Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several technological iterations, and tends to be personalized and intelligent. In current stage it has been integrated as part of intelligent cockpit. In specific modes, it can be combined with seat, display, ambient light, intelligent voice assistant and other functions to meet owners’ needs for personalized experience of sound effect.

Technically mainstream vehicle models highlight application of zone tuning and immersive sound field technologies, in addition to use of more speakers:

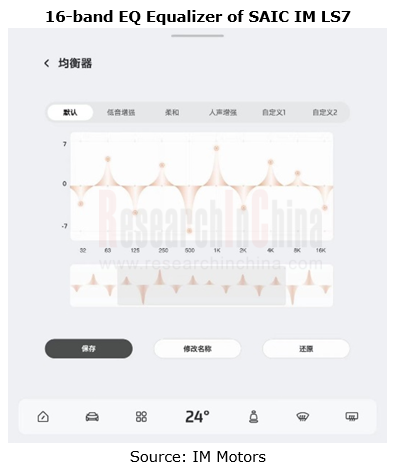

1.In tuning technology, sound effect algorithm, frequency shift algorithm, sound wave simulation algorithm, in-car active noise reduction, multi-zone sound field replay, speaker array broadband sound field control and other acoustic signal processing algorithms are critical.

2.In sound field technology, Dolby Atmos and sky surround sound are widely used, and enabled through headrest audio and canopy speaker.

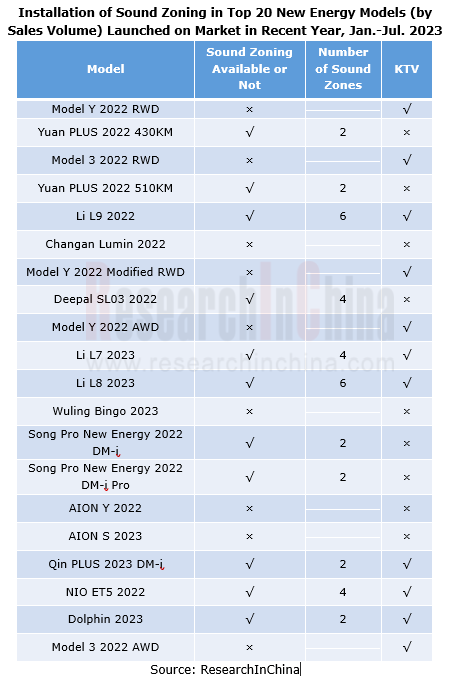

Zone tuning and KTV mode boasted far higher installation rates in models launched on market in recent year:

In addition, during upgrading the audio system solution, different scenario modes also boost optional audio components business. For example, in Li Auto’s L family, the ambient light can be linked with the audio system in KTV mode, and Li Auto Mall also launches matched microphones, including four-mic / two-mic version, priced at RMB 799/459, respectively.

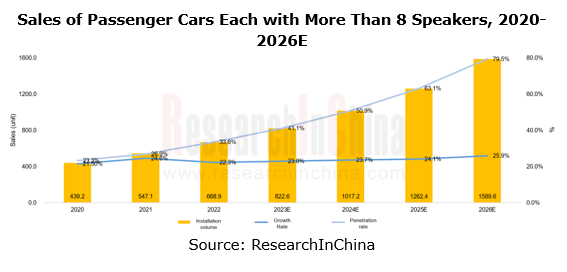

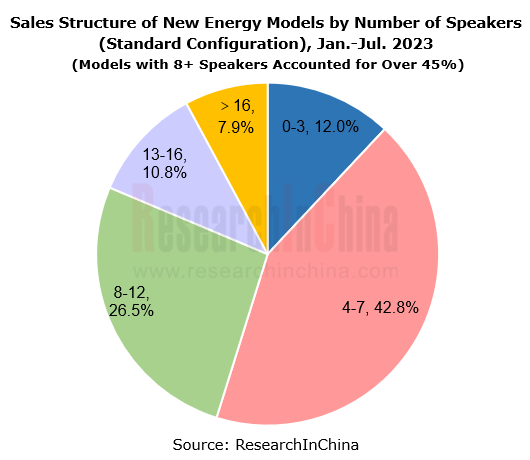

Market status: new energy models with more than 8 speakers per vehicle accounted for more than 45% of the total sales

Starting from 2020, the sales of passenger cars each with more than 8 speakers have been on the rise. As of December 2022, the sales of passenger cars each with more than 8 speakers have reached 6,689,000 units, with a penetration rate of 33.6%; the growth rate is projected to range at around 23% in 2023; it is conceivable that in 2026 the penetration rate will reach up to 79.5%, and the sales will achieve 15.896 million units, with CAGR of 24.16%.

