Global and China Cobalt Industry Report, 2021-2026

-

Mar.2022

- Hard Copy

- USD

$3,400

-

- Pages:163

- Single User License

(PDF Unprintable)

- USD

$3,200

-

- Code:

ZJF182

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$4,800

-

- Hard Copy + Single User License

- USD

$3,600

-

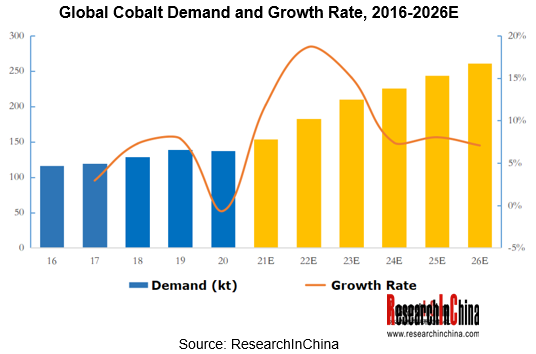

As a very rare metal and an important strategic resource for a country, cobalt gets typically utilized in battery materials, super heat-resistant alloys, tool steels, cemented carbides, and magnetic materials. Spurred by the sales boom of new energy vehicles and a rise in electricity of each vehicle, the demand from power batteries for cobalt has been growing steadily, while that from consumer batteries has plunged due to the COVID-19, resulting in global cobalt consumption with a year-on-year decrease of 0.6 % to 137,500 tons in 2020.

Although power battery cathode materials tend to feature high nickel and zero cobalt in the future, the unit cobalt consumption will edge down. With the explosive production and sales of new energy vehicle globally and the electricity increase per car, the global cobalt use in new energy vehicles will continue a bullish trend with an expected CAGR at least 30% by 2025. Benefiting from new trends like remote work and online education, the cobalt use in 3C consumer electronics is expected to grow stably or slightly. Besides, the cobalt used by cemented carbides and high-temperature alloys is projected to keep a CAGR of 3% to 4% driven by the high-end manufacturing.

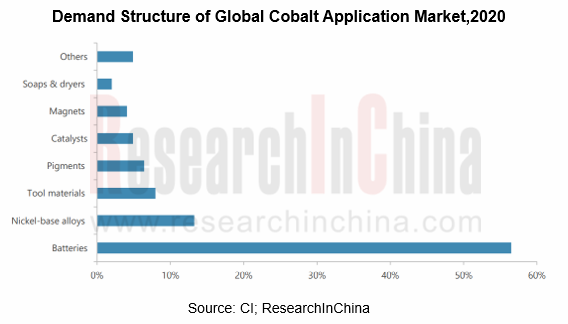

Batteries are the largest consumer of cobalt with a share of about 57%, followed by nickel-based alloys with 14%.

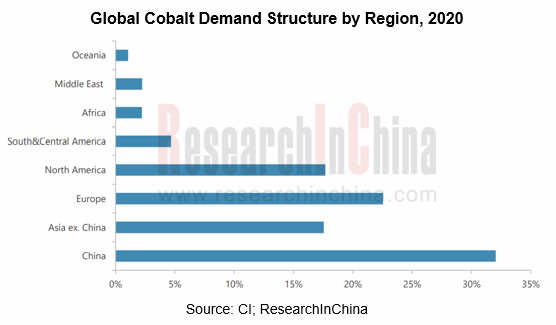

On a regional basis, China is the largest and fastest-growing cobalt consumer, sweeping approximately 32% of global consumption in 2020 when the second-ranked Europe seized about 23% and the No.3 United States 18%.

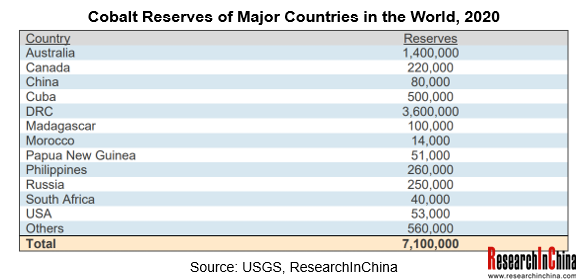

The global cobalt resource reserves are roughly 7.1 million tons, as is revealed by the data from USGS. Congo-Kinshasa boasts the most abundant resources, with 3.6 million tons of cobalt reserves (nearly a half of the world’s total); the follower Australia has 1.4 million tons of cobalt resources as a percentage of about 20%; China holds about 80,000 tons of cobalt resources, sharing only 1.12% of the world's total, and has to rely heavily on imports to meet its own demand annually.

Concerning output, the global cobalt metal output fell 6% year-on-year to about 145,000 tons in 2020, mainly because Mutanda, the world's largest cobalt mine, was closed at the end of 2019. By country, Congo-Kinshasa took a lion’s share 66% of the global total with the output about 96,000 tons, while other countries had small shares like Australia 5%, Russia 4%, the Philippines 4%, Cuba 3%, Canada 3%, etc.

Notably, Glencore became the world's largest cobalt ore manufacturer in 2020 by 31,800 tons as a percentage of 23.7% of the world's total, followed by China Molybdenum Co., Ltd. (“CMOC”) (which acquired cobalt ore resources from Freeport-McMoRan in 2017) 11.2% and Vale 3.3%.

Glencore, headquartered in Baar, Switzerland, is the world's largest commodity trader, dedicates itself to the production and marketing of metals & minerals, energy products and agricultural products. Its metals & minerals mainly include copper, zinc, cobalt, lead, nickel, ferrochrome, gold, silver, etc., among which zinc, cobalt and copper are the fields where Glencore remains superior. Glencore owns the Mutanda Mine and Katanga Mining as its core cobalt assets. The Mutanda Mine is an open-pit copper mine in the Katanga Province of the Democratic Republic of the Congo. Katanga Mining operates a major mine complex in the Congo's Katanga Province, producing refined copper and cobalt. The Mutanda Mine ceased production in late 2019. Katanga Mining resumed production in early 2018. Also, Glencore possesses INO (Integrated Nickel Operations) in Canada and Murrin Murrin (100%) in Australia.

Headquartered in Luoyang city, China, CMOC is devoted to the mining, smelting, deep processing, trade and scientific research of rare and noble metals such as molybdenum, tungsten and gold. In 2016, CMOC acquired an 80% stake in Tenke Fungrume Mining (TFM), a copper-cobalt mine owned by Freeport-McMoRan in the United States for US$2.65 billion. The mine's cobalt output was about 15,000 tons in 2020. On December 31, 2020, CMOC acquired a 95% indirect interest in the Kisanfu copper-cobalt mine in Congo-Kinshasa from Freeport-McMoRan for US$550 million; the Congo-Kinshasa government holds the rest 5% in the mine. In April 2021, CMOC signed a "Strategic Cooperation Agreement" with Brunp Times, an indirect holding company of CATL, allowing Brunp Times to acquire a 25% stake in KFM at a total consideration of US$137.5 million through its wholly-owned subsidiary Hongkong Brunp and CATL Co., Limited. As yet, the mine has not been put into production. According to the latest estimates, the average grade of cobalt in the mine is about 0.85%, and the amount of cobalt-containing metals hits about 3.1 million tons.

