XPeng Motors Strategy Research: Landing Urban NGP and Expanding Three Branch Businesses

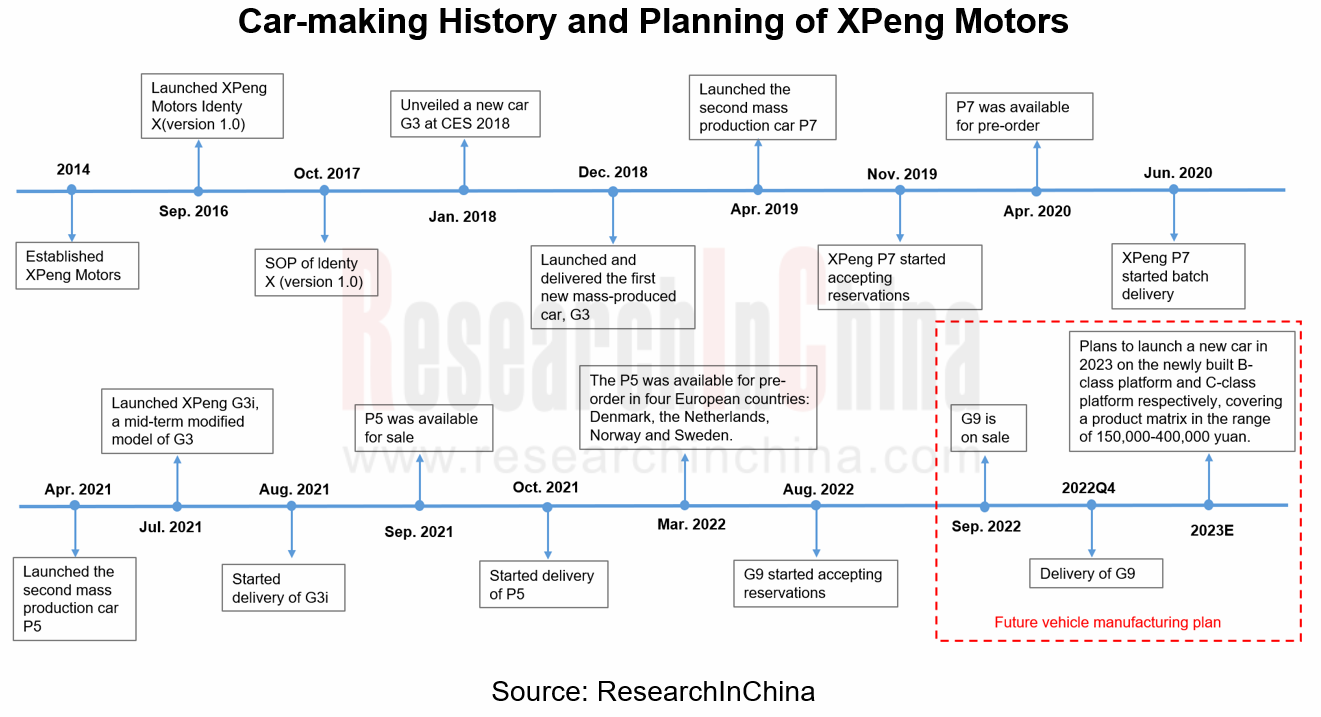

XPeng P7 drives overall sales growth, and three new models will be launched from 2022 to 2023 to drive new growth.

In 2022H1, XPeng Motors sales reached 68,896 vehicles, up 129.5% year-on-year. By model, P7 had the highest sales at 35,268 vehicles, accounting for 51.2%, followed by P5 with 23,179 vehicles, occupying 33.6%.

XPeng Motors has developed two major vehicle manufacturing platforms - David and Edward. Among them, David platform is designed for vehicles with a wheelbase of 2.6m-2.8m, and developed G3 series and P5. Edward platform is designed for vehicles with a wheelbase of 2.8m-3.1m, and already developed P7 and G9.

