Global and China Automotive Cluster and Center Console Industry Report, 2022

Automotive Display Research: Penetration Rate of OLED, Mini LED and Other Innovative Display Technology Increased Rapidly

With the penetration of new energy and intelligent driving vehicles, the trend of large-screen and multi-screen displays in vehicles is becoming more and more obvious. In addition to the central control and instrument screens, new products such as HUD, passenger display, rear entertainment display, electronic rearview mirrors and transparent A-pillars have also been added in the cabin, and the installation volume of automotive display screens has ushered in rapid growth.

OLED, Mini LED, Micro-LED is the evolution direction of automotive display technology

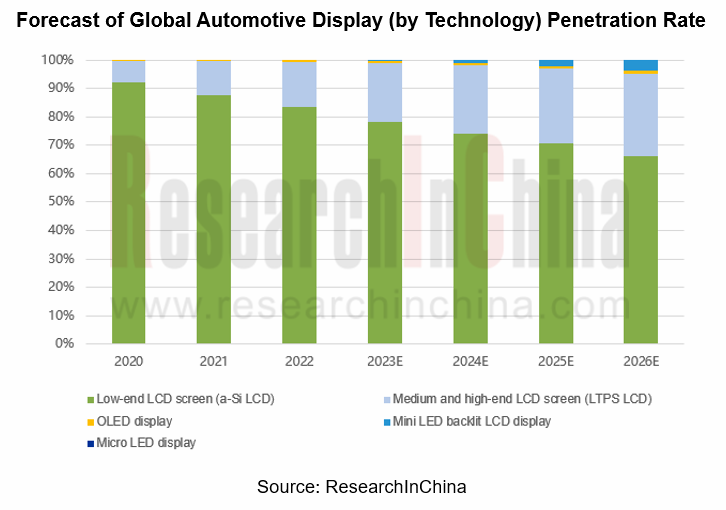

At present, the market penetration rate of the mainstream technology a-Si LCD in the automotive display market continues to decline. On the one hand, OEMs deploy LTPS-LCD in high-end models, and on the other hand, they step up the deployment of innovative technologies such as OLED, Mini-LED, and Micro-LED for mass production and installation.

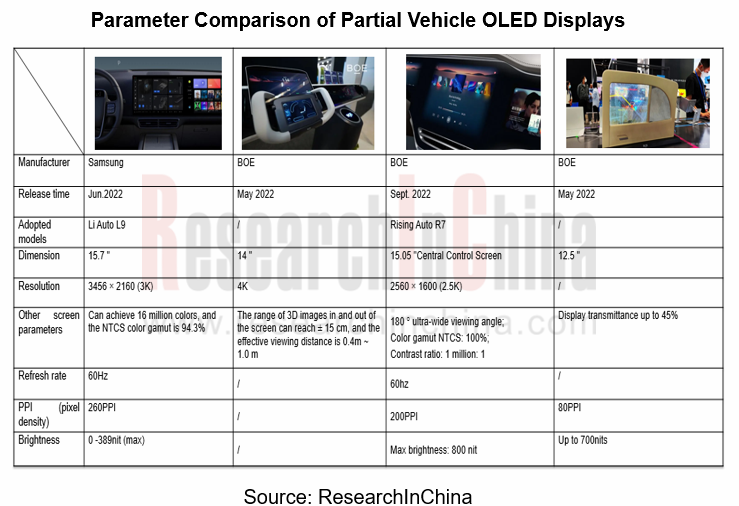

Compared with LCD, although OLED priors in strong ductility, wide color gamut, high brightness, pure color, and mature technology, the penetration rate in the automotive display market is still less than 1%. Due to the influence of OLED luminescence characteristics, in addition to cost issues, there are technical difficulties such as yield, burn-in and service life, which hinder the rapid development of OLED screens in the vehicle field.