Global and China Cobalt Industry Report, 2018-2023 highlights the following:

The cobalt industry (definition, classifications, development trends, industry policies, etc.);

The cobalt industry (definition, classifications, development trends, industry policies, etc.);

Global cobalt industry (reserves, output, demand, and competitive landscape, etc.);

Global cobalt industry (reserves, output, demand, and competitive landscape, etc.);

China's cobalt industry (output, demand, import and export, competitive landscape, etc.);

China's cobalt industry (output, demand, import and export, competitive landscape, etc.);

Output, sales volume, import and export, etc. of global and Chinese cobalt segments;

Output, sales volume, import and export, etc. of global and Chinese cobalt segments;

The cobalt application market, covering lithium batteries, high temperature metals, hard metals, magnetic materials, etc.;

The cobalt application market, covering lithium batteries, high temperature metals, hard metals, magnetic materials, etc.;

18 cobalt-related manufacturers in the world and China, including Glencore, Umicore, Vale, Freeport, CMOC, Huayou Cobalt, GEM, Jinchuan, etc. (profiles, financials, output, sales volume, hit products, production base distribution and the latest dynamics).

18 cobalt-related manufacturers in the world and China, including Glencore, Umicore, Vale, Freeport, CMOC, Huayou Cobalt, GEM, Jinchuan, etc. (profiles, financials, output, sales volume, hit products, production base distribution and the latest dynamics).