In terms of car-making planning, G9 was launched in September 2022, focusing on concept of ultra-fast charging, using 800V high-voltage SiC platform to achieve an ultra-fast charging of 5 minutes and a replenishment of more than 200km. In addition, XPeng also plans to launch a new car in 2023 on the newly built B-class platform and C-class platform respectively, covering a product matrix in the range of 150,000-400,000 yuan.

With OTA, the field of intelligent driving is the first to land urban NGP

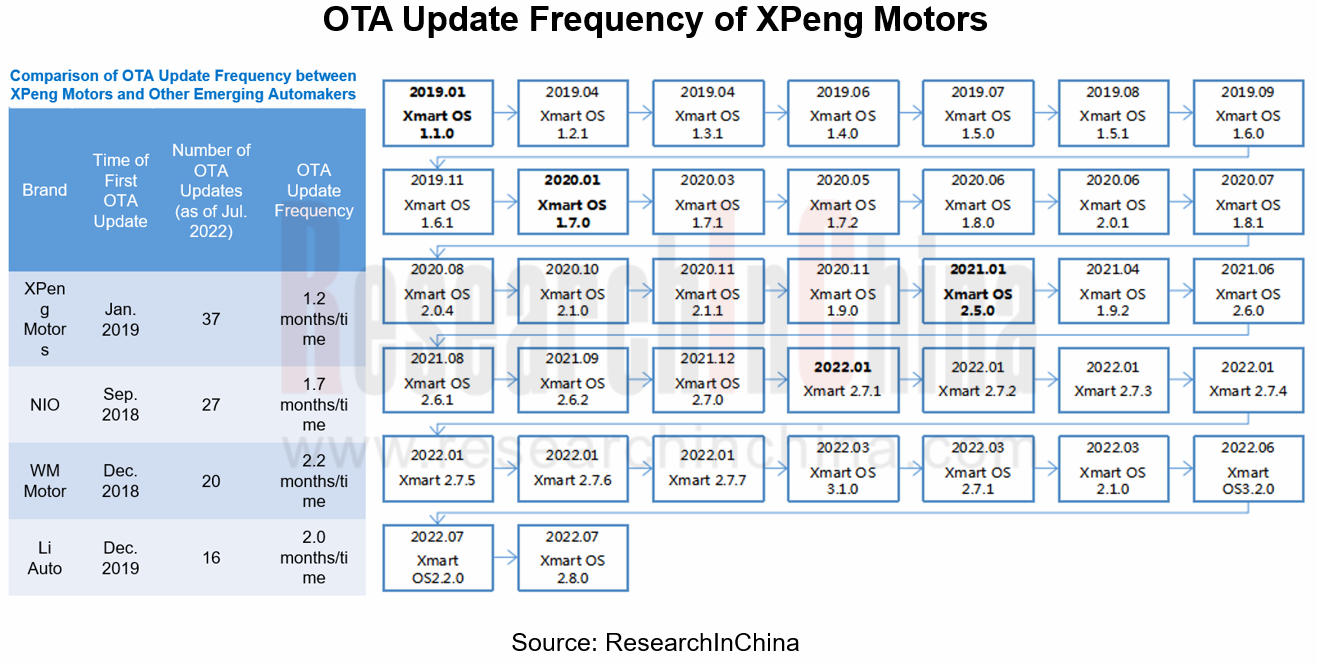

According to ResearchInChina, since XPeng Motors' first OTA upgrade in January 2019, a total of 37 OTA upgrades have been implemented as of July 2022, about once every 1.2 months.

In terms of years, there are 8 times in 2019, 10 times in 2020, 6 times in 2021, and 13 times from January to July 2022.

In terms of categories, as of July 2022, XPeng has 279 OTA functions, and the upgrade content mainly includes six categories: IVI system, body and control, power system, information and data, cockpit and ADAS-related functions. Among them, IVI system and ADAS categories have the most updates, accounting for 72.4% in total.

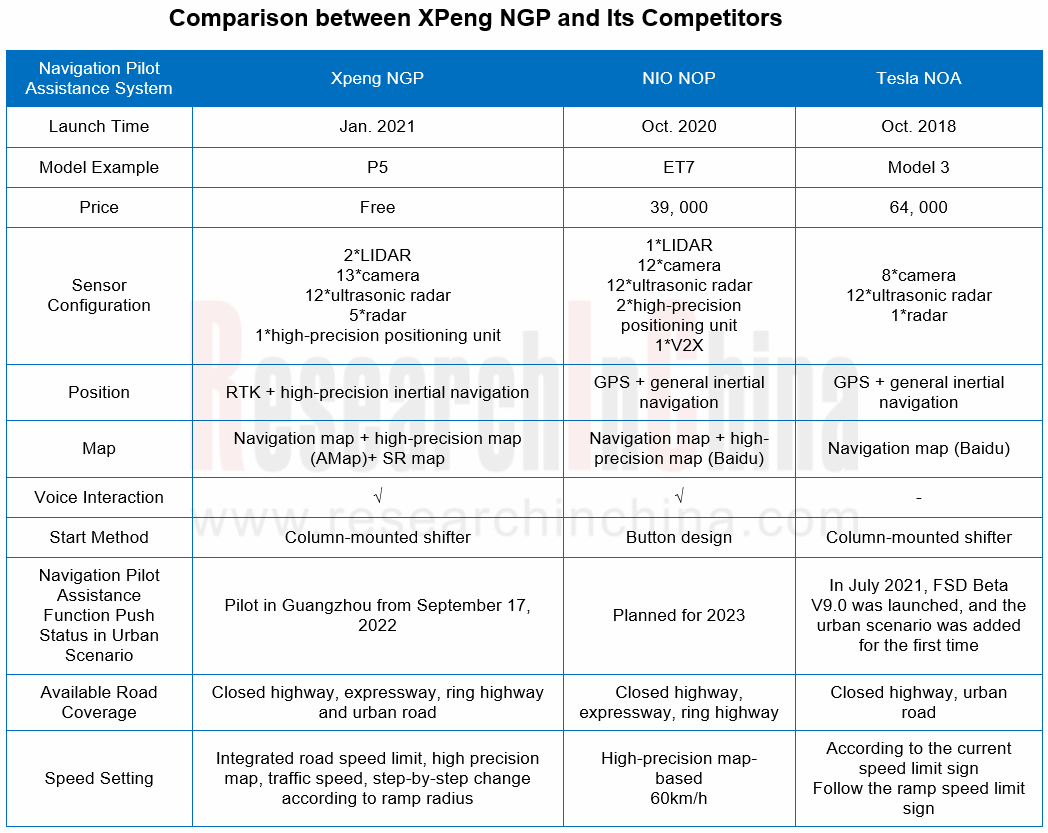

In January 2021, XPeng made NGP Navigation Guided Autopilot (public test version) function available to users for the first time through an OTA upgrade. In addition to providing common capabilities that competing products can provide (such as on/off ramps, automatic lane change, etc.), XPeng NGP is also deeply optimized for scenarios in China's road conditions, such as large truck avoidance and nighttime overtaking alert functions that Tesla NOA does not have.

On September 17, 2022, XPeng successively pushed urban NGP to some P5 users in Guangzhou through OTA, becoming the first car brand in China to mass-produce high-level intelligent assisted driving in urban scenarios. After the relevant procedures are reported and reviewed, the urban NGP will be released to the general public in Guangzhou. Its characteristics are as follows:

Full-stack self-research + LIDAR: urban NGP will be implemented on the XPeng P5 equipped with two LIDARs (provided by DJI Livox).

XPeng urban NGP mainly relies on three perception information routes: the first is to form an accessible space with LIDAR perception, which is equivalent to the 3D space identified by LIDAR in the range that vehicle can drive; the second is the lane line based on road surface; and the third is trajectory of the car nearby, such as turning without a lane.

