Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report focuses on automotive? digital power supplies and chips, including:

? Power supply side, OBC, DC-DC, 12V & 48V lithium/sodium battery solutions and their digitalization;

? Power Distribution side, high-voltage distribution, low-voltage distribution solutions and their digitalization;

? Power consumption side, power solutions and digitalization for vehicle control, autonomous driving, intelligent cockpit, suspension, Brake-by-Wire, chassis, etc.;

? Digital power supply (power supply, power distribution, power consumption) digital solutions for OEM and Tier1s.

Power supply side: low-voltage starter batteries are developed towards 12V & 48V lithium/sodium batteries and redundant power supply systems

At present, lead-acid batteries are the most widely used in the start-stop field, accounting for about 90%. However, lead-acid batteries are not the best choice for starting batteries in the future. With the development of vehicle electrification and intelligence, and the addition of a wide variety of sensors and chips, the original electrical architecture is increasingly weak, and applications such as 12V & 48V lithium/sodium batteries and low-voltage start-up battery BMS are accelerating.

Lithium iron battery (LFP) is configured as four single cells in series (4s1p), plus a battery management system (BMS) to form a typical 12V low-voltage battery network, which can support single monitoring and semiconductor battery main switch. BYD has fully switched from lead-acid batteries to lithium iron batteries. The new Tesla Model S Plaid, the new Model X, and the domestic Model Y performance version also use 12V lithium batteries.

In addition to lithium iron batteries that have been applied in large quantities, 12V sodium electricity has also entered the early stage of industrialization. On August 14, 2024, Beijing New Energy Automobile issued an invitation tenders announcement on "12V sodium electricity (sodium vanadium phosphate) new technology development service project selection".

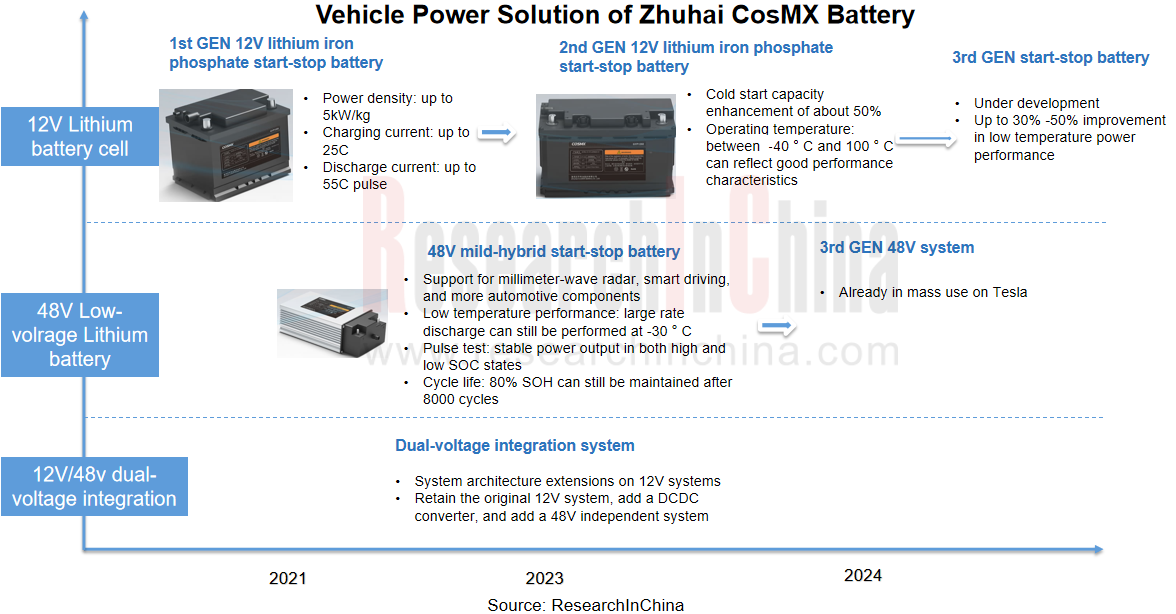

Leading battery manufacturers such as CATL, BYD, EVE Energy, Wanxiang A123 System, and Zhuhai CosMX Battery have all expanded their product lines in the field of 12V/48V start-up batteries, and gradually expanded their product lines to 12V + 48V redundant integrated systems and low-voltage power distribution systems. From the perspective of Zhuhai CosMX Battery's vehicle power solution:

