OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in the next 3-5 years.

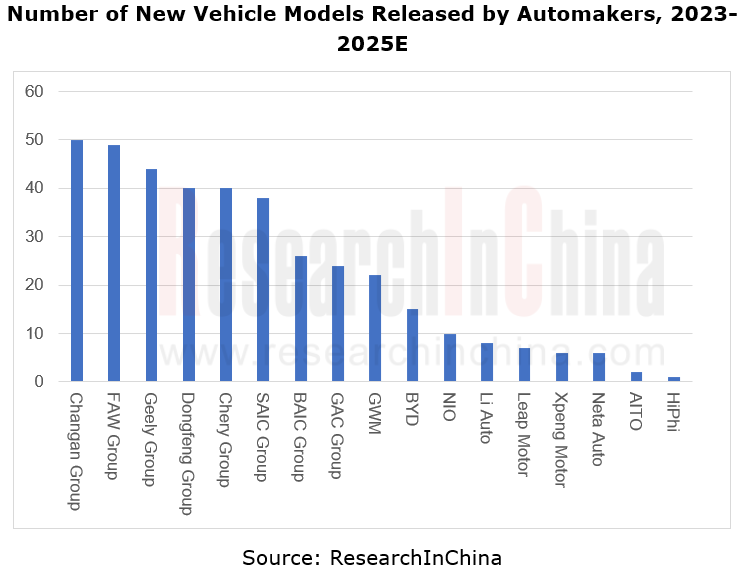

1. China will launch 388 new vehicle models during 2023-2025.

According to the summary on automakers’ strategic planning, automakers in China will launch about 388 new passenger car models (including brand new/refitted models) from 2023 to 2025, and Changan, FAW, Chery, Geely, SAIC, Dongfeng and other large groups stay far ahead in terms of number of new car models.

Changan Auto plans to release 50 new models during 2023-2025, including 22 Changan brand models, 5 Qiyuan brand models (Changan’s newest brand), 12 Deepal brand models (6 all-new + 6 refitted), 4 Avatr brand models, and 7 joint venture brand models.

Changan Auto plans to release 50 new models during 2023-2025, including 22 Changan brand models, 5 Qiyuan brand models (Changan’s newest brand), 12 Deepal brand models (6 all-new + 6 refitted), 4 Avatr brand models, and 7 joint venture brand models.

FAW Group plans to release 49 new models from 2023 to 2025, including 15 Hongqi brand models, 13 Bestune brand models, and 21 models under joint venture brands such as FAW Volkswagen, FAW Audi, FAW Jetta, and FAW Toyota.

FAW Group plans to release 49 new models from 2023 to 2025, including 15 Hongqi brand models, 13 Bestune brand models, and 21 models under joint venture brands such as FAW Volkswagen, FAW Audi, FAW Jetta, and FAW Toyota.

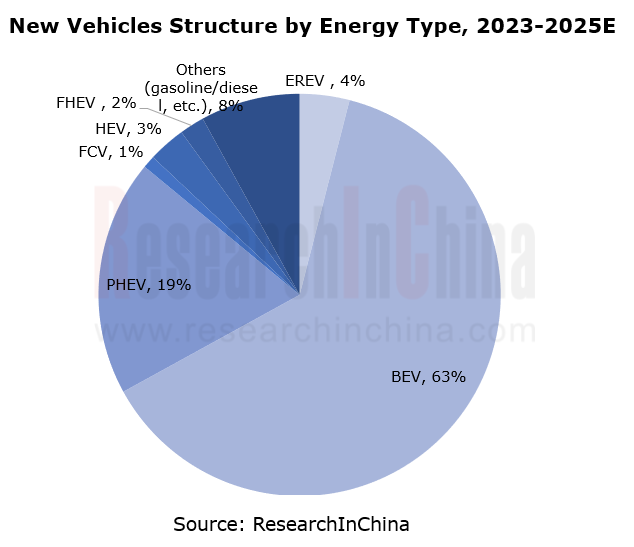

In terms of energy type, of the new vehicle models to be launched in the next three years, BEV will make up 63% and PHEV will share 19%, showing that automakers head in the direction of new energy. For example, FAW Group promotes its "All in" new energy strategy starting from 2023, and plans to launch 11 BEV models and 11 PHEV models in 2028.

