Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, suppliers, and supply chains, and predicts the future development trends of passenger car intelligent steering.

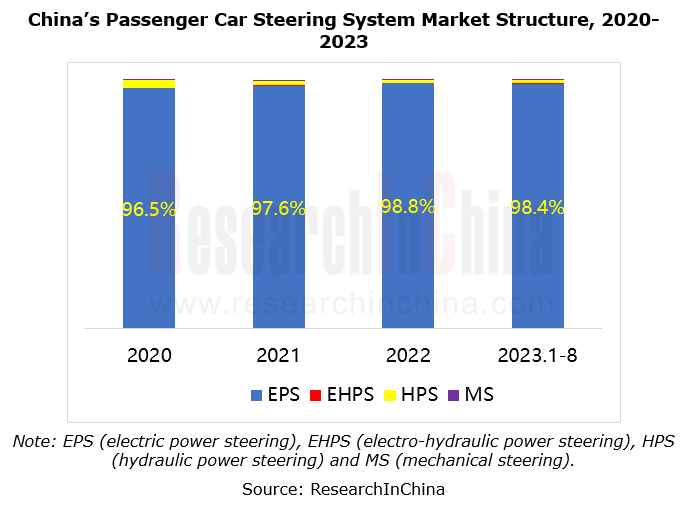

1. The penetration rate of electric power steering (EPS) in the passenger car market almost hits the peak, and the iteration and upgrading of products reflect the current development direction.

From 2020 to 2023, the penetration of EPS in the Chinese passenger car market remained at a high level. In the next stage, EPS will head in the direction of high performance.

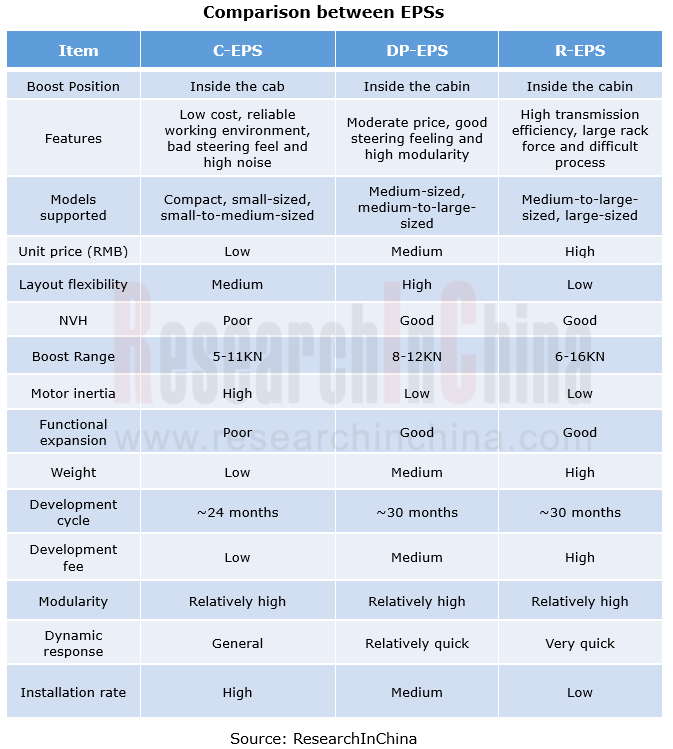

By the installation position of booster motor, EPS can be divided into four types: column EPS (C-EPS), pinion EPS (P-EPS), rack EPS (R-EPS) and dual pinion EPS (DP-EPS). In terms of transmission efficiency from high to low, the ranking is R-EPS/DP-EPS > P-EPS > C-EPS. As mid-to-high-end smart electric vehicles boom, the steering system is being upgraded from C-EPS to R-EPS and DP-EPS. The content-per-car value of the latter two is higher than that of C-EPS, and the iteration of the EPS product structure brings value increment.

2. In the process of upgrading from EPS to SBW (steer-by-wire), redundant EPS and rear wheel steering become the transitional form.