? 12V lithium battery solution

In 2023, Zhuhai CosMX Battery's low-voltage lithium battery products have begun to be shipped in batches. 12V LFP start-stop battery can reach 8000 times, much higher than lead-acid batteries, which can ensure that the battery does not need to be replaced during the life cycle of the car. The company has accelerated its overseas expansion in low-voltage start-stop business, and has successively obtained designation of many well-known OEMs such as Jaguar Land Rover (2025 SOP), Stellantis (2026 SOP), GM (2025 SOP), and IM (IM LS7 12V lithium battery, 2023 SOP).

? 48V lithium battery solution

The Cybertruck is located in the middle of the front cabin. The 48V power supply position of the Cybertruck is fixed to the vehicle by two bolts, and the torque of the bolts is 8Nm. From the disassembly point of view, Zhuhai CosMX is Tesla's 48V lithium battery supplier.

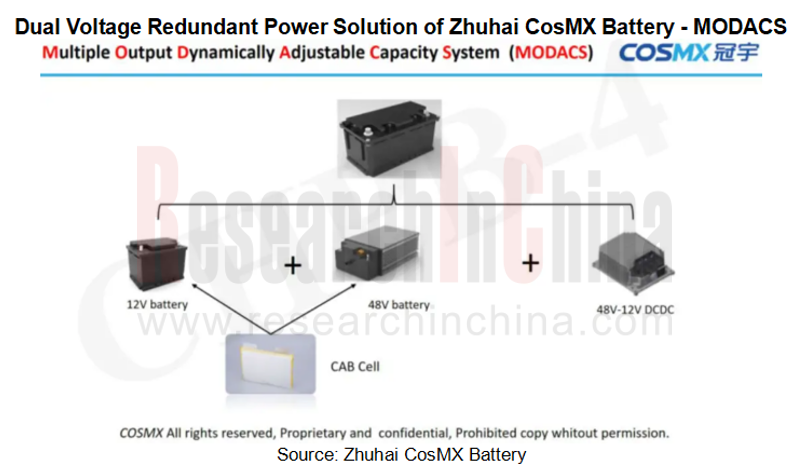

? 12 + 48V + DC/DC dual voltage redundant power supply solution

Zhuhai CosMX Battery's dual-voltage integrated products basically expand the system architecture on the 12V system, retaining the original 12V system, adding a DC/DC conversion device and a 48V independent system. The entire system is very large. The? 12V/48V dual-voltage system developed by Zhuhai CosMX Battery uses a battery pack to meet the 12V system function and 48V system function, and integrates DC/DC converter together. The integrated products can achieve 12V and 48V under the premise of fuel saving and consumption reduction. The cost is relatively low, the weight is relatively light, and the advantages are obvious.

Power supply side: DC/DC, OBC and other vehicle power modules are developing towards integration, efficiency and digitalization to achieve cost reduction and efficiency increase

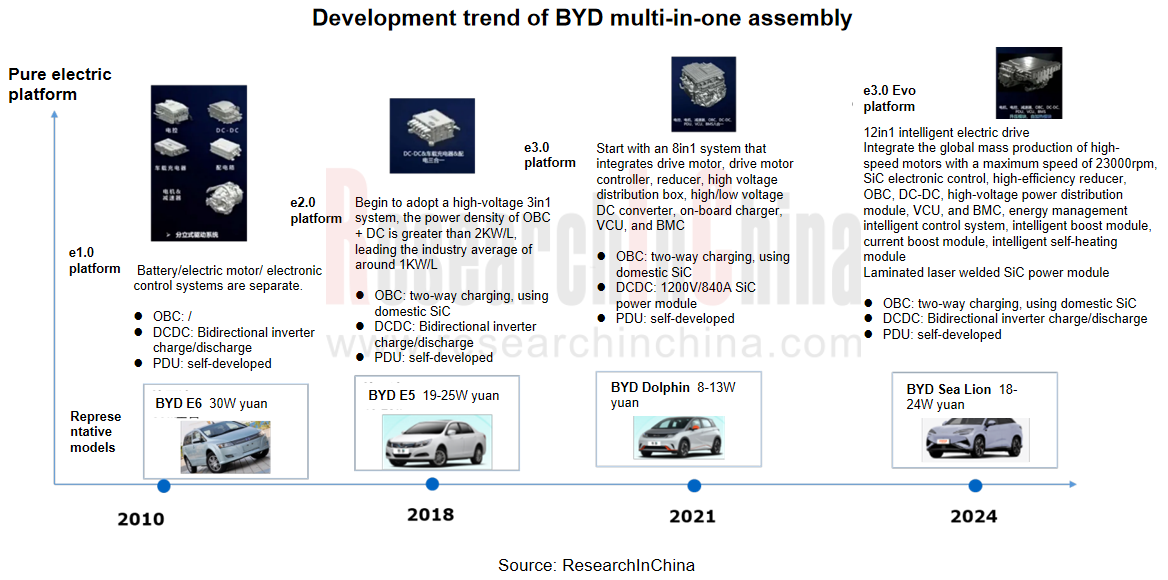

The application of "two-in-one" and "three-in-one" power assemblies has become very common, and automotive power supply has further formed an all-in-one assembly with electric drive, reducer, VCU/BMS, etc. The E/E architecture of the whole vehicle is rapidly evolving towards centralization. The ECU that used to be "separate" is integrated into one place, and new products such as 7in1, 8in1, 9in1 and even BYD e3.0 Evo's 12in1 are emerging in an endless stream.

Under this evolving trend, major Tier1 and Tier2 chip vendors have launched highly integrated solutions.

?VMAX: Committed to becoming a world-class electric vehicle power domain overall solution provider, it has obtained the fixed points of many well-known enterprises at home and abroad such as SAIC Group, Great Wall Motors, and Sany Heavy Machinery, and has realized the mass production and shipment of motor controllers, electric drive three-in-one assembly products and "power + electric drive" all-in-one assembly products.

? SemiDrive Technology: In February 2023, SemiDrive cooperated with Kotei to create a domestic power domain solution based on E3 "Control Core". The solution will also cover the all-in-one design of the power system in the future, and deeply integrate high-voltage electrical accessories such as DC/DC, OBC, and PDU.