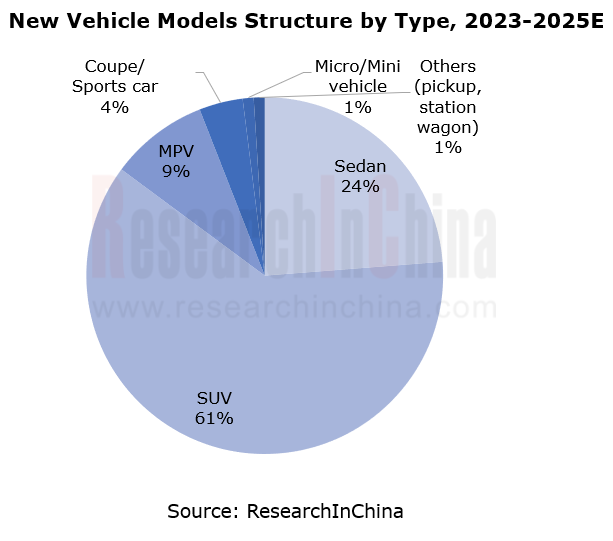

In terms of vehicle type, of the new vehicle models to be launched in the next three years, SUV will account for 61% and become the mainstream type. Among conventional OEMs, upcoming SUVs of Great Wall Motor and BYD will sweep more than 60% of the new vehicle models. Among emerging carmakers, SUVs to be launched by Li Auto and Leapmotor will take an over 70% share.

By price range, automakers still target models priced at RMB100,000-300,000. However, as brands orient to high-end market, some OEMs will enter million-level luxury vehicle market. Examples include Yangwang U8, BYD’s first all-electric SUV with a pre-sale price of RMB1.098 million; Yangwang U9, BYD’s all-electric sports car with a price estimated at around RMB1 million; Hyper SSR, GAC Aion’s supercar with a pre-sale price of RMB1.286-1.686 million; AITO’s all-electric MPV with an estimated price of around RMB1 million; and Polestar 6 with a pre-sale price of RMB1.68 million. These models are further explorations by Chinese independent brands in their efforts to advance upward.

2. Automakers create abundant brand matrices through multi-brand strategy.

In the intelligence track, OEMs like Geely, GWM, and Chery, which suffered a setback in the strategy of "more brands for bigger market share", return to the multi-brand strategy. Moreover, BYD and NIO (emerging brand), which have been carrying out a single-brand strategy, have also made multi-brand layout, hoping to set up a high-end, intelligent product image by introducing new brands and creating a richer brand matrix.

Geely Group has brewed three rounds of multi-brand strategy, and has boasted over 10 passenger car brands after a range of acquisitions and investments. In terms of brand layout, Geely targets low-to-mid-end fuel vehicle and hybrid electric vehicle markets below RMB120,000, with Emgrand + Vision series positioned in the low-end market below RMB100,000; Lynk & Co targets the mid-to-high-end market; Geometry, ZEEKR, and LIVAN build a solid foothold in the battery electric vehicle market, and target low-to-mid-end BEV, high-end BEV and battery-swap markets, respectively. In August 2023, Geely Holdings and Baidu jointly created the brand "Jiyue", which orients to high-end intelligent vehicle market.

In 2023, BYD Auto launched Yangwang and Formula Leopard, together with BYD (Dynasty and Ocean) and Denza constituting BYD’s four-brand matrix, which covers products from the household to the luxury, from the general to the personalized, meeting the needs of using vehicles in all scenarios.

Yangwang, positioned as a "high-end intelligent electric vehicle" brand, targets the high-end new energy vehicle market above RMB500,000, having unveiled million-level new energy models Yangwang U8 and U9.

Yangwang, positioned as a "high-end intelligent electric vehicle" brand, targets the high-end new energy vehicle market above RMB500,000, having unveiled million-level new energy models Yangwang U8 and U9.

Formula Leopard, positioned between Denza and Yangwang, insists on "providing new energy luxury vehicles only". It is BYD’s key layout in its attempt to complete the full range coverage "from household to luxury, from general to personalized". Formula Leopard’s products will cover hardcore SUVs, sports cars and other professional new energy vehicles.

Formula Leopard, positioned between Denza and Yangwang, insists on "providing new energy luxury vehicles only". It is BYD’s key layout in its attempt to complete the full range coverage "from household to luxury, from general to personalized". Formula Leopard’s products will cover hardcore SUVs, sports cars and other professional new energy vehicles.

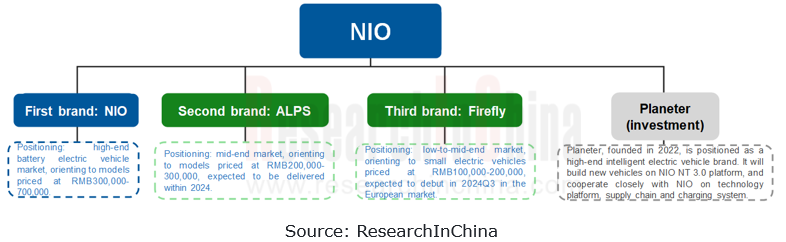

In 2024, NIO will launch its second brand, ALPS, and third brand, Firefly, forming a brand matrix with NIO brand, which will cover low-, mid- and high-end vehicles markets ranging from RMB100,000 to RMB700,000.

ALPS will build models based on NIO NT3.0 platform, supporting high-voltage fast charging technology. It targets mid-end models priced at RMB200,000-300,000. Its first product will be announced in late 2024.

ALPS will build models based on NIO NT3.0 platform, supporting high-voltage fast charging technology. It targets mid-end models priced at RMB200,000-300,000. Its first product will be announced in late 2024.

Firefly works to develop A0/A00-class small cars, and equips them with L2+ driving assistance functions. It targets low-to-mid-end models priced at RMB100,000-200,000. The first product will be mass-produced in 2024 and begin to be delivered in the European market.

Firefly works to develop A0/A00-class small cars, and equips them with L2+ driving assistance functions. It targets low-to-mid-end models priced at RMB100,000-200,000. The first product will be mass-produced in 2024 and begin to be delivered in the European market.

While trying hard to deploy its new brand matrix, NIO also invested tens of millions of US dollars (seed round) in electric vehicle startup Planeter (positioned as a high-end intelligent electric vehicle brand) in early 2023. NIO’s president describes this incubation project as NIO’s "strategic layout in the market segment". Planeter will build its first product on NIO’s NT3.0 platform, benchmarking against high-end luxury SUVs such as Land Rover Range Rover and Mercedes-Benz S-Class.

3. Central computing platform, large AI model, and urban NOA will come into mass production in the next 3-5 years.

In terms of product functions, China’s passenger car market will see mass production of central computing platform, large AI model and urban NOA among other functions in the 3-5 years to come.

1.Central computing platform

Starting from 2023, intelligent vehicles have entered a rapid iteration cycle of hardware architecture.

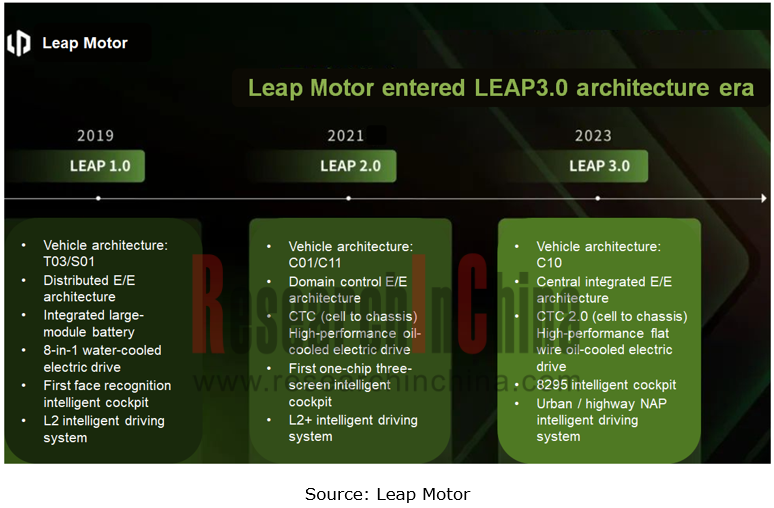

Leap Motor released LEAP 3.0 architecture in September 2023;

Leap Motor released LEAP 3.0 architecture in September 2023;

SAIC’s Z-ONE Galaxy Full-stack Solution 3.0 featuring "central computing + zone controller" will be mass-produced in 2024;

SAIC’s Z-ONE Galaxy Full-stack Solution 3.0 featuring "central computing + zone controller" will be mass-produced in 2024;

Geely will launch central computing platform architecture GEEA 3.0 in 2025.

Geely will launch central computing platform architecture GEEA 3.0 in 2025.

According to technology plans announced by automakers, E/E architecture has evolved from the distributed to the current centralized. The release of new-generation E/E architecture also brings more comprehensive functions, including high computing performance, high functional safety/information security, and continuous software update capability.

For example, Leapmotor’s LEAP 3.0 architecture can cover A-E class models and multiple vehicle types, carries both EV and hybrid modes, and allows for unconscious vehicle OTA updates. Empowered by Leapmotor’s self-developed full-stank technologies, in LEAP 3.0 architecture the self-developed self-built components of Leapmotor take up 70% of vehicle cost, and the generalization rate of the architecture reaches up to 88%, effectively reducing cost and improving efficiency.

2. Large AI model

The combination of large AI models with intelligent vehicles brings far better intelligent driving and cockpit experiences, and enables a variety of functions such as human-machine natural interaction, voice control, knowledge quiz, and coding. For example, Chery STERRA voice assistant is added in LION AI model platform; Changan, Hongqi, Voyah, Great Wall, Geely, Dongfeng Nissan and Leapmotor among others connect Baidu ERNIE Bot large language model.

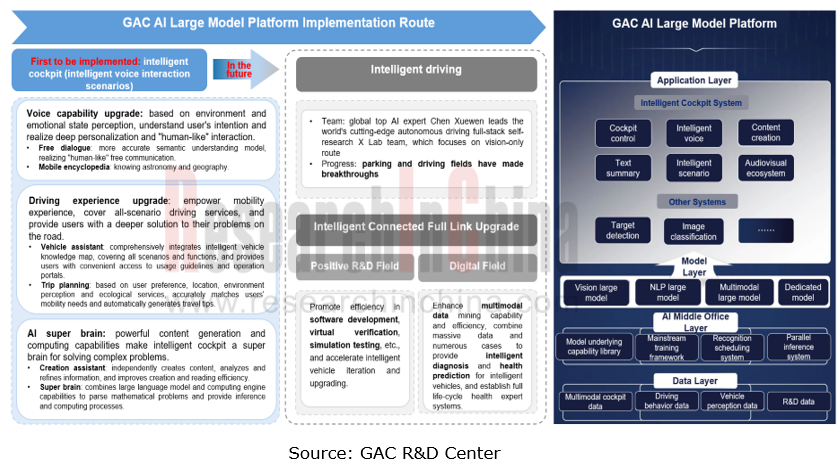

In August 2023, GAC launched its large AI model platform, which will be first available to intelligent voice interaction scenarios. This platform allows intelligent voice to combine benefits of various models, and uses vehicle local inference capabilities and cloud hybrid model technology for "accurate contextual semantic understanding". Coupled with GAC’s ADIGO MAGIC scenario co-creation platform and cloud ecosystem services, it comprehensively enhances voice intelligence and emotion, and upgrades the “Q&A” mode to no-threshold, instinctive and natural dialogue. It will be firstly applied to Hyper GT.

3. Advanced autonomous driving assistance

NOA function is a key breakthrough for automakers in their efforts to realize L3. Mature NOA solutions enable navigation-based urban and highway point-to-point autonomous driving. At present, automakers are making urban NOA layout. At the Shanghai Auto 2023, Xpeng Motor and Huawei first implemented urban NOA. In the second half of 2023, NOA solutions of NIO, Li Auto, Great Wall and other automakers will also be pushed.

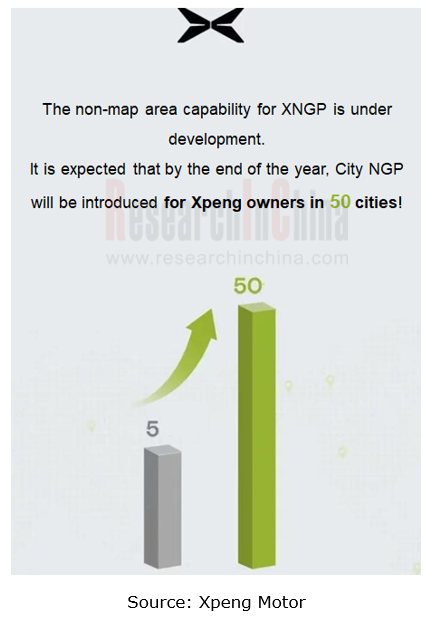

Xpeng’s City NGP has been introduced in 5 cities covered by HD maps. Xpeng plans to launch XNGP driving assistance technology in 50 cities by the end of 2023. It is also developing non-map area capability for XNGP.

In 2023, the first year of urban NOA, almost all leading companies in the new energy vehicle competition have released their own urban NOA plans. Their priority in the next 3-5 years is to provide urban coverage and promote vehicle models from top to bottom.

Research Report on Intelligent Vehicle E/E Architectures and Their Impact on Supply Chain in 2024

E/E Architecture (EEA) research: Advanced EEAs have become a cost-reducing tool and brought about deep reconstruction of the supply chain

The central/quasi-central + zonal architecture has become a w...

Automotive Digital Power Supply and Chip Industry Report, 2024

Research on automotive digital power supply: looking at the digital evolution of automotive power supply from the power supply side, power distribution side, and power consumption side

This report fo...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2024

Software business model research: from "custom development" to "IP/platformization", software enters the cost reduction cycle

According to the vehicle software system architecture, this report classi...

Passenger Car Intelligent Steering Industry Research Report, 2024

Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina ...

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024

China Passenger Car Mobile Phone Wireless Charging Research Report, 2024 highlights the following:Passenger car wireless charging (principle, standards, and Qi2.0 protocol);Passenger car mobile phone ...

Automotive Smart Exteriors Research Report, 2024

Research on automotive smart exteriors: in the trend towards electrification and intelligence, which exteriors will be replaced by intelligence?

The Automotive Smart Exteriors Research Report, 2024 ...

Automotive Fragrance and Air Conditioning System Research Report, 2024

Research on automotive fragrance/air purification: With surging installations, automotive olfactory interaction is being linked with more scenarios.

As users require higher quality of personalized, i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2024

Multi-Domain Computing Research: A Summary of Several Ideas and Product Strategies for Cross-Domain Integration

1. Several ideas and strategies for cross-domain integration of OEMs

With the increasi...

Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in bo...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.

1. Foreign ADAS Tier 1 suppliers fall behind relatively in deve...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...