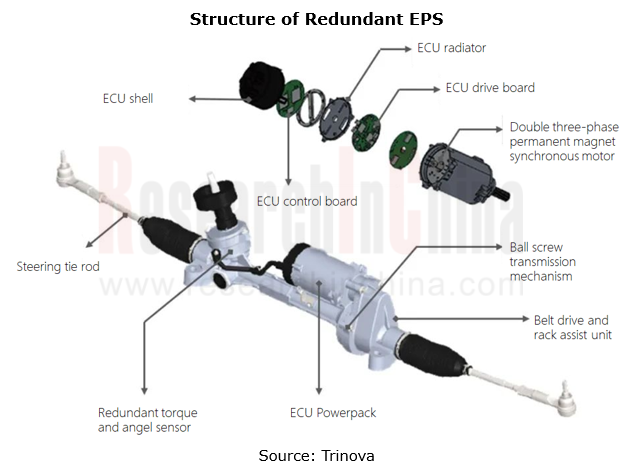

L3 driving assistance requires EPS to still have a certain power-assisting capability in the event of a single point failure. Under this requirement, redundant EPS becomes the key component of L3+ intelligent driving systems.

At present, OEMs and suppliers have made related product layout:

Bosch HASCO's HE3r B3, which was rolled out in April 2023, adopts a 50%+50% redundancy solution. The two control loops have independent power supplies and communication modules and work together. If a functional failure occurs on either of them, 50% of the steering force can cover most working conditions and ensure constant driving.

Bosch HASCO's HE3r B3, which was rolled out in April 2023, adopts a 50%+50% redundancy solution. The two control loops have independent power supplies and communication modules and work together. If a functional failure occurs on either of them, 50% of the steering force can cover most working conditions and ensure constant driving.

T-RES, a redundant electronically controlled steering system of Trinova, integrates dual winding motors, dual drive circuits, dual sensors and dual power management systems to meet the redundancy requirements of L3 autonomous driving.

T-RES, a redundant electronically controlled steering system of Trinova, integrates dual winding motors, dual drive circuits, dual sensors and dual power management systems to meet the redundancy requirements of L3 autonomous driving.

The fully redundant DP-EPS of NASN has the maximum rack force of 13.5KN, suitable for medium SUVs, large SUVs, MPVs, pickup trucks and other pan-passenger vehicles. The whole series uses 6-phase dual winding motors to satisfy the requirements of ADAS and L3+ autonomous driving.

The fully redundant DP-EPS of NASN has the maximum rack force of 13.5KN, suitable for medium SUVs, large SUVs, MPVs, pickup trucks and other pan-passenger vehicles. The whole series uses 6-phase dual winding motors to satisfy the requirements of ADAS and L3+ autonomous driving.

HYCET under Great Wall Motor is about to mass-produce dual redundant EPS with the maximum thrust of 14kN to enable L3+ autonomous driving.

HYCET under Great Wall Motor is about to mass-produce dual redundant EPS with the maximum thrust of 14kN to enable L3+ autonomous driving.

Redundant EPS will become a core technology in L3+ intelligent driving scenarios before mass production and application of steer-by-wire.

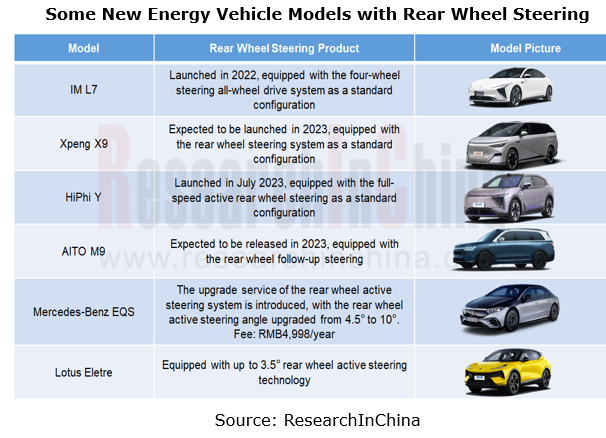

Rear wheel steering, as a supplement to front wheel steering, was originally used in large luxury cars and SUVs, such as BMW 5/7 Series and Audi Q7/8. On the one hand, rear wheel steering technology based on electrical operation is easier to implement on an all-electric platform. On the other hand, electric vehicles on an all-electric platform generally have a long wheelbase (the battery must be placed between the front and rear axles) which increases the turning radius, while rear wheel steering technology offers much higher flexibility. In recent years, as electrification has become widespread rapidly, rear wheel steering has landed on more models such as Xpeng X9, AITO M9 and IM L7.

