China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Who are players? What are their products and solutions? How to implement? These issues are exactly what ResearchInChina explores and studies in China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

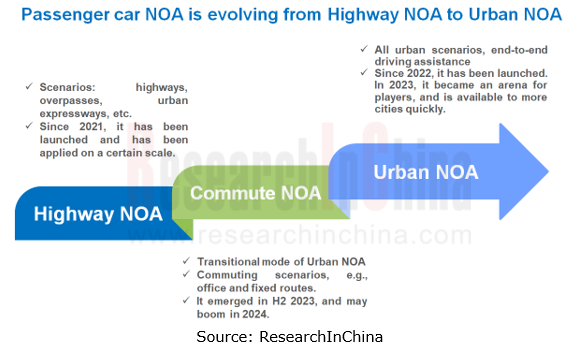

1. NOA is evolving from Highway NOA to Urban NOA.

Navigate on Autopilot (NOA) is divided into Highway NOA and Urban NOA by application scenario. At present, Highway NOA has been implemented on a scale, and Urban NOA is developing rapidly.

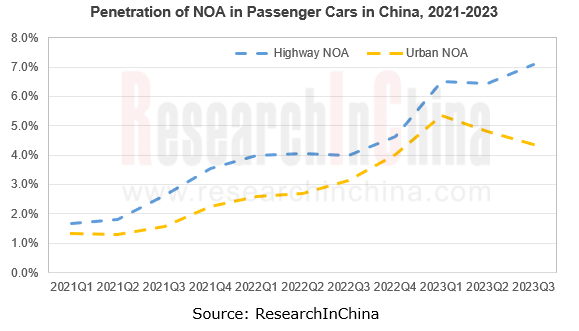

According to the statistics of ResearchInChina, from January to September 2023, the penetration of Highway NOA in passenger cars in China was 6.7%, up 2.5 percentage points from the prior-year period; the penetration of Urban NOA was 4.8%, up 2.0 percentage points. It is estimated that the full-year penetration of Highway NOA and Urban NOA will be nearly 10% and over 6%, separately.

2. Urban NOA becomes an arena for OEMs.

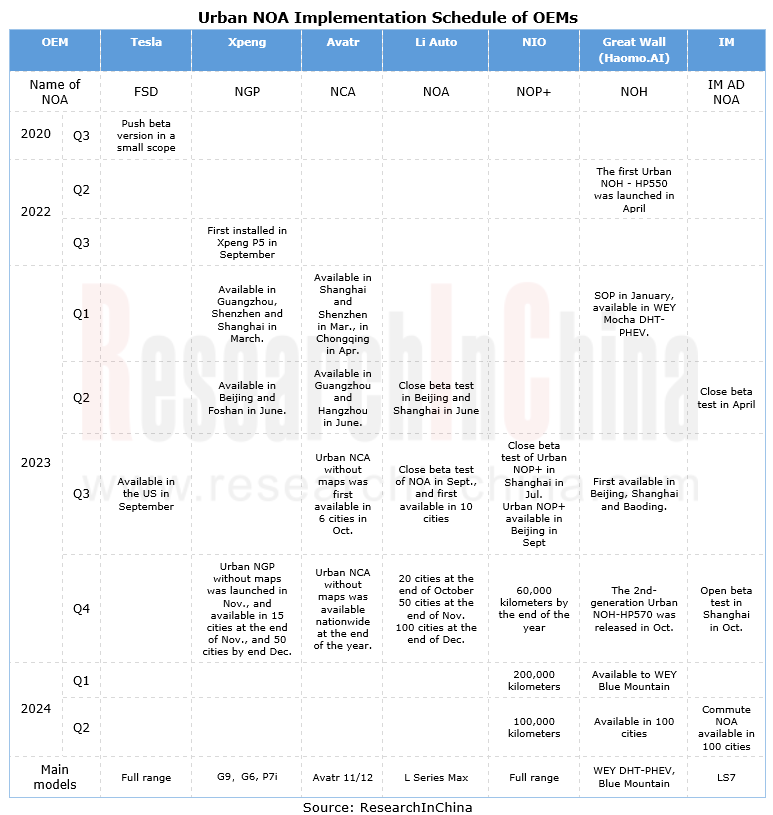

In 2023, quite a few OEMs have dabbled in Urban NOA which was booming in Chinese cities.

As per the implementation process, OEMs have initially formed two echelons:

In the first echelon, Tesla, Xpeng, Li Auto, NIO, ARCFOX, Avatr, AITO, etc. plan to implement Urban NOA in 2023.