The overall traffic efficiency is close to 90% of the manual navigation time: with mass production of urban NGP, the proportion of available time of XPeng intelligent assisted driving in the user's car-using time has increased to nearly 90%.

Expanding three branch businesses and exploring the future mobility

In addition to the intelligent driving business, Xiaopeng has also expanded three branch businesses, which together form "quartet" of future mobility.

Branch 1: Layout of Robotaxi, testing new ideas for assisted driving software

In February 2022, XPeng established an autonomous driving company--Guangzhou Pengxu Automatic Driving Technology Co., Ltd.

In July 2022, XPeng registered the trademarks "XPENG ROBOTAXI", "XPeng Zhihang" and "XPeng Zhixing" for Robotaxi business.

On the one hand, it creates commercial value through the capability of mass production pre-installed Robotaxi software and hardware, and future cooperation with various mobility operators; on the other hand, it provides a new idea for XPeng to test assisted driving software through Robotaxi's operation in generalized scenarios.

Branch 2: Entering the field of robotics to create an ecological collaboration between cars and robots

Like Tesla, XPeng also aims at the bionic robot, and released the third-generation prototype of intelligent robot horse "Little White Dragon" in July 2021. The XPeng bionic robot also chooses motor control mode. In addition to saving costs, the motor control can better complement and coexist with AI technology. XPeng has launched in-vehicle AI intelligent voice assistant “Little P” in 2020, through which XPeng linked the robot and automotive business with AI technology. Meanwhile, the intelligent robots have won the support of XPeng Motors in mass production capacity, sales channel, and user operation.

Branch 3: Layout flying cars and make efforts for air mobility

In terms of flying cars, XPENG AEROHT has developed five generations of flying cars from 2013 to March 2022. XPENG X2 is the fifth generation of XPENG AEROHT's self-developed two-person intelligent electric flying car, combining the core technology of the fourth-generation product XPENG X1. At the same time, XPENG AEROHT is promoting the R&D of the sixth-generation flying car XPENG X3, and will invest 85% of its budget in the development of this product.

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...

Global and China Automotive Gateway Industry Report, 2023

Automotive gateway research: integrated gateways have become an important trend in zonal architecture.

Automotive gateway is a core component in the automotive electronic/electrical architecture. As ...

In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

By communication connection form, au...

China Autonomous Driving Data Closed Loop Research Report, 2023

Data closed loop research: in the stage of Autonomous Driving 3.0, work hard on end-to-end development to control data.

At present, autonomous driving has entered the stage 3.0. Differing from the s...

ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous...

China Passenger Car Driving-parking Integrated Solution Industry Report, 2023

Research on driving-parking integration: with the declining share of the self-development model, suppliers' solutions blossom.

Local suppliers lead the driving-parking integration market.

The statis...

Passenger Car Cockpit Entertainment Research Report, 2023

Cockpit entertainment research: vehicle games will be the next hotspot.

The Passenger Car Cockpit Entertainment Research Report, 2023 released by ResearchInChina combs through the cockpit entertainme...

Smart Road - Roadside Perception Industry Report, 2023

Roadside perception research: evolution to integration, high performance and cost control.In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Techn...

China Passenger Car ADAS Domain Controller,Master Chip Market Data and Supplier Research Report, 2023Q1

Quarterly Report on ADAS Domain Controllers: L2+ and above ADAS Domain Controller Master Chip Market Structure This report highlights the passenger car L2+ and above (including L2+, ...

Automotive Cockpit Domain Controller Research Report, 2023

Research on cockpit domain controllers: various forms of products are mass-produced and mounted on vehicles, and product iteration speeds up.

Both quality and quantity have been improved, and the it...

Chinese Passenger Car OEMs’ Overseas Layout Research Report, 2023

OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

During 2021-2022, the global economy ...

Global and Chinese Automakers’ Modular Platform and Technology Planning Research Report, 2023

Research on modular platforms: explore intelligent evolution strategy of automakers after modular platforms become widespread.

By analyzing the planning of international automakers, Chinese conventi...