1. Cobalt

1.1 Definitions

1.2 Industry Chain

2. Status Quo of Global Cobalt Market

2.1 Cobalt Ore Reserves

2.2 Market Supply

2.2.1 Production of Cobalt Ores

2.2.2 Cobalt Recycling

2.2.3 Refined Production

2.3 Demand

2.4 Price

2.5 Competition Pattern

2.6 Development Trend

3. Cobalt Market Development in China

3.1 Overview

3.2 Policy

3.3 Cobalt Ore Resources

3.4 Market Supply and Demand

3.4.1 Supply

3.4.2 Demand

3.5 Price

3.6 Product Structure

3.7 Competition Pattern

4. China’s Import and Export of Cobalt by Product

4.1 Cobalt Ores and Concentrates

4.1.1 Import

4.1.2 Export

4.2 Cobaltosic Oxide

4.2.1 Import

4.2.2 Export

4.3 Cobalt Chloride

4.3.1 Import and Export

4.3.2 Regional Structure

4.4 Cobalt Carbonate

4.4.1 Import and Export

4.4.2 Regional Structure

4.5 Cobalt Nitrate

4.5.1 Import and Export

4.5.2 Regional Structure

4.6 Cobalt Oxalate

5. Demand of Main Cobalt Downstream Industries

5.1 Battery Materials

5.1.1 Market Development

5.1.2 Demand for Cobalt

5.2 Hard Alloy

5.2.1 Market Development

5.2.2 Demand for Cobalt

5.3 Magnetic Materials

5.3.1 Market Development

5.3.2 Demand for Cobalt

5.4 Superalloy

5.4.1 Market Development

5.4.2 Demand for Cobalt

6. Major Global Cobalt Manufacturers

6.1 Umicore

6.1.1 Profile

6.1.2 Operation

6.1.3 Cobalt Business (Cobalt Specialty Materials)

6.1.4 Business in China

6.1.5 Development Prospect

6.2 Glencore

6.2.1 Profile

6.2.2 Operation

6.2.3 Cobalt Business

6.3 Vale

6.3.1 Profile

6.3.2 Operation

6.3.3 Cobalt Business

6.3.4 Business in China

6.4 Freeport-McMoRan

6.4.1 Profile

6.4.2 Operation

6.4.3 Cobalt Business

6.4.4 Business in China

6.5 Sherritt International

6.5.1 Profile

6.5.2 Operation

6.5.3 Cobalt Business

7. Major Chinese Cobalt Producers

7.1 GEM

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Cobalt Business

7.2 Huayou Cobalt

7.2.1 Profile

7.2.2 Operation

7.2.3 Revenue Structure

7.2.4 Cobalt Business

7.3 Jinchuan International

7.3.1 Profile

7.3.2 Operation

7.3.3 Cobalt Business

7.4 Tengyuan Cobalt

7.4.1 Profile

7.4.2 Operation

7.4.3 Cobalt Business

7.4.4 IPO

7.5 Easpring Material

7.5.1 Profile

7.5.2 Operation

7.5.3 Cobalt Business

7.6 Hanrui Cobalt

7.6.1 Profile

7.6.2 Operation

7.6.3 Cobalt Business

7.7 China Molybdenum

7.7.1 Profile

7.7.2 Operation

7.7.3 Cobalt Business

7.7.4 Acquisition of Kisanfu

7.8 Guangdong Silver

7.8.1 Profile

7.8.2 Operation

7.8.3 Cobalt Business

7.9 Jiana Energy

7.9.1 Profile

7.9.2 Operation

7.9.3 Cobalt Business

7.9.4 Fundraising Projects

7.10 Ramu Nico Management (Mcc)

7.10.1 Profile

7.10.2 Operation

7.11 Jiangxi Tungsten

7.11.1 Profile

7.11.2 Jiangxi Jiangwu Cobalt Co., Ltd.

7.11.3 Jiangxi Jiangwu Nickel and Cobalt New Materials Co., Ltd.

7.11.4 Jiangxi Jiangwu International Nickel and Cobalt New Materials Co., Ltd.

7.12 Huayi Chemical

7.12.1 Profile

7.12.2 Operation

7.12.3 Nantong Xinwei Nickel & Cobalt Hightech Development Co., Ltd.

7.13 Tianjin Maolian Technology Co., Ltd

7.13.1 Profile

7.13.2 Cobalt Business

Cobalt Production Process

Cobalt Product Process

Cobalt Industry Chain

Products of Major Cobalt Downstream Industries

Cobalt Reserves in Major Countries, 2020

Global Cobalt Mine Production, 2013-2020

Cobalt Mine Production of the World excluding DRC, 2013-2020

Cobalt Output in Democratic Republic of the Congo, 2013-2021

Recycling Period and Rate of Cobalt Products

Global Estimated Recycling of Cobalt by Source, 2013-2020

Global Refined Cobalt Output, 2011-2020

Global Cobalt Consumption, 2013-2020

Consumption of cobalt in non-battery applications, 2013-2020

Cobalt Demand Structure Worldwide, 2020

Cobalt Demand Structure by Region, 2020

Global Cobalt Price, 2017-2021

Global MB Cobalt Price, 2015-2021

Changes in Global Cobalt Inventory by Region, 2020-2021

Supply of Main Cobalt Ore Companies Worldwide, 2017-2025

Global Cobalt Supply Trend, 2020-2025E

Cobalt Demand & Supply Balance in Worldwide, 2020-2025E

Chinese Companies’ Layout of Cobalt Industry Chain

Policies on Cobalt Industry in China, 2013-2021

Cobalt Reserves Distribution in China (by Province)

Cobalt Mines Invested by Chinese Companies in Democratic Republic of the Congo

China’s Refined Cobalt Output, 2015-2021

China’s Cobalt Consumption, 2016-2021

Cobalt Demand Structure in China, 2021

Cobalt Price Trend in China, 2017-2021

Cobalt Price by Product in China, 2021

China's Electrolytic Cobalt Output and Operating Rate by Month, 2020-2021

China's CoSO4 Output and Operating Rate by Month, 2020-2021

China's Co3O4 Output and Operating Rate by Month, 2020-2021

China's CoO Output and Operating Rate by Month, 2020-2021

Capacity and Operation of Major Cobalt Companies in China, 2021

Revenue and Gross Margin of China’s Major Cobalt Producers, 2020

Import Volume and Import Value of Cobalt Ores and Concentrates in China, 2014-2020

Export Volume and Export Value of Cobalt Ores and Concentrates in China, 2014-2020

China’s Import Volume and Import Value of Cobaltosic Oxide, 2015-2020

China’s Export Volume and Export Value of Cobaltosic Oxide, 2014 -2021

China’s Import Volume and Import Value of Cobalt Chloride, 2016 -2021

China’s Export Volume and Export Value of Cobalt Chloride, 2014-2021

Structure (%) of China’s Export Volume of Cobaltosic Oxide by Country, 2021

China’s Import Volume and Import Value of Cobalt Carbonate, 2011-2021

China’s Export Volume and Export Value of Cobalt Carbonate, 2014-2021

Structure (%) of China’s Export Volume of Cobalt Carbonate by Country, 2021

China’s Import Volume and Import Value of Cobalt Nitrate, 2012 -2021

China’s Export Volume and Export Value of Cobalt Nitrate, 2014-2021

Structure (%) of China’s Export Volume of Cobalt Nitrate by Country, 2015-2016

China’s Export Volume and Export Value of Cobalt Oxalate, 2012-2021

Global Lithium Battery Shipments by Type, 2016-2020

China’s Lithium Battery Shipments by Type, 2016-2020

Global Top10 Power Lithium Battery Companies by Shipment/Market Share, 2020

Global Lithium Battery Cathode Material Sales, 2016-2025

Lithium Battery Cathode Material Sales of China, 2016-2025

Competitive Pattern of Chinese Lithium Battery Cathode Material Market, 2020

Global Shipment of Ternary Materials and Ternary Precursors, 2016-2025E

Product Structure Comparison of Ternary Precursors in China, 2020-2021

Global and China Ternary Precursor Capacity

Production of Main Ternary Precursor Companies in China, 2021

Amount of Cobalt Consumed by Different Ternary Cathode Materials

Cobalt Demand Structure in Battery Industry

Metal Demand from Different Cathode Materials (Per Ton)

Demand for Cobalt from New Energy Vehicles

Global Demand for Cobalt from Battery Industry, 2020-2025E

Classification of Cemented Carbide (by Component)

Global Cemented Carbide Output, 2017-2020

China’s Cemented Carbide Output, 2010-2020

China's Cemented Carbide Output Distribution, 2020

China's Cemented Carbide Import and Export, 2017-2021

China’s Cemented Carbide -use Cobalt Demand, 2016-2026E

Classification of Magnetic Materials

Global Rare Earth Permanent Magnet Output and Growth Rate, 2015-2025E

China’s Rare Earth Permanent Magnet Output and Growth Rate, 2015-2025E

Global Magnetic Materials-use Cobalt Demand, 2017-2023E

China’s Magnetic Materials-use Cobalt Demand, 2016-2023E

Main Applications of Superalloy

Global Superalloy Consumption Structure by Application

Application of Superalloy in Aerospace Engine Thermal End Bearing Parts

Main Structure of Aerospace Engine

Superalloy Development Course in China

China’s Superalloy Output, 2014-2020

Global Superalloy-use Cobalt Demand, 2012-2020

China’s Superalloy-use Cobalt Demand, 2012-2020

Key Business of Umicore, 2021

Business Layout of Umicore, 2021

Revenue and Net income of Umicore, 2014-2021

Revenue of Umicore by Business, 2015-2021

Energy & Surface Technologies Business Group Profile

Growth and Profitability Drivers of Energy & Surface Technologies Business Group

Total Revenue Structure (%) of Umicore by Region, 2015-2020

R&D Costs and % of Total Revenue of Umicore, 2013-2021

Revenue and Profit from Energy & Surface Technologies Business of Umicore, 2017-2021

