Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides a market foundation for intelligent connected services, and consumers’ connection needs and usage habits take shape. Next how to provide diversified, personalized and intelligent application services using telematics big data will become the focus of major OEMs forging brand differentiation.

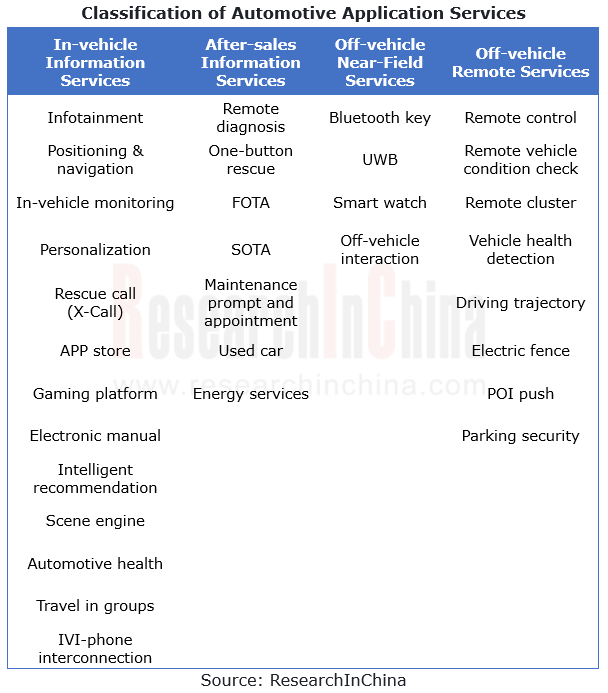

At present, China’s intelligent connected vehicle application services are mainly four scenario services: in-vehicle information services, after-sales information services, off-vehicle near-field services and off-vehicle remote services.

In-vehicle information services are mainly based on intelligent cockpit applications. In addition to conventional services such as infotainment, positioning, navigation, in-vehicle monitoring and rescue call, personalization, APP stores, vehicle gaming platforms, intelligent recommendations, scene engines, etc. have become hotspots of application services, which is accompanied by increasing big data applications in vehicles.

Centering on users’ needs for car usage and maintenance, after-sales information services provide remote diagnosis, one-button rescue, OTA updates, maintenance prompts and reservations, energy services for used cars and new energy vehicles, etc.

Off-vehicle near-field services are mainly enabled by near-field communications, such as digital keys like Bluetooth /UWB, smart watches, and off-vehicle interaction.

Off-vehicle remote services mainly use mobile phone APPs to remotely control vehicles, check vehicle conditions, detect vehicle status, etc.

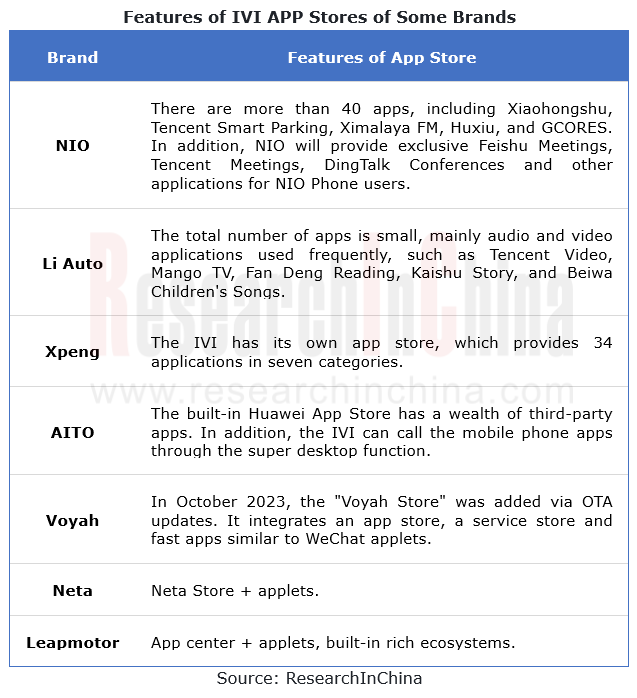

First, IVI APP stores enhance the personalization and scalability of in-vehicle services.

With rich ecological applications, APP stores can not only enhance the personalized and entertaining experience for users, but also enables the scalability of the application ecosystem, for example, users can work in the vehicle using office and conference software. At this stage, Chinese brands like BYD, NIO, Xpeng and Li Auto are the first to install APP stores in their IVI systems. Their foreign peers are following suit.

In February 2023, The Driven, an Australian electric vehicle website, issued an article saying that Tesla may already be working on its own Apple-like app store that would enable car owners to download and install applications to their electric cars.

In March 2023, Volkswagen Group officially announced that it would bring a new app store to its multiple auto brands and car models. Users can enjoy a mass of third-party applications via the update.

Second, the deep integration of mobile phones and IVI will spur more application services.

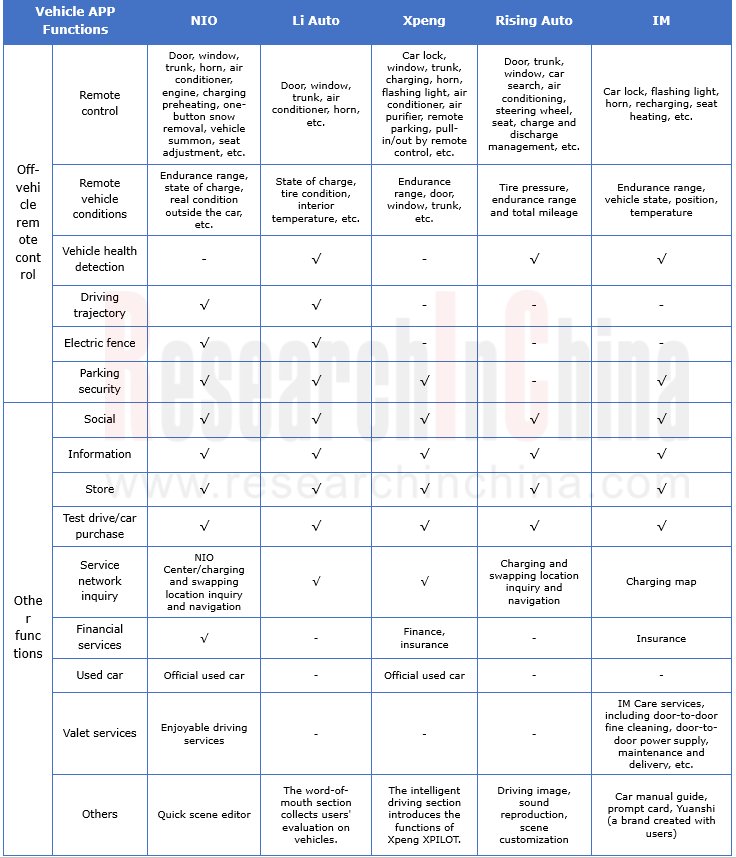

Mobile phones offer the most contact points and the longest contact time in automotive application services, and have become a bridge connecting people with cars and other devices. Mobile phone APPs can not only be used for remote car control, but also provide social contact, test drive/car purchase services, financial services, valet services, and even customized scenes, car manual guide and user evaluation, becoming a carrier for OEMs to create full life cycle services for users.

APP Functions of Some Mobile Phone Brands

Note: √ means confirmed installation;

- means uninstallation or uncertain installation.

Source: ResearchInChina

At this stage, the special services offered by OEMs through mobile phone APPs mainly include:

1.Valet services

The enjoyable driving services of NIO are 7*24h customized services directly provided by NIO’s road service team according to users' demand. Using NIO APP, users can enjoy various valet services such as valet driving and accompanying, for example, accompanying the elderly to see a doctor and sending them to the hospital for physical examination, and accompanying children to do homework.

IM Care provides users with such services as door-to-door fine cleaning, door-to-door power supply, maintenance, and pick-up and delivery.

2. Feedback

Li Auto has set up a "word-of-mouth" section on its mobile phone APP, which enables users to evaluate vehicles in three dimensions: functions (appearance design, riding space, extended-range electric mode, chassis suspension, smart space and intelligent driving), services (after-sales service) and others (reasons for buying a car, satisfaction and expected improvements), thus creating a feedback channel for users.

3. Function introduction

Xpeng introduces the functions of Xpeng XPILOT to users via the intelligent driving section of the mobile phone APP. IM provides the manual guide for users via on the mobile phone APP.

4.Custom scenarios

NIO and Rising Auto set up scenario editors on their mobile phone APPs to enable users to add custom scenarios according to their preferences.

5. Brand co-creation

The Yuanshi Plan launched by IM encourages users to share mileage data, participate in interaction tasks and official co-creation activities on the APP, so as to enhance users' brand loyalty and achieve the effect of brand co-creation by way of issuing "original stones" (Yuanshi) and product redemption.

In addition, cross-terminal system applications such as HarmonyOS, and mobile phone vendors like OPPO, VIVO, Meizu and NIO Phone have entered IVI, bringing deeper integration of mobile phones and IVI. Cross-terminal data flow applications offer a bigger imaginable space to OEMs and suppliers, which may help to create more new services.

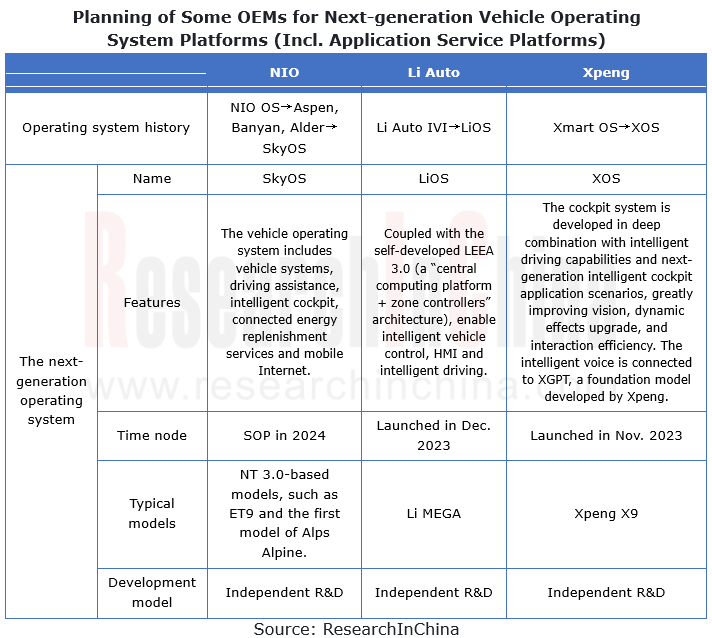

Third, the next-generation application service platform will build all-scenario service capabilities covering intelligent driving, cockpit and connectivity.

As E/E architectures tend to be centralized, automotive operating systems develop along the path of "IVI → cockpit → vehicle". In the era of vehicle operating systems, OEMs need to be based on SOA to realize cross-domain scheduling and functional integration among communication domain, cockpit domain and intelligent driving domain. There are two paths for OEMs to achieve cross-domain software integration: self-developing operating system platforms and application service platforms, represented by NIO, Xpeng and Li Auto; self-developing application service platforms but outsourcing operating system platforms to Neusoft, ThunderSoft and the like, represented by coventional automakers.

Therefore, emerging automakers such as NIO, Xpeng and Li Auto integrate the next-generation application service platforms with vehicle operating systems.

SkyOS, NIO’s next-generation operating system platform (including an application service platform), is an all-domain vehicle operating system, involving vehicle systems, driving assistance, intelligent cockpit, connected energy replenishment services and mobile Internet. It is applied to telematics, vehicle control, autonomous driving and digital cockpits.

LiOS, Li Auto’s next-generation operating system platform (including an application service platform), coupled with the self-developed LEEA 3.0 (a “central computing platform + zone controllers” architecture), combines intelligent driving domain, intelligent cockpit domain and vehicle control domain as a complete central domain.

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in di...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...