How to realize the commercialization of 800V will play a crucial part in the strategy of OEMs.

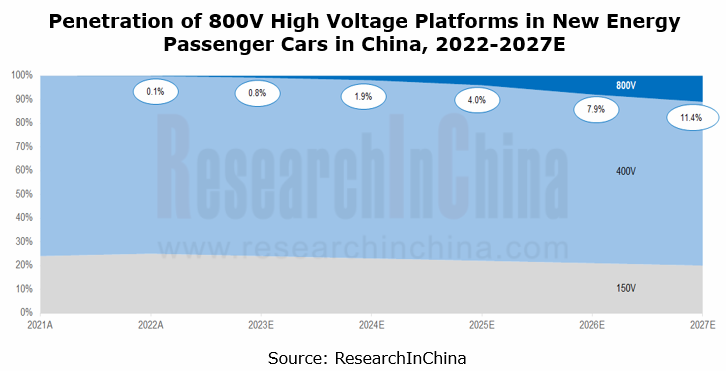

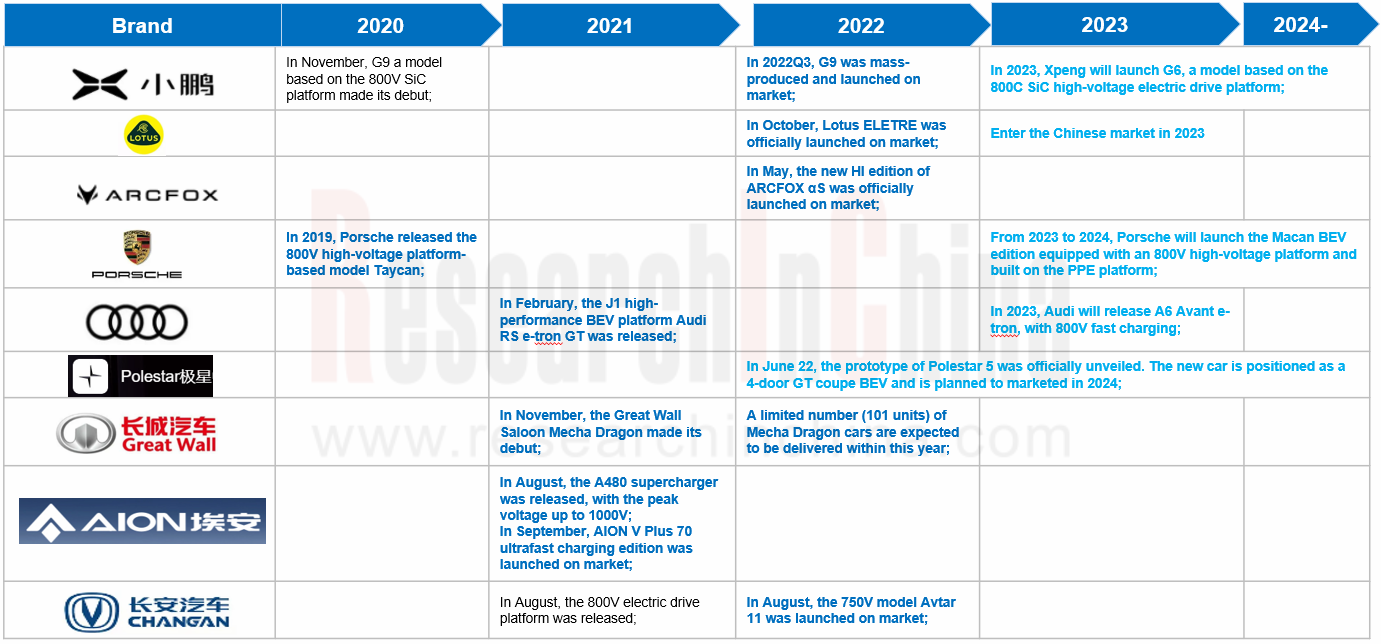

As new energy vehicles and battery technology boom, charging and battery swapping in the new energy vehicle industry chain have become weak links for the development of new energy vehicles. Inconvenient charging and short cruising range have become sore points that plague every consumer buying electric vehicles. In this context, 800V high-voltage charging for new energy vehicles has been a spotlight. 2022 is the first year for the development of 800V high-voltage platforms in China. In particular, a large number of 800V high-voltage platform models will go on sale during 2023-2024.