In the second echelon, IM, BYD, Jiyue, WEY, Leapmotor, ZEEKR, etc., plan to implement Urban NOA in 2024.

There are mainly two kinds of solutions implemented:

“High-weight perception”: Usually Urban NOA uses LiDAR. Yet in the second half of 2023, vision-only Urban NOA solutions, such as Baidu Apollo City Driving Max, and DJI Chengxing Platform - 9V, emerged.

"Low-weight map": In 2023, the market demand has gradually shifted from “high-weight HD maps” to “non-/low-weight HD maps”. Urban NOA solutions that do not rely on HD maps therefore debuted stunningly, such as Huawei ADS 2.0 and Xpeng XNGP.

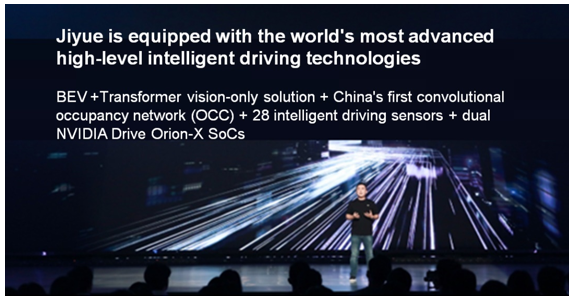

In October 2023, Jiyue's first model, Jiyue 01, was launched on market, equipped with ROBO Drive Max based on Baidu Apollo City Driving Max. It uses BEV+Transformer + convolutional occupancy network (OCC) technology, and packs 11 HD cameras (including 7 8MP cameras), 12 ultrasonic radars, 5 radars, and dual Orin-X SoCs (AI compute: 508 TOPS) to enable such functions as Highway NOA, Urban Point-To-Point Autopilot (PPA), and AVP.

Jiyue PPA enables high-level intelligent driving assistance in highway and urban scenarios. In highway scenarios, it completes automatic change lane to overtake, on/off-ramp, obstacle avoidance in/between lanes, and other tasks. In urban scenarios, it can accurately recognize zebra crossings, traffic lights, give way to pedestrians, make unprotected left turns, and avoid non-motorized vehicles.

According to the planning of Jiyue, PPA will be available in Shanghai, Shenzhen and Hangzhou in 2023, and more than 200 cities in China in 2024.

3. Commute NOA opens a new way for implementation of Urban NOA.

In the second half of 2023, Commute NOA (memory driving) was favored by the industry. Commute NOA is actually a transitional mode of Urban NOA, with the following features:

Repeated training based on relatively fixed routes;

When there are enough effective data for training, this function can be enabled;

The comprehensive update on HD maps is not required;

Generally, memorizing a simple route takes a week, and a complex route takes 2-3 weeks.

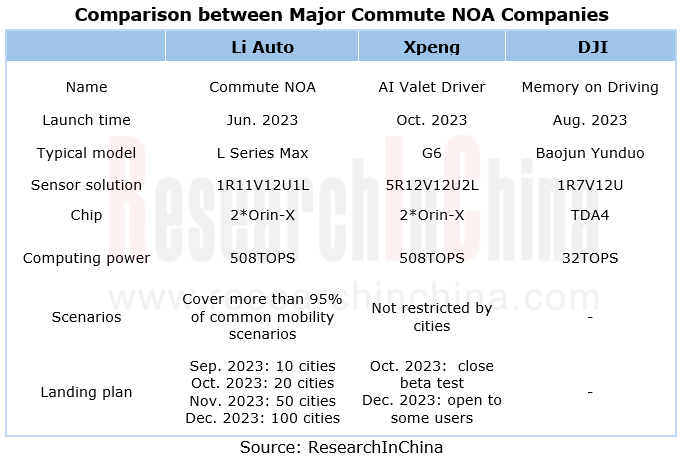

At present, Commute NOA has different names in the industry, for example, Xpeng calls it AI Valet Driver, and DJI calls it Memory on Driving, but the main purpose is to speed up the pace of "getting into the city" without HD maps. “The bottom layer of the AI Valet Driver mode does not rely on maps, and if Urban NOA gains an average score of 85 in the map-free mode, AI Valet Driver can score 90 or even 95”, said He Xiaopeng, CEO of Xpeng.

By the end of 2023, OEMs such as Xpeng, Li Auto and IM, and solution providers like DJI, Haomo.AI, Baidu and QCraft have taken the lead in this filed. Among them, Li Auto has been the most aggressive player.