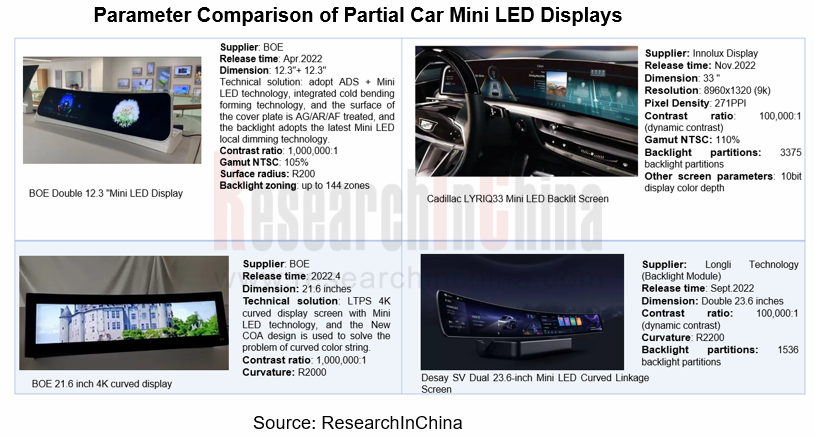

Generally, in the automotive display market, Mini LEDs use direct-type backlights, which combine the advantages of OLED and LCD, such as long service life and do not have the burn-in problem. Compared with OLED, Mini LED backlights have higher yield, lower cost, and obvious advantages in mass production. In terms of display performance, Mini LED's overall brightness, contrast, power consumption, and curved display are better than traditional side-entry backlight displays. Mini LED backlight displays have higher cost-effective advantages, so they are widely recognized by OEMs, and the willingness of OEMs to use Mini LED backlight displays is becoming stronger and stronger.

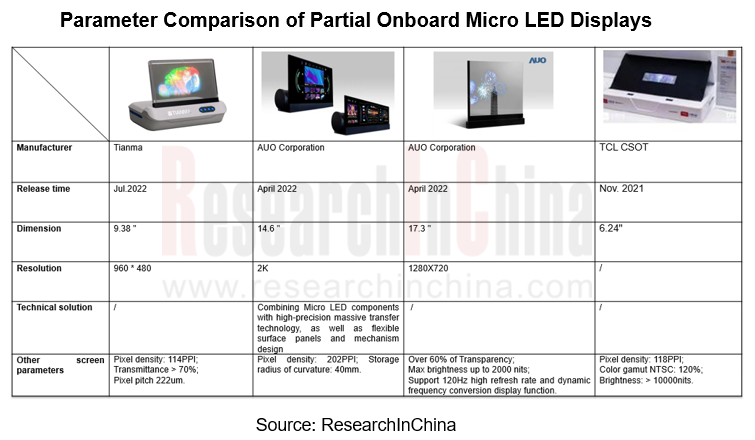

Micro LED integrates the advantages of LCD and OLED, with high image quality, low energy consumption and long life. However, its manufacturing process is difficult, the production cost is high, and the technology is not yet mature. Although it appeared at the exhibition at high frequency, it is far from meeting the mass production requirements. Therefore, it can only be used as a reserve technology for Automotive Display in the short term, and it still needs to be developed and broken through.

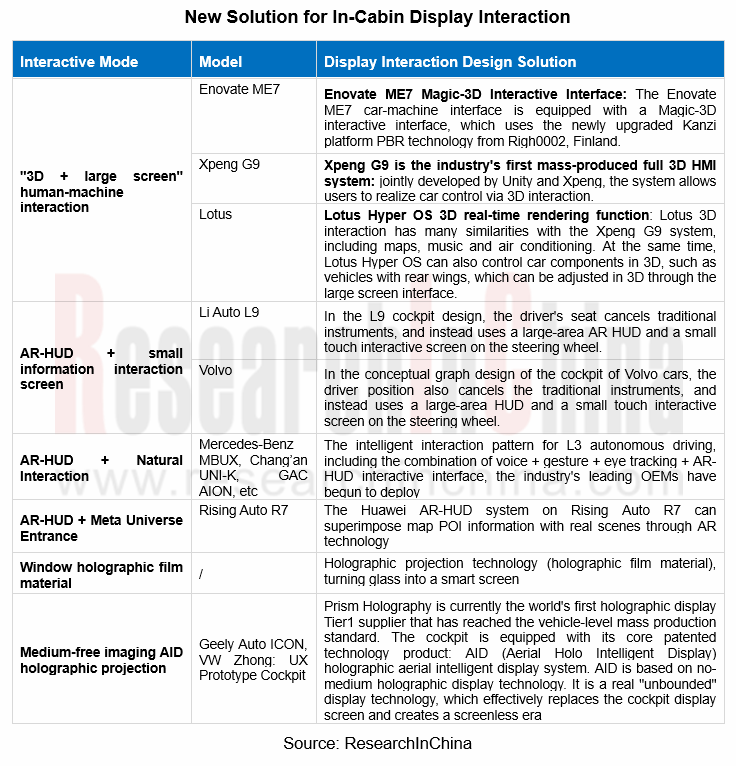

AR-HUD leads a new mode of in-cabin display interaction

The core of the development of intelligent cockpit is how to realize natural and reasonable human-vehicle interaction. After the intelligent car enters the stage of human-machine co-driving, AR-HUD will become a bridge for the interaction between people and vehicles.