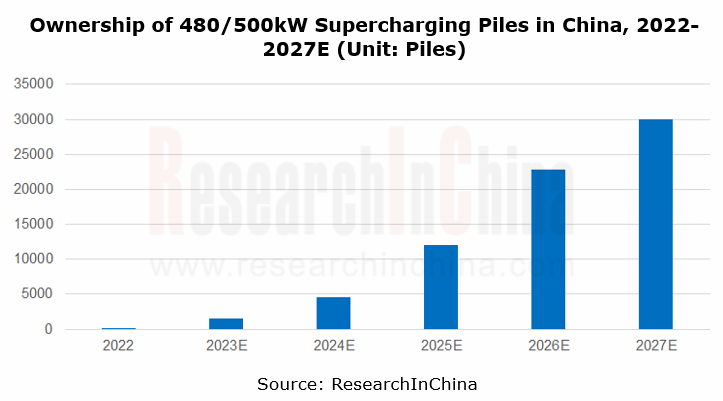

In current stage, 800V platforms are still facing a situation of loud thunder but small raindrops. ResearchInChina’s statistics about the insurance data show that insured vehicles with 800V platforms in China were still less than 10,000 units in 2022. The low cost performance and poor ultra-fast charging experience offered by 800V models are the major flaws criticized by consumers. The industry boom still requires the lower cost of upstream materials and systems, and the gradual deployment of downstream 480kW/500kW ultra-fast charging piles to cover key use scenarios, so that 800V models can be pulled into the market explosion node which is expected to come around 2024 according to the plans of large automakers.

Deployment of 800V ultra-fast charging:

Xpeng: for the top ten cities by orders for G9, concentrate on building S4 ultrafast charging stations. In 2023, S4 stations will be used to provide energy replenishment in key cities and along key highways; it is estimated that in 2025, in addition to the current self-operated 1,000 charging stations, Xpeng will build another 2,000 ultrafast charging stations.

GAC: in 2021, GAC introduced a fast charging pile with maximum charging power up to 480kW. It is predicted that in 2025, 2,000 supercharging stations will be built in 300 cities across China.

NIO: in December 2022, NIO officially released a 500kW ultrafast charging pile with maximum current of 660A supporting high-power charging. The fastest charging time for 400V models is only 20 minutes; for 800V models, the fastest charge from 10% to 80% takes 12 minutes.

Li Auto: in 2023 Li Auto has started the construction of 800V high-voltage supercharging piles in Guangdong, and its goal is to build 3,000 supercharging stations in 2025.

Huawei: in March 2023, the 600kW supercharging pile exclusively for AITO came out in Huawei Base in Bantian Street, Shenzhen. This charging pile, named FusionCharge DC Supercharging Terminal, adopts single-pile single-gun design. The manufacturer is Huawei Digital Power Technologies Co., Ltd. Its external dimensions are 295mm (L) x 340mm (W) x 1700mm (H), and the product model is DT600L1-CNA1. The charging pile features output voltage range of 200-1000V, maximum output current of 600A, maximum output power of 600kW, and liquid cooling.

Due to the high construction cost of 480kW ultrafast charging piles, generally speaking, an ultrafast charging station is equipped with just 1 or 2 480kW supercharging piles and several 240kW fast charging piles, and supports dynamic power distribution. Overall, according to the plans of automakers, it is conceivable that in late 2027, the ownership of 800V high-voltage platform models will reach 3 million units; the ownership of 800V supercharging stations will number 15,000-20,000; the ownership of 480/500kW supercharging piles will outnumber 30,000.

As well as charging piles, in the evolution of architecture from 400V to 800V, the implementation of vehicle engineering also remains very complicated. It needs simultaneous introduction of the entire system covering from semiconductor devices and battery modules to electric vehicles, charging piles, and charging networks, and poses higher requirements for reliability, size and electrical performance of connectors. It also requires technology improvements in mechanical, electrical and environmental performance.

Tier 1 suppliers race to unveil their 800V component products. Most of the new products will become available during 2023-2024.

Leadrive Technology: in 2022, the first SiC-based "three-in-one" electric drive system jointly developed by Leadrive Technology and SAIC Volkswagen went into trial production and made a debut at the Volkswagen IVET Innovation Technology Forum. Tested by SAIC Volkswagen, this "three-in-one" system equipped with Leadrive Technology's silicon carbide (SiC) ECU can increase the cruising range of the ID. 4X model by at least 4.5%. Additionally, Leadrive Technology and Schaeffler will co-develop electric drive assembly products including 800V SiC electric axle.

Vitesco Technologies: the highly integrated electric drive system product EMR4 is projected to be mass-produced in China and supplied to global customers in 2023. EMR4 will be spawned at Vitesco Technologies’ factory in Tianjin Economic-Technological Development Area and delivered to automakers inside and outside China.

BorgWarner: the new 800V SiC inverter adopts Viper's patented power module technology. The application of SiC power modules to 800V voltage platforms reduces the use of semiconductors and SiC materials. This product will be mass-produced and installed on vehicles between 2023 and 2024.

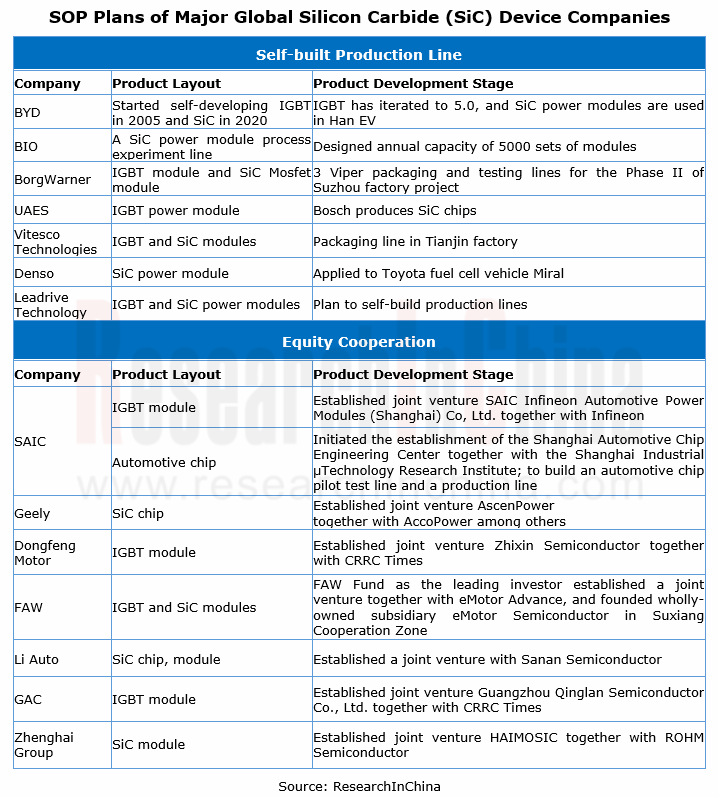

800V is still in the ascendant, but the battle for silicon carbide (SiC) production capacity has begun.

In new 800V architecture, the key to electric drive technology is the use of third-generation SiC/GaN semiconductor devices. While bringing technical benefits to new energy vehicles, technology iterations also pose many challenges to automotive semiconductors and the entire supply chain. In the future, 800V high-voltage systems with the third-generation SiC/GaN semiconductors as the core will usher in a period of large-scale development in the fields of automotive electric drive system, electronic control system, on-board charger (OBC), DC-DC, and off-board charging pile.

In particular, silicon carbide (SiC) is at the core of the high-voltage platform strategy of OEMs. Although 800V is still growing at present, the war for SiC production capacity has actually started. OEMs and Tier 1 suppliers compete to form strategic partnerships with suppliers of SiC chips and modules or set up joint ventures with them for production of SiC modules so as to lock in SiC chip capacity.

On the other hand, the campaign for SiC cost reduction has also been launched. At present, SiC power devices are extremely expensive. In Tesla’s case, the value of SiC-based MOSFET per vehicle is about USD1,300; at the just-concluded annual investor day, Tesla announced the progress in development of its second-generation power chip platform, mentioning reduction of 75% silicon carbide devices (SiC usage), which attracted market attention.

Tesla’s confidence lies in the fact that the automaker has independently developed TPAK SiC MOSFET module and takes a deep part in the chip definition and design. Each bare die in the TPAK can be purchased from different chip vendors to establish a multi-supplier system (ST, ON Semiconductor, etc.). TPAK also allows for application of cross-material platforms, for example, mixed use of IGBT/SiC MOSFET/GaN HEMT.

(1) China has built a SiC industry chain, but with the technology level slightly lower than the international.

SiC is a compound semiconductor material composed of silicon and carbon elements. Power devices based on SiC monocrystal materials offer the benefits of high frequency, high efficiency, and small volume (70% or 80% smaller than IGBT power devices), and have been seen in Tesla Model 3.

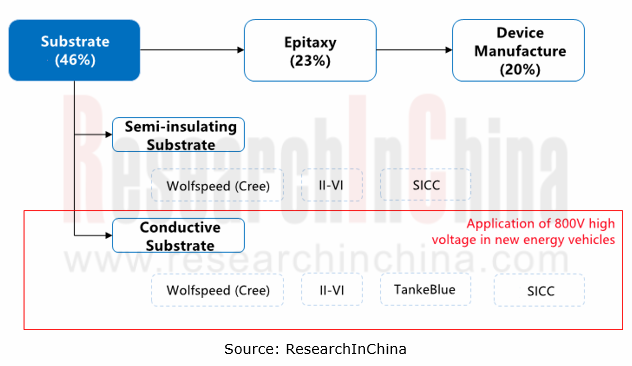

From the perspective of value chain, substrate makes up more than 45% of the cost of silicon carbide (SiC) devices, and its quality also directly affects the performance of epitaxy and the final product. Substrate and epitaxy take a nearly 70% share of the value, so cutting their cost will be the main development direction of the SiC industry. SiC required by 800V high voltage for new energy vehicles is mainly conductive substrate silicon carbide crystal. The current major manufacturers include Wolfspeed (Cree), II-VI, TankeBlue Semiconductor and SICC.

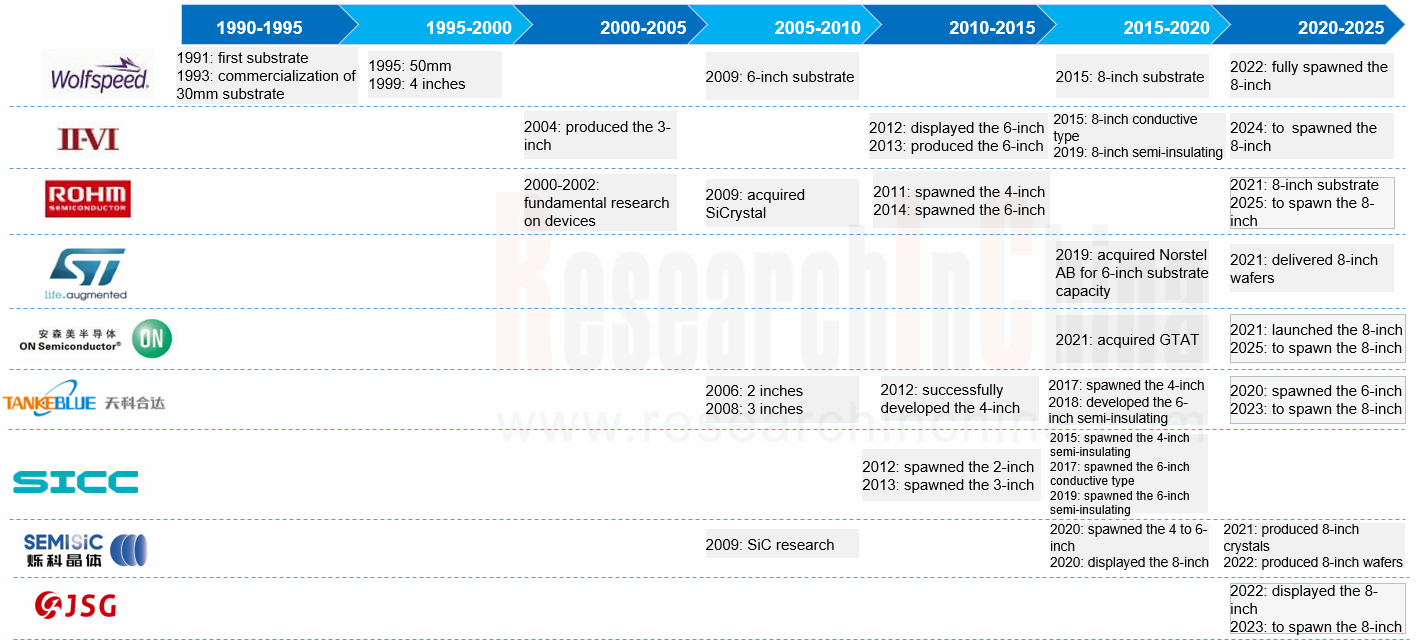

In terms of global SiC technology development, the SiC device market is monopolized by giant vendors like STMicroelectronics, Infineon, Cree and ROHM. Chinese vendors already have large-scale production capacity, and are on par with the international development level. Their capacity planning and production time are almost the same with their foreign peers.

From the development level of SiC substrates, it can be seen that 6-inch substrate currently prevails in the SiC market, and 8-inch SiC substrate is the development priority globally. At present, only Wolfspeed in the world has achieved mass production of 8-inch SiC. Chinese company SEMISiC produced 8-inch N-type SiC polished wafers on small scale in January 2022. Most international companies plan production of 8-inch SiC substrates around 2023.

(2) Gallium nitride (GaN) is still at the early stage of application in automotive, and the layout pace of related manufacturers quickens.

Gallium nitride (GaN) is largely used in consumer electronics fields such as tablet PC, TWS earbuds and notebook computer fast charging (PD). Yet as new energy vehicles thrive, electric vehicles become a potential application market for GaN. In electric vehicles, GaN field effect transistors (FETs) are very applicable to AC-DC OBC, high-voltage (HV) to low-voltage (LV) DC-DC converters, and low-voltage DC-DC converters.

In the field of electric vehicles, gallium nitride (GaN) and silicon carbide (SiC) technologies complement each other and cover different voltage ranges. GaN devices are suitable for tens of volts to hundreds of volts, and in medium and low voltage applications (less than 1200V), their switching loss is 3 times less than SiC in 650V application. SiC is more applicable to high voltage (several thousand volts). Currently the application of SiC devices in a 650V environment is mostly to enable 1200V or higher voltage in electric vehicles.

China still has a big gap with foreign counterparts in development of gallium oxide (Ga2O3), and has yet to achieve mass production.

By virtue of large band gap, high breakdown field strength and strong radiation resistance, gallium oxide (Ga2O3) is expected to dominate in the field of semiconductor power electronics in the future. Compared with common wide-bandgap SiC/GaN semiconductors, Ga2O3 boasts a higher Baliga quality factor and lower expected growth cost, and has more potential in application to high-voltage, high-power, high-efficiency, and small-size electronic devices.

In policy’s term, China also pays ever more attention to Ga2O3. As early as 2018 China has set about exploring and studying ultra-wide bandgap semiconductor materials including Ga2O3, diamond and boron nitride. In 2022, the Ministry of Science and Technology of China brought Ga2O3 into the National Key R&D Program during the "14th Five-Year Plan" Period.

On August 12, 2022, the Bureau of Industry and Security (BIS) under the U.S. Department of Commerce issued an interim final rule that establishes new export controls on four technologies that meet the criteria for emerging and foundational technologies, including: GAA technology, EDA software, PGC technology, and the two substrates of ultra-wide bandgap semiconductors, Gallium Oxide (Ga2O3) and diamond. The two export controls came into effect on August 15. Ga2O3 has drawn more attention from the global scientific research and industrial circles.

Although gallium oxide (Ga2O3) is still at the initial stage of R&D, China has made several breakthroughs within 15 months from 2022. Its gallium oxide preparation technologies from 2 inches to 6 inches in 2022, and then to the latest 8 inches are maturing. Chinese Ga2O3 material research units include: China Electronics Technology Group Corporation No.46 Research Institute (CETC46), Evolusia Semiconductor, Shanghai Institute of Optics and Fine Mechanics (SIOM), Gallium Family Technology, Beijing MIG Semiconductor, and Fujia Gallium Industry; listed companies like Xinhu Zhongbao, Sinopack Electronic Technology, Jiangsu Nata Opto-Electronic Material and San'an Optoelectronics; and dozens of colleges and universities.

Automotive Digital Key Industry Trends Research Report, 2024

Automotive Digital Key Industry Trends Research Report, 2024 released by ResearchInChina highlights the following: Forecast for automotive digital key market;Digital key standard specifications and co...

Automotive XR (VR/AR/MR) Industry Report, 2024

Automotive XR (Extended Reality) is an innovative technology that integrates VR (Virtual Reality), AR (Augmented Reality) and MR (Mixed Reality) technologies into vehicle systems. It can bring drivers...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024 released by ResearchInChina systematically analyzes the iteration process of IVI systems of mainstream automakers in Chin...

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...