From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%;

3.875 million side view ADS cameras, up 110.1%;

499,000 rear view ADS cameras, up 372.3%;

22.728 million surround view cameras, up 38.1%;

7.141 million rear view (reversing) cameras, down 4.4%;

355,000 streaming media cameras, up 75.3%;

2.336 million in-cabin cameras, up 96.3%;

2.029 million driving recorder cameras, up 17.8%.

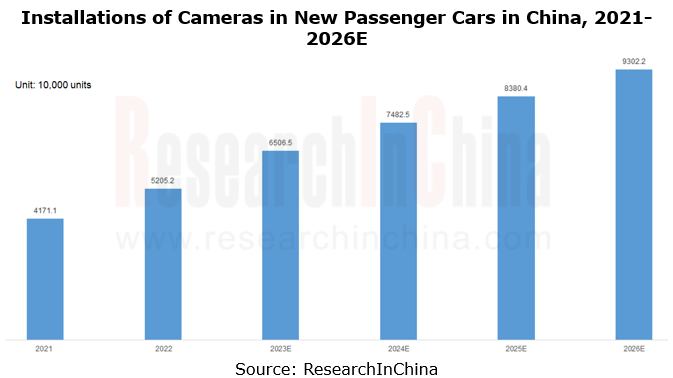

It is estimated that the total installation of cameras will hit 65.065 million units in 2023, a figure projected to jump to 93.022 million in 2026.

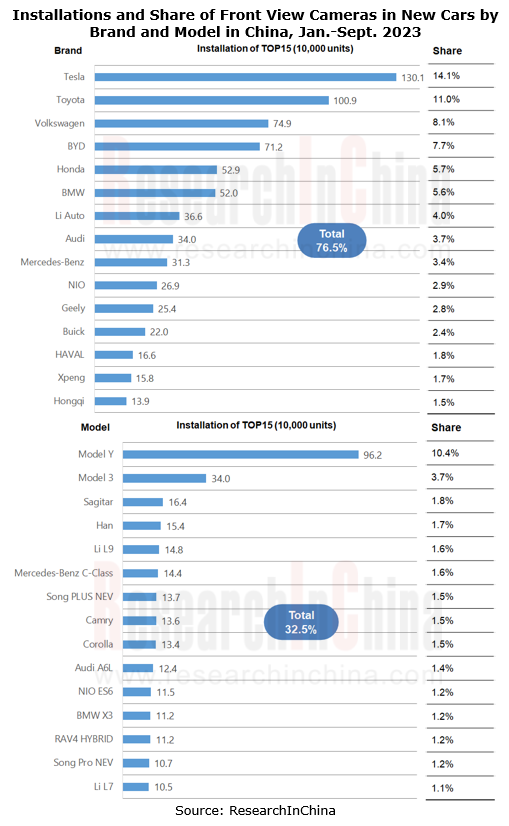

In terms of front view, mono cameras have obvious advantages. From January to September 2023, new cars in China were installed with 8.946 million front view mono cameras, up 34.5% from the prior-year period. 51.4% of front view cameras were concentrated in the vehicles priced at RMB100,000-250,000 from popular brands like Tesla, Toyota, Volkswagen and BYD, among which Tesla took an overwhelming 14.1% share. The installation of front view cameras in the vehicles worth RMB350,000-400,000 enjoyed the fastest growth, soaring by 119.2% on an annualized basis to 913,000 units, mainly driven by Model Y, Mercedes-Benz C-Class and Li L8.

It is clearly that front view cameras tend to feature high resolution. According to the data of ResearchInChina, from January to September 2023, there were 85,000 5MP front view cameras installed, surging by 10 times on a like-on-like basis, with the penetration rate rising to 0.9% from 0.1% in the same period of the previous year; the installation of 8MP front view cameras soared by 250.2% to 751,000 units from 214,000 units in the same period of the previous year, and the penetration rate also jumped from 3.1% to 8.2%.