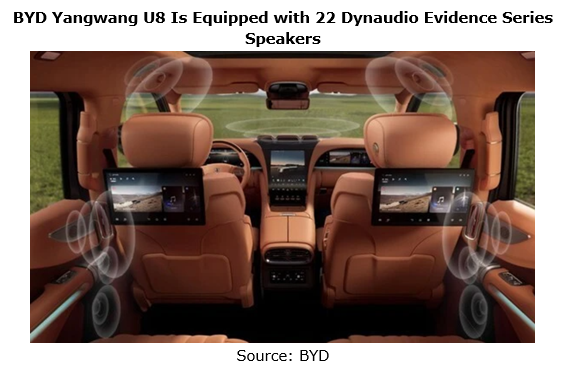

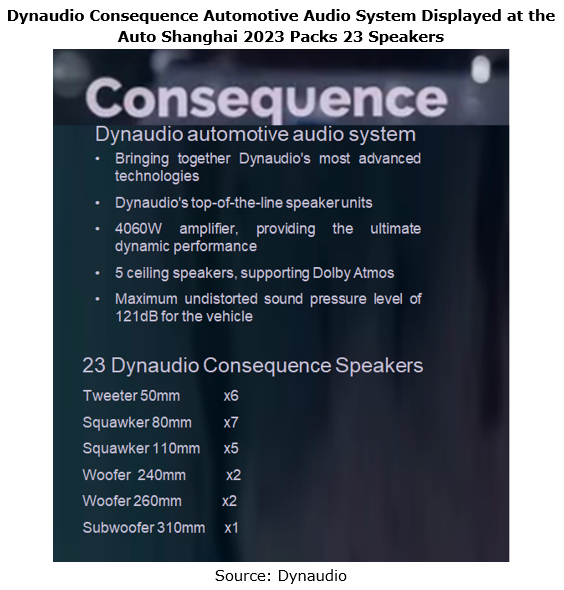

In 2023, in terms of numbers of speakers (standard configuration) per vehicle, the top ten models by sales volume pack 6, 4, 8, 2, 12, 10, 9, 14, 7, and 16 speakers, respectively. The 21-speaker and 23-speaker solutions were launched in 2022, and the sales of matched models surged by over 150%, of which the typical 21-speaker models were Li Auto’s L family and the typical 23-speaker models were NIO ET5/7 and ES7/8; the 14-speaker models also grew over 140%, mainly driven by the sales of Model Y and Denza D9.

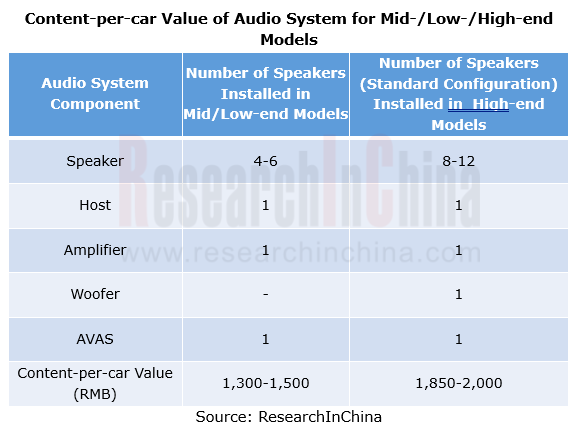

The use of more speakers and the further iteration of audio system technology have favored higher audio system value per car. As of September 2023, the content-per-car value of audio system has averaged over RMB1,500; with additional cost of RMB500-1,000, the cost of high-end models has increased by RMB2,000-2,500.

OEMs: emerging carmakers lead the way in vehicle audio solution iteration

From 2020 to H1 2023, among models of conventional OEMs like SAIC and FAW, passenger cars with over 8 speakers took a low share, compared with a high proportion in emerging carmakers. Wherein, Tesla Model 3/Y is equipped with more than 8 speakers; over half of the models of Great Wall and BMW Brilliance carry more than 8 speakers.