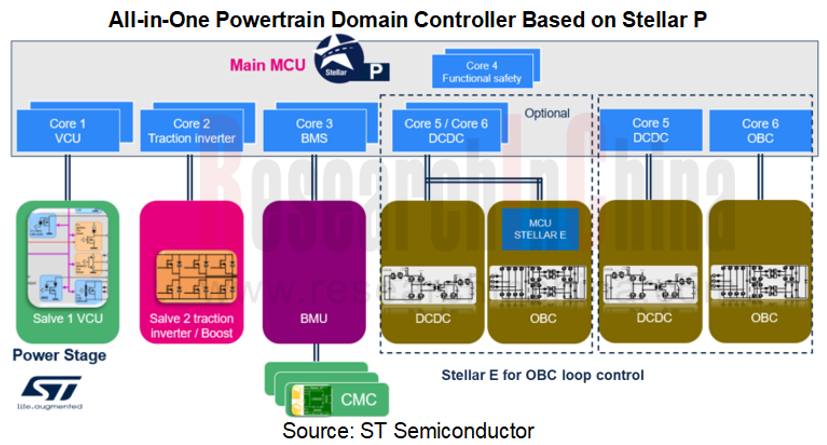

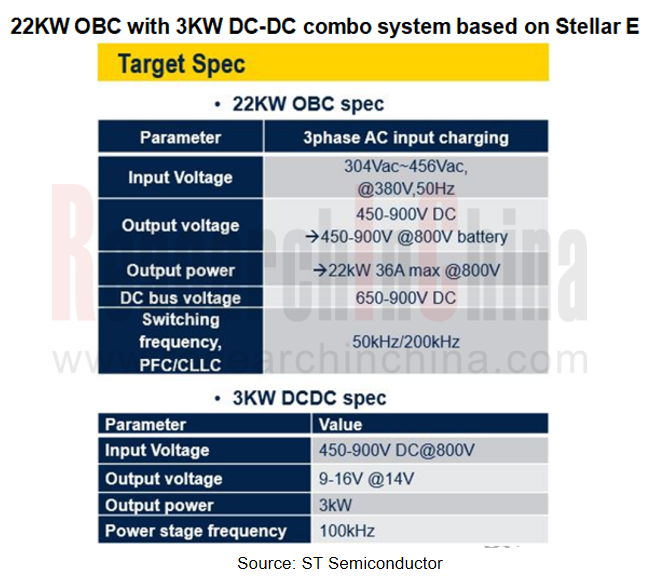

? ST: Introduced a new generation of high-performance MCU products based on Arm ? architecture - the Stellar family, including three categories of Stellar E, Stellar G and Stellar P. Includes a 22kW OBC-DC/DC 2-in-1 solution based on Stellar E, a Stellar G-based ZCU, and a new all-in-one Stellar P-based powertrain domain controller at Munich Shanghai Electronics Show in? 2023.

ST aims to achieve "replacing the respective MCUs in multiple ECUs with a single Stellar P-series MCU, realizing the centralization of computing power, and users can develop and maintain products with only one software toolchain."

Stellar P-series MCUs support up to 6 Cortex ? R52 + cores, provide more than 10K DMIPS computing power, and support OBC, DC/DC, inverter, BMU and VCU function integration. The highly integrated form allows the entire controller size to be further reduced, the degree of integration will be higher, and the system BOM cost can be further optimized.

Based on Stellar E's 22KW OBC with 3KW DC-DC combo system two-in-one solution, compatible with 3.3KW & 6.6KW & 11KW on the market, its Stellar-E1 is a dual-core MCU with 300MHz computing power, rich peripherals, the biggest advantage is that the chip has security functions, no need to be designed with a security chip, in line with the security function requirements of ISO26262 ASIL-D, and also has OTA functions.