Umicore’s Subsidiaries in China, by the End of 2020

Outlook of Umicore, 2021

Global Presence of Glencore

Revenue and Net income of Glencore, 2012-2018

Revenue Structure (%) of Glencore Xstrata by Business, 2015-2021

Revenue Structure of Glencore by region, 2019-2020

Cobalt Output of Glencore from own sources, 2017-2020

Glencore's Cobalt Mine Output, 2015-2021

Global Presence of Vale, 2021

Revenue and Net Income of VALE, 2016-2021

Revenue Structure of VALE by Business, 2019-2020

Revenue Breakdown of Vale by Region, 2019-2020

Cobalt Output of Vale by Mine Area, 2018-2020

Cobalt Product Sales Volume and Revenue of Vale, 2013-2020

Cobalt Ore Reserves and Grades of Vale, 2019-2020

Cobalt Ore Mines of Vale, 2020

Vale in China

Vale’s Revenue and YoY Growth in China, 2014-2020

Mineral Distribution of Freeport-McMoRan, 2020

Revenue and Net income of Freeport-McMoRan, 2014-2021

Revenue Structure of Freeport-McMoRan by Product, 2018-2020

Revenue Breakdown of Freeport-McMoRan by Country/Region, 2018-2020

Revenue and YoY Growth of Freeport-McMoRan in China, 2008-2020

Global Presence of Sherritt International

Key Business of Sherritt International

Sherritt’s Main Subsidiaries

Sherritt’s Key Operational Indicators, 2019-2020

Revenue Breakdown of Sherritt International by Business, 2020

Revenue Breakdown of Sherritt International by Country/Region, 2019-2020

Sherritt’s Cobalt Output and Sales, 2019-2020

Revenue and Net income of GEM, 2014-2021

Revenue Breakdown of GEM by Product, 2020-2021

Revenue Breakdown of GEM by Region, 2014-2021

Procurement from Top 5 Suppliers of GEM, 2013-2020

R&D Costs and % of Total Revenue of GEM, 2014-2020

Capacity of GEM’s Main Products until Dec, 2020

Cobalt Industry Recycling Production Mode of Shenzhen Green Eco-Manufacture

Downstream Customers for Cobalt Lithium Battery Materials of GEM

Main Products of Huayou Cobalt

Revenue and Net income of Huayou Cobalt, 2014-2021

Operating Revenue of Huayou Cobalt by Product, 2017-2020

Operating Revenue of Huayou Cobalt by Region, 2014-2020

Gross Margin of Huayou Cobalt by Product, 2014-2020

Major Customers of Huayou Cobalt

Production and Sales Volume of Cobalt Products of Huayou Cobalt, 2016-2020

Revenue and Net income of Jinchuan International, 2016-2021

Revenue Breakdown of Jinchuan International, 2021

Specification of Ruashi Mine

Specification of Musonoi Project

Revenue and Net income of Tengyuan Cobalt, 2018-2021

Revenue Breakdown of Tengyuan Cobalt by Product, 2018-2020

Revenue Breakdown of Tengyuan Cobalt by Region, 2018-2020

Gross Margin of Tengyun Cobalt by Product, 2019-2021

Capacity and Output of Tengyuan Cobalt, 2018-2020

TOP Customers of Tengyuan Cobalt, 2020

Proposed Project of Tengyuan Cobalt, 2021

Development Course of Easpring Material, 1992-2021

Revenue and Net Income of Easpring Material, 2012-2021

Revenue of Easpring Material by Business, 2019-2021

Revenue of Easpring Material by Region, 2014-2021

Gross Margin of Easpring Material by Business, 2019-2021

Key Lithium Battery Materials of Easpring Material

Capacity of Cathode Materials of Easpring Material, 2015-2021

Capacity Distribution of Easpring Material, 2021

Capacity Expansion Plan of Easpring Material, 2019-2023

Revenue and Net income of Hanrui Cobalt, 2014-2021

Revenue Breakdown of Hanrui Cobalt by Product, 2018-2021

Gross Margin of Hanrui Cobalt by Product, 2017-2021

Industrial Chain of Hanrui Cobalt

Capacity of Major Products and Capacity Planning of Hanrui Cobalt, 2021

Output of Hanrui Cobalt by Product, 2016-2020

Global Presence of China Molybdenum

Revenue and Net income of China Molybdenum, 2014-2021

Revenue and Gross Margin of China Molybdenum by Product, 2019-2021

Revenue and Gross Margin of China Molybdenum by Region, 2019-2021

Cobalt Metal Sales Volume of China Molybdenum’s TFM, 2017-2021

Revenue and Net Income of China Molybdenum’s TFM, 2019-2021

Kisanfu’s Shareholding Structure

CMOC’s Resource Reserves in TFM and KFM

Revenue and Net Income of Guangdong Silver, 2014-2021

Operating Revenue and Gross Margin of Guangdong Silver by Product, 2019-2021