Conventional OEMs differ from emerging carmakers in audio system solution design and planning:

1.Conventional OEMs (FAW-Volkswagen, FAW Toyota, BMW Brilliance, etc.) prefer the outsourcing model where suppliers are responsible for audio design, equipment, and tuning services. Thereof, mid- and low-end models use speakers from white-label suppliers, while high-end models cooperate with audio brands;

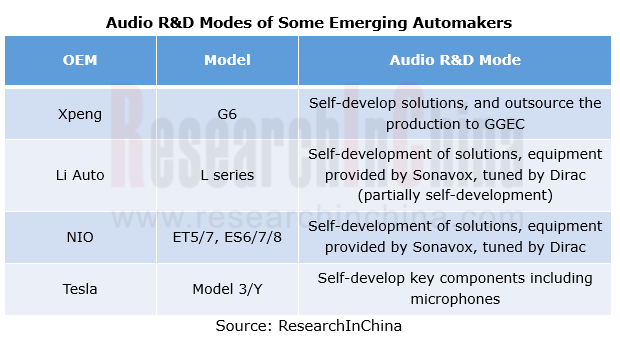

2.Emerging carmakers (Tesla, NIO, Xpeng, Li Auto, etc.) pay more attention to cost reduction. They adopt the model of “independent design of audio system solutions, outsourcing of equipment/tuning, and provision of tuning software OTA services”, and self-develop some tuning algorithms (e.g. sound effect algorithm for Li L9).

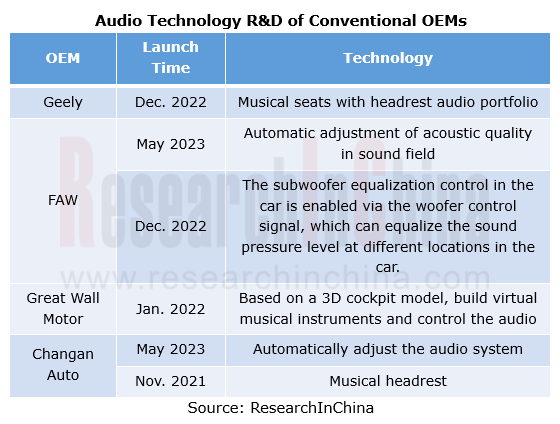

In R&D of audio system technologies, most conventional OEMs tend to develop acoustic quality adjustment and sound field technologies (e.g. headrest audio technology):

Suppliers: white-label manufacturers boast a surging share, and tuning suppliers become superior

From January to July 2023, the top 10 audio suppliers by installations took a combined market share of lower than 60%, of which the top three, Goertek Dynaudio, Harman and Martin Logan boasted installations of 1,077,000 units, 698,000 units, and 327,000 units, respectively. Among them, Goertek Dynaudio supported models of Xpeng and BYD; Harman’s multiple brands such as Harman Kardon, Infinity, JBL and Revel covered a wide range of models of BMW, Great Wall Motor, Lincoln and others. After a surge during 2021-2022, the growth of audio brands slowed down; white-label manufacturers such as Sonavox grew by over 45% in H1 2023, much higher than audio brands.

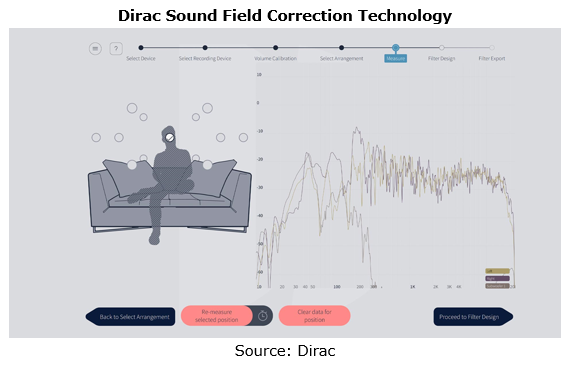

As concerns ecosystem, emerging carmakers put more focus on software tuning technology. Relying on DSP chips and sensor technology, they change the existing brand audio system solutions via software tuning system and OTA services, and then turn to the “software tuning + white-label OEM” mode. The overall audio solution is that white-label/brand manufacturers provide audio hardware, and emerging carmakers configure tuning systems according to hardware and build algorithms based on models of tuning engineers, meeting users’ personalized tuning requirements. In this context, Dirac and other tuning suppliers remain superior, with tuning algorithms slashing vehicle cost.