The Rising Auto R7, launched in Sept. 2022, adopts an in-cabin display that combines a triple screen and AR-HUD. The triple screen is integrated by a 10.25-inch Mini LED full LCD instrument, a 15.05-inch AMOLED flexible center control screen and a 12.3-inch Mini LED co-pilot entertainment screen, which can realize multi-screen linkage. For example, the co-pilot entertainment screen mainly provides entertainment applications for the co-pilot user, but during the trip, the co-pilot user can also set the navigation on the co-pilot screen to avoid the driver's distraction. After the navigation setting is successful, the display screen in the middle will automatically display the corresponding map navigation, and the AR-HUD will also absorb the navigation information to make road instructions at the same time.

The AR-HUD of Rising Auto R7 provides immersive experience of giant-screen cinema when parked and charging. Through the video application software in the automotive Infotainment, the AR projection screen can project the video content into the AR-HUD for viewing. At present, this equivalent 70-inch large frame size currently only supports the main driver. A user needs to park the car in viewing mode, and adjusts the seat height at the same time.

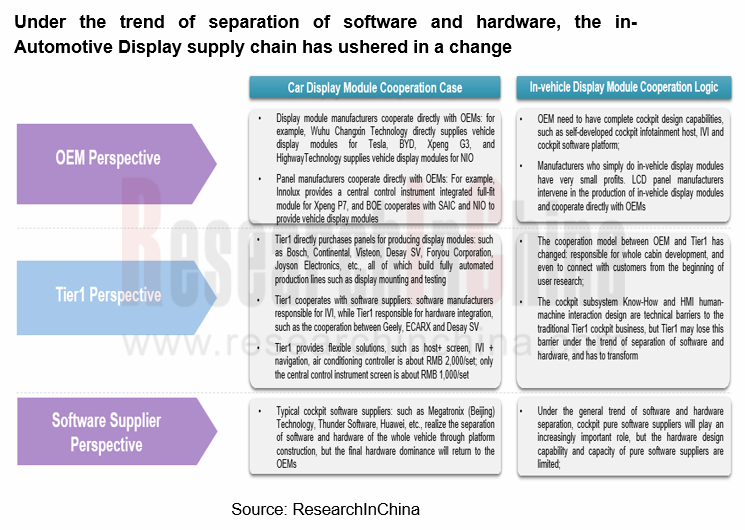

New supply model for OEM + panel (module) manufacturers

With the improvement of the software capabilities of the OEMs, the trend of separation of software and hardware is becoming more and more obvious. OEMs has begun to develop its own cockpit main engine, IVI and software platform. The business model of in-vehicle panel and module supply will change, and gradually form a new supply model of "OEM + panel (module) manufacturer". Therefore, Tier1 offering the traditional cockpit display will face challenges.

Panel (module) manufacturers will gradually play the role of on-board display module Tier1. Typical manufacturers include Tianma, BOE Varitronix, Truly International, Innolux Display, etc. Panel manufacturers can directly provide OEMs with integrated packaging module products. In addition to traditional central control instruments, panel (module) manufacturers and OEMs will further cooperate to explore transparent window display, very narrow frame on-board display, flexible OLED, 3D curved display technology, AR-HUD, OLED tail lights, etc.

For example, AUO Corporation and Innolux Display directly provide full mini LED backlight display modules to American OEMs; Samsung Display works closely with Audi to develop OLED products; Tesla leads the procurement of key display components and designates display module manufacturers for packaging. In the next step, panel suppliers will strengthen their partnerships with automakers and provide next-generation display technologies.

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...

China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes i...

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...

Automotive High-precision Positioning Research Report, 2023-2024

Autonomous driving is rapidly advancing from highway NOA to urban NOA, and poses ever higher technical requirements for high-precision positioning, highlighting the following:

1. Higher accuracy: urb...

New Energy Vehicle Thermal Management System Research Report, 2023

Thermal management system research: the mass production of CO? heat pumps, integrated controllers and other innovative products accelerates

Thermal management of new energy vehicles coordinates the c...

Commercial Vehicle Intelligent Chassis Industry Report, 2023

Commercial Vehicle Intelligent Chassis Industry Report, 2023, released by ResearchInChina, combs through and researches status quo and related product layout of OEMs and suppliers, and predicts future...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2023

1. Wide adoption of NOA begins, and local brands grab market share.

According to ResearchInChina, from January to August 2023, joint venture brands accounted for 3.0% of installations of L2.5 and hi...

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...

Automotive Audio System Industry Report, 2023

Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several...