Proposed Cobalt Project of Guangdong Silver, 2021H1

Major Subsidiaries of Jiana Energy

Revenue and Net Income of Jiana Energy, 2016-2021

Main Products of Jiana Energy

Production of Dowstone's Cobalt Products, 2018-2021

Sales Volume of Dowstone's Cobalt Products, 2018-2021

Purposes of Funds Raised by Dowstone through Non-public Offering of Shares

Shareholding Structure of Projects of Ramu Nico Management Limited, 2017

Nickel Cobalt Companies of Jiangxi Tungsten

Cobalt Related Products of Huayi Chemical

Automotive AUTOSAR Platform Research Report, 2023

AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation ...

China Autonomous Driving Algorithm Research Report, 2023

Autonomous Driving Algorithm Research: BEV Drives Algorithm Revolution, AI Large Model Promotes Algorithm Iteration

The core of the autonomous driving algorithm technical framework is divided into th...

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Dismantling Report: DJI Front View Binocular Camera and Innovusion LIDAR

Recently, ResearchInChina selected two key components essential to current intelligent driving assistance systems - front view...

Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market beco...

Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the tren...

Autonomous Driving Simulation Industry Chain Report (Chinese Companies), 2022

Simulation Research (Part II): digital twin, cloud computing, and data closed-loop improve simulation test efficiency.

Simulation tests can not only be conducted in extreme working conditions and mor...

Automotive Memory Chip Industry Research Report, 2022

Automotive Memory Chip Research: Localization is imperative amid intense competition

The global smart phone storage market size hit US$46 billion in 2021 when the global automotive storage market siz...

Autonomous Driving Simulation Industry Chain Report (Foreign Companies), 2022

Simulation test research: foreign autonomous driving simulation companies forge ahead steadily with localization services.

As the functions of ADAS and autonomous driving systems are developed and th...

China Automotive Multimodal Interaction Development Research Report, 2022

Multimodal interaction research: more hardware entered the interaction, immersive cockpit experience is continuously enhanced

ResearchInChina's “China Automotive Multimodal Interaction Development Re...

Global and China Automotive Operating System (OS) Industry Report,2022

Operating system research: the automotive operating system for software and hardware cooperation enters the fast lane.

Basic operating system: foreign providers refine and burnish functions; Chinese ...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2022

Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expect...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2022

In-cabin Monitoring Research: In the first nine months of 2022, the installations of DMS+OMS swelled by 130% yr-on-yr with visual DMS/OMS as the mainstream solution

Local manufacturers are keen to de...

NIO ET5/ET7 Intelligent Function Deconstructive Analysis Report, 2022

NIO ET5/ET7 Intelligent Function Deconstruction: R&D will change the market pattern in 2025Chinese automakers have triumphed remarkably in the field of high-end intelligent electric vehicles. Afte...

Automotive Smart Cockpit Design Trend Report, 2022

Research on design trends of intelligent cockpits: explore 3D, integrated interaction. ...

Commercial Vehicle Telematics Report, 2022

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry cont...

Passenger Car Intelligent Steering Industry Research Report, 2022

Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

In September 2022, Geely and Hella joi...

China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehic...

China L2 and L2+ Autonomous Passenger Car Research Report, 2022

L2 and L2+ research: The installation rate of L2 and L2+ is expected to exceed 50% in 2025.So far, L2 ADAS has achieved mass production, and L2+ ADAS has seen development opportunities as the layout f...