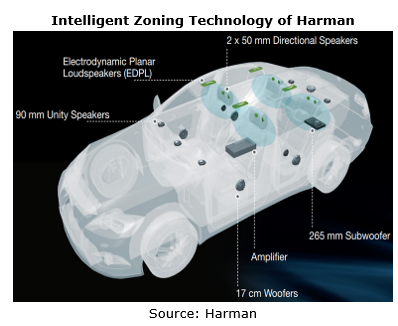

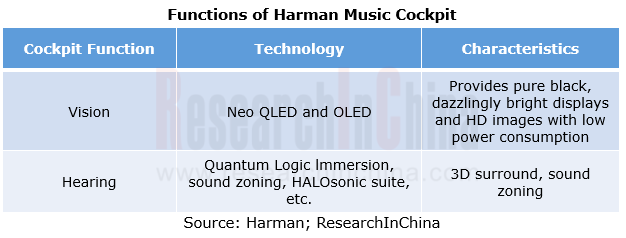

In the recent two years, Xpeng Motor and BYD among others have launched “musical cockpit” and “musical coupe” in their new energy models. They are backed by comprehensive solutions developed by audio brands such as Dynaudio and Harman using their own acoustic technologies. In May 2023, Harman planned to use its brand audio to further create an overall musical cockpit product line, including a new-generation musical cockpit which combines Harman’s technologies in intelligent vehicle connection and brand audio, and improves user experience in all aspects from vision and hearing to telematics.

OEMs’ Passenger Car Model Planning Research Report, 2024-2025

Model Planning Research in 2025: SUVs dominate the new lineup, and hybrid technology becomes the new focus of OEMs

OEMs’ Passenger Car Model Planning Research Report, 2024-2025 focuses on the medium ...

Passenger Car Intelligent Chassis Controller and Chassis Domain Controller Research Report, 2024

Chassis controller research: More advanced chassis functions are available in cars, dozens of financing cases occur in one year, and chassis intelligence has a bright future. The report combs th...

New Energy Vehicle Thermal Management System Market Research Report, 2024

xEV thermal management research: develop towards multi-port valve + heat pump + liquid cooling integrated thermal management systems.

The thermal management system of new energy vehicles evolves fro...

New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

The electric drive system is developing around technical directions of high integratio...

Global and China Automotive Smart Glass Research Report, 2024

Research on automotive smart glass: How does glass intelligence evolve?

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in d...

Passenger Car Brake-by-Wire and AEB Market Research Report, 2024

1. EHB penetration rate exceeded 40% in 2024H1 and is expected to overshoot 50% within the yearIn 2024H1, the installations of electro-hydraulic brake (EHB) approached 4 million units, a year-on-year ...

Autonomous Driving Data Closed Loop Research Report, 2024

Data closed loop research: as intelligent driving evolves from data-driven to cognition-driven, what changes are needed for data loop?

As software 2.0 and end-to-end technology are introduced into a...

Research Report on Intelligent Vehicle E/E Architectures (EEA) and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classi...

Passenger Car Intelligent Steering Industry Research Report, 2024

Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina ...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024 highlights the following:Passenger car wireless charging (principle, standards, and Qi2.0 protocol);Passenger car mobile phone ...

Automotive Smart Exteriors Research Report, 2024

Research on automotive smart exteriors: in the trend towards electrification and intelligence, which exteriors will be replaced by intelligence?

The Automotive Smart Exteriors Research Report, 2024 ...

Automotive Fragrance and Air Conditioning System Research Report, 2024

Research on automotive fragrance/air purification: With surging installations, automotive olfactory interaction is being linked with more scenarios.

As users require higher quality of personalized, i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2024

Multi-Domain Computing Research: A Summary of Several Ideas and Product Strategies for Cross-Domain Integration

1. Several ideas and strategies for cross-domain integration of OEMs

With the increasi...

Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in bo...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.???

1. Foreign ADAS Tier 1 suppliers fall behind relatively in development of inte...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...