Market status: vehicle models with smart surfaces boom in 2023

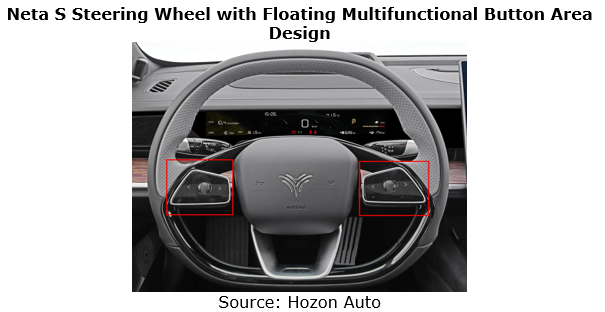

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units from January to September 2023, and main models were Haval H6, Deepal SL03, and Neta S. Among them, Deepal SL03 uses smart surfaces in ambient lighting with translucent leather; Neta S packs multifunctional steering wheel where "scroll wheel + virtual buttons" is used to complete relevant operations.

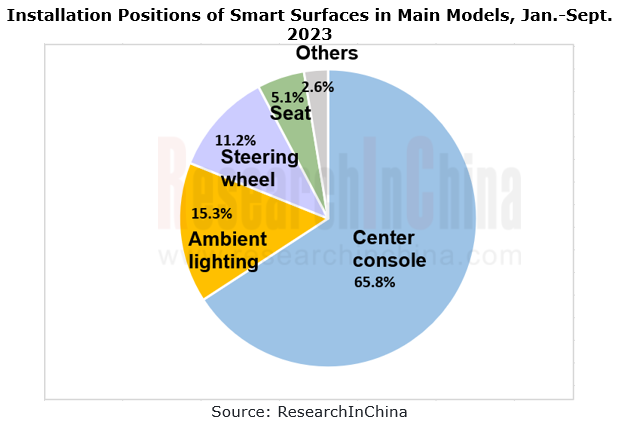

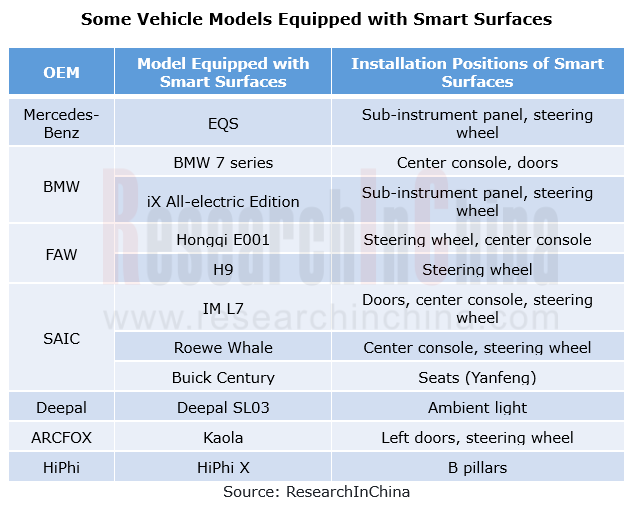

Smart surfaces can be installed on center console, ambient lighting, steering wheel, doors, seats and other parts of a vehicle. From January to September 2023, body parts equipped with smart surfaces were mainly center console, steering wheel and ambient lighting.

Suppliers: Chinese suppliers start late, but have market and cost advantages

On the whole, there is a large technical gap between Chinese smart surface suppliers and their foreign peers. Yet the Chinese market has a low-cost ecological industry chain, helping domestic suppliers to adopt more flexible market schemes.

Foreign suppliers (leading Tier1s, e.g., Continental and Antolin) can directly meet the requirements of OEMs (e.g., BMW), and use their R&D strength to help OEMs with requirement verification.

Foreign suppliers (leading Tier1s, e.g., Continental and Antolin) can directly meet the requirements of OEMs (e.g., BMW), and use their R&D strength to help OEMs with requirement verification.

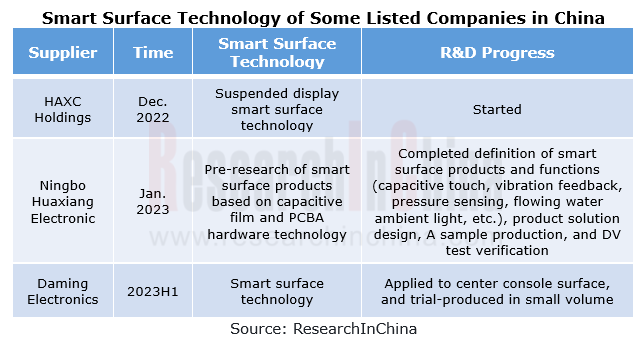

Chinese smart surface suppliers develop slowly. From 2022 to 2023, more listed companies joined the smart surface industry chain.