The Commute NOA mode introduced by Li Auto in June 2023 can cover more than 95% of common mobility scenarios. Li Auto began to push the close beta version of Commute NOA to early bird users in 10 cities including Beijing, Shanghai, Guangzhou and Shenzhen in September, and expanded it to 20 cities in October, 50 cities in November and 100 cities nationwide in December.

4. “BEV+Transformer” facilitates the application of City NOA

In the past two years, the voice of "more stress on perception and less stress on maps" has become louder and louder. Chinese players mainly use BEV+Transformer technology to optimize and upgrade system perception capabilities for lower dependence on HD maps, thus cutting down costs and promoting the rapid implementation of Urban NOA. Typical companies include Xpeng, Huawei, Li Auto and Haomo.AI.

Xpeng:

In October 2022, Xpeng launched the next-generation intelligent driving system XNGP. Based on the perception architecture XNet 1.0, this system enables Urban NOA without HD maps.

In October 2023, the upgraded XNGP introduced XBrain, an all-scenario intelligent driving architecture composed of XNet 2.0 and XPlanner. XNet2.0 is a perception system which can understand time and space. It adopts three-in-one architecture involving dynamic BEV, static BEV and occupancy network. With the longitudinal and lateral perception range increased by 200%, it can perceive 11 new types of objects, including small animals, ground locks and parked bicycles.

According to the planning of Xpeng, XNGP will spread to 50 cities in 2023. In 2024, it will achieve full coverage of road networks (including Class 1-4 roads) in major cities across the country.

Huawei

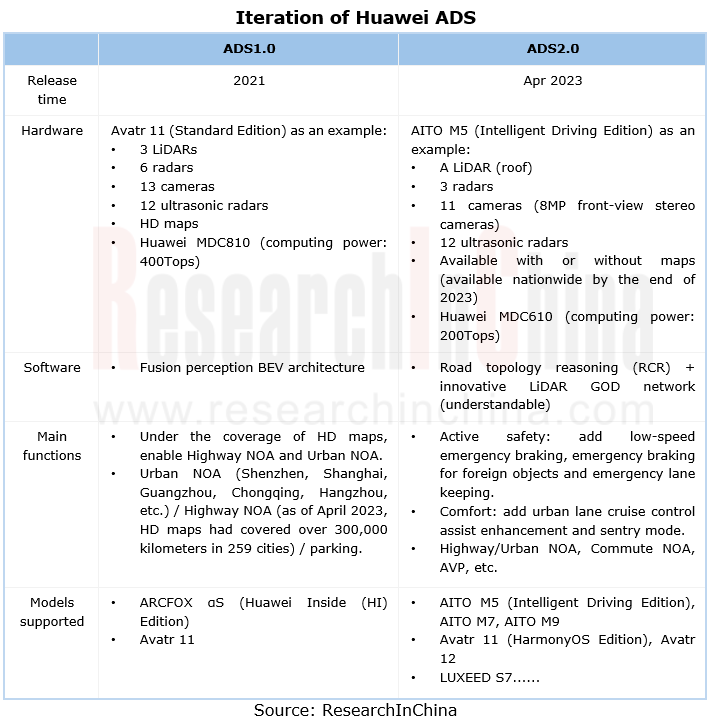

Huawei: the self-developed advanced intelligent driving system ADS has iterated twice.

Based on Transformer's BEV architecture, ADS 2.0 uses the RCR (Road Cognition and Reasoning, Road Topology Reasoning) and the innovative LiDAR GOD (General Obstacle Detection) network to fuse data from LiDAR, radar, and cameras to achieve high-level intelligent driving without HD maps. It was first installed on the Intelligent Driving Edition of AITO M5.

In September 2023, ADS 2.0 was upgraded, highlighting the iteration of two algorithms. GOD 2.0 (General Obstacle Detection) can "understand objects and roads.” Understanding objects means GOD 2.0 can recognize foreign objects outside the universal obstacle white list and accurately recognize obstacle types (ambulances, police cars, etc.). Understanding roads means RCR2.0 (Road Cognition & Reasoning) can match navigation maps with the real world.

In November 2023, Avatr 12 equipped with the latest ADS 2.0 was available on market, with an officially announced GOD recognition rate of 99.9% and an RCR perception area equivalent to 2.5 football pitches. In complex urban scenarios, it provides such functions as adaptive cruise control, intelligent lane change, obstacle avoidance, and special-shaped intersections/night/tunnels crossing. It can also pass TLC standard intersections on rural roads, change lanes in construction scenarios, change lanes in the same direction to avoid obstacles, and pass narrow roads (without lane lines).

5. Extremely cost-effective solutions drag down NOA installation costs.

In 2023, the intelligent driving industry set off a wave of price reduction. Following this trend, many suppliers, such as DJI, Haomo.AI and Yihang.AI, launched a range of NOA solutions with high cost performance.

DJI:

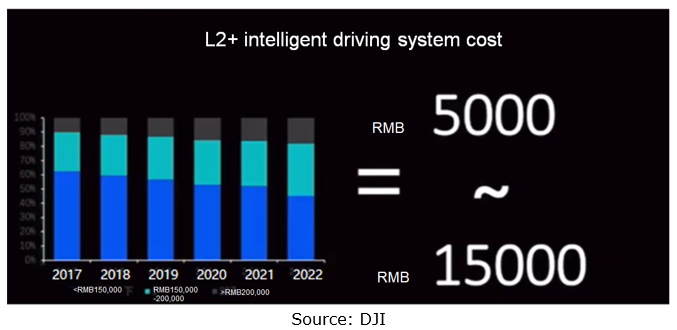

In April 2023, DJI offered L2+ intelligent driving functions including urban Memory on Driving (32TOPS)/Urban NOA (80TOPS), which “use strong vision for online real-time perception and don’t rely on HD maps or LiDAR”.

According to DJI, the hardware cost (RMB5,000~15,000) of the solution takes up about 3% to 5% of the total vehicle price. This view is echoed by Cheng Peng, the CEO of NavInfo. Cheng Peng said that automakers would accept that the total cost of intelligent driving systems shares about 3% of the selling price of vehicles.

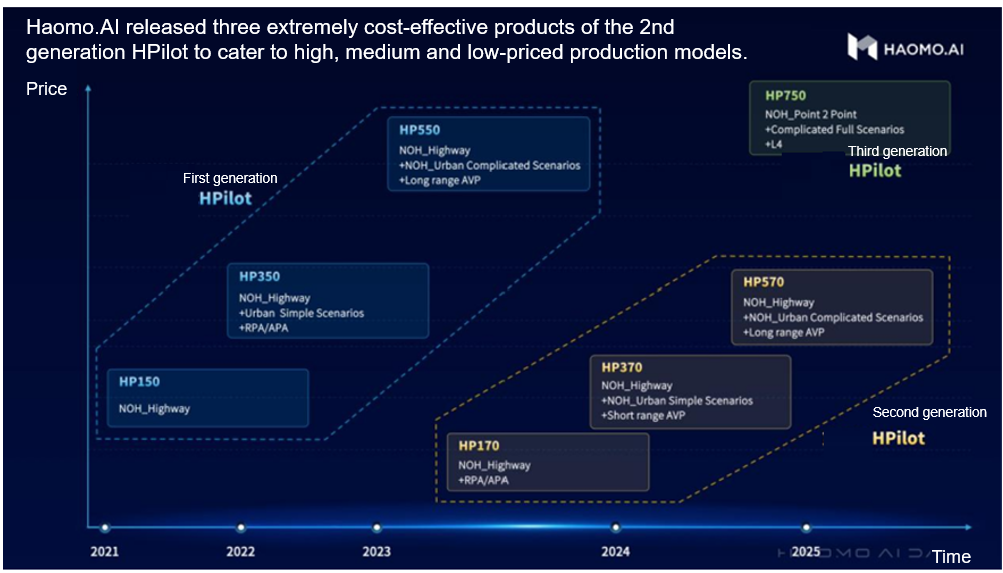

Haomo.AI

Haomo.AI unveiled three cost-effective, map-free NOH solutions of the 2nd-generation HPilot in November 2023. In HP570’s case, the RMB8,000 Urban NOH doesn’t rely on maps, and the computing power of 72/100TOPS supports driving-parking integration.

Yihang.AI

The driving-parking integrated solution NOA, released by Yihang.AI in May 2022, uses two TI TDA4VM processors with computing power of 16TOPS, enabling 16 driving functions and 10 parking functions in scenarios such as highways/urban loops, including automatic overtaking, automatic road network switching, automatic on/off-ramp, automatic merge into/exit from the main road. This solution has been first applied to models like SAIC Maxus G90. The Urban NOA solution highlighting BEV and perception has been designated for mass production, with multiple models built and functions developed.

In general cost-effective NOA solutions exploit intelligent driving hardware, and enables vision-only high-level intelligent driving capabilities based on low-compute platforms. The implementation of these solutions will, to a certain extent, facilitate the use of high-level intelligent driving in vehicles priced below RMB200,000, improving the intelligence level of the whole automotive market.

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in di...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...