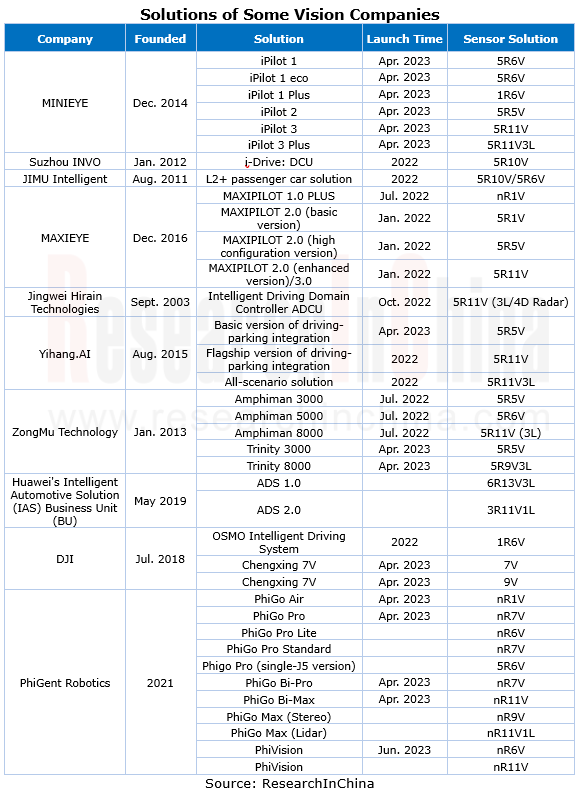

To adapt to the current "involution" in intelligent driving functions, Tier 1 vision companies are working to build themselves into "full-stack suppliers" that can provide modular and definable autonomous driving solutions with software and hardware decoupled to optimize software and hardware synchronously. For example, some suppliers can provide OEMs with complete autonomous driving solutions consisting of "domain controller hardware + underlying basic software + upper application software + sensors", so as to reduce the R&D cost and shorten the mass production time for OEMs.

Yet from the current selection of OEMs, it can be seen that there is not much scope for Tier 1 suppliers of intelligent driving, especially those without production experience.

OEMs have begun to treat intelligent driving rationally, and automakers tend to adopt “in-house R&D + outsourcing” parallel intelligent driving R&D strategies. For example:

Li Auto develops advanced intelligent driving solutions by itself, but develops low- and mid-level solutions with QCraft;

The advanced intelligent driving solutions of IM, a brand under SAIC, are provided by Momenta, while IM’s own team is mainly responsible for low-level driving assistance functions and integration;

BYD's Dynasty and Ocean Series adopt solutions from Tier 1 suppliers. Later BYD Han will carry a highway NOA solution based on Horizon Robotics J5, while DENZA N7 and Yangwang U8 will use “God's Eye” advanced intelligent driving solution (hardware is self-developed by BYD, but software is developed by BYD and Dipai Zhixing jointly).

As the competition in the ADAS market intensifies, orders go to top suppliers (e.g., Huawei, DJI and Momenta), making it hard for small and medium-sized suppliers depending on financing to survive. Some of them have to shrink their business or seek to be acquired.

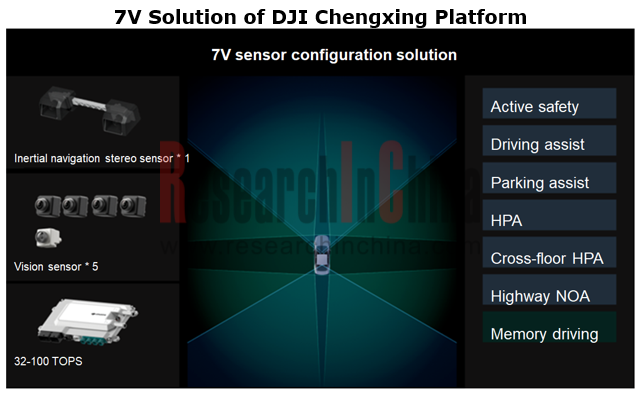

In December 2023, Chery iCAR 03 was released for global pre-sale. The Intelligent Driving Edition of iCAR 03 packs the 7V vision-only solution of DJI Chengxing Platform, with sensors including a pair of 8MP front view inertial navigation stereo cameras, a 3MP rear view mono camera and four 3MP surround view fisheye cameras. This solution enables memory driving, highway NOA, cross-floor home-zone parking assist and other functions. It costs about RMB5,000.

Following the launch of ADS 1.0 and ADS 2.0, Huawei ADS 3.0 has been filed. According to Dong Zhihua, Director of Autonomous Driving R&D at Avatr, Huawei ADS 3.0 features point-to-point connection, that is, in the period of time from the user getting on the car in the residential community garage to getting off the car in the office building garage, the entire process is fully connected, with much higher reliability and safety and fewer manual takeovers.

As of August 2023, Momenta had been publicly designated by SAIC IM, BYD DENZA/Yangwang and Geely Lotus among others for over 10 mass production projects and over 25 models. DJI has cooperated with Wuling, Volkswagen, Chery, etc. By the end of 2024, more than 20 car models will be equipped with its intelligent driving products. In December 2023, iMotion, listed on Hong Kong Exchanges and Clearing, was designated by 16 OEMs including Chery, Geely, Great Wall Motor and Dongfeng, and secured mass production orders for more than 200,000 sets.

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...

In-vehicle Payment and ETC Market Research Report, 2024

Research on in-vehicle payment and ETC: analysis on three major application scenarios of in-vehicle payment

In-vehicle payment refers to users selecting and purchasing goods or services in the car an...

Automotive Audio System Industry Report, 2024

Automotive audio systems in 2024: intensified stacking, and involution on number of hardware and software tuning

Sales of vehicle models equipped with more than 8 speakers have made stea...

China Passenger Car Highway & Urban NOA (Navigate on Autopilot) Research Report, 2024

NOA industry research: seven trends in the development of passenger car NOA

In recent years, the development path of autonomous driving technology has gradually become clear, and the industry is acce...

Automotive Cloud Service Platform Industry Report, 2024

Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chainIn 2024, as the penetration rate of intelligent connected vehicles continues to...

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...