3. Suppliers and OEMs quicken their pace of deploying steer-by-wire, with more production models.

OEMs:

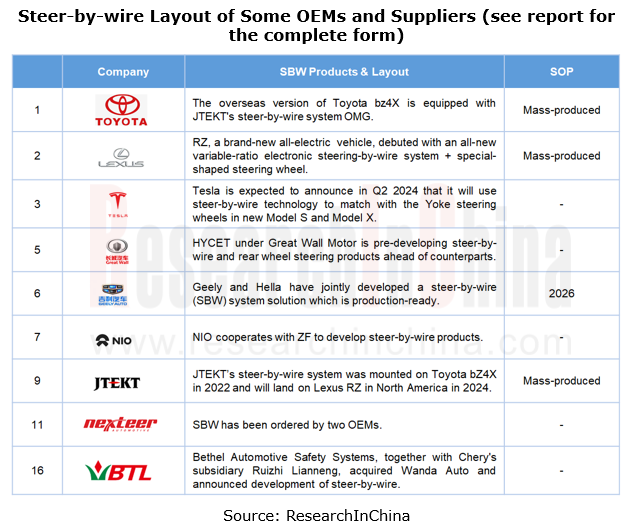

Toyota and Tesla have submitted patent applications for steer-by-wire technology.

Toyota and Tesla have submitted patent applications for steer-by-wire technology.

Great Wall Motor and Changan adopt their self-developed steer-by-wire products to deploy steer-by-wire.

Great Wall Motor and Changan adopt their self-developed steer-by-wire products to deploy steer-by-wire.

Geely and Hella have jointly developed a steer-by-wire (SBW) system which is production-ready.

Geely and Hella have jointly developed a steer-by-wire (SBW) system which is production-ready.

NIO and ZF cooperate on steer-by-wire products.

NIO and ZF cooperate on steer-by-wire products.

Suppliers:

Nexteer Automotive has secured steer-by-wire system orders from two OEMs.

Nexteer Automotive has secured steer-by-wire system orders from two OEMs.

Bethel Automotive Safety Systems, together with Chery's subsidiary Ruizhi Lianneng, acquired Wanda Auto for a layout shift to steer-by-wire R&D.

Bethel Automotive Safety Systems, together with Chery's subsidiary Ruizhi Lianneng, acquired Wanda Auto for a layout shift to steer-by-wire R&D.

JTEKT’s steer-by-wire system was available to Toyota bZ4X in 2022 and will land on Lexus RZ in 2024.

JTEKT’s steer-by-wire system was available to Toyota bZ4X in 2022 and will land on Lexus RZ in 2024.

At present, many OEMs and suppliers make many deployments in steer-by-wire, but with a low product penetration. Nexteer Automotive forecasts that it is difficult for steer-by-wire to gain pace in the next 2 or 3 years.

The policy environment has become more relaxed in recent years. The development of steer-by-wire is driven by the demand for intelligent chassis and stimulated by policies. From the implementation of the new national automotive steering standard to the release of Steer-by-wire Technology Roadmap, steer-by-wire has been production-ready in terms of policies.

On January 1, 2022, the new national automotive steering standard was officially implemented, deleting the 20-year-old requirement that full-power steering mechanisms should not be installed (steer-by-wire is full-power steering);

On January 1, 2022, the new national automotive steering standard was officially implemented, deleting the 20-year-old requirement that full-power steering mechanisms should not be installed (steer-by-wire is full-power steering);

In April, 2022, the exposure draft of the Steer-by-wire Technology Roadmap was officially released. The overall goal is to realize the world’s leading steer-by-wire for L3+ and L4+ autonomous driving in 2025 and 2030, with the penetration of steer-by-wire up to 5% and 30% and the autonomy rate of core components (controller, motor, etc.) higher than 20% and 50%, respectively.

In April, 2022, the exposure draft of the Steer-by-wire Technology Roadmap was officially released. The overall goal is to realize the world’s leading steer-by-wire for L3+ and L4+ autonomous driving in 2025 and 2030, with the penetration of steer-by-wire up to 5% and 30% and the autonomy rate of core components (controller, motor, etc.) higher than 20% and 50%, respectively.

In June 2023, the Ministry of Industry and Information Technology and other four ministries further proposed that "the automotive industry should focus on steer-by-wire".

In June 2023, the Ministry of Industry and Information Technology and other four ministries further proposed that "the automotive industry should focus on steer-by-wire".

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in di...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...

Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classi...

Passenger Car Intelligent Steering Industry Research Report, 2024

Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina ...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024 highlights the following:Passenger car wireless charging (principle, standards, and Qi2.0 protocol);Passenger car mobile phone ...