Chinese smart surface suppliers develop slowly. From 2022 to 2023, more listed companies joined the smart surface industry chain.

As smart surface technology advances in China, Chinese suppliers need to combine software and systems to overall deploy smart surfaces, and rid themselves of a business service model of simply processing or providing hardware.

In July 2023, Marelli introduced the new Miragic, a display for cars that disappears when not in use. Featuring Marelli's innovative Shy-Tech solution, this disappearing display seamlessly integrates in OEMs' cockpit style, blending discreetly with various materials and surfaces. It provides equal or better visibility than conventional displays, enhancing safety by limiting distractions for the driver.

Moreover, Marelli Miragic simplifies parts integration and assembly operations, greatly reducing weight of related body components.

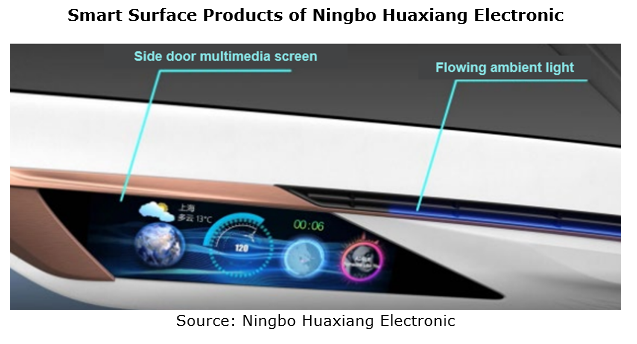

Ningbo Huaxiang Electronic develops new smart surface materials and technologies using multimodal interaction technology, fusing perception data in "vision", "voice" and other modes, and combining them with automotive electronics and optoelectronics technologies. Huaxiang Electronic plans iteration of next-generation smart surface technology based on multimodal interaction, with the ultimate goal of evolving it into an intelligent vehicle assistant.

As of June 2023, Ningbo Huaxiang Electronic's smart surface products are still under development and have yet to be designated. In the first phase of R&D, its smart surface integrates such functions as smart touch, vibration feedback, and pressure sensing for preventing touch by mistake. Ningbo Huaxiang Electronic can design and customize surface materials as required, and enables personalized HMI hardware and software functions by integrating logo and ambient lights among others, and combining hidden touch buttons and translucent surfaces on trim strips, door panels and instrument panel.

OEM: conventional OEMs are more willing to use smart surfaces.

From 2020 to 2023, conventional OEMs showed higher willingness to develop and accept smart surfaces and launched more vehicle models.

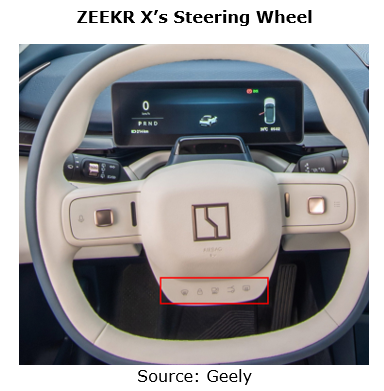

Geely ZEEKR X's steering wheel adopts a "touch buttons + physical buttons" joint operation mode where a touch panel installed under the steering wheel is used to control trunk, front glass heating and other functions.

Launched in April 2023 and scheduled to go on sale in November, Hongqi E001 is equipped with smart surface functions:

Each touch function icon can be illuminated by touch to adjust functions of music, fragrance and air conditioning;

Each touch function icon can be illuminated by touch to adjust functions of music, fragrance and air conditioning;

Smart surface operation buttons work on the capacitance principle. Inductive touch switch can penetrate insulating material shells to detect effective touch of fingers, with high sensitivity;

Smart surface operation buttons work on the capacitance principle. Inductive touch switch can penetrate insulating material shells to detect effective touch of fingers, with high sensitivity;

The pressure sensing and vibration feedback functions allow users to sense without observing, which improves driving safety.

The pressure sensing and vibration feedback functions allow users to sense without observing, which improves driving safety.

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in di...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...

Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classi...

Passenger Car Intelligent Steering Industry Research Report, 2024

Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina ...