 2021, WM W6 realizes personalized combinations and settings of scenarios based on SOA software and through APP custom programming.

Custom Scenario Programming Card for WM W6

Source: WM

Emerging Automakers Strategy Research Report, 2022--Xpeng Motors

XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch BusinessesXPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth...

Global Passenger Car Vision Industry Report, 2022

Foreign automotive vision research: leading Tier 1 suppliers vigorously deploy DMS/OMS, and vital sign detection becomes a standard configuration for OMS.

1. The revenues of major Tier 1 suppliers in...

China Automotive Vision Industry Report, 2022

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed ...

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped wit...

New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and com...

CTP, CTC and CTB Integrated Battery Industry Research Report, 2022

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module...

China Driving Recorder Market Research Report, 2022

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology s...

Autonomous Delivery Vehicle Industry Report, 2022

Research on autonomous delivery: the cost declines, and the pace of penetration and deployment in scenarios accelerate.

Autonomous delivery contains outdoor autonomous delivery (including ground-base...

China Autonomous Heavy Truck Industry Report, 2022

Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous...

China Smart Parking Industry Report, 2022

Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) hav...

Automotive Head-up Display (HUD) Industry Report, 2022

Automotive HUD research: AR HUD is being largely mounted on vehicles, and local suppliers lead the way. 1. AR HUD is being used widely, with 35,000 vehicles equipped in the first half of 2022.

S...

Intelligent Vehicle E/E Architecture Research Report, 2022

E/E architecture research: 14 key technologies, and innovative layout of 24 OEMsKey technologies of next-generation electronic and electrical architectures (EEA)

The definition of next-generation E/E...

China Automotive Lighting Market Research Report, 2022

Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automake...

Global and China Automotive IGBT and SiC Research Report, 2022

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency ...

Passenger Car Chassis Domain Controller Industry Report, 2022

Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle ...

China Automotive LiDAR Industry Research Report, 2022

LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

...

China Autonomous Driving Data Closed Loop Research Report, 2022

1. The development of autonomous driving is gradually driven by data rather than technology

Today, autonomous driving sensor solutions and computing platforms have become increasingly homogeneous, an...

Overseas LiDAR Industry Research Report, 2022

LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OE...