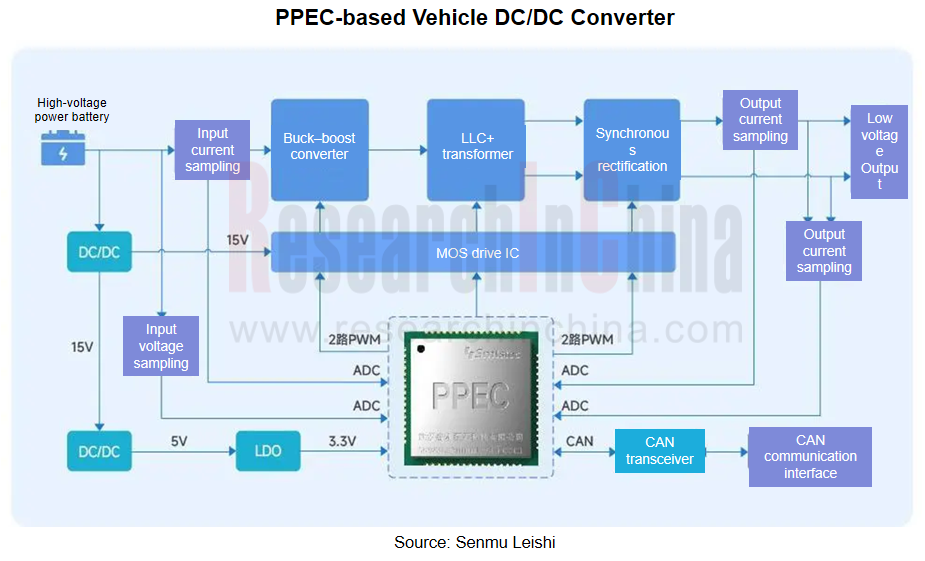

In the vehicle power system, the traditional DC/DC converter generally has problems such as low conversion efficiency and large size. It can achieve small size and high performance of DC/DC by using advanced technology controllers. Digital power solution provider "Wuhan Senmu Leishi Tech" has launched a self-developed PPEC (programmable power electronic controller) digital power control chip.

Power consumption side: safety power solutions for autonomous driving HPC, intelligent cockpit HPC, ECU, etc

The technological progress of SoCs in automotive intelligent cockpits puts forward higher requirements for computing power, main frequency and dynamic response speed. At the same time, the power consumption of the whole board continues to increase, and the power conversion efficiency needs to be higher to save energy; the dynamic response speed is faster, and the functional safety level requirements of power modules continue to increase (generally ASIL-B or above). These factors all bring various challenges to the design of automotive power supplies.

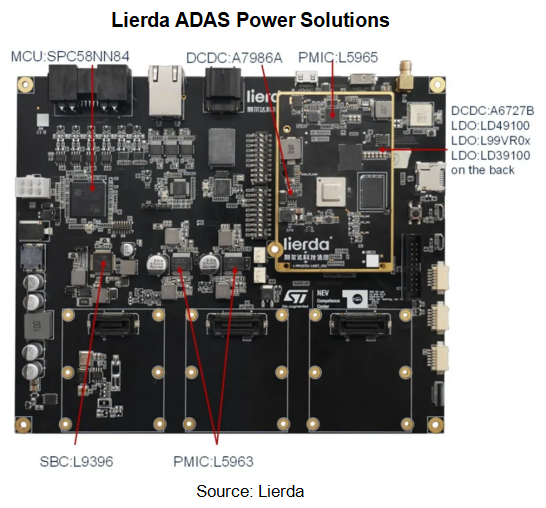

? Lierda and ST Launch ADAS Power Solution for Intelligent Driving

The core components of this solution include large computing power chip, ST's PMIC power chip, DCDC chip, LDO chip and ST's SPC series MCU. The power management chip solution can ensure that the ADAS domain controller can still provide stable and reliable power supply in the face of high current power consumption.

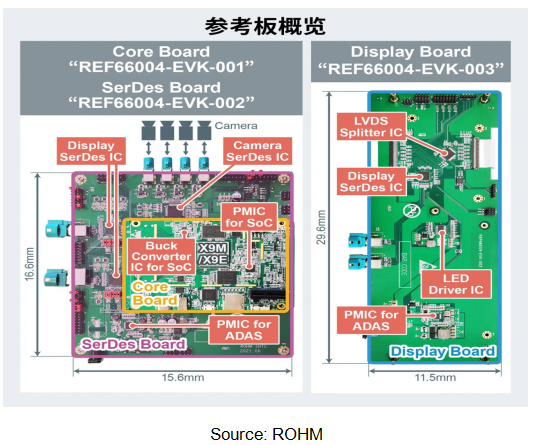

ROHM and SemiDrive Technology jointly develop an in-vehicle SoC reference design

The reference design mainly covers SemiDrive Technology's smart cockpit SoC * 1 "X9M" and "X9E" products, which are equipped with ROHM's PMIC * 2, SerDes IC * 3 and LED drivers.

In addition to the SerDes IC used in the "X9H" reference board, ROHM further provided? "BD96801Q12-C" SoC PMIC and "BD9SA01F80-C" buck converter IC? for driving the SoC, as well as??? "BD39031MUF-C" general-purpose PMIC for ADAS that supplies power to the SerDes IC. This solution supports operation of up to three display projections and four ADAS cameras (Surround-view camera).

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...